UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

SCHEDULE 14A

(Rule 14a-101)

________________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Name of Registrant as Specified in its Charter)

____________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply): |

||

|

☒ |

No fee required |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

Riversedge North

2529 Virginia Beach Boulevard

Virginia Beach, VA 23452

April 29, 2022

Dear Fellow Stockholder:

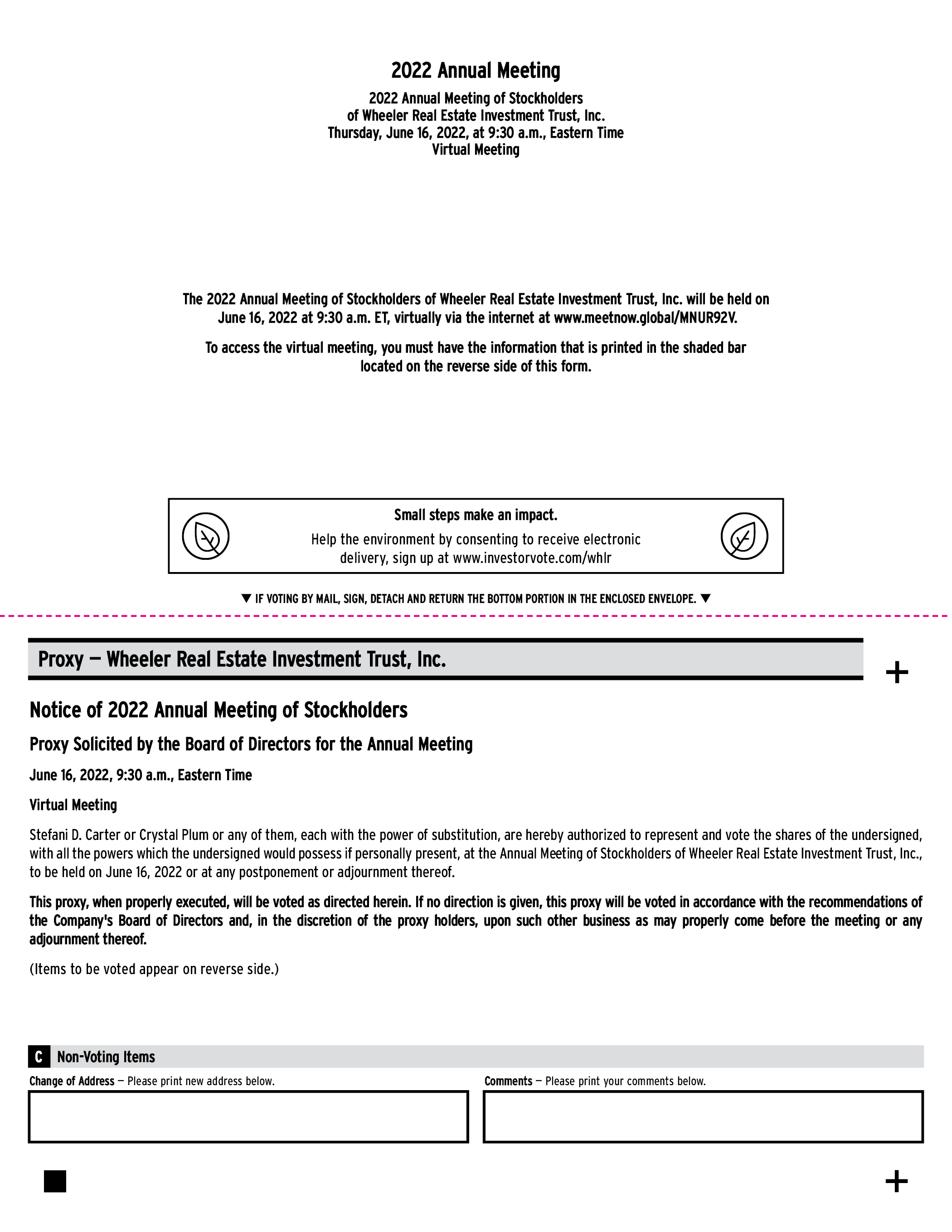

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”) to be held on June 16, 2022 at 9:30 a.m., Eastern Time. The Annual Meeting will be held as a virtual meeting of stockholders. You will be able to attend the Annual Meeting, vote and submit questions during the Annual Meeting via a live webcast by visiting https://meetnow.global/MNUR92V and entering the control number provided with your proxy materials. Prior to the Annual Meeting, you will be able to authorize a proxy to vote your shares on the matters submitted for stockholder approval at www.investorvote.com/whlr, or by telephone or mail, and we encourage you to do so. Stockholders who wish to observe the Annual Meeting (without being able to vote or submit questions) may also do so by following the instructions in this Proxy Statement.

