Exhibit 99.4

STEAMBOAT CAPITAL PARTNERS, LLC

December 20, 2022

Steamboat Capital Public Letter Regarding Wheeler Real Estate Investment Trust (WHLR)

Michelle D. Bergman

E.J. Borrack

Kerry G. Campbell

Stefani D. Carter

Saverio M. Flemma

Joseph D. Stilwell

Megan Parisi

Wheeler Real Estate Investment Trust, Inc.

2529 Virginia Beach Blvd, Suite 200

Virginia Beach, Virginia, 23452

Steamboat Capital Partners LLC (“Steamboat”) is a registered investment advisor whose clients own preferred stock and common stock of Wheeler Real Estate Investment Trust (Nasdaq: WHLR, “Wheeler” or the “company”). We believe that the company’s securities are undervalued 1 and we are issuing this public letter to address the inadequacies in the company’s current Exchange Offer for its Series D Preferred Stock and to state our intention not to tender our shares.

We urge the board of directors to commence genuine, good-faith negotiations with the Series D preferred holders and to cease value-destructive actions, such as paying the interest on the company’s 7.00% Convertible Notes in anything other than cash.

We would also like to remind the board of directors of their fiduciary duty to all shareholders, not simply those that created and hold the 7.00% Convertible Notes. The issuance of deeply-discounted Series B and Series D preferred stock to these noteholders is rife with conflicts of interest and is manifestly wrong.

As illustrated below, by taking the unconscionable act of paying the interest on the 7.00% Convertible Notes in discounted preferred stock, the board is unduly enriching the holders of that security at the expense of its common shareholders:

| 7.00% Convertible Note Interest Payments Value | ||||

| Principal Amount ($ in millions) | $ | 30.0 | ||

| Coupon | 7.00 | % | ||

| Annual Interest Amount | 2.1 | |||

| Semi Annual Interest Payment | 1.1 | |||

| Payments in Series B Prefered | Series B | |||

| Trading Price (15 Day VWAP) | $ | 2.26 | ||

| Multiplier | 0.55 | |||

| Implied Price for Interest | 1.24 | |||

| Semi Annual Interest Payment ($ in millions) | $ | 1.1 | ||

| Preferred Shares Issued (in shares) | 845,441 | |||

| Par Value Per Share | 25.00 | |||

| Par Value Issued ($ in millions) | $ | 21.1 | ||

| Implied Annual Return on Principal Amount | 140.9 | % | ||

| 1 | In Appendix A, we outline our view of the stand-alone and private market value for the company. The bulk of this letter, however, addresses conduct by the board and the company that has frustrated the ability to achieve this value. |

STEAMBOAT CAPITAL PARTNERS, LLC

The first three semi-annual interest payments alone have already created additional preferred stock liquidation preference 2 outstanding in excess of $34 million, more than double the current equity market capitalization.

Furthermore, while we would be willing (as Series D preferred holders) to negotiate a reasonable settlement with the company to address our upcoming September 2023 optional redemption feature, the current Exchange Offer is coercive, ill-constructed and not in our interest. We believe that Series D holders will fare much better on the existing terms of the Series D preferred stock, which they relied on and which must be honored. Therefore, we believe that the Exchange Offer is not a good-faith offer, is highly unlikely to be successful and will only perpetuate the jeopardy the existing common stock faces upon the Series D redemption date.

As of September 30, 2022, the Series D preferred has a liquidation preference of $78.8 million and unpaid dividends of $32.5 million, for a total liquidation value of $114 million. With 3.2 million shares of Series D preferred stock outstanding, this value equates to nearly $36 per share of Series D preferred stock. This amount will be due, at the option of Series D holders, commencing in September 2023, in either stock or cash. The company does not have enough cash to address this maturity, so the Series D preferred stock will likely be issued new stock in the company. As Series D preferred holders, why would we exchange that for a security with only $16 per share in par value and with a below-market 6.00% interest rate? The Exchange Offer securities are far less attractive than the existing Series D terms, especially because the Series D has a fixed-dollar claim with much stronger contractual protections 3 that will be payable one way or another in less than one year.

