UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

SCHEDULE

(Rule 14a-101)

__________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

________________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Riversedge North

2529 Virginia Beach Boulevard

Virginia Beach, VA 23452

April 6, 2023

Dear Fellow Stockholder:

We hope to see you at the Annual Meeting of Stockholders (the “Annual Meeting”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”) to be held at the Marriott Virginia Beach Oceanfront, 4201 Atlantic Avenue, Virginia Beach, Virginia 23451 in the Miller Room on May 19, 2023 at 9:30 a.m., Eastern Daylight Time.

The Annual Meeting will be held in person only and not in a virtual meeting format.

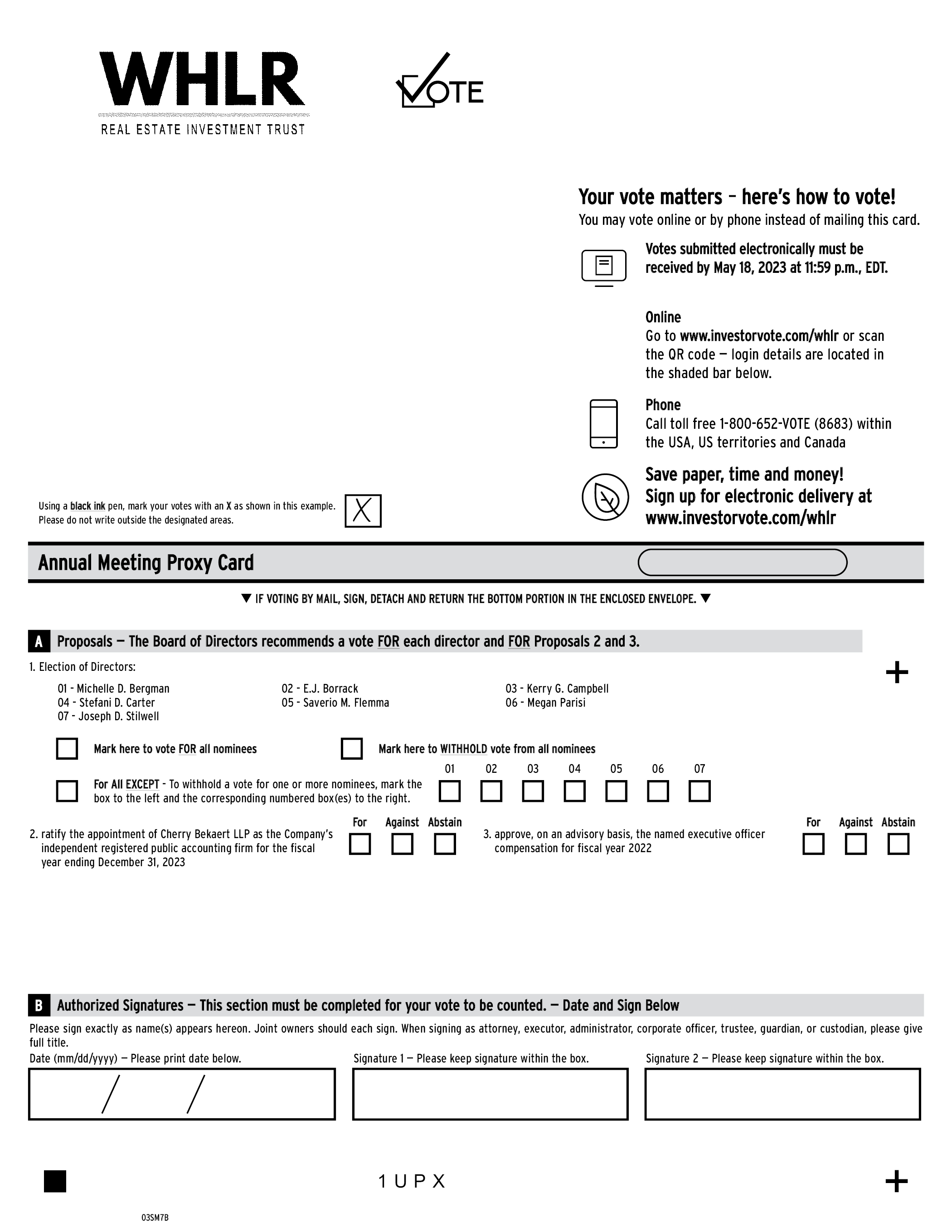

During the Annual Meeting, you will have the opportunity to vote on each item of business discussed in the enclosed Notice of Annual Meeting of Stockholders and Proxy Statement. In addition, you will also have the opportunity to vote before the Annual Meeting at www.investorvote.com/whlr, or by telephone or mail.

The enclosed Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting. Directors and officers of the Company will be present to answer any questions that you and other stockholders may have. Also available online for your review is our Annual Report on Form 10-K, which contains detailed information concerning the activities and operating performance of the Company.

The business to be conducted at the Annual Meeting consists of:

• the election of seven members of the Board of Directors;

• the ratification of the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and

• the approval, on an advisory basis, of the named executive officer compensation for fiscal year 2022.

The Board of Directors unanimously recommends a vote FOR each of the director nominees listed in the enclosed Proxy Statement, FOR the ratification of Cherry Bekaert LLP’s appointment, and FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers.

Your vote is important. Please indicate your vote by internet or telephone or, if you received your materials by mail, by returning the properly completed enclosed proxy card.

Regardless of whether you vote before or at the Annual Meeting, we hope to see you in person in Virginia Beach.

Sincerely,

|

Stefani D. Carter |

M. Andrew Franklin |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2023

Wheeler Real Estate Investment Trust, Inc. will hold its Annual Meeting on May 19, 2023, at the Marriott Virginia Beach Oceanfront, 4201 Atlantic Avenue, Virginia Beach, Virginia 23451 in the Miller Room at 9:30 a.m., Eastern Daylight Time. The Annual Meeting will be held in person only and not in a virtual meeting format.

The purpose of the Annual Meeting is to:

• elect a Board of Directors of seven directors to serve until the next Annual Meeting and until their successors are duly elected and qualified;

• ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and

• approve, on an advisory basis, the named executive officer compensation for fiscal year 2022.

These items of business are more fully described in the Proxy Statement.

The Board of Directors unanimously recommends a vote FOR each of the director nominees listed in the enclosed Proxy Statement, FOR the ratification of Cherry Bekaert LLP’s appointment, and FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers.

Only stockholders of record at the close of business on March 27, 2023 are entitled to vote at the Annual Meeting. However, we welcome all stockholders and supporters of the Company and hope to see you in Virginia Beach.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares on the internet or by telephone, or, if you received the proxy materials by mail, you may also authorize a proxy to vote your shares by mail.

If you are present at the Annual Meeting and hold shares in your name, you may vote in person even if you have previously submitted your proxy by telephone, over the internet, or by mail.

If your shares are held in “street name” with your bank, broker, or other nominee and you wish to vote in person at the Annual Meeting, you will need to obtain a legal proxy from the institution that holds your shares and provide that legal proxy at the Annual Meeting.

Your vote will ensure your representation at the Annual Meeting regardless of whether you attend on May 19, 2023.

|

By order of the Board of Directors, |

||

|

Angelica Beltran |

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 19, 2023: This Proxy Statement and our 2022 Annual Report on Form 10-K are available on the internet at www.investorvote.com/whlr.

Dated: April 6, 2023

TABLE OF CONTENTS

|

Page |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

3 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

8 |

||

|

8 |

||

|

9 |

||

|

10 |

||

|

10 |

||

|

10 |

||

|

11 |

||

|

11 |

||

|

11 |

||

|

12 |

||

|

13 |

||

|

13 |

||

|

13 |

||

|

13 |

||

|

13 |

||

|

13 |

||

|

Employment Agreements with the Company’s Named Executive Officers |

14 |

|

|

14 |

||

|

14 |

||

|

15 |

||

|

16 |

||

|

16 |

||

|

16 |

||

|

18 |

||

|

Security Ownership of Certain Beneficial Owners and Management |

18 |

|

|

18 |

||

|

19 |

i

ii

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement before voting. The approximate date on which this Proxy Statement and form of accompanying proxy card are first being provided to stockholders, or being made available through the internet for those stockholders receiving proxy materials electronically, is April 6, 2023.

