| Table of Contents | |||||

| Page | |||||

| Company Overview | |||||

| Financial and Portfolio Overview | |||||

| Financial and Operating Results | |||||

| Financial Summary | |||||

| Consolidated Balance Sheets | |||||

| Consolidated Statements of Operations | |||||

| Reconciliation of Non-GAAP Measures | |||||

| Debt Summary | |||||

| Portfolio Summary | |||||

| Property Summary | |||||

| Top Ten Tenants by Annualized Base Rent and Lease Expiration Schedule | |||||

| Leasing Summary | |||||

| Definitions | |||||

WHLR | Financial & Operating Data | 2 | ||||

| Corporate Headquarters | ||||||||

| Wheeler Real Estate Investment Trust, Inc. | ||||||||

| Riversedge North | ||||||||

| 2529 Virginia Beach Boulevard Virginia Beach, VA 23452 | ||||||||

| Phone: (757) 627-9088 Toll Free: (866) 203-4864 | ||||||||

| Website: www.whlr.us | ||||||||

| Executive Management | ||||||||

| Daniel Khoshaba - CEO | ||||||||

| Crystal Plum - CFO | ||||||||

| M. Andrew Franklin - COO | ||||||||

| Board of Directors | ||||||||

Stefani D. Carter (Chairman) | Andrew R. Jones | |||||||

Clayton ("Chip") Andrews | Daniel Khoshaba (CEO) | |||||||

E. J. Borrack | Paula J. Poskon | |||||||

Kerry G. Campbell | Joseph D. Stilwell | |||||||

| Investor Relations Representative | ||||||||

| Mary Jensen - IRRealized, LLC mjensen@whlr.us Office: (757) 627-9088 Cell: (310) 526-1707 | ||||||||

| Transfer Agent and Registrar | ||||||||

| Computershare Trust Company, N.A. 250 Royall Street Canton, MA 02021 www.computershare.com | ||||||||

WHLR | Financial & Operating Data | 3 | ||||

Financial Results | |||||

| Net loss attributable to Wheeler REIT common stockholders (in 000s) | $ | (3,001) | |||

| Net loss per basic and diluted shares | $ | (0.31) | |||

Funds from operations available to common stockholders and Operating Partnership (OP) unitholders (FFO) (in 000s) (1) | $ | (3,673) | |||

| FFO per common share and OP unit | $ | (0.37) | |||

Adjusted FFO (AFFO) (in 000s) (1) | $ | 87 | |||

| AFFO per common share and OP unit | $ | 0.01 | |||

Assets and Leverage | |||||

| Investment Properties, net of $61.25 million accumulated depreciation (in 000s) | $ | 388,769 | |||

| Cash and Cash Equivalents (in 000s) | $ | 9,371 | |||

| Total Assets (in 000s) | $ | 483,081 | |||

Debt to Total Assets(3) | 74.24 | % | |||

| Debt to Gross Asset Value | 61.92 | % | |||

Market Capitalization | |||||

| Common shares outstanding | 9,706,738 | ||||

| OP units outstanding | 221,565 | ||||

| Total common shares and OP units | 9,928,303 | ||||

| Shares Outstanding at March 31, 2021 | First Quarter stock price range | Stock price as of March 31, 2021 | |||||||||||||||

| Common Stock | 9,706,738 | $2.56 - $7.36 | $ | 3.75 | |||||||||||||

| Series B preferred shares | 1,875,748 | $10.84 - $14.95 | $ | 11.00 | |||||||||||||

| Series D preferred shares | 3,142,196 | $16.94 - $18.72 | $ | 18.00 | |||||||||||||

Total debt (in 000s)(3) | $ | 358,627 | |||

| Common Stock market capitalization (as of March 31, 2021 closing stock price, in 000s) | $ | 36,400 | |||

Portfolio Summary | |||||

| Total Leasable Area (GLA) in sq. ft. | 5,511,881 | ||||

| Occupancy Rate | 89.4 | % | |||

Leased Rate (2) | 91.1 | % | |||

| Annualized Base Rent (in 000s) | $ | 47,401 | |||

| Total number of leases signed or renewed during the first quarter of 2021 | 59 | ||||

| Total sq. ft. leases signed or renewed during the first quarter of 2021 | 300,599 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 4 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 5 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 6 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 7 | ||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| (unaudited) | |||||||||||

| ASSETS: | |||||||||||

| Investment properties, net | $ | 388,769 | $ | 392,664 | |||||||

| Cash and cash equivalents | 9,371 | 7,660 | |||||||||

| Restricted cash | 34,838 | 35,108 | |||||||||

| Rents and other tenant receivables, net | 7,585 | 9,153 | |||||||||

| Assets held for sale | 10,859 | 13,072 | |||||||||

| Above market lease intangibles, net | 3,239 | 3,547 | |||||||||

| Operating lease right-of-use assets | 12,673 | 12,745 | |||||||||

| Deferred costs and other assets, net | 15,747 | 15,430 | |||||||||

| Total Assets | $ | 483,081 | $ | 489,379 | |||||||

| LIABILITIES: | |||||||||||

| Loans payable, net | $ | 338,533 | $ | 334,266 | |||||||

| Liabilities associated with assets held for sale | 10,939 | 13,124 | |||||||||

| Below market lease intangibles, net | 4,235 | 4,554 | |||||||||

| Warrant liability | 2,959 | 594 | |||||||||

| Operating lease liabilities | 13,161 | 13,200 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 10,980 | 11,229 | |||||||||

| Total Liabilities | 380,807 | 376,967 | |||||||||

| Series D Cumulative Convertible Preferred Stock (no par value, 4,000,000 shares authorized, 3,142,196 and 3,529,293 shares issued and outstanding, respectively; $99.27 million and $109.13 million aggregate liquidation preference, respectively) | 87,321 | 95,563 | |||||||||