The enclosed Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting. Directors and officers of the Company will be present to answer any questions that you and other stockholders may have. Also available online for your review is our Annual Report on Form 10-K, which contains detailed information concerning the activities and operating performance of the Company.

The business to be conducted at the Annual Meeting consists of:

• the election of six members of the Board of Directors;

• the approval, on an advisory basis, of named executive officer compensation for fiscal year 2021; and

• the ratification of the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

The Board of Directors unanimously recommends a vote “FOR” all proposals.

Please indicate your vote by internet or telephone or, if you received your materials by mail, by using the enclosed proxy card. Your vote is important, and it is important that we receive your vote as soon as possible.

Sincerely,

|

Stefani D. Carter |

M. Andrew Franklin |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2022

Wheeler Real Estate Investment Trust, Inc. will hold its Annual Meeting on June 16, 2022, at 9:30 a.m., Eastern Time, via webcast at https://meetnow.global/MNUR92V. The purpose of the meeting is to:

• elect a Board of Directors of six directors to serve until the next annual meeting and until their successors are duly-elected and qualified;

• approve, on an advisory basis, named executive officer compensation for fiscal year 2021; and

• ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

Only stockholders of record at the close of business on March 21, 2022, will be entitled to vote at the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares on the internet or by telephone, or, if you received the proxy materials by mail, you may also authorize a proxy to vote your shares by mail. Your vote will ensure your representation at the Annual Meeting regardless of whether you attend via webcast on June 16, 2022.

Dated: April 29, 2022

|

By order of the Board of Directors, |

||

|

Angelica Beltran |

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on June 16, 2022

This proxy statement and the Company’s 2021 Annual Report on Form 10-K are available at

www.investorvote.com/whlr.

|

Page |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

3 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

6 |

||

|

8 |

||

|

8 |

||

|

9 |

||

|

9 |

||

|

9 |

||

|

10 |

||

|

10 |

||

|

10 |

||

|

10 |

||

|

11 |

||

|

12 |

||

|

12 |

||

|

12 |

||

|

12 |

||

|

12 |

||

|

13 |

||

|

Employment Agreements with the Company’s Named Executive Officers |

13 |

|

|

13 |

||

|

13 |

||

|

14 |

||

|

15 |

||

|

16 |

||

|

Security Ownership of Certain Beneficial Owners and Management |

16 |

|

|

Securities Authorized for Issuance Under Equity Compensation Plans |

18 |

|

|

18 |

||

|

18 |

||

|

18 |

i

|

Page |

||

|

19 |

||

|

21 |

||

|

22 |

||

|

22 |

||

|

24 |

||

|

25 |

||

|

PROPOSAL 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

26 |

|

|

27 |

||

|

27 |

||

|

27 |

||

|

27 |

||

|

27 |

||

|

A-1 |

ii

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement before voting. The approximate date on which this Proxy Statement and form of proxy are first being provided to stockholders, or being made available through the internet for those stockholders receiving proxy materials electronically, is April 29, 2022.

2022 Annual Meeting of Stockholders

|

Date and Time: |

June 16, 2022 at 9:30 a.m., Eastern Time |

|

|

Place: |

Via webcast, at https://meetnow.global/MNUR92V |

|

|

Record Date: |

March 21, 2022 |

Voting Matters and Board of Directors Recommendation

|

Items of Business |

Board of |

|

|

1. Election of Six Directors |

FOR |

|

|

2. Advisory Vote to Approve 2021 Executive Compensation |

FOR |

|

|

3. Ratification of Cherry Bekaert LLP as the Independent Registered Public Accounting Firm |

FOR |

1

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 16, 2022

The Board of Directors of Wheeler Real Estate Investment Trust, Inc. (the “Company” or “we” or “us”) is soliciting proxies to be used at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”). Beginning on or about April 29, 2022, we will send Notices of Internet Availability of Proxy Materials (each, a “Notice”) by mail to stockholders entitled to notice of the Annual Meeting.

Record holders of Common Stock, $0.01 par value per share (“Common Stock”) of the Company at the close of business on March 21, 2022 (the “Record Date”) may vote at the Annual Meeting. On the Record Date, 9,720,532 shares of Common Stock were outstanding. Each share is entitled to cast one vote.

How You Can Attend the Annual Meeting

The Annual Meeting will be a virtual meeting of stockholders held via live webcast, which will be accessible at the date and time given above. The live webcast will provide stockholders with the opportunity to vote and ask questions.

The process for attending the Annual Meeting depends on how your Common Stock is held. Generally, you may hold Common Stock in your name as a “record holder” or in an account with a bank, broker, or other nominee (i.e., in “street name”).