2023 Annual Meeting of Stockholders

|

Date and Time: |

May 19, 2023 at 9:30 a.m., Eastern Daylight Time |

|

|

Place: |

Marriott Virginia Beach Oceanfront, 4201 Atlantic Avenue, Virginia Beach, Virginia 23451 in the Miller Room |

|

|

Record Date: |

March 27, 2023 |

Voting Matters and Board of Directors Recommendation

|

Items of Business |

Board of |

|

|

1. Election of Seven Directors |

FOR |

|

|

2. Ratification of Cherry Bekaert LLP as the Independent Registered Public Accounting Firm |

FOR |

|

|

3. Advisory “Say-On-Pay” Vote to Approve 2022 Executive Compensation |

FOR |

1

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2023

The Board of Directors of Wheeler Real Estate Investment Trust, Inc. (the “Company” or “we” or “us”) is soliciting proxies to be used at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”).

Beginning on or about April 6, 2023, the Notice of Internet Availability of Proxy Materials (the “Notice”) is being mailed to our stockholders of record as of March 27, 2023 (the “Record Date”).

ABOUT THE MEETING

Location

The Annual Meeting will be held on May 19, 2023 at 9:30 a.m., Eastern Daylight Time, at the Marriott Virginia Beach Oceanfront, 4201 Atlantic Avenue, Virginia Beach, Virginia 23451 in the Miller Room. The Annual Meeting will be held in person only and not in a virtual meeting format. We welcome all stockholders and supporters of the Company and hope to see you in Virginia Beach.

Who Can Vote

Record holders of Common Stock, $0.01 par value per share (“Common Stock”) of the Company at the close of business on the Record Date may vote at the Annual Meeting. On the Record Date, 9,793,957 shares of Common Stock were outstanding. Each share is entitled to cast one vote.

How You Can Access the Proxy Materials

We are providing access to our proxy materials (including this Proxy Statement and our 2022 Annual Report on Form 10-K) over the internet pursuant to rules adopted by the Securities and Exchange Commission (“SEC”).

Beginning on or about April 6, 2023, the Notice is being mailed to our stockholders of record as of the Record Date. The Notice includes instructions on how to view the electronic proxy materials on the internet, which will be available to all stockholders beginning on or about April 6, 2023. The Notice also includes instructions on how to elect to receive future proxy materials by email. If you choose to receive future proxy materials by email, next year you will receive an email with a link to the proxy materials and proxy voting site and will continue to receive proxy materials in this manner until you terminate your election. We encourage you to take advantage of the availability of our proxy materials on the internet.

If you wish to receive a printed copy of the proxy materials, including the proxy card, you may request that they be mailed to you at no cost by following the instructions on the Notice. In addition, you may choose to receive future proxy materials by mail by following the instructions on the Notice.

What is the difference between a stockholder of record and a beneficial owner of shares held in “street name”?

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Computershare Inc., you are considered the stockholder of record with respect to those shares and the Notice is being sent directly to you by the Company. As a stockholder of record, you can vote your shares via the internet, telephone or mail, or by attending the Annual Meeting. If you request printed copies of the proxy materials by mail, you will also receive a proxy card.

Beneficial Owner of Shares Held in “Street Name”. If your shares are held in an account at a bank, broker, or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. If you request printed copies of the proxy materials by mail, you will also receive a voting instruction form from the organization holding your shares.

2

How You Can Vote in Advance of the Annual Meeting

If you are a stockholder of record, you may vote your shares using any of the following methods:

• Via the Internet. To vote via the internet, visit www.investorvote.com/whlr and follow the instructions on your Notice or the proxy card. You will need the control number included on your Notice or the proxy card, as applicable.

• By Telephone. To vote by telephone, dial toll-free 1-800-652-VOTE (8683) and follow the recorded instructions. You will need the control number included on the Notice or the proxy card, as applicable.

• By Mail. If you request printed copies of the proxy materials be sent to you by mail, you may vote by proxy by completing, signing and dating the enclosed proxy card and returning it in the enclosed postage-paid envelope.

If you vote via the internet or by telephone, there is no need to return a proxy card by mail. The proxy you submit will be voted in accordance with your instructions.

If you are a beneficial owner of shares held in “street name”:

You will need to follow the voting instructions provided by your bank, broker, or other nominee to ensure that your shares are represented and voted at the Annual Meeting. The availability of internet or telephone voting will depend upon your bank’s, broker’s, or other nominee’s voting process.

Please note that internet and telephone voting will close at 11:59 p.m., Eastern Daylight Time, on May 18, 2023.

How You Can Vote in Person at the Annual Meeting

If you are a stockholder of record:

You will need to bring your Notice or proxy card as evidence of your ownership of the Company’s Common Stock as of the Record Date. You will then receive a ballot in order to vote at the Annual Meeting.

If you are a beneficial owner of shares held in “street name”:

You will need to bring a legal proxy from the institution that holds your shares. You will then receive a ballot in order to vote at the Annual Meeting.

Revocation of Proxies

If you submit your proxy over the internet, by telephone or by mail, you may change your vote by subsequently properly submitting a new proxy. Only your most recent proxy will be exercised, and all others will be disregarded, regardless of the method by which the proxies were authorized. You may also revoke your earlier proxy by voting in person at the Annual Meeting. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request. If you hold your shares in “street name”, you should follow the instructions provided by your bank, broker, or other nominee to revoke your proxy.

Notices of revocation of proxies delivered by mail should be delivered prior to the Annual Meeting to the Company’s principal offices at Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452, Attention: Angelica Beltran, Corporate Secretary.

What am I voting on?

You will be voting on the following:

(1) The election of seven members of the Board of Directors, to serve until the 2024 annual meeting of stockholders and until their respective successors are duly elected and qualified or until any such director’s earlier resignation, retirement or other termination of service;

3

(2) To ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and

(3) To approve, on an advisory basis, the named executive officer compensation for fiscal year 2022.

Who is soliciting my vote?

The Board of Directors, on behalf of the Company, is soliciting your proxy to vote your shares of our Common Stock on all matters scheduled to come before the Annual Meeting, whether or not you attend in person. By submitting your proxy and voting instructions by telephone or via the internet, or if you have chosen to receive your proxy materials by mail, by completing, signing, dating and returning the proxy card or voting instruction form, you are authorizing the persons named as proxies to vote your shares of our Common Stock at the Annual Meeting as you have instructed.

Quorum; Vote Required

The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the meeting will constitute a quorum for the transaction of business at the Annual Meeting. As of March 27, 2023, there were 9,793,957 shares of Common Stock issued and outstanding. If you are the record owner of your shares and you attend the Annual Meeting or return a properly executed proxy card, then your shares will be counted as present for purposes of determining a quorum at the Annual Meeting. If your shares are held by a bank, broker, trustee or other nominee (i.e., your shares are held in “street name”), then your shares will be counted as present for purposes of determining a quorum if you provide voting instructions to your nominee and such nominee submits a proxy covering your shares. Withheld votes (in the case of the election of directors), abstentions and broker non-votes will all be counted for purposes of determining whether a quorum is present.

Election of Directors (Proposal 1). A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected to that slot. In voting on the election of directors, you may vote “FOR” or “WITHHOLD” from voting as to each director nominee. For purposes of this vote, neither a “WITHHOLD” vote nor a broker non-vote will count as a vote cast, so neither will affect the outcome of the vote.

Ratification of the Appointment of Cherry Bekaert LLP (Proposal 2). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal.

Advisory Vote to Approve Executive Compensation (Proposal 3). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal.

A “broker non-vote” occurs when the broker holding shares for a beneficial owner has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares. If you own your shares in street name through a broker and do not provide voting instructions to your broker, then your broker will not have the authority to vote your shares on any proposal presented at the Annual Meeting unless it has discretionary authority with respect to that proposal. In that case, your shares will be considered to be broker non-votes and will not be voted on that proposal. Whether a broker has discretionary authority depends on your agreement with your broker and the rules of the various regional and national exchanges of which your broker is a member. In general, a broker does not have discretionary authority to vote on the election of directors (Proposal 1) or the approval, by non-binding advisory vote, of the compensation paid to the named executive officers (Proposal 3). Accordingly, it is very important that you instruct your broker or other nominee on how to vote shares that you hold in street name.

