TERM LOAN AGREEMENT

between

THE BORROWERS LISTED ON SCHEDULE I ATTACHED HERETO,

individually and collectively,

as Borrower

and

GUGGENHEIM REAL ESTATE, LLC,

a Delaware limited liability company,

as Lender

May 18, 2023

TABLE OF CONTENTS

Page

| | | | | |

ARTICLE 1 CERTAIN DEFINITIONS | |

Section 1.1 Certain Definitions | |

Section 1.2 Principles of Construction | |

ARTICLE 2 LOAN TERMS | |

Section 2.1 The Loan | |

Section 2.2 Interest Rate; Late Charge; Default Rate | |

Section 2.3 Terms of Payment | |

Section 2.4 Security | |

Section 2.5 Withholding Taxes; Changes In Legal Requirements; Market Disruption | |

Section 2.6 Reserve Funds | |

Section 2.7 Reserved | |

Section 2.8 Use of Proceeds | |

Section 2.9 Cash Management | |

Section 2.10 Intentionally omitted. | |

Section 2.11 Project Releases | |

ARTICLE 3 INSURANCE, CONDEMNATION AND IMPOUNDS | |

Section 3.1 Insurance | |

Section 3.2 Use and Application of Insurance Proceeds | |

Section 3.3 Condemnation Awards | |

Section 3.4 Impounds | |

| | | | | |

ARTICLE 4 ENVIRONMENTAL MATTERS | |

Section 4.1 Representations and Warranties on Environmental Matters | |

Section 4.2 Covenants on Environmental Matters | |

Section 4.3 Allocation of Risks and Indemnity | |

Section 4.4 No Waiver | |

Section 4.5 Obligations Unsecured | |

ARTICLE 5 LEASING MATTERS | |

Section 5.1 Representations and Warranties on Leases | |

Section 5.2 Standard Lease Form; Approval Rights; Security Deposits | |

Section 5.3 Covenants | |

Section 5.4 Tenant Estoppels | |

ARTICLE 6 REPRESENTATIONS AND WARRANTIES | |

Section 6.1 Organization and Power | |

Section 6.2 Validity of Loan Documents | |

Section 6.3 Liabilities; Litigation | |

Section 6.4 Taxes and Assessments | |

Section 6.5 Other Agreements; Defaults | |

Section 6.6 Compliance with Legal Requirements | |

Section 6.7 Location of Borrower | |

Section 6.8 ERISA | |

Section 6.9 Margin Stock | |

Section 6.10 Tax Filings | |

ii

US_ACTIVE\123288794\V-8

| | | | | |

Section 6.11 Solvency | |

Section 6.12 Full and Accurate Disclosure | |

Section 6.13 Single Purpose Entity | |

Section 6.14 Property Specific Representations | |

Section 6.15 Taxpayer I.D. Number | |

Section 6.16 Organization I.D. Number | |

Section 6.17 Legal Name | |

Section 6.18 Use of Proceeds | |

Section 6.19 Survey | |

Section 6.20 Financial Statements | |

Section 6.21 Financial Condition | |

Section 6.22 Management Agreement | |

Section 6.23 Ground Lease | |

Section 6.24 CFIUS | |

ARTICLE 7 FINANCIAL REPORTING | |

Section 7.1 Financial Statements | |

Section 7.2 Accounting Principles | |

Section 7.3 Other Information | |

Section 7.4 Annual Budget | |

Section 7.5 Audits and Records | |

Section 7.6 Annual Ownership Report | |

Section 7.7 Electronic Submissions | |

ARTICLE 8 COVENANTS | |

iii

US_ACTIVE\123288794\V-8

| | | | | |

Section 8.1 Due on Sale and Encumbrance; Transfers of Interests | |

Section 8.2 Taxes; Charges | |

Section 8.3 Property Management | |

Section 8.4 Operation; Maintenance; Inspection; Alterations | |

Section 8.5 Taxes on Security | |

Section 8.6 Legal Existence; Name; Organizational Documents | |

Section 8.7 Affiliate Transactions | |

Section 8.8 Limitation on Other Debt | |

Section 8.9 Further Assurances | |

Section 8.10 Estoppel Certificates | |

Section 8.11 Notice of Certain Events | |

Section 8.12 Indemnification | |

Section 8.13 Compliance With Legal Requirements | |

Section 8.14 Single Purpose Covenants | |

Section 8.15 Cooperation | |

Section 8.16 Required Debt Yield; Cash Sweep | |

Section 8.17 Financial Covenants | |

Section 8.18 Ground Lease. | |

Section 8.19 Accounts | |

Section 8.20 ERISA | |

Section 8.21 No Cross-Default or Cross-Collateralization | |

iv

US_ACTIVE\123288794\V-8

| | | | | |

Section 8.22 No Cessation of Business | |

Section 8.23 No Cash Distributions | |

ARTICLE 9 EVENTS OF DEFAULT | |

Section 9.1 Payments | |

Section 9.2 Insurance | |

Section 9.3 Sale, Encumbrance, etc | |

Section 9.4 Covenants | |

Section 9.5 Representations and Warranties | |

Section 9.6 Single Purpose Entity | |

Section 9.7 Involuntary Bankruptcy or Other Proceeding | |

Section 9.8 Voluntary Petitions, etc | |

Section 9.9 Failure to Make Deposit | |

Section 9.10 Misapplication or Misappropriation of Funds | |

Section 9.11 Failure To Make Deposits | |

Section 9.12 Mezzanine Loan | |

Section 9.13 Anti-Terrorism and Anti-Money Laundering | |

Section 9.14 Other Loan Documents | |

Section 9.15 Other Defaults | |

Section 9.16 ERISA | |

Section 9.17 Ground Lease | |

ARTICLE 10 REMEDIES | |

Section 10.1 Remedies - Insolvency Events | |

Section 10.2 Remedies - Other Events | |

| | | | | |

Section 10.3 Lender’s Right to Perform the Obligations | |

ARTICLE 11 MISCELLANEOUS | |

Section 11.1 Notices | |

Section 11.2 Amendments and Waivers | |

Section 11.3 Limitation on Interest | |

Section 11.4 Invalid Provisions | |

Section 11.5 Reimbursement of Expenses | |

Section 11.6 Approvals; Third Parties; Conditions | |

Section 11.7 Lender Not in Control; No Partnership | |

Section 11.8 Time of the Essence | |

Section 11.9 Successors and Assigns | |

Section 11.10 Renewal, Extension or Rearrangement | |

Section 11.11 Waivers | |

Section 11.12 Cumulative Rights | |

Section 11.13 Singular and Plural | |

Section 11.14 Phrases | |

Section 11.15 Exhibits and Schedules | |

Section 11.16 Titles of Articles, Sections and Subsections | |

Section 11.17 Lender’s Promotional Material | |

Section 11.18 Survival | |

Section 11.19 Waiver of Jury Trial | |

vi

US_ACTIVE\123288794\V-8

| | | | | |

Section 11.20 Waiver of Punitive or Consequential Damages | |

Section 11.21 Governing Law/Jurisdiction | |

Section 11.22 Entire Agreement | |

Section 11.23 Counterparts; Electronic Signatures | |

Section 11.24 Waiver of Set-Off | |

Section 11.25 Construction | |

Section 11.26 Use of Websites | |

Section 11.27 Language | |

Section 11.28 Joint and Several Obligations | |

Section 11.29 Electronic Imaging | |

| ARTICLE 12 | |

| LIMITATIONS ON LIABILITY | |

Section 12.1 Limitation on Liability | |

Section 12.2 Limitation on Liability of Lender and its Officers, Employees, etc | |