| 2 | The fact that the preferred stock is trading below its par value does not negate the reality that these securities sit senior to the common stock in any eventual economic outcome for the company, including a sale. |

| 3 | While a full discussion of Wheeler’s capital structure is too complex in an abridged letter, we note that the dividend rate on the Series D preferred stock was appropriately structured to increase to as high as 14% after its September 2023 redemption date, along with other structural protections like an asset coverage ratio test and voting rights for two additional directors if dividends are not paid for six consecutive quarters. The company, however, has not honored these two latter rights and its adversarial and noncompliant behavior raises questions about how the Exchange Offer notes will be treated. |

2

STEAMBOAT CAPITAL PARTNERS, LLC

The unfortunate reality for common shareholders is that their potential dilution has only been exacerbated by the board’s actions, first by creating the 7.00% Convertible Notes to convert into common stock at a 45% discount to the price at which the Series D preferred stock converts and, second, by issuing additional discounted shares of preferred stock as interest on these Notes. Instead of acting as caretakers for common stock investors, the board has used them as hostages in unnecessarily adversarial actions with its other stakeholders.

The end result is that the existing common equity is likely to be diluted in its ownership by as much as 90%:

| Wheeler Preferred | Wheeler | |||||||||||||||

| Wheeler Real Estate Security Summary | Common | Series B | Series D | 7.00% | ||||||||||||

| (in millions unless otherwise noted) | Stock | Preferred | Preferred | Convertible | ||||||||||||

| (as of December 16, 2022) | ||||||||||||||||

| Shares Outstanding | 9.9 | 2.3 | 3.2 | 1.2 | ||||||||||||

| Market Price (per share) | $ | 1.57 | $ | 2.40 | $ | 11.21 | $ | 30.15 | ||||||||

| Market Value | 15.6 | 5.5 | 35.3 | 36.2 | ||||||||||||

| Par Value (per share) | NM | 25.00 | 25.00 | 25.00 | ||||||||||||

| Dividend / Interest Rate (a) | 9.00 | % | 8.75 | % | 7.00 | % | ||||||||||

| Accumulated Dividends (per share) (b) | - | 10.32 | - | |||||||||||||

| Redemption Date | 9/21/23 | |||||||||||||||

| Estimated Common Shares Issued Upon Conversion | ||||||||

| Liquidation Preference + Accumulated Dividends (per share) | 35.32 | 25.00 | ||||||

| Total Amount | 111.3 | 30.0 | ||||||

| Conversion Price (c) | $ | 1.57 | $ | 0.86 | ||||

| Shares of Common Stock Issued Upon Conversion | 70.9 | 34.7 |

| Post Redemption | Pre- | Post- | ||||||

| Common Stock Ownership | Conversion | Conversion | ||||||

| (in millions of shares) | ||||||||

| Existing Common Stock | 9.9 | 9.9 | ||||||

| Series D Holders | - | 70.9 | ||||||

| 7.00% Convertible Noteholders | - | 34.7 | ||||||

| Total | 9.9 | 115.6 | ||||||

| Ownership Dilution of Existing Common | (91.4) | % | ||||||

| (a) | The | dividend on the Wheeler Series D preferred increased to 10.75% while dividends have not been paid. |

| (b) | The accumulated dividend feature on the Wheeler Series B preferred was removed in November 2021. |

| (c) | The Series D preferred converts to common stock at the common share price and the 7.00% convertible notes convert into common stock at a 45% discount to that price. |