If you received multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different names. You should vote each of the proxy cards to ensure that all your shares are voted.

If a proxy is executed and returned but no instructions are given, the shares will be voted according to the recommendations of the Board of Directors. The Board of Directors unanimously recommends a vote FOR Proposals 1, 2 and 3.

4

Other Matters to Be Acted Upon at the Annual Meeting

We do not know of any other matters to be validly presented or acted upon at the Annual Meeting. If any other matter is presented at the Annual Meeting on which a vote may be properly taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

Expenses of Solicitation

The Company is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, by telephone or mail.

Available Information

Our internet website address is www.whlr.us. We make available free of charge through our website our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we have posted the Charters of our Asset Liability Committee, Audit Committee, Compensation Committee, Governance and Nominating Committee, and Executive Committee, as well as our Insider Trading Policy, Code of Business Conduct and Ethics for Board Members, Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives, and Corporate Governance Principles, all under separate headings. These documents are not incorporated in this instrument by reference. We will also provide a copy of these documents free of charge to stockholders upon written request.

Questions

You may call our Corporate Secretary at 757-627-9088 if you have any questions.

PLEASE VOTE — YOUR VOTE IS IMPORTANT

5

CORPORATE GOVERNANCE AND BOARD MATTERS

The affairs of the Company are managed by the Board of Directors. Directors are elected at the annual meeting of stockholders each year or, in the event of a vacancy, elected by the incumbent Board of Directors, and serve until the next annual meeting of stockholders or until a successor has been elected or approved.

Corporate Governance Profile

Our Board of Directors currently consists of seven directors. All of the directors are independent as determined in accordance with the listing standards established by Nasdaq Stock Market, and our Board of Directors makes an affirmative determination as to the independence of each of our directors on an annual basis. We have adopted a Code of Business Conduct and Ethics for Board Members, a Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives, and Corporate Governance Principles, which are available on our website, all under separate headings.

Role of the Board of Directors in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from the Asset Liability Committee, Audit Committee, Compensation Committee, Governance and Nominating Committee, Executive Committee, and Litigation Committee, each of which addresses risks specific to their respective areas of oversight.

The Asset Liability Committee evaluates the level of risk inherent in the Company’s real estate assets and monitors the level of risk that is appropriate. The Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The Governance and Nominating Committee oversees the corporate governance policies and practices of the Company and develops and recommends to the Board of Directors any changes or additions to the governance policies and practices it deems appropriate. The Executive Committee has the ability to act with the full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. The Litigation Committee is responsible for overseeing any material litigation matters involving the Company, and assisting the Board of Directors in fulfilling its oversight responsibilities with respect to such matters.

Members of the Board of Directors

As of April 6, 2023 (the date of this Proxy Statement), the members of the Board of Directors (and their respective committee memberships) are identified below:

|

Director |

Asset |

Audit |

Compensation |

Governance and |

Executive |

Litigation |

||||||

|

Michelle D. Bergman |

— |

Member |

Member |

— |

— |

— |

||||||

|

E.J. Borrack |

— |

— |

Member |

— |

— |

Chair |

||||||

|

Kerry G. Campbell |

Chair |

Chair |

— |

— |

— |

— |

||||||

|

Stefani D. Carter |

— |

— |

— |

Member |

Member |

— |

||||||

|

Saverio M. Flemma |

Member |

Member |

— |

— |

— |

— |

||||||

|

Megan Parisi |

— |

— |

— |

Member |

— |

— |

||||||

|

Joseph D. Stilwell |

— |

— |

Chair |

Chair |

Member |

— |

Board of Directors Committees

Our Board of Directors has established six committees: an Asset Liability Committee, an Audit Committee, a Compensation Committee, a Governance and Nominating Committee, an Executive Committee, and a Litigation Committee. The principal functions of each committee are briefly described below. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of the Company.

6

Asset Liability Committee. Our Asset Liability Committee currently consists of two directors: Kerry G. Campbell and Saverio M. Flemma. Mr. Campbell is the Chair of the Asset Liability Committee. The purpose of the Asset Liability Committee is to evaluate the level of risk inherent in the Company’s real estate assets, monitor the level of risk that is appropriate in the Company’s real estate assets, monitor the financing of the Company’s real estate assets, develop guidelines on improving the Company’s financing processes relating to the Company’s real estate assets, and review the Company’s financing processes relating to the Company’s real estate assets. The Asset Liability Committee was formed in June 2021. The charter of the Asset Liability Committee is available on the Company’s Investor Relations tab of our website (https://ir.whlr.us). All of the members of the Asset Liability Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Asset Liability Committee met once in 2022.

Audit Committee. Our Audit Committee currently consists of three directors: Kerry G. Campbell, Michelle D. Bergman and Saverio M. Flemma. Mr. Campbell is the Chair of the Audit Committee. Mr. Campbell qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and Nasdaq Stock Market corporate governance requirements. In addition, each of the Audit Committee members is “financially sophisticated” as that term is defined by the Nasdaq Stock Market corporate governance requirements. The functions of the Audit Committee are described below under the heading “Report of the Audit Committee.” The charter of the Audit Committee is available on the Company’s Investor Relations tab of our website (https://ir.whlr.us). All of the members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Audit Committee met five times in 2022.

Compensation Committee. Our Compensation Committee currently consists of three directors: Joseph D. Stilwell, E.J. Borrack and Michelle D. Bergman. Mr. Stilwell is the Chair of the Compensation Committee. The Compensation Committee is responsible for overseeing compensation paid to the Company’s principal executive officers. The charter of the Compensation Committee is available on the Company’s Investor Relations tab of our website (https://ir.whlr.us). All of the members of the Compensation Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Compensation Committee met once in 2022.

Governance and Nominating Committee. Our Governance and Nominating Committee currently consists of three directors: Joseph D. Stilwell, Stefani D. Carter and Megan Parisi. Mr. Stilwell is the Chair of the Governance and Nominating Committee. The Governance and Nominating Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Principles. In addition, the Governance and Nominating Committee develops and reviews background information on candidates for the Board of Directors and makes recommendations to the Board of Directors regarding such candidates. The Governance and Nominating Committee also prepares and supervises the Board of Directors’ annual review of director independence. The charter of the Governance and Nominating Committee is available on the Company’s Investor Relations tab of our website (https://ir.whlr.us). All of the members of the Governance and Nominating Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Governance and Nominating Committee met four times in 2022.

Executive Committee. Our Executive Committee currently consists of two directors: Joseph D. Stilwell and Stefani D. Carter. The purpose of the Executive Committee is to generally act with the full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. However, the Executive Committee does not have the authority to act on any matters that are expressly delegated to other committees of the Board of Directors or are under active review by the Board of Directors or another committee of the Board of Directors. The Executive Committee was formed in February 2020. The charter of the Executive Committee is available on the Company’s Investor Relations tab of our website (https://ir.whlr.us). Joseph D. Stilwell and Stefani D. Carter are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Executive Committee met twice in 2022.

Litigation Committee. Our Litigation Committee currently consists of one director: E.J. Borrack. Ms. Borrack is the Chair of the Litigation Committee. The Litigation Committee is responsible for overseeing any material litigation matters involving the Company, and assisting the Board of Directors in fulfilling its oversight responsibilities with respect to such matters. In addition, the Litigation Committee has the authority to retain outside counsel or other

7

experts or consultants as it deems appropriate in connection with any such matters, including the authority to approve the fees and other retention terms for such persons. Ms. Borrack is independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles.

Board of Directors Leadership Structure

The Board of Directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chair of the Board of Directors. At present, the Board of Directors believes that it is in the best interests of the Company that these roles be separate, in order to permit each person to focus on his or her primary role, which provides an appropriate balance between the managerial responsibilities of the Chief Executive Officer and the independent oversight and strategic direction provided by our Board of Directors. Further, the Board of Directors believes this issue is part of the succession planning process and that it is in the best interests of the Company for the Board of Directors to make a determination on a case-by-case basis when it selects a new President or elects a new Chair of the Board of Directors. The current Chief Executive Officer and President, M. Andrew Franklin, is not a member of the Board of Directors. The current Chair of the Board of Directors is Stefani D. Carter.