If you are a record stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the internet. Record stockholders should follow the instructions provided on their Notice and in their proxy materials.

If you hold your shares in “street name,” you must register in advance to attend and vote at the virtual Annual Meeting webcast. If you hold your shares in “street name” and do not register, you may still listen to the Annual Meeting webcast by visiting https://meetnow.global/MNUR92V but you will not be able to participate or vote in the meeting. To register, you must obtain a “legal proxy” from the bank, broker or other nominee of your shares and submit the legal proxy to Computershare in order to be entitled to vote those shares electronically. Please note that obtaining a legal proxy may take several days. Registration requests must be received no later than 5:00 p.m. Eastern Time on June 13, 2022. You will receive a confirmation of your registration by email. Requests must include your legal proxy (an image of the legal proxy or a forward of the email from your broker including the legal proxy are acceptable) and be sent by email to legalproxy@computershare.com with the subject “Legal Proxy” or by mail to Computershare, Wheeler Real Estate Investment Trust, Inc. Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001. If you wish to observe the Annual Meeting (without being able to vote or submit questions) you may do so by visiting the above website and using your name and email address.

Please note that you may vote by proxy prior to June 16, 2022 and still attend the Annual Meeting. Even if you currently plan to attend the Annual Meeting webcast, we strongly recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. If you hold your shares in street name, we urge you to submit your proxy in advance as described below.

How You Can Access the Proxy Materials

We are providing access to our proxy materials (including this proxy statement, notice of annual meeting and our 2021 annual report on Form 10-K) over the internet pursuant to rules adopted by the Securities and Exchange Commission (“SEC”). Beginning on or about April 29, 2022, we will send Notices by mail to stockholders entitled to notice of the Annual Meeting. The Notice includes instructions on how to view the electronic proxy materials on the internet, which will be available to all stockholders beginning on or about April 29, 2022. The Notice also includes instructions on how to elect to receive future proxy materials by email. If you choose to receive future proxy materials

2

by email, next year you will receive an email with a link to the proxy materials and proxy voting site and will continue to receive proxy materials in this manner until you terminate your election. We encourage you to take advantage of the availability of our proxy materials on the internet.

If you wish to receive a printed copy of the proxy materials, including the proxy card, you may request that they be mailed to you at no cost by following the instructions on the Notice. In addition, you may choose to receive future proxy materials by mail by following the instructions on the Notice.

The process for voting your Common Stock depends on how your Common Stock is held.