3

STEAMBOAT CAPITAL PARTNERS, LLC

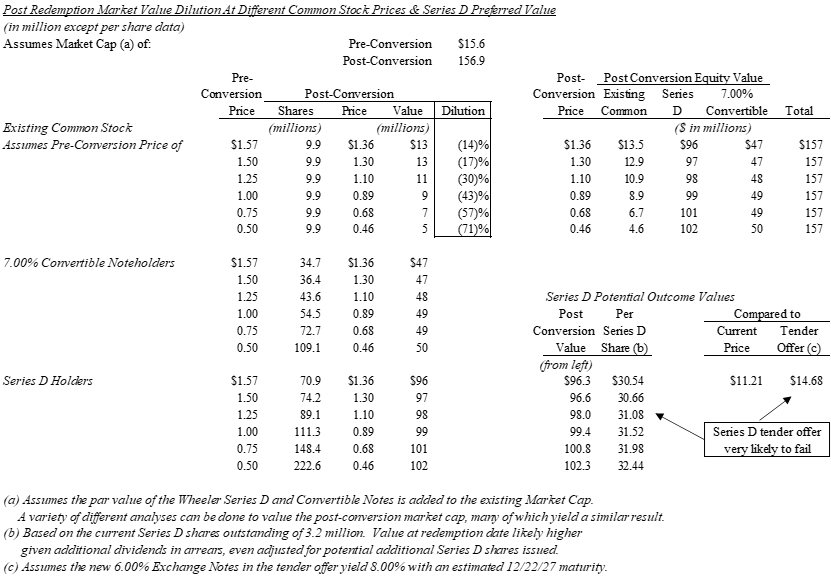

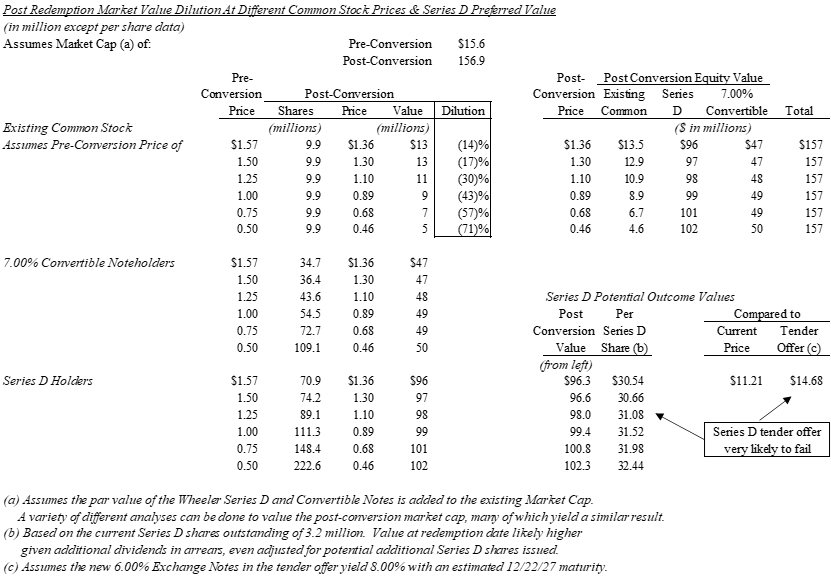

The economic impact is likely to also be very severe as the common share price may decline if investors fear the upcoming dilution. Given the fixed claims of the Series D and 7.00% Convertible Notes, a declining share price creates a “death spiral” 4 that requires more shares to be issued, and this has been greatly exacerbated by the board’s actions. In this scenario, the existing common equity could see as much as 70% dilution 5 of its value, with an egregious value transfer from common shareholders to the holders of the 7.00% Convertible Notes:

Post Redemption Market Value Dilution At Different Common Stock Prices & Series D Preferred Value (in million except per share data) Assumes Market Cap (a) of: Pre-Conversion $ 15.6 Post-Conversion 156.9 Pre- Conversion Post-Conversion Price Shares Price Value Dilution Existing Common Stock (millions) (millions) Assumes Pre-Conversion Price of $ 1.57 9.9 $ 1.36 $ 13 (14 )% 1.50 9.9 1.30 13 (17 )% 1.25 9.9 1.10 11 (30 )% 1.00 9.9 0.89 9 (43 )% 0.09 0.75 9.9 0.68 7 (57 )% 0.61 0.50 9.9 0.46 5 (71 )% 0.30 7.00% Convertible Noteholders $ 1.57 34.7 $ 1.36 $ 47 1.50 36.4 1.30 47 1.25 43.6 1.10 48 1.00 54.5 0.89 49 0.75 72.7 0.68 49 0.50 109.1 0.46 50 Series D Holders $ 1.57 70.9 $ 1.36 $ 96 1.50 74.2 1.30 97 1.25 89.1 1.10 98 1.00 111.3 0.89 99 0.75 148.4 0.68 101 0.50 222.6 0.46 102 Post- Post Conversion Equity Value Conversion Existing Series 7.00% Price Common D Convertible Total ($ in millions) $ 1.36 $ 13.5 $ 96 $ 47 $ 157 1.30 12.9 97 47 157 1.10 10.9 98 48 157 0.89 8.9 99 49 157 0.68 6.7 101 49 157 0.46 4.6 102 50 157 Series D Potential Outcome Values Post Per Compared to Conversion Series D Current Tender Value Share (b) Price Offer (c) (from left) $ 96.3 $ 30.54 $ 11.21 $ 14.68 96.6 30.66 98.0 31.08 99.4 31.52 100.8 31.98 102.3 32.44