| EQUITY: | |||||||||||

| Series A Preferred Stock (no par value, 4,500 shares authorized, 562 shares issued and outstanding) | 453 | 453 | |||||||||

| Series B Convertible Preferred Stock (no par value, 5,000,000 authorized, 1,875,748 shares issued and outstanding; $46.90 million aggregate liquidation preference) | 41,196 | 41,174 | |||||||||

| Common Stock ($0.01 par value, 18,750,000 shares authorized, 9,706,738 and 9,703,874 shares issued and outstanding, respectively) | 97 | 97 | |||||||||

| Additional paid-in capital | 234,086 | 234,061 | |||||||||

| Accumulated deficit | (262,800) | (260,867) | |||||||||

| Total Stockholders’ Equity | 13,032 | 14,918 | |||||||||

| Noncontrolling interests | 1,921 | 1,931 | |||||||||

| Total Equity | 14,953 | 16,849 | |||||||||

| Total Liabilities and Equity | $ | 483,081 | $ | 489,379 | |||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 8 | ||||

| Three Months Ended March 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| REVENUE: | |||||||||||

| Rental revenues | $ | 14,656 | $ | 15,355 | |||||||

| Other revenues | 72 | 219 | |||||||||

| Total Revenue | 14,728 | 15,574 | |||||||||

| OPERATING EXPENSES: | |||||||||||

| Property operations | 4,884 | 4,723 | |||||||||

| Depreciation and amortization | 3,716 | 4,799 | |||||||||

| Impairment of assets held for sale | — | 600 | |||||||||

| Corporate general & administrative | 1,582 | 1,872 | |||||||||

| Total Operating Expenses | 10,182 | 11,994 | |||||||||

| Gain (loss) on disposal of properties | 176 | (26) | |||||||||

| Operating Income | 4,722 | 3,554 | |||||||||

| Interest expense | (8,961) | (4,399) | |||||||||

| Net changes in fair value of warrant | (347) | — | |||||||||

| Other income | 552 | — | |||||||||

| Other expense | — | (1,024) | |||||||||

| Net Loss Before Income Taxes | (4,034) | (1,869) | |||||||||

| Income tax expense | — | (8) | |||||||||

| Net Loss | (4,034) | (1,877) | |||||||||

| Less: Net income (loss) attributable to noncontrolling interests | 15 | (9) | |||||||||

| Net Loss Attributable to Wheeler REIT | (4,049) | (1,868) | |||||||||

| Preferred Stock dividends - undeclared | (3,341) | (3,657) | |||||||||

| Deemed contribution related to preferred stock redemption | 4,389 | — | |||||||||

| Net Loss Attributable to Wheeler REIT Common Stockholders | $ | (3,001) | $ | (5,525) | |||||||

| Loss per share: | |||||||||||

| Basic and Diluted | $ | (0.31) | $ | (0.57) | |||||||

| Weighted-average number of shares: | |||||||||||

| Basic and Diluted | 9,704,638 | 9,694,284 | |||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 9 | ||||

Three Months Ended March 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Net Loss | $ | (4,034) | $ | (1,877) | ||||||||||

| Depreciation and amortization of real estate assets | 3,716 | 4,799 | ||||||||||||

| (Gain) loss on disposal of properties | (176) | 26 | ||||||||||||

| Impairment of assets held for sale | — | 600 | ||||||||||||

| FFO | (494) | 3,548 | ||||||||||||

| Preferred stock dividends - undeclared | (3,341) | (3,657) | ||||||||||||

| Preferred stock accretion adjustments | 162 | 170 | ||||||||||||

| FFO available to common stockholders and common unitholders | (3,673) | 61 | ||||||||||||

| Acquisition and development costs | — | 1 | ||||||||||||

| Capital related costs | 128 | 4 | ||||||||||||

Other non-recurring and non-cash (income) expenses (2) | 145 | 1,024 | ||||||||||||

| Net changes in fair value of warrant | 347 | — | ||||||||||||

| Straight-line rental revenue, net straight-line expense | (214) | (5) | ||||||||||||

| Loan cost amortization | 3,642 | 310 | ||||||||||||

| Above (below) market lease amortization | (12) | (273) | ||||||||||||

| Recurring capital expenditures and tenant improvement reserves | (276) | (279) | ||||||||||||

| AFFO | $ | 87 | $ | 843 | ||||||||||

| Weighted Average Common Shares | 9,704,638 | 9,694,284 | ||||||||||||

| Weighted Average Common Units | 223,665 | 234,019 | ||||||||||||

| Total Common Shares and Units | 9,928,303 | 9,928,303 | ||||||||||||

| FFO per Common Share and Common Units | $ | (0.37) | $ | 0.01 | ||||||||||

| AFFO per Common Share and Common Units | $ | 0.01 | $ | 0.08 | ||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 10 | ||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| Same Store | Non-same Store | Total | |||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||||||||||||||||||

| Net Loss | $ | (3,546) | $ | (1,802) | $ | (488) | $ | (75) | $ | (4,034) | $ | (1,877) | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Income tax expense | — | 8 | — | — | — | 8 | |||||||||||||||||||||||||||||

| Other expense | — | 1,024 | — | — | — | 1,024 | |||||||||||||||||||||||||||||

| Other income | (552) | — | — | — | (552) | — | |||||||||||||||||||||||||||||

| Net changes in fair value of warrant | 347 | — | — | — | 347 | — | |||||||||||||||||||||||||||||

| Interest expense | 8,253 | 4,366 | 708 | 33 | 8,961 | 4,399 | |||||||||||||||||||||||||||||

| (Gain) loss on disposal of properties | — | — | (176) | 26 | (176) | 26 | |||||||||||||||||||||||||||||

| Corporate general & administrative | 1,579 | 1,868 | 3 | 4 | 1,582 | 1,872 | |||||||||||||||||||||||||||||

| Impairment of assets held for sale | — | 600 | — | — | — | 600 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 3,716 | 4,767 | — | 32 | 3,716 | 4,799 | |||||||||||||||||||||||||||||