Selection of Nominees for the Board of Directors

The Governance and Nominating Committee will consider candidates for Board of Directors membership that are suggested by its members and other members of the Board of Directors, as well as management and stockholders. A stockholder who wishes to recommend a prospective nominee for the Board of Directors should notify the Company’s Corporate Secretary or any member of the Governance and Nominating Committee in writing with supporting material that the stockholder considers appropriate. The Governance and Nominating Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of the Company’s Bylaws relating to stockholder nominations.

Once the Governance and Nominating Committee has identified a prospective nominee, the committee will make an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination will be based on a number of factors and the information provided to the committee with the recommendation of the prospective candidate will be important. The preliminary determination will be based primarily on the need for additional members of the Board of Directors to fill vacancies or the need to expand the size of the Board of Directors, as well as the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the committee determines that additional consideration is warranted, it may request a third-party search firm to gather additional information about the prospective nominee’s background and experience.

We do not have a diversity policy. The Governance and Nominating Committee considers the directors and nominees in terms of skills and experience, and how they may contribute to the overall effectiveness of our Board of Directors, as generally set out in the Company’s Corporate Governance Principles. The Governance and Nominating Committee evaluates the prospective nominee against the following standards and qualifications:

• whether the prospective nominee is a stockholder of the Company;

• the ability of the prospective nominee to represent the interests of the Company;

• the prospective nominee’s standards of integrity, commitment and independence of thought and judgment;

• the prospective nominee’s ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Principles; and

• the extent to which the prospective nominee contributes to the talent, skill and expertise appropriate for the Board of Directors.

The Governance and Nominating Committee does not take into account race, sex or creed in its evaluation of any director or nominee.

8

The Governance and Nominating Committee also considers such other relevant factors as it deems appropriate, including (without limitation) the current composition of the Board of Directors, the need for Audit Committee expertise, and evaluations of other prospective nominees.

In connection with this evaluation, the Governance and Nominating Committee determines whether to interview the prospective nominee and, if warranted, one or more members of the committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Governance and Nominating Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors, and the Board of Directors determines the nominees after considering the recommendation of the committee.

Stockholders who wish to recommend nominees for election as directors should provide those recommendations in writing to our Corporate Secretary, specifying the nominee’s name and qualifications for membership on the Board of Directors.

For a stockholder to nominate a director candidate, the stockholder must comply with the advance notice provisions and other requirements of Section 11 of Article II of our Bylaws.

We urge any stockholder who intends to recommend a director candidate to the Governance and Nominating Committee for consideration to review thoroughly our Governance and Nominating Committee Charter and Section 11 of Article II of our Bylaws.

Copies of our Governance and Nominating Committee Charter and our Bylaws are available upon written request to the Corporate Secretary, Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452.

Board Diversity Matrix

In August 2021, the SEC approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. The Board Diversity Matrix below presents the Board of Directors’ diversity statistics for the current year and the immediately preceding year in the format prescribed by the Nasdaq rules:

|

2023 Board Diversity Matrix (as of April 6, 2023) |

||||

|

Total Number of Directors |

7 |

|||

|

Female |

Male |

Non-Binary |

Did Not |

|

|

Part I: Gender Identity |

||||

|

Directors |

— |

— |

— |

7 |

|

Part II: Demographic Background |

||||

|

African American or Black |

— |

— |

— |

— |

|

Alaskan Native or Native American |

— |

— |

— |

— |

|

Asian |

— |

— |

— |

— |

|

Hispanic or Latinx |

— |

— |

— |

— |

|

Native Hawaiian or Pacific Islander |

— |

— |

— |

— |

|

White |

— |

— |

— |

— |

|

Two or More Races or Ethnicities |

— |

— |

— |

— |

|

LGBTQ+ |

— |

|||

|

Did Not Disclose Demographic Background |

7 |

|||

9

|

2022 Board Diversity Matrix (as of August 1, 2022) |

||||

|

Total Number of Directors |

6 |

|||

|

Female |

Male |

Non-Binary |

Did Not |

|

|

Part I: Gender Identity |

||||

|

Directors |

— |

— |

— |

6 |

|

Part II: Demographic Background |

||||

|

African American or Black |

— |

— |

— |

— |

|

Alaskan Native or Native American |

— |

— |

— |

— |

|

Asian |

— |

— |

— |

— |

|

Hispanic or Latinx |

— |

— |

— |

— |

|

Native Hawaiian or Pacific Islander |

— |

— |

— |

— |

|

White |

— |

— |

— |

— |

|

Two or More Races or Ethnicities |

— |

— |

— |

— |

|

LGBTQ+ |

— |

|||

|

Did Not Disclose Demographic Background |

6 |

|||

Determination of Director Independence

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers whether there are any transactions and relationships between any director (and his or her immediate family and affiliates) and the Company and its management to determine, to the extent such transactions and relationships exist, whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law and listing standards.

The Company believes that its Board of Directors consists of directors who are all independent under the definition of independence provided by Nasdaq Listing Rule 5605(a)(2).

Board of Directors Meetings During Fiscal 2022

The Board of Directors met seventeen (17) times during fiscal year 2022.

No director attended fewer than 75%, in the aggregate, of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served). Under the Company’s Corporate Governance Principles, directors are expected to attend Board of Directors’ meetings and meetings of committees on which they serve, spend the time needed, and meet as frequently as necessary to discharge their responsibilities properly. In addition, each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties.

Although we do not have a policy requiring director attendance at an annual meeting of stockholders, directors are encouraged to attend the annual meeting of stockholders. All of our director nominees who were directors at the time of our 2022 annual meeting of stockholders attended the 2022 annual meeting which was held virtually.

Stockholder Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the Board of Directors, including communications regarding concerns relating to accounting, internal accounting controls or audit measures, or fraud or unethical behavior, may do so by writing to the directors at the following address: Wheeler Real Estate Investment Trust, Inc., Attention: Corporate Secretary, Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452.

The Governance and Nominating Committee of the Board of Directors has approved a process for handling letters received by the Company and addressed to members of the Board of Directors but received at the Company. Under that process, the Corporate Secretary of the Company reviews all such correspondence and regularly forwards to the Board of Directors all such correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board of Directors or committees thereof or that she otherwise determines requires their attention.

10

Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board of Directors and received by the Company and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chair of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics for Board Members, and a Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives (collectively, our “Code of Business Conduct and Ethics”). These documents are available on the Investor Relations tab of our website (https://ir.whlr.us). The Company will post any amendments to or waivers from its Code of Business Conduct and Ethics (to the extent applicable to the Company’s Chief Executive Officer and Chief Financial Officer) on its website.

Hedging

As of the date hereof, the Company does not have a policy regarding hedging activities.

Director Compensation

It is our policy that any employees of our Company or its subsidiaries who may also be directors of our Company or its subsidiaries shall not receive any compensation for their services as directors. As of the date hereof, the Company does not have any employee directors. However, the Company’s Chief Executive Officer and Chief Financial Officer also serve as directors of Cedar Realty Trust, Inc. (“Cedar”). Consistent with the above policy, our Chief Executive Officer and Chief Financial Officer do not receive any compensation for their services as directors of Cedar.

For fiscal year 2022, the Company’s non-employee directors were entitled to annual cash compensation in the amount of $60,000 for their services as directors, with an additional annual cash retainer of $40,000 for service as Chair of the Company’s Board of Directors, to be paid quarterly.

Non-employee directors who serve on the board of directors of our subsidiary Cedar were entitled to annual cash compensation in the amount of $50,000 for their services as directors, with an additional annual cash retainer of $40,000 for service as Chair of the Cedar board of directors.

We reimburse each of our directors for his or her expenses incurred in connection with attendance at board of directors and committee meetings.