Section 12.3 Claims Against Lender | |

ARTICLE 13 SANCTIONS, ANTI-MONEY LAUNDERING AND ANTI-BRIBERY PROVISIONS | |

Section 13.1 Sanctions | |

Section 13.2 Anti-Money Laundering Laws and Anti-Bribery Laws | |

Section 13.3 Use of Proceeds | |

Section 13.4 Certain Transfers | |

vii

US_ACTIVE\123288794\V-8

viii

US_ACTIVE\123288794\V-8

EXHIBITS AND SCHEDULES

EXHIBIT A — Legal Description of Project

EXHIBIT B — Reserved

EXHIBITS C-1, C-2, C-3, C-4 — U.S. Tax Compliance Certificates

SCHEDULE I — Borrowers

SCHEDULE II — Allocated Loan Amounts

SCHEDULE 2.2(a) — Contract Rate

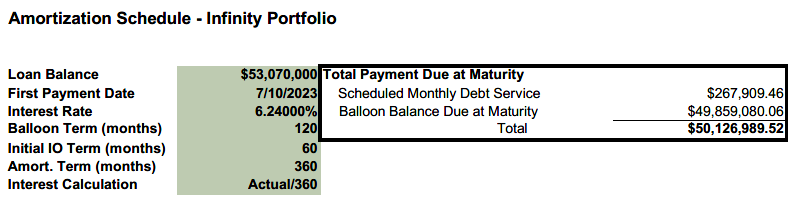

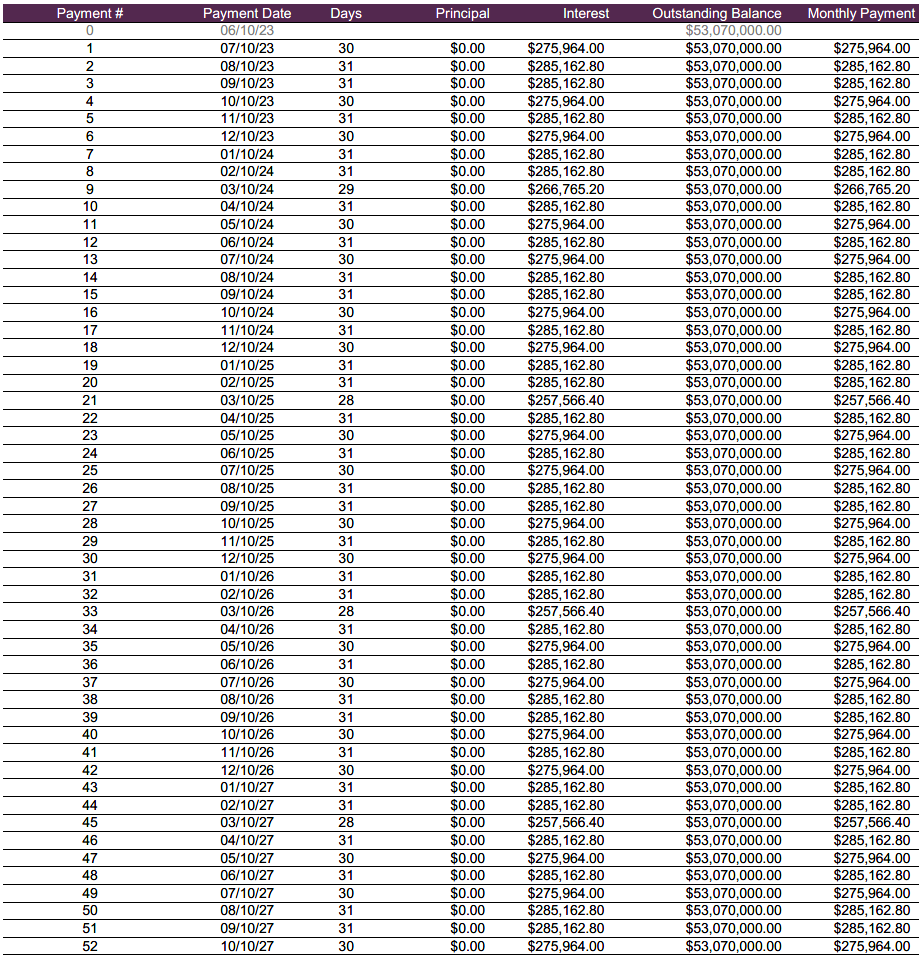

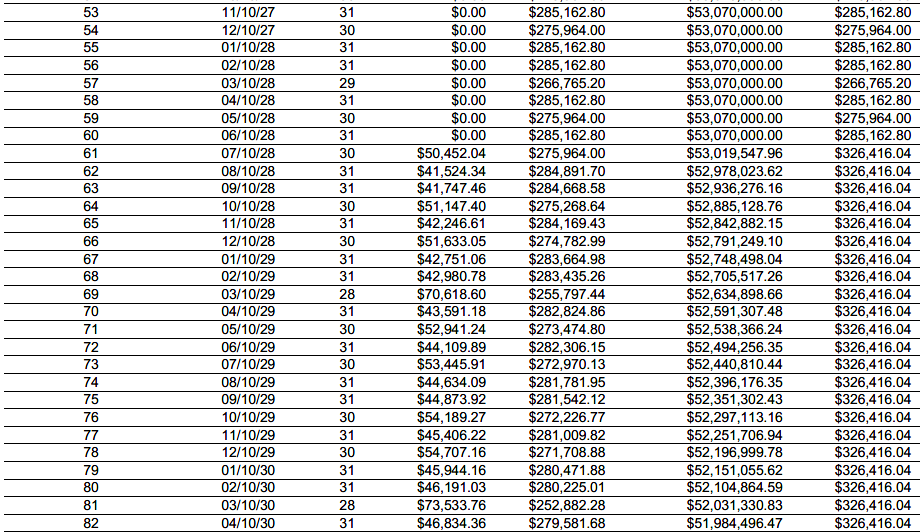

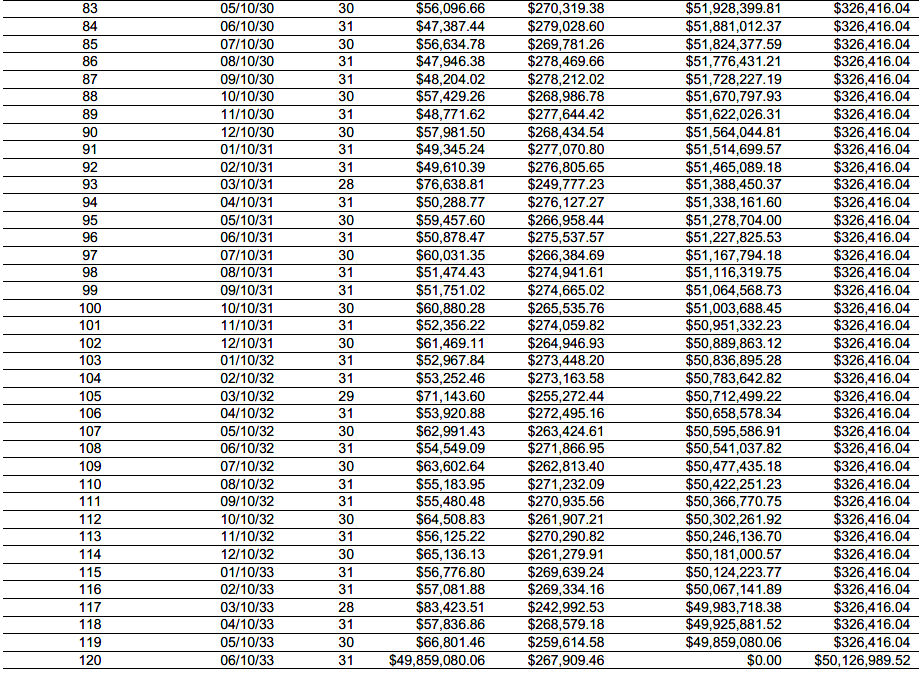

SCHEDULE 2.3(b) — Amortization Schedule

SCHEDULE 2.3(d) — Yield Maintenance Amount

SCHEDULE 2.5 — Withholding Taxes; Changes in Legal Requirements; Market Disruption; EEA Financial Institution

SCHEDULE 2.6(a) — Replacement Reserve

SCHEDULE 2.6(b) — Leasing Reserve

SCHEDULE 2.6(c) — Required Repairs

SCHEDULE 5.1(a) — Leasing Matters

SCHEDULE 5.1(b) — Rent Roll

SCHEDULE 6.1(a) — States of Organization and Borrower’s Taxpayer I.D.

Number and Organization I.D. Number

SCHEDULE 6.1(b) — Borrower’s Organizational Chart

SCHEDULE 6.3 — Liabilities; Litigation

SCHEDULE 6.8 — ERISA

ix

US_ACTIVE\123288794\V-8

TERM LOAN AGREEMENT

This Term Loan Agreement (this “Agreement”) is entered into as of May 18, 2023 between THE ENTITIES LISTED ON SCHEDULE I ATTACHED HERETO (collectively, the “Borrower”), and GUGGENHEIM REAL ESTATE, LLC, a Delaware limited liability company (“Lender”). The following recitals form the basis and are a material part of this Agreement:

A.Borrower desires to obtain the Loan from Lender.

B. Lender is willing to make the Loan to Borrower subject to and in accordance with the conditions and terms of this Agreement and the other Loan Documents.

NOW, THEREFORE, in consideration of the covenants set forth in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties hereto, the parties agree as follows:

Article 1

CERTAIN DEFINITIONS

Section 1.1Certain Definitions. As used herein, the following terms have the meanings indicated:

“A/B Notes” has the meaning assigned in Section 8.15(b).

“Above the Fund Transfer” shall mean any Transfer or Permitted Transfer of any direct or indirect legal or beneficial interest in Wheeler Real Estate Investment Trust, Inc., a Maryland corporation.

“Act” has the meaning assigned in Section 8.14(a).

“Accounts” means the Collections Account, the Cash Management Account (if any), and each other deposit account now or hereafter pledged by Borrower to Lender as security for the Obligations or any portion thereof.

“Affiliate” shall mean, as to any Person, any other Person that, directly or indirectly, is in control of, is controlled by or is under common control with such Person or is a director or officer of such Person or of an Affiliate of such Person.