Starting in September 2023, Series D holders are entitled to receive common stock or cash worth more than $36 per share of Series D preferred stock, so a $16 per share headline price exchange offer is not adequate compensation. To be clear, the Series D holders are entitled to this value fair and square and if there is any ill-derived gains, it is in the hands of the 7.00% Convertible Note holders that will reap greater than 50% gains on their principal value due to the actions of the board. We will remind the board members that the Maryland Corporations and Associations code Section 2-405.1 requires that directors act: (1) in good faith, (2) in a manner he reasonably believes to be in the best interests of the corporation; and (3) with the care that an ordinarily prudent person in a like position would use under similar circumstances.

The Series D holders have not received any good faith negotiations from the company regarding their contractual rights (Series B preferred holders have been treated even worse). It is not in the company’s interest to pay its obligations on the 7.00% Convertible Notes in anything other than cash, as the company has significant unrestricted cash that can meet these obligations in a far less dilutive manner. Indeed, the actions of the board appear to benefit only one constituency.

| 4 | We would note that some members of the board explicitly used this term to describe the Series D preferred stock redemption feature (coming due in five years) in their criticism of the company’s prior management team in 2018 (https://www.sec.gov/Archives/edgar/data/1113303/000092189518002703/dfan14a10318009_10042018.htm). How, then, can the board justify issuing the same Series D preferred stock at a 45% discount to its current price as interest on its 7.00% Convertible Notes, with the same “death spiral” less than a year away? |

| 5 | The actual amount of dilution would depend on numerous unknown factors including whether options to redeem, convert or exercise are exercised all at once or over multiple dates, the portion (if any) of Series D that is redeemed in cash, the price impact of the conversion and any impact from whether those receiving shares of common stock attempt to dispose of them. |

4

Steamboat Capital Partners, LLC

There is still time to address the challenges that the company faces, but the first step must be a bona fide discussion with all stakeholders and an immediate cessation to the payment of 7.00% Convertible Note interest in anything other than cash.

Sincerely,

| /s/ Parsa Kiai | |

| Parsa Kiai |

5

Steamboat Capital Partners, LLC

Appendix A: Wheeler Standalone and Private Market Value

As illustrated below, comparable real estate companies are valued at 13 times their estimated next twelve month “FFO” (funds from operations):

| Regency | Brixmor | Kimco | SITE | Retail | ||||||||||||||||||||

| Peer | Centers | Property | Realty | Centers | Opportunities | |||||||||||||||||||

| Comparable Company Valuation | Median | REG | BRX | KIM | SITC | ROIC | ||||||||||||||||||

| Current Price (as of 12/19/22) | $ | 62.73 | $ | 22.14 | $ | 21.23 | $ | 13.10 | $ | 15.03 | ||||||||||||||

| FFO Per Share | 3.98 | 1.96 | 1.58 | 1.16 | 1.10 | |||||||||||||||||||

| FFO Multiple | 13.0 | x | 15.8 | x | 11.3 | x | 13.4 | x | 11.3 | x | 13.7 | x | ||||||||||||

| Kite | Federal | Urban | Saul | RPT | Phillips | |||||||||||||||||||

| Realty | Realty | Edge | Centers | Realty | Edison | |||||||||||||||||||

| KRG | FRT | UE | BFS | RPT | PECO | |||||||||||||||||||

| Current Price (as of 12/19/22) | $ | 21.07 | $ | 102.53 | $ | 14.35 | $ | 40.20 | $ | 10.37 | $ | 32.03 | ||||||||||||

| FFO Per Share | 1.86 | 6.26 | 1.18 | 3.10 | 1.02 | 2.19 | ||||||||||||||||||

| FFO Multiple | 11.3 | x | 16.4 | x | 12.2 | x | 13.0 | x | 10.2 | x | 14.6 | x | ||||||||||||