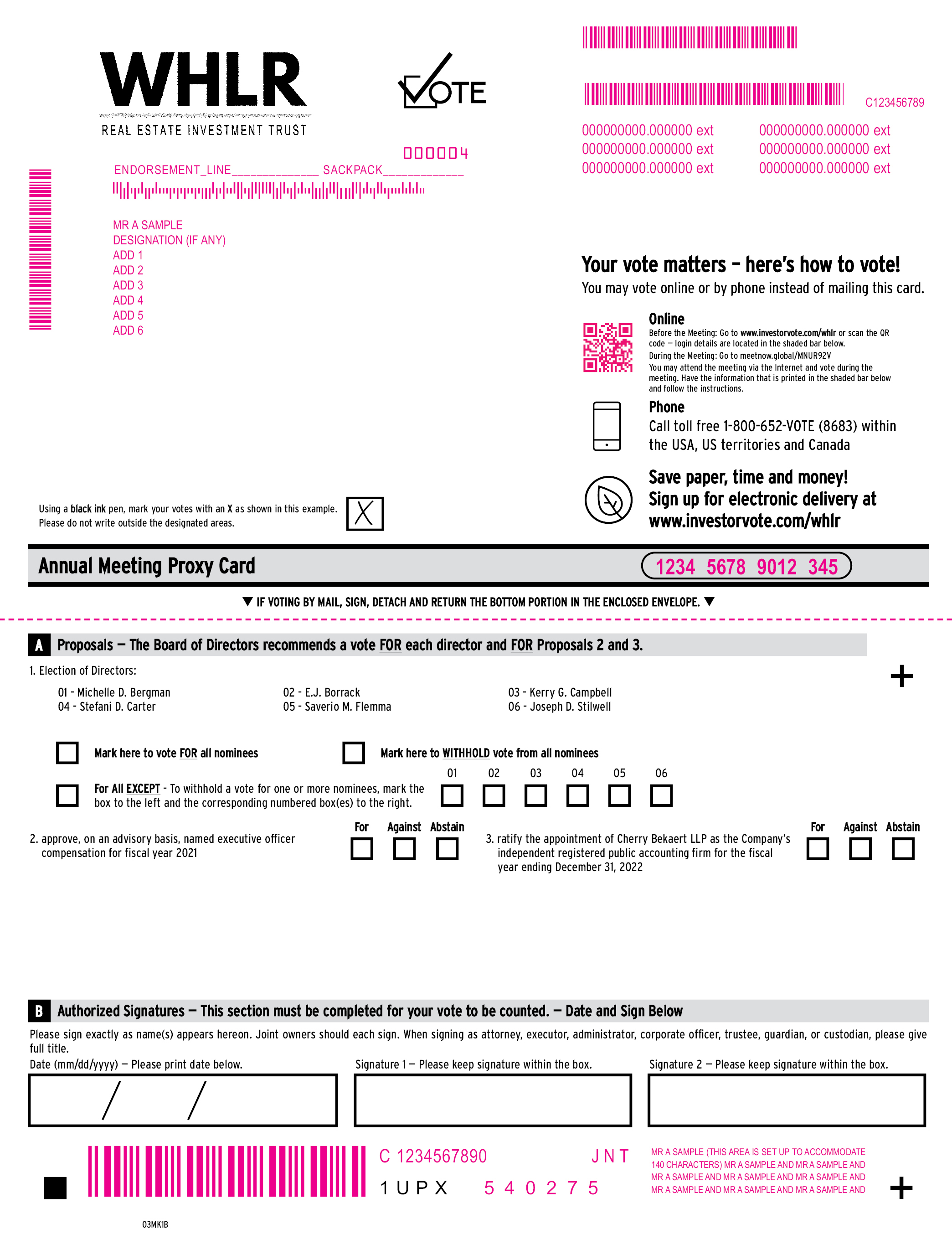

If you are a record holder, you can vote your shares by going to www.investorvote.com/whlr, or by calling the toll-free number (for residents of the United States and Canada) listed on your proxy card, using the 16-digit control number on your proxy card. If you chose to receive proxy materials by mail, you can also complete, sign and date the enclosed proxy card and mail it in the enclosed postage-paid envelope. If you vote online or by phone, there is no need to return a proxy card by mail. The proxy you submit will be voted in accordance with your instructions.

If you hold your shares in “street name,” you must follow the voting instructions provided by your bank, broker or other nominee to ensure that your shares are represented and voted at the Annual Meeting.

Please note voting in advance by telephone and internet will not be available after 11:59 p.m., Eastern Time, on June 15, 2022.

If a proxy is executed and returned but no instructions are given, the shares will be voted according to the recommendations of the Board of Directors. The Board of Directors unanimously recommends a vote FOR all of Proposals 1, 2 and 3.

How You Can Vote Electronically at the Annual Meeting

If you are a record holder, in order to vote and/or submit a question during the Annual Meeting, you will need to follow the instructions posted at www.investorvote.com/whlr and will need the control number included in the Notice sent to you.

If you hold your shares in street name, you must obtain a “legal proxy” from the bank, broker or other nominee of your shares and send the “legal proxy” to Computershare as described above.

If you submit your proxy over the internet, by telephone or by mail, you may change your vote by subsequently properly submitting a new proxy. Only your most recent proxy will be exercised and all others will be disregarded, regardless of the method by which the proxies were authorized. You may also revoke your earlier proxy by voting in person at the Annual Meeting. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request. If you hold your shares in “street name,” you should follow the instructions provided by your bank, broker or other nominee to revoke your proxy.

Notices of revocation of proxies delivered by mail must be delivered by June 15, 2022 to the Company’s principal offices at Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452, Attention: Angelica Beltran, Corporate Secretary.

You will be voting on the following:

(1) The election of six members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Stockholders in 2023 or until their successors are duly elected and qualified;

(2) To approve, on an advisory basis, named executive officer compensation for fiscal year 2021; and

(3) To ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

3

The Board of Directors, on behalf of the Company, is soliciting your proxy to vote your shares of our Common Stock on all matters scheduled to come before the Annual Meeting, whether or not you attend in person. By submitting your proxy and voting instructions by telephone or via the internet, or if you have chosen to receive your proxy materials by mail, by completing, signing, dating and returning the proxy card or voting instruction form, you are authorizing the persons named as proxies to vote your shares of our Common Stock at the Annual Meeting as you have instructed.

The holders of a majority of the shares entitled to vote who are either present in person or represented by a proxy at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. As of March 21, 2022, there were 9,720,532 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of a majority of stockholders entitled to cast votes at the meeting will constitute a quorum for adopting the proposals at the Annual Meeting. If you have properly signed and returned your proxy card by mail or voted by internet or phone, you will be considered part of the quorum, and the persons named on the proxy card will vote your shares as you have instructed. If the broker holding your shares in “street” name indicates to us on a proxy card that the broker has discretionary authority to vote your shares on any proposal, we will consider your shares as present and entitled to vote for the purposes of determining the presence of a quorum.