“Agreement” means this Term Loan Agreement, as originally executed by Borrower, and Lender, as the same may be supplemented, amended, modified, consolidated, extended, refinanced, substituted, replaced, renewed and/or restated from time to time.

“Allocated Loan Amount” shall, for each Project, have the meaning set forth on Schedule II attached hereto.

“Alterations Threshold” has the meaning assigned in Section 8.4(b).

“Amortization Payment” has the meaning assigned in Section 2.3(b).

“Anti-Bribery Laws” means the U.S. Foreign Corrupt Practices Act of 1977, as amended, 15 U.S.C. §§ 78dd-1, et seq., the U.K. Bribery Act of 2010, and all other applicable anti-bribery or corruption laws.

“Anti-Money Laundering Laws” means the USA Patriot Act, the U.S. Bank Secrecy Act and locally applicable anti-money laundering or terrorism laws.

“Application” means that certain Loan Application, dated as of February 27, 2023, accepted on behalf of Borrower with respect to the Project.

“Appraisal” means an as-is appraisal of the Project prepared by an Appraiser, which appraisal must comply in all respects with the standards for real estate appraisal established pursuant to Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended, and otherwise in form and substance satisfactory to Lender.

“Appraiser” shall mean Cushman & Wakefield or any other “state certified general appraiser” as such term is defined and construed under applicable regulations and guidelines issued pursuant to Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended, which appraiser must have been licensed and certified by the applicable Governmental Authority having jurisdiction in the State, and which appraiser shall have been selected by Lender.

“Assignment of Management Agreement” means, for each Borrower and its Project, the Assignment of Management Agreement and Subordination of Management Fees dated as of the date hereof, as originally executed by the applicable Borrower and Property Manager, to and in favor of Lender, as each the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time, together with all consents from other parties as contemplated therein.

“Assignment of Rents and Leases” means, for each Borrower and its Project, the Assignment of Rents and Leases dated as of the date hereof, as originally executed by the applicable Borrower in favor of Lender, and pertaining to a Project, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“Bankruptcy Code” means the Federal Bankruptcy Code of 1978, as amended from time to time.

“Bankruptcy Party” has the meaning assigned in Section 9.7.

“Below the Fund Transfer” means, to the extent not covered as an Above the Fund Transfer, any Transfer or Permitted Transfer of the direct partnership, membership or other ownership interests or beneficial ownership interests in Borrower or Guarantor. For the avoidance of doubt, this Agreement shall not restrict the creation or transfers of de minimus, non-controlling interests of certain preferred shareholders, membership units or partnership interests in the ownership structure of Borrower or Guarantor solely for real estate investment trust compliance purposes, and such transfers shall be deemed to be Permitted Transfers.

“Borrower” has the meaning assigned in the Preamble.

“Borrower Party” means, individually and collectively, each Borrower and Guarantor.

“Business Day” means a day (other than a Saturday or Sunday) on which (a) commercial national banks are not authorized or required to close in (i) New York City, or (ii) the place of business of each of (A) Lender and (B) any Servicer, and (b) the New York Stock Exchange and the Federal Reserve Bank of New York are each open for business.

“Capital Expenditures Budget” has the meaning assigned in Schedule 2.6(a).

“Cash Management Account” has the meaning assigned in Section 2.9(a).

“Cash Management Agreement” means any cash management agreement executed by Borrower, Lender, Cash Management Bank and Property Manager in accordance with Section 2.9(c), as the same may be supplemented, amended, modified, consolidated, extended, refinanced, substituted, replaced, renewed and/or restated from time to time.

“Cash Management Bank” means a depositary bank designated by Lender to serve as the cash management bank under the Cash Management Agreement pursuant to Section 2.4(b).

“Cash Sweep Cure Event” has the meaning assigned in Section 2.9(b).

“Cash Sweep Period” means a period of time beginning on the date of a Cash Sweep Trigger and continuing until the date of a Cash Sweep Cure Event.

“Cash Sweep Pro Forma Net Cash Flow” means the amount by which Cash Sweep Pro Forma Operating Revenues exceed (a) Underwritten Expenses, plus (b) all Underwritten Reserves. Lender’s calculation of Cash Sweep Pro Forma Net Cash Flow shall be calculated in good faith and shall be final absent manifest error.

“Cash Sweep Pro Forma Operating Revenues” means, for any period as reasonably estimated by Lender, the Operating Revenues received for the Project during the trailing twelve (12) month period.

“Cash Sweep Trigger” has the meaning assigned in Section 2.9(a).

“CFIUS” means the Committee on Foreign Investment in the United States or any successor agency.

“CFIUS Approval” means (a) written confirmation provided by CFIUS that the Loan is not a Covered Transaction under the DPA, (b) written confirmation provided by CFIUS that it has completed its review or, if applicable, investigation of the Loan pursuant to a declaration or notice filed under the DPA and determined that there are no unresolved national security concerns with respect to the Loan, or (c) CFIUS shall have sent a report to the President of the United States requesting the decision of the President of the United States under the DPA, and the President shall have announced a decision not to take any action to suspend, prohibit, or place any limitations on the Loan.

“CFIUS Review” has the meaning assigned in Section 8.13.

“Change” has the meaning assigned in Schedule 2.5(f).

“Code” means the Internal Revenue Code of 1986, as amended, reformed or otherwise modified from time to time, and the regulations promulgated thereunder from time to time.

“Collateral Assignment” means, for each Borrower and its Project, that certain Collateral Assignment dated as of the date hereof, as originally executed by such Borrower in favor of Lender, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“Collections Account” has the meaning assigned in Section 2.4(b).

“Collections Account DACA” means, collectively, those certain Blocked Account Agreements dated as of the date hereof, as originally executed by each entity comprising Borrower, Lender and Depositary Bank, as the same may be supplemented, amended, modified, consolidated, extended, refinanced, substituted, replaced, renewed and/or restated from time to time.

“Commitment” the amount set forth on Lender’s signature page hereof or in any subsequent amendment hereof or in any assignment and assumption agreement related hereto.

“Connection Income Taxes” means Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes.

“Contract Rate” has the meaning assigned in Schedule 2.2(a).

“control” or “controlled” means the possession, directly or indirectly, of the power to direct or cause the direction of the day-to-day management and policies of an entity through the ownership of voting securities or equity interests, by contract or otherwise.

“Controlled Group” means all members of a controlled group of corporations and all trades or businesses (whether or not incorporated) under common control which, together with any Loan Party or any of their respective Subsidiaries or Affiliates (as applicable), are treated as a single employer under Section 414(b) or (c) of the Code, and any organization which is required to be treated as a single employer with any Loan Party under Sections 414(m) or 414(o) of the Code.

“Covered Transaction” has the meaning assigned in the DPA.

“Creditors’ Rights Law” shall mean with respect to any Person any existing or future law of any state or Federal jurisdiction, domestic or foreign, relating to bankruptcy, insolvency, reorganization, conservatorship, arrangement, adjustment, winding-up, liquidation, dissolution, assignment for the benefit of creditors, composition or other relief with respect to its debts or debtors.

“Debt” means, for any Person, without duplication: (a) all indebtedness of such Person for borrowed money, for amounts drawn under a letter of credit, or for the deferred purchase price of property for which such Person or its assets is liable, (b) all unfunded amounts under a loan agreement, letter of credit, or other credit facility for which such Person would be liable, if such amounts were advanced under the credit facility, (c) all amounts required to be paid by such Person as a guaranteed payment to partners or a preferred or special dividend, including any mandatory redemption of shares or interests, (d) all indebtedness guaranteed by such Person, directly or indirectly, (e) all obligations under leases that constitute capital leases for which such Person is liable, and (f) all obligations of such Person under interest rate swaps, caps, floors, collars and other interest hedge agreements, in each case whether such Person is liable contingently or otherwise, as obligor, guarantor or otherwise, or in respect of which obligations such Person otherwise assures a creditor against loss.

“Debt Service” means the aggregate interest, scheduled principal, and other payments due on account of the Loan and on any other outstanding Debt of Borrower (whether permitted or not permitted by Lender) for the period of time for which calculated, but excluding payments of Excess Cash Flow applied to reduction of principal.

“Debt Yield” means the ratio of (a) Net Operating Income for the immediately preceding twelve (12) month period to (b) the Principal Balance.

“Default Rate” means the lesser of (a) the maximum rate of interest allowed by applicable Legal Requirements, and (b) five percent (5%) per annum in excess of the Contract Rate.

“Depositary Bank” means KeyBank National Association, and its successors and assigns.

“Dodd-Frank” means the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended, modified, replaced and/or supplemented from time to time, and any orders, rules, regulations, rulings, authorizations, determinations, guidelines, directives and/or any other requirements and/or provisions issued under such Act, existing now or in the future.

“DPA” means the Defense Production Act of 1950, 50 U.S.C. § 4565, as amended, all laws and regulations related thereto, and all mandates, requirements, powers and similar requirements imposed or exercised thereunder.