The following table summarizes our directors’ compensation for 2022:

|

Name |

Fees Earned |

Stock |

Total |

|||||

|

Stefani D. Carter |

$ |

100,000 |

— |

$ |

100,000 |

|||

|

Michelle D. Bergman |

|

60,000 |

— |

|

60,000 |

|||

|

E.J. Borrack |

|

77,900 |

— |

|

77,900 |

|||

|

Kerry G. Campbell |

|

92,250 |

— |

|

92,250 |

|||

|

Saverio M. Flemma |

|

60,000 |

— |

|

60,000 |

|||

|

Megan Parisi(2) |

|

10,000 |

— |

|

10,000 |

|||

|

Paula J. Poskon(3) |

|

45,592 |

— |

|

45,592 |

|||

|

Joseph D. Stilwell |

|

60,000 |

— |

|

60,000 |

|||

____________

(1) Includes the following amounts payable to directors for service as directors of Cedar (as prorated for the partial year of service): Mr. Campbell, $32,250; Ms. Borrack, $17,900; and Ms. Poskon, $17,900.

(2) Ms. Parisi was elected to the Board of Directors on November 1, 2022.

(3) Ms. Poskon’s term as a director expired at the Company’s annual meeting held on June 16, 2022. Ms. Poskon serves on the board of directors of Cedar.

11

EXECUTIVE OFFICERS

M. Andrew Franklin

Chief Executive Officer and President since October 2021

Age — 42

Andrew Franklin was appointed Chief Executive Officer and President in October 2021. In August 2022, he was appointed Chief Executive Officer and President and Director of Cedar. He previously served in the following roles at the Company: Interim Chief Executive Officer since July 2021; Chief Operating Officer since February 2018; and Senior Vice President of Operations since January 2017. Mr. Franklin has over 23 years of commercial real estate experience. Mr. Franklin is responsible for overseeing the property management, lease administration and leasing divisions of our growing portfolio of commercial assets. Prior to joining us, Mr. Franklin was a partner with Broad Reach Retail Partners where he ran the day-to-day operations of the company, managing the leasing team as well as overseeing the asset, property and construction management of the portfolio with assets totaling $50 million. Mr. Franklin is a graduate of the University of Maryland, with a Bachelor of Science degree in Finance.

Crystal Plum

Chief Financial Officer since February 2020

Age — 41

Crystal Plum was appointed Chief Financial Officer in February 2020. In August 2022, she was appointed Chief Financial Officer, Treasurer, Corporate Secretary and Director of Cedar. She previously served in the following roles at the Company: Vice President of Financial Reporting and Corporate Accounting from March 2018 to February 2020; and Director of Financial Reporting from September 2016 to March 2018. Prior to that time, she served as a Manager at Dixon Hughes Goodman LLP from September 2014 to August 2016 and as a Supervisor at Dixon Hughes Goodman LLP from 2008 to September 2014. Ms. Plum has experience reviewing and performing audits, reviews, compilations and tax engagements for a diverse group of clients, as well as banking experience. Ms. Plum is a Certified Public Accountant and has a Bachelor of Science in Business Administration — Accounting and Finance from Old Dominion University.

12

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation for the fiscal years indicated paid or awarded to each of our named executive officers, calculated in accordance with SEC rules and regulations.

|

Name and Principal Position |

Fiscal |

Salary |

Bonus |

Stock |

All Other Compensation ($) |

Total |

||||||||

|

M. Andrew Franklin(1) |

2022 |

400,000 |

175,000 |

— |

|

42,121 |

(2) |

617,121 |

||||||

|

Chief Executive Officer and President |

2021 |

278,846 |

— |

— |

|

35,844 |

|

314,690 |

||||||

|

Crystal Plum |

2022 |

250,000 |

100,000 |

— |

|

11,737 |

|

361,737 |

||||||

|

Chief Financial Officer |

2021 |

216,346 |

— |

57,200 |

(3) |

8,717 |

|

282,263 |

||||||

|

Daniel Khoshaba(4) |

2021 |

— |

— |

— |

|

— |

|

— |

||||||

|

Chief Executive Officer and President |

|

|

||||||||||||

____________

(1) Mr. Franklin was appointed as Interim Chief Executive Officer in July 2021 and Chief Executive Officer and President in October 2021. Prior to such appointments, he served as the Chief Operating Officer.

(2) Approximately $28 thousand of “All Other Compensation” for 2022 was for housing.

(3) Represents an award of 5,000 shares of unrestricted common stock and 15,000 shares of restricted common stock valued at the closing trading price on the date of grant.

(4) Mr. Khoshaba was appointed as Chief Executive Officer in April 2020 and he resigned for personal reasons in July 2021. He did not receive any compensation from the Company in 2021 in respect of such service.

Outstanding Equity Awards at 2022 Fiscal Year-End

|

Name |

Equity Incentive |

Equity Incentive |

||

|

Crystal Plum |

15,000 |

20,940 |

____________

(1) Represents shares of restricted common stock granted on August 13, 2021, vesting in three equal installments on each anniversary of the grant date, subject to both (i) continued employment, and (ii) the average closing price per share of the Company’s common stock over all trading days in any consecutive 20-business day period during the three-year period following the grant date being equal to at least $6.25.

(2) Based on the closing price per share of the Company’s common stock on December 30, 2022 ($1.396), the last trading day of 2022.

Stock Plans

2015 Long-Term Incentive Plan

Pursuant to our 2015 Long-Term Incentive Plan, we may award incentives covering an aggregate of 125,000 shares of our Common Stock. As of March 27, 2023, we have issued 83,896 shares under the plan to employees, directors, and outside contractors for services provided.

2016 Long-Term Incentive Plan

Pursuant to our 2016 Long-Term Incentive Plan, we may award incentives covering an aggregate of 625,000 shares of our Common Stock. As of March 27, 2023, we have issued 497,293 shares under the plan to employees, directors, and outside contractors for services provided.

13

Employment Agreements with the Company’s Named Executive Officers

Generally

In February 2018, we entered into an employment agreement with M. Andrew Franklin, who was at that time our Chief Operating Officer. In October 2021, Mr. Franklin was appointed as our Chief Executive Officer and President. Mr. Franklin’s employment agreement continued in effect as described below. In August 2021, we entered into an employment agreement with Crystal Plum, our Chief Financial Officer, as further described below.

Employment Agreement of M. Andrew Franklin

General Terms. On February 14, 2018, the Company, on its own behalf and on behalf of its subsidiaries, including Wheeler REIT, L.P., entered into an employment agreement with M. Andrew Franklin (the “Franklin Employment Agreement”) for a period of three years beginning on February 14, 2018, and ending on February 13, 2021 (the “Initial Term”). At the end of the Initial Term, the Franklin Employment Agreement automatically renews for subsequent one-year terms on a year-over-year basis unless terminated pursuant to the terms of the Franklin Employment Agreement. Under the terms of the Franklin Employment Agreement, Mr. Franklin is entitled to the following compensation:

• Base salary of $250,000 per annum (subsequently increased to $400,000 effective upon Mr. Franklin’s appointment as Chief Executive Officer and President); and

• Reimbursement of reasonable and necessary business expenses, and eligibility to participate in any current or future bonus, incentive, and other compensation and benefit plans available to the Company’s executives.

Severance Terms. Under the Franklin Employment Agreement, if Mr. Franklin’s employment were terminated by the Company without “Cause” (as defined in the Franklin Employment Agreement), then Mr. Franklin would generally be entitled to severance pay of the greater of (i) salary continuation payments at Mr. Franklin’s current salary, less mandatory deductions, for six (6) months plus one (1) additional month for each full calendar quarter remaining in the then-current term of Mr. Franklin’s employment or (ii) salary continuation for a period equal to the remainder of the term of the Franklin Employment Agreement. Mr. Franklin would also be entitled to any annual bonuses that would have been earned based solely on his continued employment for the remainder of the term of the Franklin Employment Agreement. In addition, Mr. Franklin would be entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

In the event that Mr. Franklin terminated his employment with “Good Reason” (as defined in the Franklin Employment Agreement), Mr. Franklin would generally be entitled to current base salary, less mandatory deductions for twelve (12) months, plus any earned but unpaid bonus for the fiscal year prior to the year in which termination occurs. In addition, Mr. Franklin would be entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

In the event that Mr. Franklin terminated his employment with Good Reason following a “Change in Control” (as defined in the Franklin Employment Agreement) or was terminated by the Company without Cause and such termination occurred within six (6) months of a Change in Control, Mr. Franklin would generally be entitled to a lump sum payment equal to 2.99 times Mr. Franklin’s annual base salary less mandatory deductions payable within ninety (90) calendar days of the termination (and, in the case of such a termination without Cause, a bonus amount based on any bonus determined by the Board of Directors and payable to other executives of the Company during the twelve (12) months after the Change in Control). In addition, Mr. Franklin would be entitled to health care coverage pursuant to COBRA at Mr. Franklin’s expense for up to eighteen (18) months.