| Other non-property revenue | (13) | (22) | — | — | (13) | (22) | |||||||||||||||||||||||||||||

| Property Net Operating Income | $ | 9,784 | $ | 10,809 | $ | 47 | $ | 20 | $ | 9,831 | $ | 10,829 | |||||||||||||||||||||||

| Property revenues | $ | 14,607 | $ | 15,449 | $ | 108 | $ | 103 | $ | 14,715 | $ | 15,552 | |||||||||||||||||||||||

| Property expenses | 4,823 | 4,640 | 61 | 83 | 4,884 | 4,723 | |||||||||||||||||||||||||||||

| Property Net Operating Income | $ | 9,784 | $ | 10,809 | $ | 47 | $ | 20 | $ | 9,831 | $ | 10,829 | |||||||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 11 | ||||

| Three Months Ended March 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

Net Loss | $ | (4,034) | $ | (1,877) | ||||||||||

Add back: | Depreciation and amortization (1) | 3,704 | 4,526 | |||||||||||

Interest Expense (2) | 8,961 | 4,399 | ||||||||||||

Income tax (benefit) expense | — | 8 | ||||||||||||

EBITDA | 8,631 | 7,056 | ||||||||||||

| Adjustments for items affecting comparability: | ||||||||||||||

Acquisition and development costs | — | 1 | ||||||||||||

Capital related costs | 128 | 4 | ||||||||||||

| Change in fair value of warrant | 347 | — | ||||||||||||

Other non-recurring and non-cash expenses (3) | (552) | 1,024 | ||||||||||||

Impairment of assets held for sale | — | 600 | ||||||||||||

(Gain) loss on disposal of properties | (176) | 26 | ||||||||||||

Adjusted EBITDA | $ | 8,378 | $ | 8,711 | ||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 12 | ||||

| Property/Description | Monthly Payment | Interest Rate | Maturity | March 31, 2021 | December 31, 2020 | |||||||||||||||||||||||||||

First National Bank (7) | $ | 24,656 | LIBOR + 350 basis points | March 2021 | $ | 982 | $ | 1,045 | ||||||||||||||||||||||||

| Lumber River | $ | 10,723 | LIBOR + 350 basis points | April 2021 | 1,349 | 1,367 | ||||||||||||||||||||||||||

| Rivergate | $ | 103,167 | LIBOR + 295 basis points | April 2021 | 21,021 | 21,164 | ||||||||||||||||||||||||||

| JANAF Bravo | $ | 36,935 | 4.65 | % | April 2021 | 6,225 | 6,263 | |||||||||||||||||||||||||

| Columbia Fire Station | Interest only | 14.00 | % | July 2021 | 3,363 | 3,893 | ||||||||||||||||||||||||||

| Litchfield Market Village | $ | 46,057 | 5.50 | % | November 2022 | 7,417 | 7,418 | |||||||||||||||||||||||||

| Twin City Commons | $ | 17,827 | 4.86 | % | January 2023 | 2,897 | 2,915 | |||||||||||||||||||||||||

| Walnut Hill Plaza | $ | 26,850 | 5.50 | % | March 2023 | 3,252 | 3,287 | |||||||||||||||||||||||||

Powerscourt Financing Agreement (6) | Interest only | 13.50 | % | March 2023 | — | 25,000 | ||||||||||||||||||||||||||

| New Market | $ | 48,747 | 5.65 | % | June 2023 | 6,454 | 6,508 | |||||||||||||||||||||||||

Benefit Street Note (3) | $ | 53,185 | 5.71 | % | June 2023 | 7,088 | 7,145 | |||||||||||||||||||||||||

Deutsche Bank Note (2) | $ | 33,340 | 5.71 | % | July 2023 | 5,547 | 5,567 | |||||||||||||||||||||||||

| JANAF | $ | 333,159 | 4.49 | % | July 2023 | 48,423 | 48,875 | |||||||||||||||||||||||||

| Tampa Festival | $ | 50,797 | 5.56 | % | September 2023 | 7,878 | 7,920 | |||||||||||||||||||||||||

| Forrest Gallery | $ | 50,973 | 5.40 | % | September 2023 | 8,184 | 8,226 | |||||||||||||||||||||||||

South Carolina Food Lions Note (5) | $ | 68,320 | 5.25 | % | January 2024 | 11,418 | 11,473 | |||||||||||||||||||||||||

| Cypress Shopping Center | $ | 34,360 | 4.70 | % | July 2024 | 6,134 | 6,163 | |||||||||||||||||||||||||

| Port Crossing | $ | 34,788 | 4.84 | % | August 2024 | 5,876 | 5,909 | |||||||||||||||||||||||||

| Freeway Junction | $ | 41,798 | 4.60 | % | September 2024 | 7,544 | 7,582 | |||||||||||||||||||||||||

| Harrodsburg Marketplace | $ | 19,112 | 4.55 | % | September 2024 | 3,324 | 3,343 | |||||||||||||||||||||||||

| Bryan Station | $ | 23,489 | 4.52 | % | November 2024 | 4,290 | 4,312 | |||||||||||||||||||||||||

| Crockett Square | Interest only | 4.47 | % | December 2024 | 6,338 | 6,338 | ||||||||||||||||||||||||||

| Pierpont Centre | $ | 39,435 | 4.15 | % | February 2025 | 7,965 | 8,001 | |||||||||||||||||||||||||

| Shoppes at Myrtle Park | $ | 33,180 | 4.45 | % | February 2025 | 5,858 | 5,892 | |||||||||||||||||||||||||

| Folly Road | $ | 41,482 | 4.65 | % | March 2025 | 7,183 | 7,223 | |||||||||||||||||||||||||

| Alex City Marketplace | Interest only | 3.95 | % | April 2025 | 5,750 | 5,750 | ||||||||||||||||||||||||||

| Butler Square | Interest only | 3.90 | % | May 2025 | 5,640 | 5,640 | ||||||||||||||||||||||||||

| Brook Run Shopping Center | Interest only | 4.08 | % | June 2025 | 10,950 | 10,950 | ||||||||||||||||||||||||||

| Beaver Ruin Village I and II | Interest only | 4.73 | % | July 2025 | 9,400 | 9,400 | ||||||||||||||||||||||||||

| Sunshine Shopping Plaza | Interest only | 4.57 | % | August 2025 | 5,900 | 5,900 | ||||||||||||||||||||||||||