“Employee Benefit Plan” means any employee benefit plan within the meaning of Section 3(3) of ERISA or other plan established or maintained, or to which contributions have been made, by any Loan Party.

“Environmental Laws” means any Legal Requirement governing health, safety, industrial hygiene, the environment or natural resources, or Hazardous Materials, including, without limitation, such

Legal Requirements governing or regulating the use, generation, storage, removal, recovery, treatment, handling, transport, disposal, control, discharge of, or exposure to, Hazardous Materials.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, modified, replaced and/or supplemented from time to time, and any current or future regulations thereunder.

“Eurodollar Rate” has the meaning assigned in Schedule 2.2(a).

“Event of Default” has the meaning assigned in Article 9.

“Excess Cash Flow” means, for any period, the amount by which Operating Revenues exceed the sum of (a) Operating Expenses, (b) Debt Service, and (c) Underwritten Reserves.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to a Recipient or required to be withheld or deducted from a payment to a Recipient, (a) Taxes imposed on (or measured by) net income (however denominated), franchise Taxes, and branch profits or similar Taxes, in each case (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes; (b) in the case of Lender, any U.S. federal Withholding Tax that is imposed on amounts payable to or for the account of Lender with respect to an applicable interest in the Loan or the Commitment pursuant to a law in effect on the date on which (i) Lender acquires such interest in the Loan or the Commitment (other than pursuant to an assignment request by Borrower under paragraph (h)(i) of Schedule 2.5) or (ii) Lender changes its lending office), except in each case to the extent that, pursuant to paragraph (c) of Schedule 2.5, amounts with respect to such Taxes were payable either to Lender’s assignor, immediately before Lender became a party hereto or to Lender immediately before it changed its lending office; (c) Taxes attributable to such Recipient’s failure to comply with paragraph (a) of Schedule 2.5; and (d) any U.S. federal Withholding Taxes imposed under FATCA.

“Executive Order” means Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001, and relating to Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism, as amended, modified, replaced and/or supplemented from time to time.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any applicable intergovernmental agreement entered into pursuant to Section 1471(b)(1) of the Code.

“Fee Estate” means, with respect to the Ground Lease, the fee interest of the lessor under the Ground Lease in the land and the improvements demised under the Ground Lease.

“FDIC” means the Federal Deposit Insurance Corporation or any successor agency.

“Financial Covenants” has the meaning assigned in Section 8.17.

“Fixed Rate” has the meaning assigned in Schedule 2.2(a).

“GAAP” means the generally accepted accounting principles, consistently applied, set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board (or agencies with similar functions of comparable stature and authority within accounting profession), or in such other statements by such entity as may be in general use by significant segments of the U.S. accounting profession, to the extent such principles apply to partnerships, corporations or limited liability companies, as applicable.

“Governmental Authority(ies)” means any court, legislature, council, agency, authority, board (including, without limitation, environmental protection, planning and zoning), bureau, commission, department, office or instrumentality of any nature whatsoever of any governmental or quasi-governmental unit, or any governmental, public or quasi-public authority, of any foreign, domestic, federal, state, county, city, borough, municipal government or other political subdivision of any of the foregoing, or any official thereof, whether now or hereafter in existence.

“Ground Lease” means, collectively, the “Ground Lease,” as such term is defined in each of the Mortgages applicable to the individual Projects known as Beaver Ruin I and Beaver Ruin II.

“Guarantor” means Wheeler REIT, L.P., a Virginia limited partnership.

“Hazardous Material(s)” means (i) any and all substances, materials, wastes or mixtures which are or shall be listed, defined, or otherwise determined by any Governmental Authority to be hazardous, toxic or otherwise regulated, affected, controlled or which may give rise to liability or a standard of conduct under any Environmental Laws, including any substance identified under any Environmental Law based upon their harmful or deleterious properties as a pollutant, contaminant, hazardous waste, hazardous constituent, special waste, hazardous substance, hazardous material or toxic substance, or petroleum or petroleum-derived substance or waste; (ii) asbestos or asbestos-containing materials; (iii) polychlorinated biphenyls (PCBs) and compounds containing them; (iv) radon gas; (v) laboratory wastes; (vi) experimental products, including genetically engineered microbes and other recombinant DNA products; (vii) petroleum, crude oil, natural gas, natural gas liquid, liquefied natural gas, other petroleum or chemical products, whether liquid, solid or gaseous form, or synthetic gas useable as fuel; (viii) ”source,” “special nuclear” and “by-product” material, as defined in the Atomic Energy Act of 1954, 42 U.S.C. § 3011 et seq., as amended from time to time; (ix) explosives, radioactive or flammable materials; (x) underground or above-ground storage tanks, whether empty or containing any substance; (xi) indoor air contaminants, mold, fungi, toxins, irritants and other allergens and microbial matter; and (xii) lead and lead-based paint.

“Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of any Loan Party under any Loan Document and (b) to the extent not otherwise described in (a), Other Taxes.

“Indemnity Agreement” means each Hazardous Materials Indemnity Agreement now or hereafter executed by Guarantor and Borrower, collectively and jointly and severally, as indemnitors, to and in favor of Lender, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“Independent Manager” of any corporation or limited liability company shall mean an individual with at least three (3) years of employment experience serving as an independent manager at the time of appointment who is provided by, and is in good standing with, CT Corporation, Corporation Service Company, National Registered Agent, Inc., Wilmington Trust Company, Stewart Management Company, Lord Securities Corporation or, if none of those companies is then providing professional independent managers or managers, another nationally recognized company reasonably approved by Lender, that is not an Affiliate of such corporation or limited liability company and that provides professional independent managers or managers and other corporate services in the ordinary course of its business, and which individual is duly appointed as a member of the board of directors or board of managers of such corporation or limited liability company and is not, and has never been, and will not while serving as independent manager or manager be:

(a) a member (other than an independent, non-economic “springing” member), partner, equityholder, manager, director, officer or employee of such corporation or limited liability company, or any of its respective equityholders or Affiliates (other than as an independent manager or manager of an Affiliate of such corporation or limited liability company that is not in the direct chain of ownership of such corporation or limited liability company and that is required by a creditor to be a single purpose bankruptcy remote entity, provided that such independent manager or manager is employed by a

company that routinely provides professional independent managers or managers in the ordinary course of business);

(b) a customer, creditor, supplier or service provider (including provider of professional services) to such corporation or limited liability company or any of its respective equityholders or Affiliates (other than a nationally recognized company that routinely provides professional independent managers or managers and other corporate services to such corporation or limited liability company or any of its respective equityholders or Affiliates in the ordinary course of business);

(c) a family member of any such member, partner, equityholder, manager, director, officer, employee, creditor, supplier or service provider; or

(d) a Person that controls or is under common control with (whether directly, indirectly or otherwise) any of the Persons referred to in clauses (a), (b) or (c) above.

A natural person who otherwise satisfies the foregoing definition other than subparagraph (a) by reason of being the independent manager or manager of a “special purpose entity” in the direct chain of ownership of such corporation or limited liability company shall not be disqualified from serving as an independent manager or manager of such corporation or limited liability company, provided that the fees that such individual earns from serving as independent managers or managers of such Affiliates in any given year constitute in the aggregate less than five percent (5%) of such individual’s annual income for that year. For purposes of this paragraph, a “special purpose entity” is an entity whose organizational documents contain restrictions on its activities and impose requirements intended to preserve such entity’s separateness that are substantially similar to those contained in Section 8.14.

“Independent Manager Event” shall mean, with respect to an Independent Manager, (i) any acts or omissions by such Independent Manager that constitute willful disregard of such Independent Manager’s duties under the applicable organizational documents, (ii) such Independent Manager engaging in or being charged with, or being convicted of, fraud or other acts constituting a crime under any law applicable to such Independent Manager, (iii) such Independent Manager is unable to perform his or her duties as Independent Manager due to death, disability or incapacity, or (iv) such Independent Manager no longer meeting the definition of Independent Manager in this Agreement.

“IRS” means the U.S. Internal Revenue Service or any successor agency.

“Lease(s)” means a fully executed lease(s), occupancy agreement(s), license agreement(s) or other rental or occupancy arrangement(s) by or binding upon Borrower, as lessor, for space in the Project.

“Leasing Reserve” has the meaning assigned in Schedule 2.6(b).

“Legal Requirement(s)” means, collectively, all foreign, domestic, federal, state, local and municipal laws, statutes, codes, ordinances, rules, rulings, orders, judgments, decrees, injunctions, arbitral decisions, regulations, authorizations, determinations, directives and any other requirements and/or provisions (including building codes and zoning regulations and ordinances) of all Governmental Authorities, whether now or hereafter in force, which may be or become applicable to Borrower or any Borrower Party, the relationship of lender and borrower, Lender, the Project, any of the Loan Documents, or any part of any of them (whether or not the same may be valid) and all requirements, obligations and conditions of all instruments of record on the date hereof.