Election of Directors (Proposal 1). A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected to that slot. In voting on the election of directors, you may vote “FOR” or “WITHHOLD” from voting as to each director nominee. A proxy that has properly withheld authority with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. For purposes of this vote, abstentions and broker non-votes will not count as votes cast and will not affect the outcome of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Advisory Vote to Approve Executive Compensation (Proposal 2). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Ratification of the Appointment of Cherry Bekaert LLP (Proposal 3). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum. We do not expect there to be any broker non-votes with respect to Proposal 3, as brokers are entitled to vote on the ratification of independent registered accounting firms.

A broker nominee generally may not vote on “non-routine” matters without receiving your specific voting instructions. A “broker non-vote” occurs when a broker nominee holding shares in street name votes shares on some matters at the meeting but not others. Your broker nominee will not be able to submit a vote on the Election of Directors (Proposal 1) and the Advisory Vote to Approve Executive Compensation (Proposal 2), unless it receives your specific instructions.

The Company’s Bylaws do not require that stockholders ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm. The Audit Committee will consider the outcome of this vote in its decision to appoint an independent registered public accounting firm next year. The Company, however, is not bound by the stockholders’ decision. Even if the selection is ratified, the Audit Committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of the Company.

If you received multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different names. You should vote each of the proxy cards to ensure that all your shares are voted.

4

Other Matters to Be Acted Upon at the Annual Meeting

We do not know of any other matters to be validly presented or acted upon at the Annual Meeting. If any other matter is presented at the Annual Meeting on which a vote may be properly taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

The Company is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, by telephone or mail.

Our internet website address is www.whlr.us. We make available free of charge through our website our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we have posted the Charters of our Audit Committee, Compensation Committee, and Governance and Nominating Committee, as well as our Insider Trading Policy, Code of Business Conduct and Ethics for Members of the Board of Directors, Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives, and Corporate Governance Principles, all under separate headings. These documents are not incorporated in this instrument by reference. We will also provide a copy of these documents free of charge to stockholders upon written request.

You may call our Corporate Secretary at 757-627-9088 if you have any questions.

PLEASE VOTE — YOUR VOTE IS IMPORTANT

5

CORPORATE GOVERNANCE AND BOARD MATTERS

The affairs of the Company are managed by the Board of Directors. Directors are elected at the annual meeting of stockholders each year or, in the event of a vacancy, appointed by the incumbent Board of Directors, and serve until the next annual meeting of stockholders or until a successor has been elected or approved.

Our Board of Directors currently consists of seven directors. All of the directors are independent as determined in accordance with the listing standards established by the NASDAQ Capital Market, and our Board of Directors makes an affirmative determination as to the independence of each of our directors on an annual basis. We have adopted a Code of Business Conduct and Ethics for Members of the Board of Directors, a Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives, and Corporate Governance Principles, which are available on our website, all under separate headings.

Role of the Board of Directors in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from the Audit Committee, Compensation Committee, Governance and Nominating Committee, Executive Committee and Asset Liability Committee, each of which addresses risks specific to their respective areas of oversight.

The Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The Governance and Nominating Committee oversees the corporate governance policies and practices of the Company and develops and recommends to the Board of Directors any changes or additions to the governance policies and practices it deems appropriate. The Executive Committee has the ability to act with the full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. Our Asset Liability Committee evaluates the level of risk inherent in the Company’s real estate assets and monitors the level of risk that is appropriate.

Members of the Board of Directors

As of April 29, 2022 (the date of this proxy statement), the members of the Board of Directors (and their respective committee memberships) are identified below:

|

Director |

Audit |

Compensation |

Governance and |

Executive |

Asset |

|||||

|

Kerry G. Campbell |

Chair |

— |

Member |

— |

Chair |

|||||

|

Stefani Carter |

— |

— |

Member |

Member |

— |

|||||

|

Paula J. Poskon(1) |

Member |

Chair |

— |

— |

Member |

|||||

|

Joseph D. Stilwell |

— |

— |

Chair |

Member |

— |

|||||

|

E.J. Borrack |

— |

Member |

— |

— |

— |

|||||

|

Michelle D. Bergman |

— |

Member |

— |

— |

— |

|||||

|

Saverio M. Flemma |

Member |

— |

— |

— |

Member |

____________

(1) Ms. Poskon’s term as a director of the Company will expire at the Annual Meeting. Ms. Poskon will not stand for re-election.

Our Board of Directors has established five committees: an Audit Committee, a Compensation Committee, a Governance and Nominating Committee, an Executive Committee, and an Asset Liability Committee. The principal functions of each committee are briefly described below. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of the Company.