Mr. Franklin would not be entitled to any severance benefits under the Franklin Employment Agreement in the case of the Company terminating his employment for Cause or Mr. Franklin terminating his employment without Good Reason.

14

Death and Disability. In the event of a termination of employment on account of death, then Mr. Franklin’s estate would generally be entitled to: (a) Mr. Franklin’s regular base salary (determined on the date of death) for a period of twelve (12) months following death; (b) the amount of any bonus remaining payable by the Company to Mr. Franklin for its fiscal year prior to death; and (c) any accrued and unpaid bonus determined by the Board of Directors for the year in which the death occurs prorated for the number of completed calendar months served prior to death.

In the event of a “Disability” (as defined in the Franklin Employment Agreement) by Mr. Franklin for one hundred twenty (120) consecutive days or longer at any point during his employment, then the Company would pay to Mr. Franklin his regular base salary for a twelve (12)-month period following the date on which the Disability first begins, net of any benefits received by Mr. Franklin under any disability policy obtained by the Company or Mr. Franklin, the premiums for which were paid by the Company. Mr. Franklin would also be entitled to any bonus remaining payable to Mr. Franklin for his fiscal year prior to the date the Disability began and any unpaid bonus for the fiscal year in which the disability occurred prorated for the number of completed calendar months served prior to the date of Disability.

Miscellaneous Provisions. The Franklin Employment Agreement provides for confidentiality and nondisclosure provisions, and also contains a non-solicitation of employees clause for a duration of eighteen (18) months following the last day of Mr. Franklin’s employment with the Company.

Employment Agreement of Crystal Plum

On August 13, 2021, the Company, on its own behalf and on behalf of its subsidiaries, including Wheeler REIT, L.P., entered into an amended and restated employment agreement with Crystal Plum (the “Plum Employment Agreement”) for a three-year term. Under the terms of the Plum Employment Agreement, Ms. Plum is entitled to the following compensation:

• Base salary of $250,000 per annum;

• A grant of 20,000 shares of common stock (the “Initial Equity Award”), 5,000 of which were vested upon grant and 15,000 of which were subject to vesting conditions as described above under “Outstanding Equity Awards at 2021 Fiscal Year-End”; and

• Reimbursement of reasonable and necessary business expenses, and eligibility to participate in any current or future bonus, incentive, and other compensation and benefit plans available to the Company’s executives.

Severance Terms. Under the Plum Employment Agreement, if Ms. Plum’s employment were terminated by the Company without “Cause” or by Ms. Plum for “Good Reason” (as those terms are defined in the Plum Employment Agreement), then, subject to execution of a release of claims, Ms. Plum would generally be entitled to (i) salary continuation payments at Ms. Plum’s current salary, less mandatory deductions, for twelve (12) months, (ii) health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Ms. Plum was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Ms. Plum, and (iii) eligibility to vest in a prorated portion of the Initial Equity Award scheduled to vest on the next scheduled vesting date, subject to satisfaction of the applicable performance vesting condition. Ms. Plum would not be entitled to any severance benefits under the Plum Employment Agreement in the case of the Company terminating her employment for Cause or Ms. Plum terminating her employment without Good Reason.

Death and Disability. In the event of a termination of employment on account of death or “Disability” (as defined in the Plum Employment Agreement), then Ms. Plum (or her estate, as the case may be) would generally be entitled to any accrued but unpaid salary and employee benefits and the amount of any earned but unpaid bonus for any completed fiscal year of the Company prior to the termination.

Miscellaneous Provisions. The Plum Employment Agreement provides for a nondisclosure covenant, a non-solicit of employees, service providers, and customers that applies during Ms. Plum’s employment and for eighteen (18) months thereafter, a non-compete that applies during Ms. Plum’s employment and for twelve (12) months thereafter, and a customary non-disparagement covenant.

15

Potential Payments Upon Termination or Change in Control

See “Employment Agreements with the Company’s Named Executive Officers” above.

Pay Versus Performance Disclosure

The information below presents the relationship between the compensation of the Company’s named executive officers and certain performance measures in accordance with Item 402(v) of SEC’s Regulation S-K.

| Year | Summary | Compensation | Average | Average | Value of Initial | Net Income | ||||||||||||

| 2022 | $ | | $ | | $ | | $ | | $ | | ( | ) | ||||||

| 2021 | $ | | $ | | $ | | $ | | $ | | ( | ) | ||||||

____________

(1)

(2)

(3)

(4)