“Lender” has the meaning assigned in the Preamble, and its successors and assigns.

“Lender Exposure” means any one or more of the following: (i) the Loan is in violation of Legal Requirements, or (ii) the Project or any other collateral for the Loan or any portion thereof (including the Rents (as defined in the Mortgage) or other income to be derived therefrom) is subject to forfeiture or to being frozen, seized, sequestered or otherwise impaired by a Governmental Authority, or (iii) the Loan or any payments made or to be made in respect thereof (including principal and interest) is subject to forfeiture or to being frozen, seized, sequestered or otherwise impaired by a Governmental Authority or

(iv) Lender or any of its collateral for the Loan or the Lien priority thereof or Lender’s rights or remedies in respect of the Loan or the collateral therefor is otherwise impaired or adversely affected, or (v) Lender, its affiliates and its or their respective directors, officers, employees, attorneys, agents, advisors, participants, successors and assigns is subject to criminal or civil liability or penalty.

“Lending Installation” means any office, branch, subsidiary or Affiliate of Lender.

“Lien” means any interest, or claim thereof, in the Project securing an obligation owed to, or a claim by, any Person other than the owner of the Project, whether such interest is based on common law, statute or contract, including the lien or security interest arising from a deed of trust, mortgage, assignment, encumbrance, pledge, security agreement, conditional sale or trust receipt or a lease, consignment or bailment for security purposes. The term “Lien” shall include reservations, exceptions, encroachments, easements, rights of way, covenants, conditions, restrictions, leases and other title exceptions and encumbrances affecting the Project.

“Loan” means the loan to be made by Lender to Borrower under this Agreement and all other amounts secured by the Loan Documents.

“Loan Amount” has the meaning assigned in Section 2.1.

“Loan Documents” has the meaning assigned in Section 2.4(a), as any or all of the same may be supplemented, amended, restated and/or replaced from time to time.

“Loan Party” means each Borrower and Guarantor.

“Loan Year” means the period between the date hereof and May 17, 2024 for the first Loan Year and the period between each succeeding May 18th and May 17th until the Maturity Date.

“Lockout Account” has the meaning assigned in Section 2.9(a).

“Major Lease” means each of (a) a ground Lease, sandwich Lease or master Lease, (b) a Lease which, when combined with all other space in the individual Project leased to the same tenant or an Affiliate thereof, demises aggregate space in excess of 15,000 square feet.

“Management Agreement” shall mean those certain Wheeler Real Estate Company Management Agreements between each Borrower and Property Manager as described in the Assignment of Management Agreement.

“Material Action” shall mean, as to any Person, an action to file any insolvency, or reorganization case or proceeding, to institute proceedings to have such Person be adjudicated bankrupt or insolvent, to institute proceedings under any applicable insolvency law, to seek any relief under any law relating to relief from debts or the protection of debtors, to consent to the filing or institution of bankruptcy or insolvency proceedings against such Person, to file a petition seeking, or consent to, reorganization or relief with respect to such Person under any applicable federal or state law relating to bankruptcy or insolvency, to seek or consent to the appointment of a receiver, liquidator, assignee, trustee, sequestrator, custodian, or any similar official of or for such Person or a substantial part of its property, to make any assignment for the benefit of creditors of such Person, to admit in writing such Person’s inability to pay its debts generally as they become due (unless such admission is true), or to take action in furtherance of any of the foregoing.

“Material Adverse Effect” or “Material Adverse Change” means a material adverse effect upon or a material adverse change in (i) the business affairs, operations or the financial condition of Borrower or Guarantor or (ii) the ability of Borrower or Guarantor to perform its or his or her material contractual obligations under any Loan Document to which it or he or she is a party, or (iii) the validity or priority of the Lien of the Mortgage or the validity or enforceability of this Agreement or any of the other Loan Documents or any of the material rights, remedies or options of Lender hereunder or thereunder or

(iv) the Project, in Borrower’s interest in and under the Ground Lease, or the other collateral for the Loan or a material portion or component thereof (including the value or marketability thereof).

“Major Potential Default” means a monetary Potential Default or a material non-monetary Potential Default.

“Maturity Date” means the earlier of (a) the Scheduled Maturity Date, or (b) any earlier date on which the entire Loan is required to be paid in full, by acceleration or otherwise, under this Agreement or any of the other Loan Documents.

“Member” has the meaning assigned in Section 8.14(a).

“Moody’s” means Moody’s Investors Services, Inc., and its successors in interest.

“Mortgage” means, for any Project, the mortgage, deed of trust or deed to secure debt, as applicable, and security agreement and fixture filing, dated as of the date hereof, as originally executed by the applicable Borrower in favor of, or for the benefit of, Lender, covering and creating a first lien on such Project, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“Multiemployer Plan” means an Employee Benefit Plan maintained pursuant to a collective bargaining agreement or any other arrangement to which any Loan Party or any member of the Controlled Group is a party to which more than one employer is obligated to make contributions and which otherwise is a “multiemployer plan” as defined in Section 3(37) of ERISA.

“Net Operating Income” means the amount by which Operating Revenues exceed Operating Expenses.

“Note(s)” means the Promissory Note dated as of the date hereof from Borrower payable to Lender evidencing the Loan, as originally executed, and any substitute promissory note(s) executed by Borrower pursuant to Section 8.15, all as the same may be issued, supplemented, amended, modified, consolidated, extended, refinanced, substituted, replaced, renewed and/or restated from time to time.

“Notice Date” has the meaning assigned in Section 2.11(a).

“Obligations” means all loans, advances, debts, liabilities and obligations for monetary amounts (whether such amounts are liquidated or determinable) owing by Borrower to Lender, and all present or future covenants and duties of Borrower regarding such amounts, of any kind or nature, whether evidenced by any note, agreement or other instrument, arising under this Agreement or any of the other Loan Documents. This term includes all interest, charges, expenses, reasonable attorneys’ fees and any other sum chargeable to Borrower under any of the Loan Documents.

“OECD” means the Organization for Economic Cooperation and Development or any successor organization.

“OFAC” means the U.S. Department of the Treasury’s Office of Foreign Assets Control.

“Operating Account” has the meaning assigned in Section 2.9(a).

“Operating Expenses” means, for any period, all reasonable and necessary recurring expenses of operating a Project in the ordinary course of business and which are directly associated with and fairly allocable to such Project for the applicable period, including payments pursuant to the Ground Lease, ad valorem real estate taxes and assessments, insurance premiums, maintenance costs, management fees and costs, accounting, legal, and other professional fees, and other expenses incurred by Lender and reimbursed by Borrower under this Agreement and the other Loan Documents, and wages, salaries, and personnel expenses, but excluding Debt Service, extraordinary one-time expenses, capital expenditures, deposits to Reserve Funds, any payment or expense that is non-recurring or for which Borrower was or is

to be reimbursed from proceeds of the Loan or insurance or by any third party (including without limitation, any Tenant), and any non-cash charges such as depreciation and amortization. Operating Expenses shall not include federal, state or local income taxes or legal and other professional fees unrelated to the operation of such Project.

“Operating Revenues” means, for any period, all revenues of Borrower from operation of a Project or otherwise arising in respect of such Project after the date hereof which are properly allocable to such Project for the applicable period, including receipts from Leases and parking agreements, license and concession fees and charges and other miscellaneous operating revenues, proceeds from rental or business interruption insurance, any sum received or receivable from any deposit held as security for performance of a Tenant’s obligation, any other moneys paid or payable in respect of any display or advertising at such Project including any fixture or fitting at such Project for display or advertisement, but excluding Tenant security or other deposits until they are forfeited by the depositor, advance rentals until they are earned, disbursements from Reserve Funds, extraordinary or non-recurring income (including without limitation, lease termination payments), and proceeds from a sale or other disposition.

“Other Connection Taxes” means with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than connections arising from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in the Loan or the Loan Document).

“Other Taxes” means all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement, filing, recordation or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document, except any such Taxes that are Other Connection Taxes imposed with respect to an assignment (other than an assignment made pursuant to paragraph (h) of Schedule 2.5.

“Partial Release Date” has the meaning assigned in Section 2.12.

“Partial Release Price” means (i) for any individual Partial Project Release Parcel the subject of a Partial Project Release, one hundred ten percent (110%) of the allocated loan amount for such Partial Project Release Parcel, as determined by Lender upon receipt of an Appraisal pursuant to Section 2.12, or (ii) for multiple Partial Project Release Parcels the subject of simultaneous Partial Project Release, one hundred ten percent (110%) of the aggregate the allocated loan amount for all such Partial Project Release Parcel, as determined by Lender upon receipt of an Appraisal pursuant to Section 2.12.

“Partial Project Release” has the meaning assigned in Section 2.12.

“Patriot Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56 and the regulations promulgated thereunder, as each of the same may be amended, modified, replaced and/or supplemented from time to time.

“Payment Date” has the meaning assigned in Section 2.3(a).