6

Audit Committee. Our Audit Committee currently consists of three directors: Kerry G. Campbell, Paula J. Poskon and Saverio M. Flemma. Mr. Campbell is the Chair of the Audit Committee. Mr. Campbell qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NASDAQ Capital Market corporate governance requirements. In addition, each of the Audit Committee members is “financially sophisticated” as that term is defined by the NASDAQ Capital Market corporate governance requirements. The functions of the Audit Committee are described below under the heading “Report of the Audit Committee.” The charter of the Audit Committee is available on the Company’s Investor Relations tab of our website (www.whlr.us). All of the members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Audit Committee met four times in 2021.

Governance and Nominating Committee. Our Governance and Nominating Committee currently consists of three directors: Joseph D. Stilwell, Stefani D. Carter and Kerry G. Campbell. Mr. Stilwell is the Chair of the Governance and Nominating Committee. The Governance and Nominating Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Principles. In addition, the Governance and Nominating Committee develops and reviews background information on candidates for the Board of Directors and makes recommendations to the Board of Directors regarding such candidates. The Governance and Nominating Committee also prepares and supervises the Board of Directors’ annual review of director independence and the Board of Directors’ performance self-evaluation. The charter of the Governance and Nominating Committee is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Governance and Nominating Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Governance and Nominating Committee met once in 2021.

Compensation Committee. Our Compensation Committee consists of three directors: Paula J. Poskon, E.J. Borrack and Michelle D. Bergman. Ms. Poskon is the Chair of the Compensation Committee. The Compensation Committee is responsible for overseeing the policies of the Company relating to compensation to be paid by the Company to the Company’s principal executive officer and any other officers designated by the Board of Directors, making recommendations to the Board of Directors with respect to such policies, producing necessary reports on executive compensation for inclusion in the Company’s proxy statement in accordance with applicable rules and regulations and monitoring the development and implementation of succession plans for the principal executive officer and other key executives and making recommendations to the Board of Directors with respect to such plans. The charter of the Compensation Committee is available on the Company’s Investor Relations website (www.whlr.us). While the Company’s executives will communicate with the Compensation Committee regarding executive compensation issues, the Company’s executives do not participate in any executive compensation decisions. During 2021, the Compensation Committee retained Pearl Meyer as a compensation consultant. Pearl Meyer advised the Compensation Committee on the Company’s executive pay levels relative to a peer group it developed and the broader market of real estate companies and it developed recommendations for consideration by the Compensation Committee to maintain and improve executive pay competitiveness. All of the members of the Compensation Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Compensation Committee met three times in 2021.

Executive Committee. Our Executive Committee currently consists of two directors: Joseph D. Stilwell and Stefani D. Carter. The purpose of the Executive Committee is to generally act with the full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. However, the Executive Committee does not have the authority to act on any matters that are expressly delegated to other committees of the Board of Directors or are under active review by the Board of Directors or another committee of the Board of Directors. The Executive Committee may be delegated specific actions and authority from time to time by the Board of Directors. The Executive Committee was formed in February 2020. Joseph D. Stilwell and Stefani D. Carter are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Executive Committee met twice in 2021.

Asset Liability Committee. Our Asset Liability Committee currently consists of three directors: Kerry G. Campbell, Paula J. Poskon and Saverio M. Flemma. Mr. Campbell is the Chair of the Asset Liability Committee. The purpose of the Asset Liability Committee is to evaluate the level of risk inherent in the Company’s real estate assets, monitor the level of risk that is appropriate in the Company’s real estate assets, monitor the financing of the

7

Company’s real estate assets, develop guidelines on improving the Company’s financing processes relating to the Company’s real estate assets, and review the Company’s financing processes relating to the Company’s real estate assets. The Asset Liability Committee was formed in June 2021. All of the members of the Asset Liability Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Asset Liability Committee met once in 2021.

Board of Directors Leadership Structure

The Board of Directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chair of the Board of Directors. At present, the Board of Directors believes that it is in the best interests of the Company that these roles be separate, in order to permit each person to focus on his or her primary role, which provides an appropriate balance between the managerial responsibilities of the Chief Executive Officer and the independent oversight and strategic direction provided by our Board of Directors. The current Chief Executive Officer and President, M. Andrew Franklin, is not a member of the Board of Directors. The current Chair of the Board of Directors is Stefani D. Carter.

Selection of Nominees for the Board of Directors

The Governance and Nominating Committee will consider candidates for Board of Directors membership that are suggested by its members and other members of the Board of Directors, as well as management and stockholders. The committee may also retain a third-party executive search firm to identify candidates upon request of the committee from time to time. A stockholder who wishes to recommend a prospective nominee for the Board of Directors should notify the Company’s Corporate Secretary or any member of the Governance and Nominating Committee in writing with supporting material that the stockholder considers appropriate. The Governance and Nominating Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of the Company’s Bylaws relating to stockholder nominations.