Barnett Portfolio (4) | Interest only | 4.30 | % | September 2025 | 8,770 | 8,770 | ||||||||||||||||||||||||||

| Fort Howard Shopping Center | Interest only | 4.57 | % | October 2025 | 7,100 | 7,100 | ||||||||||||||||||||||||||

| Conyers Crossing | Interest only | 4.67 | % | October 2025 | 5,960 | 5,960 | ||||||||||||||||||||||||||

| Grove Park Shopping Center | Interest only | 4.52 | % | October 2025 | 3,800 | 3,800 | ||||||||||||||||||||||||||

| Parkway Plaza | Interest only | 4.57 | % | October 2025 | 3,500 | 3,500 | ||||||||||||||||||||||||||

| Winslow Plaza | $ | 24,295 | 4.82 | % | December 2025 | 4,535 | 4,553 | |||||||||||||||||||||||||

| JANAF BJ's | $ | 29,964 | 4.95 | % | January 2026 | 4,814 | 4,844 | |||||||||||||||||||||||||

| Tuckernuck | $ | 32,202 | 5.00 | % | March 2026 | 5,150 | 5,193 | |||||||||||||||||||||||||

Wilmington Financing Agreement (6) | Interest only | 8.00 | % | March 2026 | 35,000 | — | ||||||||||||||||||||||||||

| Chesapeake Square | $ | 23,857 | 4.70 | % | August 2026 | 4,254 | 4,279 | |||||||||||||||||||||||||

| Berkley/Sangaree/Tri-County | Interest only | 4.78 | % | December 2026 | 6,176 | 9,400 | ||||||||||||||||||||||||||

| Riverbridge | Interest only | 4.48 | % | December 2026 | 4,000 | 4,000 | ||||||||||||||||||||||||||

| Franklin Village | $ | 45,336 | 4.93 | % | January 2027 | 8,372 | 8,404 | |||||||||||||||||||||||||

| Village of Martinsville | $ | 89,664 | 4.28 | % | July 2029 | 15,881 | 15,979 | |||||||||||||||||||||||||

| Laburnum Square | Interest only | 4.28 | % | September 2029 | 7,665 | 7,665 | ||||||||||||||||||||||||||

Total Principal Balance (1) | 358,627 | 353,916 | ||||||||||||||||||||||||||||||

Unamortized debt issuance cost (1) | (9,349) | (6,812) | ||||||||||||||||||||||||||||||

| Total Loans Payable, including assets held for sale | 349,278 | 347,104 | ||||||||||||||||||||||||||||||

| Less loans payable on assets held for sale, net loan amortization costs | 10,745 | 12,838 | ||||||||||||||||||||||||||||||

| Total Loans Payable, net | $ | 338,533 | $ | 334,266 | ||||||||||||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 13 | ||||

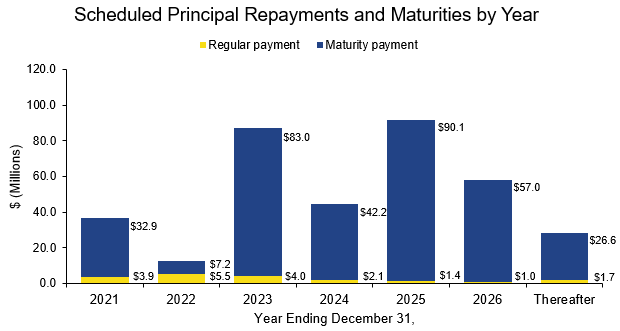

| Scheduled principal repayments and maturities by year | Amount | % Total Principal Payments and Maturities | ||||||||||||

| For the remaining nine months ending December 31, 2021 | $ | 36,815 | 10.27 | % | ||||||||||

| December 31, 2022 | 12,675 | 3.53 | % | |||||||||||

| December 31, 2023 | 86,970 | 24.25 | % | |||||||||||

| December 31, 2024 | 44,340 | 12.36 | % | |||||||||||

| December 31, 2025 | 91,530 | 25.52 | % | |||||||||||

| December 31, 2026 | 58,025 | 16.18 | % | |||||||||||

| Thereafter | 28,272 | 7.89 | % | |||||||||||

| Total principal repayments and debt maturities | $ | 358,627 | 100.00 | % | ||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 14 | ||||

Property | Location | Number of Tenants (1) | Total Leasable Square Feet | Percentage Leased (1) | Percentage Occupied | Total SF Occupied | Annualized Base Rent (in 000's) (2) | Annualized Base Rent per Occupied Sq. Foot | ||||||||||||||||||||||||

| Alex City Marketplace | Alexander City, AL | 17 | 151,843 | 96.8 | % | 96.8 | % | 147,043 | $ | 1,129 | $ | 7.68 | ||||||||||||||||||||

| Amscot Building | Tampa, FL | 1 | 2,500 | 100.0 | % | 100.0 | % | 2,500 | 83 | 33.00 | ||||||||||||||||||||||

| Beaver Ruin Village | Lilburn, GA | 28 | 74,038 | 95.2 | % | 90.4 | % | 66,948 | 1,166 | 17.42 | ||||||||||||||||||||||

| Beaver Ruin Village II | Lilburn, GA | 4 | 34,925 | 100.0 | % | 100.0 | % | 34,925 | 457 | 13.08 | ||||||||||||||||||||||