“Pension Plan” means an employee pension benefit plan within the meaning of Section 3(2) of ERISA (other than a Multiemployer Plan) that is covered by Title IV of ERISA or subject to the minimum funding standards under Section 412 of the Code and as to which any Loan Party or any member of the Controlled Group may have any liability.

“Permitted Transfer” means

(a) leasing of space within the Project, so long as Borrower complies with the provisions of the Loan Documents relating to such leasing activity;

10

US_ACTIVE\123288794\V-8

(b) a Transfer by devise or descent or by operation of law upon the death of an individual having a legal or beneficial ownership or economic interest in Borrower;

(c) any Below the Fund Transfer, in one or a series of transactions, of the direct membership interests in Borrower or Guarantor, so long as, at all times during the term of the Loan, both of the following shall be satisfied: (i) Guarantor or its successor by merger or consolidation or a sale of all or substantially all of its assets owns, directly or indirectly, at least fifty-one percent (51%) of the voting and beneficial ownership interests in Borrower, and (ii) Guarantor or its successor by merger or consolidation or a sale of all or substantially all of its assets shall maintain the day to day control and management of Borrower, or

(d) Above the Fund Transfers, provided that after giving effect to any such Above the Fund Transfer the following listed entities (either individually or in combination with one another) shall own and retain at least fifty-one (51%) percent of the direct or indirect controlling ownership interests of Wheeler REIT, L.P., a Virginia limited partnership: (1) Wheeler Real Estate Investment Trust, Inc.

(e) Lender’s consent shall not be required in connection with one or a series of Transfers, of not more than forty-nine percent (49%) of the membership interests in a Borrower; provided, however, no such Transfer shall result in the change of control in Borrower, and as a condition to each such Transfer, Lender shall receive not less than thirty (30) days prior written notice of such proposed Transfer. Borrower shall pay any and all reasonable out-of-pocket costs and expenses incurred in connection with such Transfers (including Lender’s counsel fees and disbursements).

“Person” means any individual, corporation, partnership, joint venture, association, joint stock company, trust, trustee, estate, limited liability company, unincorporated organization, real estate investment trust, government or any agency or political subdivision thereof, or any other form of entity.

“Pledge of Accounts” means that certain Pledge of Accounts dated as of the date hereof, as originally executed by Borrower in favor of Lender, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“PML” has the meaning assigned in Section 3.1(a)(vi).

“Potential Default” means the occurrence of any event or condition which, with the giving of notice, the passage of time, or both, would reasonably be expected to constitute an Event of Default, as determined in good faith.

“Prepayment Date” has the meaning assigned in Schedule 2.3(d).

“Prepayment Fee” has the meaning assigned in Section 2.3(d).

“Prime Rate” has the meaning assigned in Schedule 2.2(a).

“Principal Balance” means the outstanding principal balance of the Note from time to time.

“Prohibited Person” means any Person: (a) listed in the Annex to, or that fails to comply with the provisions of, the Executive Order; (b) that is owned or controlled by, or acting for or on behalf of, any person or entity that is listed in the Annex to, or that otherwise fails to comply with the provisions of, the Executive Order; (c) with whom Lender is prohibited from dealing; (d) that is otherwise engaging in any transaction in violation of any terrorism or money laundering Legal Requirements, including, without limitation, the Executive Order and the Patriot Act; (e) that commits, threatens or conspires to commit, or supports, “terrorism,” as such term is defined in the Executive Order or the Patriot Act; (f) that is named as a “specially designated national and blocked person” on the most current list published by OFAC at its official website or at any replacement website or other replacement official publication of such list; or (g) that is an Affiliate of a Person listed above.

“Project Release” has the meaning assigned in Section 2.11.

11

US_ACTIVE\123288794\V-8

“Project” means, individually and collectively, as the context may require, each of the real properties described in Exhibit A, and all improvements now or hereafter located thereon, including without limitation, the retail buildings located on each property, and all related facilities, amenities, fixtures, and personal property owned by the applicable Borrower.

“Projects” means, collectively, each and every Project that secures the Loan at the time in question.

“Property Manager” means Wheeler Real Estate LLC, d/b/a Wheeler Real Estate Company, a Virginia limited liability company, a subsidiary of Wheeler Real Estate Investment Trust.

“Public Official” means any officer or employee of a government or any government department or agency; any person in an official capacity for or on behalf of a government or any government department or agency; any officer or employee of a government investment vehicle owned or funded by a government, including but not limited to currency reserve funds, government-employee pension funds, and sovereign wealth funds; any officer or employee of a company or business that is 25% or more owned or controlled by a government agency (even is such agency is not considered a public official under local law); any officer or employee of a public international organization, such as the World Bank or the United Nations; any officer or employee of a political party or any person acting in an official capacity on behalf of a political party; any candidate for political office.

“Recipient” means Lender and its successors and/or assigns in interest under the Loan Documents.

“Recourse Indemnity” means each Limited Recourse Indemnity Agreement now or hereafter executed by Guarantor to and in favor of Lender, as the same may be supplemented, amended, modified, consolidated, extended, substituted, replaced, renewed and/or restated from time to time.

“Redirection Notice” means a written notice from Lender to Depositary Bank whereby Lender is able to take control of the Collections Account and Borrower shall not have a right of withdrawal from the Collections Account.

“Regulation D” has the meaning assigned in the definition of Reserve Requirement.

“Reimbursement Contribution” is defined in Section 14.1(c).

“Release Date” has the meaning assigned in Section 2.11.

“Release Price” means (i) for any individual Project the subject of a Project Release, one hundred ten percent (110%) of the Allocated Loan Amount as set forth in Schedule II for such Project, or (ii) for multiple Projects the subject of simultaneous Project Release, one hundred ten percent (110%) of the aggregate Allocated Loan Amount as set forth in Schedule II for all such Projects.

“Replacement Rate” has the meaning assigned in Schedule 2.2(a).

“Replacement Reserve” has the meaning assigned in Schedule 2.6(a).

“Replacement Reserve Monthly Deposit” has the meaning assigned in Schedule 2.6(a).

“Required Repairs” has the meaning assigned in Section 2.6(c).

“Required Repair Fund” has the meaning assigned in Section 2.6(c).

“Requirements” has the meaning assigned in Section 8.13.

12

US_ACTIVE\123288794\V-8

“Reserve Funds” means, collectively, the Leasing Reserve, the Tax and Insurance Escrow Fund, the Replacement Reserve Fund, the Required Repair Fund, and any other escrow fund or impound now or hereafter established pursuant to the Loan Documents; “Reserve Fund” means any one of them.

“Reserve Requirement” means, for any day, the highest reserve percentage (expressed as a decimal) from time to time established by (x) the Council Regulation established by the European Central Bank, as revised from time to time, or (y) the Board of Governors of the U.S. Federal Reserve System or (z) any other banking authority to which any Lender is now or hereafter subject, including, without limitation, any (i) reserve on Eurocurrency Liabilities as defined in Regulation D of the Board of Governors of the U.S. Federal Reserve System (as the same may be amended, modified, replaced and/or supplemented from time to time, “Regulation D”) at the ratios provided in such Regulation D from time to time, and (ii) any marginal, supplemental or emergency reserves.

“Risk-Based Capital Guidelines” has the meaning assigned in paragraph (f) of Schedule 2.5.

“S&P” means S&P Global Ratings, a division of The McGraw Hill Companies, Inc., and its successors in interest.

“Sanctioned Country” means any country or jurisdiction who is, or whose government or government-owned entity is the subject of Sanctions which countries include the Crimea region (formerly Ukraine), Cuba, Iran, North Korea and Syria.

“Sanctioned Party” means, at any time, any Person, including any entity that is 50% or more owned or controlled, either directly or indirectly, by any Person who is (a) the subject of Sanctions, or (b) located in or resident of a Sanctioned Country.

“Sanctions” means sanctions laws, regulations and executive orders administered and enforced by the United States (including OFAC and the U.S. Department of State), the United Nations, the European Union, Her Majesty’s Treasury-UK, or any locally applicable sanctions regime, as each of the same may be amended, modified, replaced and/or supplemented from time to time.

“Scheduled Maturity Date” means June 10, 2033, provided, that if such day is not a Business Day, then the immediately preceding Business Day.

“Secondary Market Transaction” has the meaning assigned in Section 8.15(a).

“Servicer” has the meaning provided in Section 8.15(d).

“Servicing Agreement has the meaning provided in Section 8.15(d).

“Single Purpose Entity” has the meaning assigned in Section 8.14(a).

“Site Assessment” means an environmental engineering report for a Project prepared by an engineer engaged by Lender, at Borrower’s expense, and in a manner satisfactory to Lender, based upon an investigation relating to and making appropriate inquiries concerning the existence of Hazardous Materials on or about such Project, and the past or present discharge, disposal, release or escape of any such substances, all consistent with good customary and commercial practice, including without limitation the Operations and Maintenance Plans described on Exhibit A to the Indemnity Agreement.

“Special Member” has the meaning assigned in Section 8.14(a).