Once the Governance and Nominating Committee has identified a prospective nominee, the committee will make an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination will be based on a number of factors and the information provided to the committee with the recommendation of the prospective candidate will be important. The preliminary determination will be based primarily on the need for additional members of the Board of Directors to fill vacancies or the need to expand the size of the Board of Directors, as well as the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the committee determines, in consultation with the Chair of the Board of Directors and other members of the Board of Directors as appropriate, that additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the committee. The committee will then evaluate the prospective nominee against the standards and qualifications generally set out in the Company’s Corporate Governance Principles, including:

• whether the prospective nominee is a stockholder of the Company;

• the ability of the prospective nominee to represent the interests of the Company;

• the prospective nominee’s standards of integrity, commitment and independence of thought and judgment;

• the prospective nominee’s ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Principles;

• the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board of Directors; and

• the willingness of the prospective nominee to meet any minimum equity interest holding guideline that may be in place from time to time.

The Governance and Nominating Committee also considers such other relevant factors as it deems appropriate, including (without limitation) the current composition of the Board of Directors, the need for Audit Committee expertise and evaluations of other prospective nominees. In connection with this evaluation, the Governance and Nominating Committee determines whether to interview the prospective nominee and, if warranted, one or more

8

members of the committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Governance and Nominating Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors, and the Board of Directors determines the nominees after considering the recommendation and report of the committee.

Stockholders who wish to recommend nominees for election as directors should provide those recommendations in writing to our Corporate Secretary, specifying the nominee’s name and qualifications for membership on the Board of Directors.

For a stockholder to nominate a director candidate, the stockholder must comply with the advance notice provisions and other requirements of Section 11 of Article II of our Bylaws.

We urge any stockholder who intends to recommend a director candidate to the Governance and Nominating Committee for consideration to review thoroughly our Governance and Nominating Committee Charter and Section 11 of Article II of our Bylaws. Copies of our Governance and Nominating Committee Charter and our Bylaws are available upon written request to the Corporate Secretary, Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452.

Determinations of Director Independence

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers whether there are any transactions and relationships between any director (and his or her immediate family and affiliates) and the Company and its management to determine, to the extent such transactions and relationships exist, whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law and listing standards. The Company believes that its Board of Directors consists of directors who are all independent under the definition of independence provided by NASDAQ Listing Rule 5605(a)(2).

Board of Directors Meetings During Fiscal 2021

The Board of Directors met twenty-one (21) times during fiscal year 2021.

No director attended fewer than 75%, in the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served). Under the Company’s Corporate Governance Principles, each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including by attending meetings of the stockholders of the Company, the Board of Directors and Committees of which he or she is a member.

Although we do not have a policy requiring director attendance at an annual meeting of stockholders, directors are encouraged to attend the annual meeting of stockholders. All of our director nominees who were directors at the time of our 2021 annual meeting of stockholders attended the meeting.

Stockholder Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the Board of Directors, including communications regarding concerns relating to accounting, internal accounting controls or audit measures, or fraud or unethical behavior, may do so by writing to the directors at the following address: Wheeler Real Estate Investment Trust, Inc., Attention: Corporate Secretary, Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452. The Governance and Nominating Committee of the Board of Directors has approved a process for handling letters received by the Company and addressed to members of the Board of Directors but received at the Company. Under that process, the Corporate Secretary of the Company reviews all such correspondence and regularly forwards to the Board of Directors a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board of Directors or committees thereof or that she otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board of Directors and received by the Company and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chair of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

9

The Company has adopted a Code of Business Conduct and Ethics for Members of the Board of Directors, and a Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives (collectively, our “Code of Business Conduct and Ethics”). These documents are available on the Investor Relations tab of our website (www.whlr.us). The Company will post any amendments to or waivers from its Code of Business Conduct and Ethics (to the extent applicable to the Company’s Chief Executive Officer and Chief Financial Officer) on its website.

As of the date hereof, the Company does not have a policy regarding hedging activities.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee currently consists of three of our independent directors: Paula J. Poskon, E.J. Borrack and Michelle D. Bergman. Ms. Poskon is the Chair of the Compensation Committee. Previously in 2021, our Compensation Committee consisted of Stefani D. Carter, Joseph D. Stilwell, Andrew R. Jones and E.J. Borrack, and then Stefani D. Carter, Paula J. Poskon, Andrew R. Jones and E.J. Borrack (with Stefani D. Carter serving as the Chair of the Compensation Committee in each case). None of these directors is a former or current officer or employee of the Company or any of its subsidiaries. During fiscal year 2021, none of our executive officers served as a member of the Compensation Committee (or other committee performing similar functions) or as a director of any other entity of which an executive officer served on our Board of Directors or Compensation Committee. None of the directors who served on our Compensation Committee during fiscal 2021 has ever served as one of the Company’s officers or employees or had any relationship with the Company since the beginning of fiscal 2021 pursuant to which disclosure would be required under the SEC rules pertaining to the disclosure of transactions with related persons.