Relationship to Compensation Actually Paid

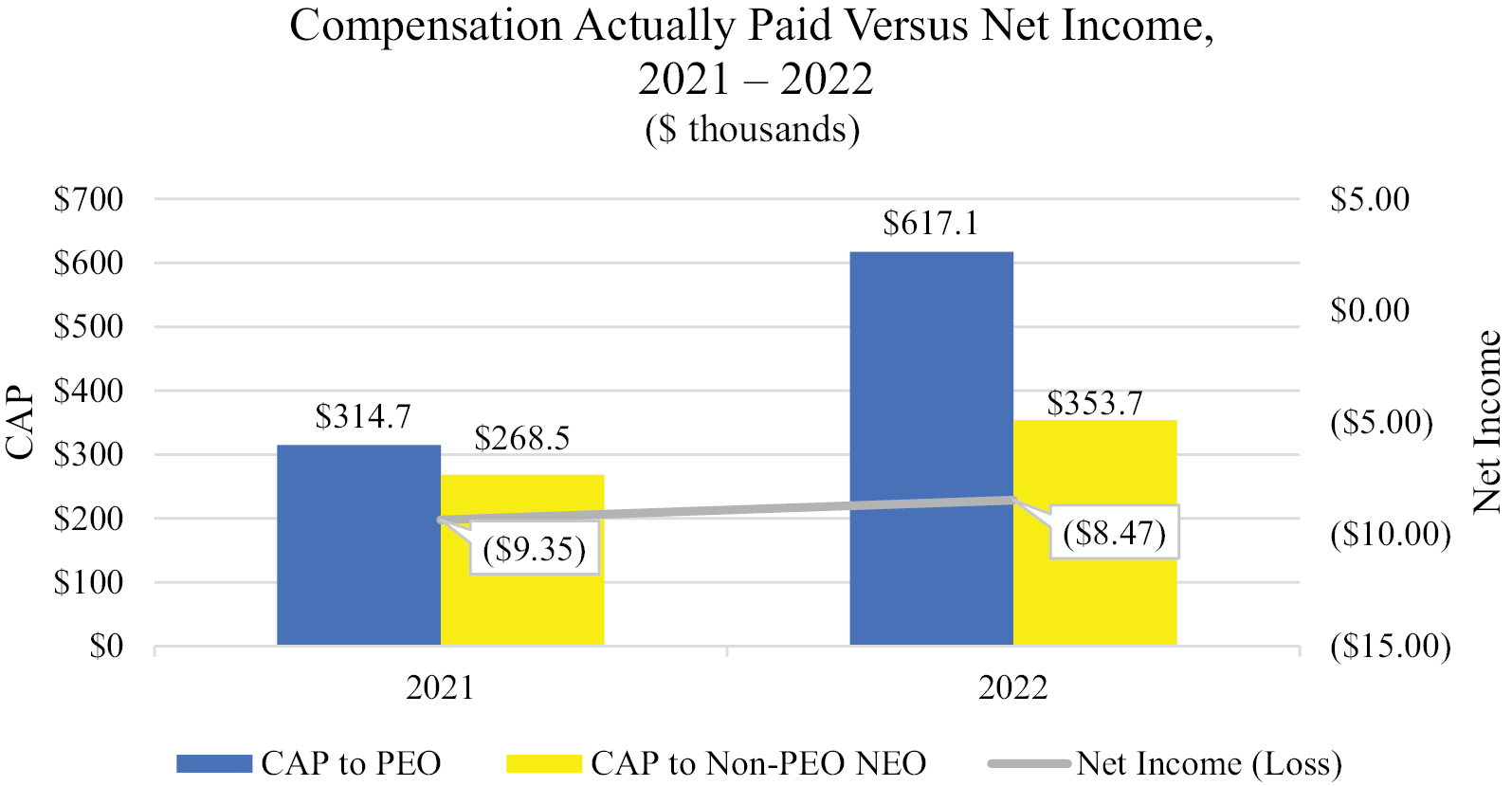

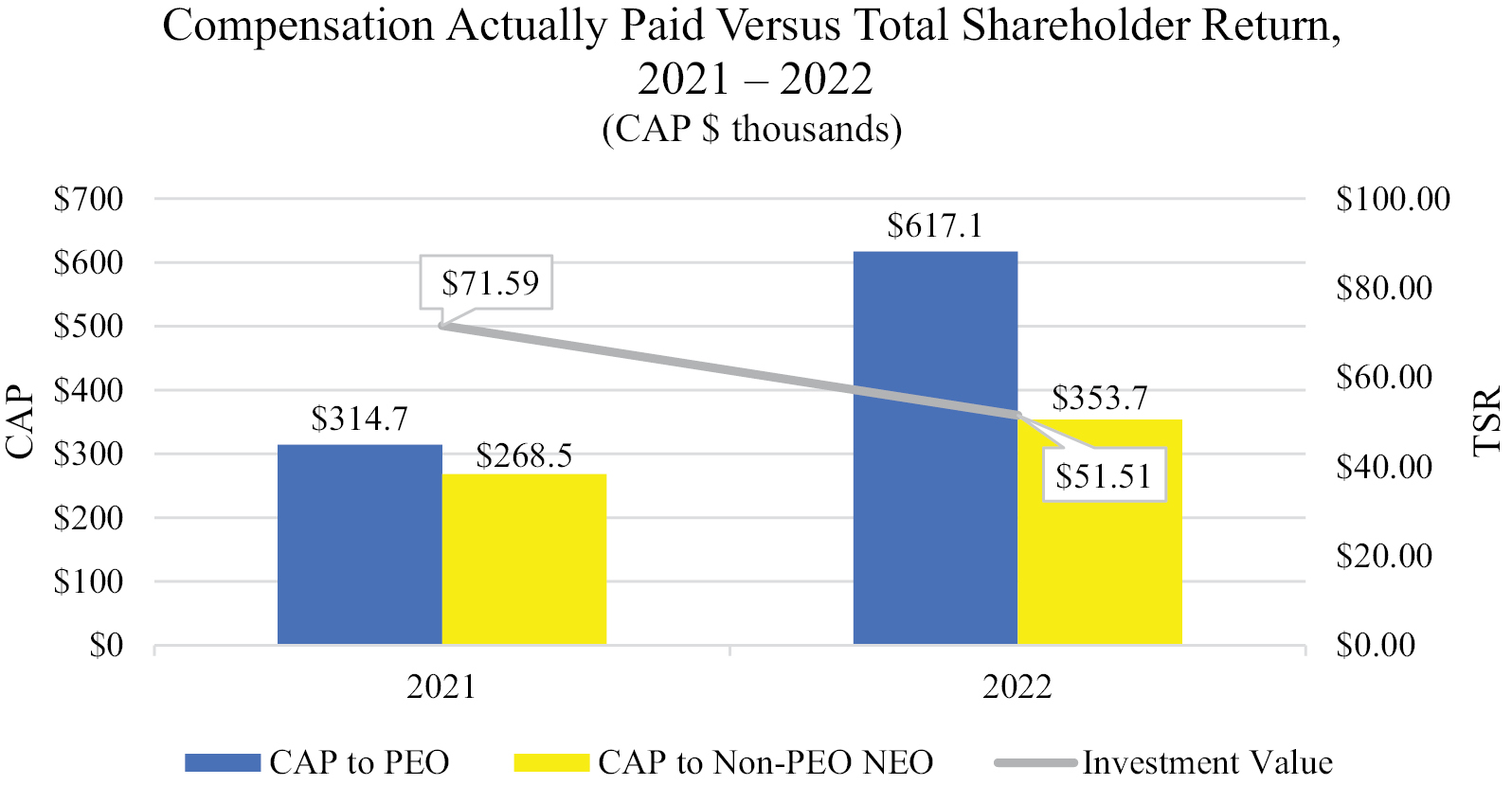

The following charts show the relationship of the CAP to Mr. Franklin (PEO) and the average CAP to Ms. Plum (Non-PEO NEO) to, respectively, net income of the Company and total shareholder return:

16

17

MISCELLANEOUS

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information regarding the beneficial ownership of shares of our common stock as of February 28, 2023 for (1) each of our directors and our named executive officers, (2) all of our directors and all of our named executive officers as a group, and (3) each person known by us to be the beneficial owner of 5% or more of our outstanding common stock. Each person or entity named in the tables has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the tables.

Unless otherwise indicated, the address of each named person is c/o Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452.

|

Directors and Named Executive Officers |

||||||

|

Number of |

Percentage of |

|||||

|

Directors |

|

|

||||

|

Michelle D. Bergman |

— |

|

— |

|

||

|

E.J. Borrack |

— |

|

— |

|

||

|

Kerry G. Campbell |

21,042 |

(2) |

* |

|

||

|

Stefani D. Carter |

1,800 |

|

* |

|

||

|

Saverio M. Flemma |

— |

|

— |

|

||

|

Megan Parisi(3) |

— |

|

— |

|

||

|

Joseph D. Stilwell |

5,818,976 |

(4) |

40.3 |

% |

||

|

Named Executive Officers |

|

|

||||

|

M. Andrew Franklin |

9,531 |

(5) |

* |

|

||

|

Crystal Plum |

22,022 |

(6) |

* |

|

||

|

All directors and named executive officers as a group (9 persons) |

5,873,371 |

|

40.9 |

% |

||

____________

* Less than 1.0%

(1) Based upon 9,793,957 shares of Common Stock outstanding on February 28, 2023. In addition, amounts assume that all convertible securities held by the stockholder are converted into Common Stock.

(2) Includes (i) 3,000 shares of Common Stock, (ii) Notes convertible into 16,000 shares of Common Stock, and (iii) 3,268 shares of Series B Convertible Preferred Stock (“Series B Preferred Stock”) convertible into 2,042 shares of Common Stock.

(3) Ms. Parisi was elected to the Board of Directors on November 1, 2022.

(4) Includes (i) 1,181,336 shares of Common Stock, (ii) Notes convertible into 3,999,980 shares of Common Stock, (iii) 817,085 shares of Series B Preferred Stock convertible into 510,677 shares of Common Stock, and (iv) 86,150 shares of Series D Cumulative Convertible Preferred Stock (“Series D Preferred Stock”) convertible into 126,983 shares of Common Stock. Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., Stilwell Value Partners VII, L.P., Stilwell Value LLC, and Joseph Stilwell each possesses shared voting and investment power over 5,818,976 shares of Common Stock (assuming conversion of the Notes, Series B Preferred Stock and Series D Preferred Stock into Common Stock). Mr. Stilwell is the managing member and owner of Stilwell Value LLC, which is the general partner of Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., and Stilwell Value Partners VII, L.P.

(5) Includes (i) 4,356 shares of Common Stock, (ii) 7.00% Senior Subordinated Convertible Notes Due 2031 (“Notes”) convertible into 4,276 shares of Common Stock, (iii) 92 shares of Series D Preferred Stock convertible into 135 shares of Common Stock, and (iv) 1,223 shares of Series B Preferred Stock convertible into 764 shares of Common Stock.

(6) Includes 15,000 shares of restricted stock granted by the Company on August 13, 2021 that are subject to vesting in three equal installments on each anniversary of the grant date (each, a “Vesting Date”), subject to both (1) Ms. Plum’s continued employment through the applicable Vesting Date and (2) the average closing price per share of the Company’s common stock over all trading days in any consecutive 20-business day period during the three-year period following the grant date (the “Performance Period”) being equal to or greater than $6.25 (the “Price Target”). In the event of certain terminations of employment, Ms. Plum is eligible for pro-rated vesting, provided the Price Target is achieved during the Performance Period.