Valuing Wheeler at a comparable valuation, even after assuming the preferred securities are worth their par 6 liquidation value, yields a common stock price more than double the current share price:

| Wheeler Real Estate Income & Cash Flow | ||||

| Annualized Run-Rate ($ in millions) | 3Q22 | |||

| Rent | $ | 96.8 | ||

| Property Expenses | (34.4 | ) | ||

| Property NOI | 62.4 | |||

| G&A | (12.9 | ) | ||

| NOI | 49.5 | |||

| Interest Expense | (27.8 | ) | ||

| Funds From Operations (FFO) | 21.7 | |||

| Capex | (8.3 | ) | ||

| Preferred Dividends (a) | - | |||

| Free Cash Flow (FCF) | 13.4 | |||

| Shares Outstanding | 9.9 | |||

| FFO Per Share | 2.18 | |||

| FCF Per Share | 1.34 | |||

| Wheeler FFO | $ | 21.7 | ||

| FFO Multiple of Peers | 13.0 | x | ||

| Value for Equity + Preferred | $ | 280.8 | ||

| Preferred Value at Par | (236.7 | ) | ||

| Equity Value | 44.1 | |||

| Per Share of Existing Common Stock | $ | 4.44 | ||

| Current Price | 1.57 |

| (a) | Assumes no preferred dividends for sake of analysis to illustrate value available to common and preferred holders. |

This analysis assumes that the 7.00% Convertible Notes are paid their 7.00% interest rate in cash and no longer gouge the common stock and other stakeholders for illicit gains.

| 6 | For the same of simplicity, we assume that all the preferred stock is treated at its par value, despite the very different terms of the Wheeler Series D and Series B preferred stock and the Cedar Series B and Series C preferred stock. A full analysis of the breakdown of value is beyond the scope of this letter but this analysis is to illustrate that there is sufficient asset value for a far better outcome for all securities than the status quo. |

6

Steamboat Capital Partners, LLC

In addition to the above, any and all value-maximizing strategic options must be evaluated, including the sale of non-core assets and a potential sale of the company. We believe that despite all the negative actions conducted by the board of Wheeler, the company still has desirable assets and the private market valuations for high-quality, grocery-anchored real estate are still attractive (as evidenced by the sale of Cedar Realty Trust in August 2022, a transaction that is obviously very relevant to a financial analysis of Wheeler). As illustrated in the Cedar 7 transactions, the private market values for Wheeler are well in excess of its current market prices for nearly all of its securities. This is especially the case in the sale to a strategic buyer that can eliminate a significant amount of the corporate expenses at Wheeler, increasing net operating income (“NOI”) from a corporate level of $49 million closer to $62 million of property NOI:

| Asset Value and Recoveries in Potential Sale | Property | |||||

| ($ in million except per share data) | NOI | Comment | ||||

| Net Operating Income | $ | 62.4 | ||||

| Cap Rate | 7.50 | % | ||||

| Asset Value | 831.5 | |||||

| Debt | (450.7 | ) | ||||

| 7% Convertible 0% | (33.0 | ) | ||||

| Asset Value for Preferred | 347.9 | Assumes par value for preferred excluding | ||||

| Preferred Stock at Par 20% | (236.7 | ) | accumulated and unpaid dividends | |||

| Asset Value for Common | 111.2 | |||||

| Asset Value Per Common Share (a) | $ | 11.19 | ||||

Asset Value Per Common Share at Different Cap Rates

| 6.50 | % | Range in Cedar | $ | 24.06 | ||||

| 7.50 | % | Merger Proxy | 11.19 | |||||

| 8.00 | % | 5.96 | ||||||

| 8.50 | % | 1.34 |

The simplified analysis above shows that there is significant value for common shareholders, even if preferred shareholders receive their full liquidation preference.

| 7 | The Cedar merger proxy highlights the appropriate valuation ranges for comparable real estate on page 47 (FFO multiples ranging from 10.5x to 13.0x) and page 49 (cap rates of 7.2% to 6.8%). |

7