“State” means, unless the context otherwise indicates, the state where each Project, or the applicable Project, is located.

“Subsidiary” means, with respect to any Person, any corporation, partnership, limited liability company, association, joint venture, or other business entity of which more than 50% of the total voting power of shares of stock or other ownership interests entitled (without regard to the occurrence of any

13

US_ACTIVE\123288794\V-8

contingency) to vote in the election of the Person or Persons (whether directors, managers, trustees, or other Persons performing similar functions) having the power to direct or cause the direction of the management and policies thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof; provided, that in determining the percentage of ownership interests of any Person controlled by another Person, no ownership interest in the nature of a “qualifying share” of the former Person shall be deemed to be outstanding.

“Tax and Insurance Escrow Fund” has the meaning assigned in Section 2.6(d).

“Tax Requirements” means, collectively, all foreign, domestic, federal, state, local and municipal laws, statutes, codes, ordinances, rules, rulings, orders, judgments, decrees, injunctions, arbitral decisions, regulations, authorizations, determinations, directives and any other requirements of all Taxing Authorities, including, without limitation, FATCA, whether now or hereafter in force (whether or not the same may be valid).

“Taxes” means any and all present or future taxes, levies, imposts, duties, deductions, withholdings (including backup withholding), assessments, fees or other charges imposed by any Taxing Authority, including any interest, additions to tax or penalties applicable thereto.

“Taxing Authority” means the U.S. government or the government of any other nation, or of any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government (including, without limitation, any supra-national bodies such as the European Union or the European Central Bank, if applicable).

“Test Date” means the last day of each calendar quarter during the term of the Loan, commencing on December 31, 2023.

“Title Policy(ies)” means each ALTA Loan Policy issued to Lender in connection with the Loan in accordance with the Lender’s written instructions, as amended, modified and/or endorsed from time to time in accordance with Lender’s written instructions.

“Transfer” means (a) the sale, transfer, conveyance, grant, mortgage, pledge, hypothecation, lease, license, declaration of trust, assignment or other disposal of a direct legal or beneficial ownership or economic interest in (i) the Project, (ii) Borrower, or (iii) Guarantor, and (b) any division of a limited liability company into multiple entities or series pursuant to Section 18-217 of the Delaware Limited Liability Company Act, as amended, with allocation of any of the collateral for the Loan to any such entity or series; “Transfer” shall not include the leasing of individual units within the Project so long as Borrower complies with the provisions of the Loan Documents relating to such leasing activity.

“Underwritten Expenses” means (a) the greater of actual Operating Expenses for the trailing twelve (12) month period and the Operating Expenses expected to be incurred by the Project during the twelve (12) month period following the date of calculation, as reasonably estimated by Lender reflected in the Appraisal approved by Lender, plus (b) a vacancy rate equal to the greater of actual Project vacancy and five percent 5% and plus (c) in the case of management fees, the greater of the actual management fee for the Project and three percent (3%).

“Underwritten Reserves” means the greater of (a) actual annual Reserve Funds required to be deposited under this Agreement, and (b) an annual replacement reserve of $0.20 per rentable square foot of space in the Project.

“Unrelated Claims” has the meaning assigned in Section 12.3(d).

“U.S.” means The United States of America.

“U.S. Lender” has the meaning assigned in paragraph (a)(iii) of Schedule 2.5.

14

US_ACTIVE\123288794\V-8

“Withholding Agent” means any Loan Party and Lender.

“Withholding Taxes” means any and all Taxes collected by withholding or deduction.

“Yield Maintenance Amount” has the meaning set forth in Schedule 2.3(d) attached hereto and made a part hereof.

Section 1.2Principles of Construction. All references to sections and schedules are to sections and schedules in or to this Agreement unless otherwise specified. Unless otherwise specified, the words “hereof,” “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. Unless otherwise specified, all meanings attributed to defined terms herein shall be equally applicable to both the singular and plural forms of the terms so defined.

Article 2

LOAN TERMS

Section 1.1The Loan. Lender agrees, on the terms and conditions set forth in this Agreement, to make a loan to Borrower in the principal amount of Fifty-Three Million Seventy Thousand and 00/100 Dollars ($53,070,000.00) (the “Loan Amount”), all of which is being disbursed to or at the direction of Borrower on the date hereof, as provided for in this Agreement. The Loan is not a revolving facility and in no event shall Borrower have the right to re-borrow any amount repaid or prepaid under this Agreement.

Section 1.2Interest Rate; Late Charge; Default Rate.

(a)The Principal Balance of the Loan (including any amounts added to principal under the Loan Documents) shall bear interest at the Contract Rate. Interest on the Principal Balance shall be computed on the basis of the actual number of days elapsed in the period during which interest or fees accrue and a year of three hundred sixty (360) days. In computing interest on the Loan, the date of the making of a disbursement under the Loan shall be included and the date of payment shall be excluded.

(b)Except with respect to the payment due on the Maturity Date, in addition to the payments required under this Section 2.2, if Borrower fails to pay any installment of interest or principal on the date on which the same is due, Borrower shall pay to Lender a late charge on such past-due amount, as liquidated damages and not as a penalty, equal to five percent (5%) of such amount, but not in excess of the maximum amount of interest allowed by applicable Legal Requirements. These charges shall be paid to defray the expenses incurred by Lender in handling and processing such delinquent payment(s) and to compensate Lender for the loss of the use of such funds. These charges shall be secured by the Loan Documents.

(c)In addition to the payments required under this Section 2.2, while an Event of Default exists, the Loan shall bear interest at the Default Rate.

Section 1.3Terms of Payment. Borrower hereby covenants to punctually (i) pay the Loan and the other Obligations, in immediately available funds, as provided herein, in the Note and in the other Loan Documents and (ii) perform the Obligations. Without limiting the foregoing, the Loan shall be payable as follows:

(a)Interest. Borrower shall pay Lender interest in accordance with the terms of the Note and this Agreement. Interest on the Principal Balance of the Loan shall accrue from and after the date hereof until the Obligations are indefeasibly paid in full. On the date hereof, Borrower shall pay interest in advance for the period commencing on the date hereof and ending June 9, 2023. Commencing on July 10, 2023 and continuing thereafter, Borrower shall pay interest in arrears on the tenth (10th) Business Day of each month (each a “Payment Date”) until the Obligations are indefeasibly paid in full.

15

US_ACTIVE\123288794\V-8

(b)Principal Amortization. Commencing on July 10, 2028 and continuing thereafter on each Payment Date until the Maturity Date (whereupon all amounts due under the Loan Documents shall be paid in full), Borrower shall pay to Lender monthly installments of principal in the amount set forth on Schedule 2.3(b) (each, an “Amortization Payment”).

(c)Maturity. On the Maturity Date, Borrower shall pay to Lender all outstanding principal, accrued and unpaid interest, and any other outstanding Obligations.

(d)Prepayment. Except as otherwise expressly stated in Articles 2 and 3 hereof, upon not less than thirty (30) days prior notice to Lender, Borrower may prepay the Loan and any other amounts then due and payable under this Agreement and other Loan Documents in whole but not in part, upon payment of a prepayment fee (the “Prepayment Fee”) equal to, as applicable, (i) for any Prepayment Date occurring prior to the Seventh (7th) Loan Year, the Yield Maintenance Amount, (ii) for any Prepayment Date occurring on or after the date set forth in clause (i) above, but prior to the eighth (8th) Loan Year, two percent (2.0%) of the amount of Principal Balance being prepaid on such Prepayment Date; and (iii) for any Prepayment Date occurring on or after the date set forth in clause (ii) above, but prior to the ninth (9th) Loan Year, one percent (1.0%) of the amount of Principal Balance being prepaid on such Prepayment Date. Thereafter, upon not less than thirty (30) days’ prior notice to Lender, Borrower may prepay the Loan and any other amounts then due and payable under this Agreement and other Loan Documents in whole but not in part, without Prepayment Fee. The Prepayment Fee shall be due and payable upon any acceleration or prepayment of the Loan, whether voluntary, involuntary, as a result of, or otherwise in connection with, a Creditors’ Rights Law proceeding or upon occurrence of an Event of Default, and Lender shall not be obligated to accept any prepayment unless it is accompanied by all accrued interest due under the Loan Documents and all other Obligations of Borrower due under the Loan Documents, together with an amount equal to the applicable Prepayment Fee. Such amounts may be applied by Lender in such order and priority as Lender shall determine. The parties hereto acknowledge and agree that the damages that Lender would suffer as a result of the Loan being prepaid are difficult or impossible to ascertain and, therefore, agree that the aforesaid Prepayment Fee is a reasonable approximation of such damages and does not constitute a penalty. Lender is not obligated hereunder or under any of the other Loan Documents to re-advance to Borrower any sums prepaid by Borrower, whether prepaid voluntarily or involuntarily. If for any reason Borrower prepays the Loan on a date other than a Payment Date, Borrower shall also pay to Lender, in addition to any other amounts required under this Section 2.3(d), all interest which would have accrued on the prepayment amount from the Prepayment Date until (but not including) the next succeeding Payment Date.