| Brook Run Shopping Center | Richmond, VA | 18 | 147,738 | 87.0 | % | 86.2 | % | 127,283 | 1,099 | 8.63 | ||||||||||||||||||||||

| Brook Run Properties (3) | Richmond, VA | — | — | — | % | — | % | — | — | — | ||||||||||||||||||||||

| Bryan Station | Lexington, KY | 10 | 54,277 | 100.0 | % | 100.0 | % | 54,277 | 594 | 10.95 | ||||||||||||||||||||||

| Butler Square | Mauldin, SC | 16 | 82,400 | 98.2 | % | 98.2 | % | 80,950 | 850 | 10.50 | ||||||||||||||||||||||

| Cardinal Plaza | Henderson, NC | 8 | 50,000 | 97.0 | % | 97.0 | % | 48,500 | 478 | 9.85 | ||||||||||||||||||||||

| Chesapeake Square | Onley, VA | 12 | 108,982 | 96.5 | % | 96.5 | % | 105,182 | 796 | 7.57 | ||||||||||||||||||||||

| Clover Plaza | Clover, SC | 10 | 45,575 | 100.0 | % | 100.0 | % | 45,575 | 377 | 8.26 | ||||||||||||||||||||||

| Columbia Fire Station | Columbia, SC | 1 | 21,273 | 14.4 | % | 14.4 | % | 3,063 | 81 | 26.60 | ||||||||||||||||||||||

| Courtland Commons (3) | Courtland, VA | — | — | — | % | — | % | — | — | — | ||||||||||||||||||||||

| Conyers Crossing | Conyers, GA | 13 | 170,475 | 98.0 | % | 98.0 | % | 166,975 | 895 | 5.36 | ||||||||||||||||||||||

| Crockett Square | Morristown, TN | 4 | 107,122 | 100.0 | % | 100.0 | % | 107,122 | 970 | 9.06 | ||||||||||||||||||||||

| Cypress Shopping Center | Boiling Springs, SC | 16 | 80,435 | 40.8 | % | 39.5 | % | 31,775 | 429 | 13.49 | ||||||||||||||||||||||

| Darien Shopping Center | Darien, GA | 1 | 26,001 | 100.0 | % | 100.0 | % | 26,001 | 156 | 6.00 | ||||||||||||||||||||||

| Devine Street | Columbia, SC | 2 | 38,464 | 100.0 | % | 100.0 | % | 38,464 | 319 | 8.28 | ||||||||||||||||||||||

| Edenton Commons (3) | Edenton, NC | — | — | — | % | — | % | — | — | — | ||||||||||||||||||||||

| Folly Road | Charleston, SC | 5 | 47,794 | 100.0 | % | 100.0 | % | 47,794 | 731 | 15.29 | ||||||||||||||||||||||

| Forrest Gallery | Tullahoma, TN | 26 | 214,451 | 80.3 | % | 80.3 | % | 172,124 | 1,246 | 7.24 | ||||||||||||||||||||||

| Fort Howard Shopping Center | Rincon, GA | 19 | 113,652 | 95.1 | % | 95.1 | % | 108,120 | 1,054 | 9.75 | ||||||||||||||||||||||

| Freeway Junction | Stockbridge, GA | 19 | 156,834 | 100.0 | % | 100.0 | % | 156,834 | 1,342 | 8.55 | ||||||||||||||||||||||

| Franklin Village | Kittanning, PA | 26 | 151,821 | 98.7 | % | 98.7 | % | 149,821 | 1,285 | 8.58 | ||||||||||||||||||||||

| Franklinton Square | Franklinton, NC | 15 | 65,366 | 100.0 | % | 100.0 | % | 65,366 | 589 | 9.02 | ||||||||||||||||||||||

| Georgetown | Georgetown, SC | 2 | 29,572 | 100.0 | % | 100.0 | % | 29,572 | 267 | 9.04 | ||||||||||||||||||||||

| Grove Park | Orangeburg, SC | 13 | 93,265 | 97.7 | % | 97.7 | % | 91,121 | 688 | 7.55 | ||||||||||||||||||||||

| Harbor Point (3) | Grove, OK | — | — | — | % | — | % | — | — | — | ||||||||||||||||||||||

| Harrodsburg Marketplace | Harrodsburg, KY | 6 | 60,048 | 79.0 | % | 79.0 | % | 47,448 | 404 | 8.52 | ||||||||||||||||||||||

| JANAF (4) | Norfolk, VA | 111 | 798,086 | 89.7 | % | 89.7 | % | 716,224 | 8,518 | 11.89 | ||||||||||||||||||||||

| Laburnum Square | Richmond, VA | 20 | 109,405 | 97.5 | % | 97.5 | % | 106,705 | 985 | 9.23 | ||||||||||||||||||||||

| Ladson Crossing | Ladson, SC | 15 | 52,607 | 100.0 | % | 100.0 | % | 52,607 | 507 | 9.64 | ||||||||||||||||||||||

| LaGrange Marketplace | LaGrange, GA | 13 | 76,594 | 96.9 | % | 96.9 | % | 74,194 | 430 | 5.80 | ||||||||||||||||||||||

| Lake Greenwood Crossing | Greenwood, SC | 7 | 47,546 | 90.1 | % | 90.1 | % | 42,818 | 351 | 8.19 | ||||||||||||||||||||||

| Lake Murray | Lexington, SC | 5 | 39,218 | 100.0 | % | 100.0 | % | 39,218 | 254 | 6.47 | ||||||||||||||||||||||

| Litchfield Market Village | Pawleys Island, SC | 19 | 86,740 | 88.7 | % | 87.3 | % | 75,702 | 902 | 11.91 | ||||||||||||||||||||||

| Lumber River Village | Lumberton, NC | 10 | 66,781 | 84.6 | % | 84.6 | % | 56,481 | 417 | 7.39 | ||||||||||||||||||||||