18

Based upon our records and the information reported in filings with the SEC, the following were beneficial owners of more than 5% of our shares of Common Stock as of February 28, 2023 (in addition to those noted above).

|

5% + Beneficial Owners |

|||||

|

Number of |

Percentage of |

||||

|

Magnetar Financial LLC(2) |

1,922,634 |

16.4 |

% |

||

|

1603 Orrington Avenue, 13th Floor |

|

||||

|

Daniel Khoshaba(3) |

1,105,924 |

11.3 |

% |

||

|

Alexander Palm Road |

|

||||

|

Bradley J. Schafer(4) |

942,751 |

9.6 |

% |

||

|

900 North Third Street |

|

||||

|

Calgary Leveen(5) |

913,649 |

9.1 |

% |

||

|

185 Wythe Avenue, Suite 9D |

|

||||

|

William Carlton Derrick(6) |

896,343 |

8.8 |

% |

||

|

3900 Essex Lane, Suite 340 |

|

||||

|

Steamboat Capital Partners LLC(7) |

764,391 |

7.3 |

% |

||

|

31 Old Wagon Road |

|

||||

|

Eidelman Virant Capital, Inc.(8) |

680,000 |

6.9 |

% |

||

|

8000 Maryland Avenue, Suite 600 |

|

||||

____________

(1) Based upon 9,793,957 shares of Common Stock outstanding on February 28, 2023. In addition, amounts assume that all convertible securities held by the stockholder are converted into Common Stock. All beneficial ownership identified on this table is held by the beneficial owners with sole voting power and sole investment power unless otherwise indicated.

(2) Based solely upon the Schedule 13G/A filed with the SEC by the beneficial owner on January 31, 2023, reporting beneficial ownership as of December 31, 2022. Magnetar Financial LLC (“Magnetar”) possesses shared voting power and shared investment power over (i) Common Stock Purchase Warrants that are exercisable for 998,547 shares of Common Stock, (ii) Notes convertible into 763,292 shares of Common Stock, (iii) 16,439 shares of Series D Preferred Stock convertible into 24,229 shares of Common Stock and (iv) 218,512 shares of Series B Preferred Stock convertible into 136,566 shares of Common Stock. Includes the shares reported by Magnetar Capital Partners LP, Supernova Management LLC and David J. Snyderman. Mr. Snyderman is the manager of Supernova Management LLC, which is the general partner of Magnetar Capital Partners LP. Magnetar Capital Partners LP is the sole member and parent holding company of Magnetar.

(3) Based solely upon the Schedule 13D/A filed with the SEC by the beneficial owner on December 14, 2021, reporting beneficial ownership of 1,105,924 shares of Common Stock as of December 14, 2021.

(4) Based solely upon the Schedule 13D/A filed jointly by SR Equity Ventures, LLC (“Ventures”), Bradley Schafer (“Schafer”), Steven Norcutt (“Norcutt”), N. Christopher (Kit) Richardson (“Kit Richardson”), Evan Richardson (“E. Richardson”), Gregory J. Springer (“Springer”), Schafer Richardson, Inc., (“SR, Inc.”), David Smith (“Smith”), Srikanth Malladi (“Malladi”), Gwendolyn A. Collins (“Collins”), Alexander J. Wodka (“Wodka”), Karen P. Gallivan (“Gallivan”), and Stephen P. Ceurvorst (“Ceurvorst”) with the SEC on January 5, 2023, reporting beneficial ownership as of January 5, 2023. Includes an aggregate of 942,751 shares of Common Stock. Additionally, Ventures may be deemed to beneficially own (A) 5,889 shares of Series B Preferred Stock and (B) 11,327 shares of Series D Preferred Stock, but such shares owned by Ventures are not included within the aggregate number of shares of Common Stock held by the beneficial owners. Ventures is a member-managed limited liability company. Schafer, Norcutt, Kit Richardson, E. Richardson, Springer and SR, Inc. are the sole members of Ventures, and, as such, control the management and operations of Ventures. Therefore, Ventures may be deemed to share voting and dispositive power with regard to the shares of Common Stock held by Ventures with each of Schafer, Norcutt, Kit Richardson, E. Richardson, Springer and SR, Inc. Smith, Malladi, Collins, Wodka, Gallivan and Ceurvorst are not members of Ventures, and, therefore, do not share the voting and dispositive power with regard to the Shares held by Ventures.

19

(5) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on January 23, 2023, reporting beneficial ownership as of December 31, 2022. Includes (i) 703,964 shares of Common Stock, (ii) Notes convertible into 8,520 shares of Common Stock, (iii) 132,353 shares of Series D Preferred Stock convertible into 195,096 shares of Common Stock, and (iv) 9,711 shares of Series B Preferred Stock convertible into 6,069 shares of Common Stock.

(6) Based solely upon the Schedule 13G/A filed jointly by William Carlton Derrick and Bruce William Derrick with the SEC on February 14, 2023, reporting beneficial ownership as of February 10, 2023. Includes (i) 504,699 shares of Common Stock, (ii) Notes convertible into 7,556 shares of Common Stock, (iii) 256,200 shares of Series D Preferred Stock convertible into 377,653 shares of Common Stock, and (iv) 10,296 shares of Series B Preferred Stock convertible into 6,435 shares of Common Stock. William Carlton Derrick and Bruce William Derrick collectively beneficially own 896,343 of these shares. William Carlton Derrick possesses sole voting power and sole dispositive power over 368,081 of these shares, and Bruce William Derrick possesses sole voting power and sole dispositive power over 528,262 of these shares.

(7) Based solely upon the Schedule 13D/A filed jointly by Steamboat Capital Partners, LLC and Parsa Kiai with the SEC on December 21, 2022, reporting beneficial ownership as of December 20, 2022. Includes (i) 50,000 shares of Common Stock, (ii) 392,716 shares of Series D Preferred Stock, which are convertible into Common Stock, and (iii) 216,781 shares of Series B Preferred Stock, which are convertible into Common Stock.

(8) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on February 2, 2022, reporting beneficial ownership as of December 31, 2021 of 680,000 shares of Common Stock.

To our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of the Company’s Common Stock as of February 28, 2023.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 31, 2022 regarding our compensation plans and the Common Stock we may issue under the plan.

|

Equity Compensation Plan Information Table |

|||||||

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted- average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

||||

|

Equity compensation plans approved by stockholders(1) |

15,000 |

(2) |

— |

153,811 |

|||

|

Equity compensation plans not approved by stockholders |

— |

|

— |

— |

|||

|

Total |

15,000 |

|

— |

153,811 |

|||

____________

(1) Includes our 2015 and 2016 Long-Term Incentive Plans, which authorized a maximum of 125,000 and 625,000 shares, respectively, of our Common Stock for issue. Awards are granted by the Compensation Committee.

(2) Includes 15,000 performance awards assuming maximum payout (as a result, this aggregate reported number may overstate actual dilution). Performance awards are not taken into account in the weighted-average exercise price as such awards have no exercise price.

Certain Relationships and Related Transactions

Related Party Transaction Policies

Our Code of Business Conduct and Ethics provides that a conflict of interest may occur when a director or an employee has an ownership or financial interest in another business organization that is doing business with the Company, and characterizes these transactions between the Company and the other organization as “related party transactions.”

20

Our Code of Business Conduct and Ethics for Board Members provides that if a director or a family member has any ownership or financial interest in another organization that conducts business or seeks to conduct business with the Company, they must report the situation to the Chair of the Governance and Nominating Committee and provide all relevant facts as requested, and the Governance and Nominating Committee will determine whether or not the related party transaction is a conflict of interest.

Our Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives provides that, if an employee or a family member has any ownership or financial interest in another organization that conducts business or seeks to conduct business with the Company, the employee must report the situation to the Chief Executive Officer and cooperate with the legal staff by providing all relevant facts. The Chief Executive Officer will determine whether or not the related party transaction is a conflict of interest.

Related Party Transactions

With the completion of the Company’s merger with Cedar, Cedar became a subsidiary of the Company. The Company performs property management and leasing services for Cedar. During the year ended December 31, 2022, Cedar paid the Company $1.0 million for these services.

In addition, other related party amounts payable to the Company for the year ended December 31, 2022, were $7.3 million, which consists primarily of financing costs, real estate taxes and costs paid on Cedar’s behalf at the closing of the KeyBank Credit Agreement.