(e)Application of Payments. All payments received by Lender under the Loan Documents shall be applied: first, to any previously billed fees and expenses due hereunder to Lender under the Loan Documents; second, to any other fees and expenses due to Lender under the Loan Documents; third, to the payment of protective advances; fourth, to any Default Rate interest and late charges; fifth, to accrued and unpaid interest at the Contract Rate; and sixth, to the Principal Balance and other amounts due under the Loan Documents. Notwithstanding the foregoing, while an Event of Default exists, Lender may apply payments in such order and manner as Lender elects in its sole discretion.

(f)Set-Off. Subject to the terms and conditions of Section 2.5, all payments of the Obligations shall be made, without set-off, deduction, or counterclaim, in immediately available funds by wire transfer to Lender’s account set forth in the Note or to such other account(s) or location(s) as Lender may, from time to time, designate upon notice to Borrower.

Section 1.4Security. The Loan shall be evidenced, secured and supported by the following, all dated as of the date hereof (except as otherwise noted below) (collectively, with any amendments, supplements, restatements, consolidations, extensions, modifications, renewals, substitutions and replacements thereto from time to time, the “Loan Documents”):

(a)this Agreement;

16

US_ACTIVE\123288794\V-8

(b)the Note;

(c)the Mortgage;

(d)the Assignment of Rents and Leases;

(e)the Assignment of Management Agreement;

(f)the Collateral Assignment;

(g)the Pledge of Accounts;

(h)the Collections Account DACA;

(i)each Cash Management Agreement (if any);

(j)the Recourse Indemnity;

(k)the Indemnity Agreement;

(l)the financing statements referred to in the Mortgage; and

(m)such other assignments, pledges, documents and agreements as Lender may require.

Section 1.5Withholding Taxes; Changes In Legal Requirements; Market Disruption; EEA Financial Institution. Borrower and Lender shall be bound by the provisions of Schedule 2.5 of this Agreement; provided that (a) if Lender is a U.S. Lender, no provisions relating to Non-U.S. Lenders shall apply, and (b) at any time while Lender is not an EEA Financial Institution, the provisions of Schedule 2.5(i) shall not apply.

Section 1.6Reserve Funds. Borrower shall deposit with Lender such amounts as are required under this Section 2.6 from the Replacement Reserve, the Leasing Reserve, and the Tax and Insurance Escrow Fund on the terms and conditions of this Section 2.6 and the other terms and conditions of this Agreement.

(a)Borrower shall establish and fund the Replacement Reserve, and Borrower shall have the right to request disbursements from the Replacement Reserve in accordance with Schedule 2.6(a).

(b)Borrower shall establish and fund the Leasing Reserve and shall have the right to request disbursements from the Leasing Reserve in accordance with Schedule 2.6(b).

(c)Required Repair Funds. Borrower shall perform the repairs at the Project that are listed on Schedule 2.6(c) hereto (such repairs hereinafter collectively referred to as “Required Repairs”). Borrower shall complete the Required Repairs on or before the required deadline for each repair as set forth on Schedule 2.6(c). On the date hereof, Borrower shall deposit with Lender an amount equal to $242,906.25 to perform the Required Repairs. Amounts so deposited with Lender shall hereinafter be referred to as Borrower’s “Required Repair Fund.” Subject to the terms and conditions of this Agreement, the Required Repair Fund shall be advanced by Lender to Borrower to fund or reimburse Borrower for the cost of Required Repairs in accordance with the conditions for replacements, repairs and capital improvements advances under Schedule 2.6(a). Any such funding or reimbursement will, with respect to each individual Required Repair, equal no more than 125% of the actual cost of such Required Repair. While an Event of Default exists, Lender shall not be obligated to advance to Borrower any portion of the Required Repair Fund, and while an Event of Default exists, Lender shall be entitled, without notice to Borrower, to apply any funds in the Required Repair Fund to fund completion of the

17

US_ACTIVE\123288794\V-8

Required Repairs or to satisfy the Obligations in such order, proportion and priority as Lender may determine in its sole discretion. Lender’s right to withdraw and apply Required Repair Funds shall be in addition to all other rights and remedies provided to Lender under this Agreement and the other Loan Documents. Upon completion of the Required Repairs in accordance herewith, Lender shall disburse to Borrower any then remaining Required Repair Funds in the Required Repair Reserve.

(d)Tax and Insurance Escrow Fund. Borrower shall pay to Lender (i) on the date hereof an initial deposit in the amount of $682,636.85 and (ii) on each Payment Date thereafter (a) one twelfth (1/12th) of the Taxes that Lender estimates will be payable with respect to each Project during the next ensuing twelve (12) months in order to accumulate with Lender sufficient funds to pay all such Taxes at least thirty (30) days prior to their respective due dates, and (b) one twelfth (1/12th) of the insurance premiums that Lender estimates will be payable for the renewal of the coverage afforded by the policies of insurance required pursuant to Article 3 hereof upon the expiration thereof in order to accumulate with Lender sufficient funds to pay all such insurance premiums at least thirty (30) days prior to the expiration of such policies of insurance (said amounts in (i) and (ii) above hereinafter called the “Tax and Insurance Escrow Fund”). Provided no Event of Default exists, Lender will apply funds in the Tax and Insurance Escrow Fund to payments of Taxes and insurance premiums required to be made by Borrower pursuant to the terms and conditions of this Agreement and the Mortgage. Borrower shall be responsible for ensuring the receipt by Lender, at least thirty (30) days prior to the respective due date for payment thereof, of all bills, invoices and statements for all Taxes and insurance premiums to be paid from the Tax and Insurance Escrow Fund, and so long as no Event of Default exists, Lender shall pay the governmental authority or other party entitled thereto directly to the extent funds are available for such purpose in the Tax and Insurance Escrow Fund. In making any payment relating to the Tax and Insurance Escrow Fund, Lender may do so according to any bill, statement or estimate procured from the appropriate public office (with respect to Taxes) or insurer or agent (with respect to insurance premiums), without inquiry into the accuracy of such bill, statement or estimate or into the validity of any tax, assessment, sale, forfeiture, tax Lien or title or claim thereof. If the amount of the Tax and Insurance Escrow Fund shall exceed the amounts due for Taxes and insurance premiums, Lender shall, in its sole discretion and only while no Event of Default exists, return any excess to Borrower or credit such excess against future payments to be made to the Tax and Insurance Escrow Fund. Any amount remaining in the Tax and Insurance Escrow Fund after the Obligations have been satisfied in full shall be returned to Borrower. In allocating such excess, Lender may deal with the Person shown on the records of Lender to be the owner of the Project. If at any time Lender reasonably determines that the Tax and Insurance Escrow Fund is not or will not be sufficient to pay Taxes and insurance premiums by the dates set forth in (i) and (ii) above, Lender shall notify Borrower of such determination and Borrower shall increase its monthly payments to Lender by the amount that Lender estimates is sufficient to make up the deficiency at least thirty (30) days prior to the due date of the Taxes and/or thirty (30) days prior to expiration of the applicable insurance policies, as the case may be.

(e)Reserve Funds Generally.

(i)Borrower grants to Lender a continuing, first-priority perfected security interest in each of the Reserve Funds and (A) any and all monies now or hereafter deposited in each Reserve Fund, (B) the accounts into which the Reserve Funds have been deposited, (C) all insurance of said accounts, (D) all accounts, contract rights and general intangibles or other rights and interests pertaining thereto, (E) all sums now or hereafter therein or represented thereby, (F) all replacements, substitutions or proceeds thereof, (G) all instruments and documents now or hereafter evidencing the Reserve Funds or such accounts, (H) all powers, options, rights, privileges and immunities pertaining to the Reserve Funds (including the right to make withdrawals therefrom), and (I) all proceeds of the foregoing as additional security for the Obligations. Until expended or applied in accordance herewith, the Reserve Funds shall constitute additional security for the Obligations. While an Event of Default exists, Lender may, in addition to any and all other rights and remedies available to Lender, apply any sums then

18

US_ACTIVE\123288794\V-8

present in any or all of the Reserve Funds to the payment of the Obligations in any order in its sole discretion. The Reserve Funds shall not constitute trust funds and may be commingled with other monies held by Lender.

(ii)Borrower shall not, without obtaining the prior consent of Lender, further pledge, assign or grant any security interest in any Reserve Fund or the monies deposited therein or permit any Lien or encumbrance to attach thereto, or any levy to be made thereon, or any UCC-1 Financing Statements, except those naming Lender as the secured party, to be filed with respect thereto.

(iii)Any interest or other earnings on a Reserve Fund shall be added to and become a part of such Reserve Fund and shall be disbursed in the same manner as other monies deposited in such Reserve Fund. Borrower shall be responsible for payment of any federal, state or local income or other tax applicable to the interest or income earned on the Reserve Funds.