| Moncks Corner | Moncks Corner, SC | 1 | 26,800 | 100.0 | % | 100.0 | % | 26,800 | 323 | 12.07 | ||||||||||||||||||||||

| Nashville Commons | Nashville, NC | 12 | 56,100 | 100.0 | % | 100.0 | % | 56,100 | 625 | 11.14 | ||||||||||||||||||||||

| New Market Crossing | Mt. Airy, NC | 10 | 117,076 | 88.3 | % | 88.3 | % | 103,338 | 915 | 8.86 | ||||||||||||||||||||||

| Parkway Plaza | Brunswick, GA | 4 | 52,365 | 81.7 | % | 81.7 | % | 42,785 | 351 | 8.20 | ||||||||||||||||||||||

| Pierpont Centre | Morgantown, WV | 15 | 111,162 | 88.4 | % | 88.4 | % | 98,256 | 914 | 9.30 | ||||||||||||||||||||||

| Port Crossing | Harrisonburg, VA | 8 | 65,365 | 97.9 | % | 97.9 | % | 64,000 | 852 | 13.31 | ||||||||||||||||||||||

| Ridgeland | Ridgeland, SC | 1 | 20,029 | 100.0 | % | 100.0 | % | 20,029 | 140 | 7.00 | ||||||||||||||||||||||

| Riverbridge Shopping Center | Carrollton, GA | 10 | 91,188 | 94.7 | % | 94.7 | % | 86,388 | 690 | 7.99 | ||||||||||||||||||||||

| Rivergate Shopping Center | Macon, GA | 30 | 201,680 | 90.2 | % | 73.8 | % | 148,905 | 2,398 | 16.11 | ||||||||||||||||||||||

| Sangaree Plaza | Summerville, SC | 8 | 66,948 | 87.4 | % | 87.4 | % | 58,498 | 599 | 10.24 | ||||||||||||||||||||||

| Shoppes at Myrtle Park | Bluffton, SC | 13 | 56,601 | 99.3 | % | 99.3 | % | 56,181 | 609 | 10.83 | ||||||||||||||||||||||

| South Lake | Lexington, SC | 6 | 44,318 | 93.9 | % | 16.3 | % | 7,200 | 93 | 12.98 | ||||||||||||||||||||||

| South Park | Mullins, SC | 3 | 60,734 | 96.9 | % | 83.2 | % | 50,509 | 351 | 6.95 | ||||||||||||||||||||||

| South Square | Lancaster, SC | 6 | 44,350 | 81.0 | % | 81.0 | % | 35,900 | 300 | 8.36 | ||||||||||||||||||||||

| St. George Plaza | St. George, SC | 6 | 59,279 | 96.2 | % | 92.3 | % | 54,719 | 376 | 6.86 | ||||||||||||||||||||||

| Sunshine Plaza | Lehigh Acres, FL | 23 | 111,189 | 100.0 | % | 100.0 | % | 111,189 | 1,077 | 9.69 | ||||||||||||||||||||||

| Surrey Plaza | Hawkinsville, GA | 3 | 42,680 | 96.5 | % | 96.5 | % | 41,180 | 247 | 6.00 | ||||||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 15 | ||||

Property | Location | Number of Tenants (1) | Total Leasable Square Feet | Percentage Leased (1) | Percentage Occupied | Total SF Occupied | Annualized Base Rent (in 000's) (2) | Annualized Base Rent per Occupied Sq. Foot | ||||||||||||||||||||||||

| Tampa Festival | Tampa, FL | 20 | 137,987 | 71.9 | % | 64.6 | % | 89,166 | $ | 896 | $ | 10.05 | ||||||||||||||||||||

| Tri-County Plaza | Royston, GA | 7 | 67,577 | 94.1 | % | 94.1 | % | 63,577 | 409 | 6.43 | ||||||||||||||||||||||

| Tuckernuck | Richmond, VA | 12 | 93,624 | 87.2 | % | 87.2 | % | 81,648 | 841 | 10.30 | ||||||||||||||||||||||

| Tulls Creek (3) | Moyock, NC | — | — | — | % | — | % | — | — | — | ||||||||||||||||||||||

| Twin City Commons | Batesburg-Leesville, SC | 5 | 47,680 | 100.0 | % | 100.0 | % | 47,680 | 480 | 10.06 | ||||||||||||||||||||||

| Village of Martinsville | Martinsville, VA | 19 | 290,902 | 96.6 | % | 96.1 | % | 279,446 | 2,124 | 7.60 | ||||||||||||||||||||||

| Walnut Hill Plaza | Petersburg, VA | 6 | 87,239 | 38.1 | % | 38.1 | % | 33,225 | 279 | 8.41 | ||||||||||||||||||||||

| Waterway Plaza | Little River, SC | 10 | 49,750 | 100.0 | % | 100.0 | % | 49,750 | 497 | 9.99 | ||||||||||||||||||||||

| Westland Square | West Columbia, SC | 11 | 62,735 | 95.7 | % | 95.7 | % | 60,065 | 529 | 8.80 | ||||||||||||||||||||||

| Winslow Plaza | Sicklerville, NJ | 18 | 40,695 | 100.0 | % | 100.0 | % | 40,695 | 637 | 15.65 | ||||||||||||||||||||||

Total Portfolio | 759 | 5,511,881 | 91.1 | % | 89.4 | % | 4,925,961 | $ | 47,401 | $ | 9.62 | |||||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 16 | ||||

| Tenants | Annualized Base Rent ($ in 000s) | % of Total Annualized Base Rent | Total Occupied Square Feet | Percent Total Leasable Square Foot | Base Rent Per Occupied Square Foot | ||||||||||||||||||||||||||||||

| 1. | Food Lion | $ | 4,392 | 9.27 | % | 551,469 | 10.01 | % | $ | 7.96 | |||||||||||||||||||||||||

| 2. | Piggly Wiggly | 1,488 | 3.14 | % | 202,968 | 3.68 | % | 7.33 | |||||||||||||||||||||||||||

| 3. | Kroger (1) | 1,355 | 2.86 | % | 186,064 | 3.38 | % | 7.28 | |||||||||||||||||||||||||||

| 4. | Winn Dixie | 887 | 1.87 | % | 133,575 | 2.42 | % | 6.64 | |||||||||||||||||||||||||||

| 5. | Planet Fitness | 837 | 1.77 | % | 100,427 | 1.82 | % | 8.33 | |||||||||||||||||||||||||||

| 6. | Hobby Lobby | 717 | 1.51 | % | 114,298 | 2.07 | % | 6.27 | |||||||||||||||||||||||||||

| 7. | BJ's Wholesale Club | 651 | 1.37 | % | 147,400 | 2.67 | % | 4.42 | |||||||||||||||||||||||||||

| 8. | KJ's Market | 610 | 1.29 | % | 75,198 | 1.36 | % | 8.11 | |||||||||||||||||||||||||||

| 9. | Dollar Tree | 591 | 1.25 | % | 70,379 | 1.28 | % | 8.40 | |||||||||||||||||||||||||||

| 10. | Harris Teeter (1) | 579 | 1.22 | % | 39,946 | 0.72 | % | 14.49 | |||||||||||||||||||||||||||

| $ | 12,107 | 25.55 | % | 1,621,724 | 29.41 | % | $ | 7.47 | |||||||||||||||||||||||||||

| Lease Expiration Period | Number of Expiring Leases | Total Expiring Square Footage | % of Total Expiring Square Footage | % of Total Occupied Square Footage Expiring | Expiring Annualized Base Rent (in 000s) | % of Total Annualized Base Rent | Expiring Base Rent Per Occupied Square Foot | |||||||||||||||||||||||||||||||||||||

| Available | — | 585,920 | 10.63 | % | — | % | $ | — | — | % | $ | — | ||||||||||||||||||||||||||||||||

| Month-to-Month | 12 | 94,984 | 1.72 | % | 1.93 | % | 587 | 1.24 | % | 6.18 | ||||||||||||||||||||||||||||||||||

| 2021 | 67 | 149,310 | 2.71 | % | 3.03 | % | 2,187 | 4.61 | % | 14.65 | ||||||||||||||||||||||||||||||||||

| 2022 | 129 | 511,959 | 9.29 | % | 10.39 | % | 5,393 | 11.38 | % | 10.53 | ||||||||||||||||||||||||||||||||||

| 2023 | 129 | 863,848 | 15.67 | % | 17.54 | % | 7,562 | 15.95 | % | 8.75 | ||||||||||||||||||||||||||||||||||

| 2024 | 118 | 685,592 | 12.44 | % | 13.92 | % | 6,618 | 13.96 | % | 9.65 | ||||||||||||||||||||||||||||||||||

| 2025 | 105 | 808,251 | 14.66 | % | 16.41 | % | 7,894 | 16.65 | % | 9.77 | ||||||||||||||||||||||||||||||||||

| 2026 | 85 | 739,898 | 13.42 | % | 15.02 | % | 6,856 | 14.46 | % | 9.27 | ||||||||||||||||||||||||||||||||||

| 2027 | 30 | 193,631 | 3.51 | % | 3.93 | % | 2,343 | 4.94 | % | 12.10 | ||||||||||||||||||||||||||||||||||

| 2028 | 21 | 331,609 | 6.02 | % | 6.73 | % | 2,336 | 4.93 | % | 7.04 | ||||||||||||||||||||||||||||||||||

| 2029 | 16 | 114,020 | 2.07 | % | 2.31 | % | 1,158 | 2.44 | % | 10.16 | ||||||||||||||||||||||||||||||||||

| 2030 and thereafter | 47 | 432,859 | 7.86 | % | 8.79 | % | 4,467 | 9.44 | % | 10.32 | ||||||||||||||||||||||||||||||||||

| Total | 759 | 5,511,881 | 100.00 | % | 100.00 | % | $ | 47,401 | 100.00 | % | $ | 9.62 | ||||||||||||||||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 17 | ||||

| No Option | Option | ||||||||||||||||||||||||||||||||||

| Lease Expiration Nine and Twelve Month Periods Ending December 31, | Number of Expiring Leases | Expiring Occupied Square Footage | Expiring Annualized Based Rent (in 000s) | % of Total Annualized Base Rent | Expiring Base Rent per Square Foot | Number of Expiring Leases | Expiring Occupied Square Footage | Expiring Annualized Based Rent (in 000s) | % of Total Annualized Base Rent | Expiring Base Rent per Square Foot | |||||||||||||||||||||||||

| Available | — | 196,572 | $ | — | — | % | $ | — | — | — | $ | — | — | % | $ | — | |||||||||||||||||||

| Month-to-Month | 1 | 58,473 | 250 | 13.03 | % | 4.28 | — | — | — | — | % | — | |||||||||||||||||||||||

| 2021 | — | — | — | — | % | — | — | — | — | — | % | — | |||||||||||||||||||||||

| 2022 | — | — | — | — | % | — | 5 | 178,882 | 1,294 | 7.09 | % | 7.23 | |||||||||||||||||||||||

| 2023 | 2 | 43,392 | 445 | 23.19 | % | 10.26 | 15 | 523,775 | 3,323 | 18.21 | % | 6.34 | |||||||||||||||||||||||

| 2024 | 1 | 32,000 | 125 | 6.51 | % | 3.91 | 8 | 318,759 | 2,231 | 12.23 | % | 7.00 | |||||||||||||||||||||||

| 2025 | 2 | 84,633 | 619 | 32.26 | % | 7.31 | 12 | 472,936 | 3,777 | 20.70 | % | 7.99 | |||||||||||||||||||||||

| 2026 | 1 | 20,152 | 97 | 5.04 | % | 4.81 | 13 | 429,484 | 3,476 | 19.05 | % | 8.09 | |||||||||||||||||||||||

| 2027 | — | — | — | — | % | — | 2 | 57,345 | 447 | 2.45 | % | 7.79 | |||||||||||||||||||||||

| 2028 | — | — | — | — | % | — | 7 | 280,841 | 1,637 | 8.97 | % | 5.83 | |||||||||||||||||||||||

| 2029 | 1 | 21,213 | 317 | 16.53 | % | 14.94 | 2 | 45,700 | 307 | 1.68 | % | 6.72 | |||||||||||||||||||||||

| 2030+ | 1 | 20,858 | 66 | 3.44 | % | 3.16 | 6 | 288,576 | 1,754 | 9.62 | % | 6.08 | |||||||||||||||||||||||

| Total | 9 | 477,293 | $ | 1,919 | 100.00 | % | $ | 6.84 | 70 | 2,596,298 | $ | 18,246 | 100.00 | % | $ | 7.03 | |||||||||||||||||||

| No Option | Option | ||||||||||||||||||||||||||||||||||

| Lease Expiration Nine and Twelve Month Periods Ending December 31, | Number of Expiring Leases | Expiring Occupied Square Footage | Expiring Annualized Based Rent (in 000s) | % of Total Annualized Base Rent | Expiring Base Rent per Square Foot | Number of Expiring Leases | Expiring Occupied Square Footage | Expiring Annualized Based Rent (in 000s) | % of Total Annualized Base Rent | Expiring Base Rent per Square Foot | |||||||||||||||||||||||||

| Available | — | 389,348 | $ | — | — | % | $ | — | — | — | $ | — | — | % | $ | — | |||||||||||||||||||

| Month-to-Month | 10 | 35,461 | 322 | 2.56 | % | 9.08 | 1 | 1,050 | 15 | 0.10 | % | 14.29 | |||||||||||||||||||||||

| 2021 | 47 | 94,880 | 1,243 | 9.87 | % | 13.10 | 20 | 54,430 | 944 | 6.45 | % | 17.34 | |||||||||||||||||||||||

| 2022 | 65 | 139,803 | 1,817 | 14.42 | % | 13.00 | 59 | 193,274 | 2,282 | 15.59 | % | 11.81 | |||||||||||||||||||||||

| 2023 | 64 | 128,486 | 1,644 | 13.05 | % | 12.80 | 48 | 168,195 | 2,150 | 14.69 | % | 12.78 | |||||||||||||||||||||||

| 2024 | 66 | 174,637 | 2,076 | 16.48 | % | 11.89 | 43 | 160,196 | 2,186 | 14.94 | % | 13.65 | |||||||||||||||||||||||

| 2025 | 53 | 114,011 | 1,668 | 13.24 | % | 14.63 | 38 | 136,671 | 1,830 | 12.50 | % | 13.39 | |||||||||||||||||||||||

| 2026 | 42 | 128,062 | 1,576 | 12.51 | % | 12.31 | 29 | 162,200 | 1,707 | 11.66 | % | 10.52 | |||||||||||||||||||||||

| 2027 | 11 | 37,184 | 655 | 5.20 | % | 17.62 | 17 | 99,102 | 1,241 | 8.48 | % | 12.52 | |||||||||||||||||||||||

| 2028 | 10 | 31,652 | 498 | 3.95 | % | 15.73 | 4 | 19,116 | 201 | 1.37 | % | 10.51 | |||||||||||||||||||||||

| 2029 | 7 | 23,850 | 241 | 1.91 | % | 10.10 | 6 | 23,257 | 293 | 2.00 | % | 12.60 | |||||||||||||||||||||||

| 2030+ | 16 | 37,101 | 860 | 6.81 | % | 23.18 | 24 | 86,324 | 1,787 | 12.22 | % | 20.70 | |||||||||||||||||||||||

| Total | 391 | 1,334,475 | $ | 12,600 | 100.00 | % | $ | 13.33 | 289 | 1,103,815 | $ | 14,636 | 100.00 | % | $ | 13.26 | |||||||||||||||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 18 | ||||

| Three Months Ended March 31, | |||||||||||

| 2021 | 2020 | ||||||||||

Renewals(1): | |||||||||||

| Leases renewed with rate increase (sq feet) | 145,173 | 137,599 | |||||||||

| Leases renewed with rate decrease (sq feet) | 24,873 | 26,980 | |||||||||

| Leases renewed with no rate change (sq feet) | 17,959 | 20,578 | |||||||||

| Total leases renewed (sq feet) | 188,005 | 185,157 | |||||||||

| Leases renewed with rate increase (count) | 27 | 30 | |||||||||

| Leases renewed with rate decrease (count) | 5 | 5 | |||||||||

| Leases renewed with no rate change (count) | 8 | 6 | |||||||||

| Total leases renewed (count) | 40 | 41 | |||||||||

| Option exercised (count) | 4 | 5 | |||||||||

| Weighted average on rate increases (per sq foot) | $ | 0.68 | $ | 1.70 | |||||||

| Weighted average on rate decreases (per sq foot) | $ | (1.15) | $ | (2.20) | |||||||

| Weighted average rate on all renewals (per sq foot) | $ | 0.38 | $ | 0.94 | |||||||

| Weighted average change over prior rates | 4.22 | % | 8.60 | % | |||||||

New Leases(1) (2): | |||||||||||

| New leases (sq feet) | 112,594 | 27,622 | |||||||||

| New leases (count) | 19 | 14 | |||||||||

| Weighted average rate (per sq foot) | $ | 8.25 | $ | 13.89 | |||||||

| Gross Leasable Area ("GLA") expiring during the next 9 months, including month-to-month leases | 4.43 | % | 9.33 | % | |||||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 19 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 20 | ||||

WHLR | Financial & Operating Data | as of 3/31/2021 unless otherwise stated | 21 | ||||