Directors who are employees of our Company do not receive any compensation for their services. For fiscal year 2020 and 2021, non-employee directors were entitled to annual cash compensation in the amount of $60,000 for their services as directors, with an additional annual cash retainer of $40,000 for service as Chair, to be paid quarterly. The Board in 2021 also approved an additional cash compensation amount for Ms. Borrack, Mr. Campbell and Ms. Poskon (each $20,000) and Ms. Carter ($25,000) in light of their significant efforts on behalf of the Company over the preceding year.

We reimburse each of our directors for his or her expenses incurred in connection with attendance at Board of Directors and committee meetings.

The following table summarizes our directors’ compensation for 2021:

|

Name |

Fees Earned |

Stock |

Total |

|||||

|

Andrew R. Jones(1) |

$ |

32,500 |

— |

$ |

32,500 |

|||

|

Stefani D. Carter |

|

125,000 |

— |

|

125,000 |

|||

|

Clayton Andrews(2) |

|

32,500 |

— |

|

32,500 |

|||

|

Joseph D. Stilwell |

|

60,000 |

— |

|

60,000 |

|||

|

Paula J. Poskon |

|

80,000 |

— |

|

80,000 |

|||

|

Kerry G. Campbell |

|

80,000 |

— |

|

80,000 |

|||

|

Daniel Khoshaba(3) |

|

— |

— |

|

— |

|||

|

E.J. Borrack |

|

80,000 |

— |

|

80,000 |

|||

|

Michelle D. Bergman(4) |

|

27,500 |

— |

|

27,500 |

|||

|

Saverio M. Flemma(4) |

|

27,500 |

— |

|

27,500 |

|||

____________

(1) Mr. Jones’s term as a director expired at the Company’s annual meeting held on July 15, 2021.

(2) Mr. Andrews’s term as a director expired at the Company’s annual meeting held on July 15, 2021.

(3) Directors who are employees of the Company do not receive any compensation for their services as a director. Mr. Khoshaba was CEO through July 2021 when he resigned from the Board. Accordingly, Mr. Khoshaba received no compensation for his services as a director in 2021.

(4) Ms. Bergman and Mr. Flemma were elected to the Board at the Company’s annual meeting held on July 15, 2021.

10

M. Andrew Franklin

Chief Executive Officer and President since October 2021

Age — 41

Andrew Franklin was appointed as Chief Executive Officer and President in October 2021. He previously served as the Interim Chief Executive Officer since July 2021, Chief Operating Officer since February 2018, and Senior Vice President of Operations since January 2017. Mr. Franklin has over 23 years of commercial real estate experience. Mr. Franklin is responsible for overseeing the property management, lease administration and leasing divisions of our growing portfolio of commercial assets. Prior to joining us, Mr. Franklin was a partner with Broad Reach Retail Partners where he ran the day-to-day operations of the company, managing the leasing team as well as overseeing the asset, property and construction management of the portfolio with assets totaling $50 million. Mr. Franklin is a graduate of the University of Maryland, with a Bachelor of Science degree in Finance.

Crystal Plum

Chief Financial Officer since February 2020

Age — 40

Crystal Plum was appointed as Chief Financial Officer in February 2020. She most recently served as the Vice President of Financial Reporting and Corporate Accounting for the Company from March 2018 to February 2020 and as Director of Financial Reporting for the Company from September 2016 to March 2018. Prior to that time, she served as Manager at Dixon Hughes Goodman LLP from September 2014 to August 2016 and as Supervisor at Dixon Hughes Goodman LLP from 2008 to September 2014. Ms. Plum has experience reviewing and performing audits, reviews, compilations and tax engagements for a diverse group of clients, as well as banking experience. Ms. Plum is a Certified Public Accountant and has a Bachelor of Science in Business Administration — Accounting and Finance from Old Dominion University.

11

The table below summarizes the total compensation for the fiscal years indicated paid or awarded to each of our named executive officers, calculated in accordance with SEC rules and regulations.

|

|

Fiscal |

Salary |

Stock |

All Other Compensation |

Total |

||||||

|

M. Andrew Franklin(1) |

2021 |

278,846 |

— |

|

35,844 |

314,690 |

|||||

|

Chief Executive Officer and President |

2020 |

250,000 |

— |

|

29,477 |

279,477 |

|||||

|

Crystal Plum(2) |

2021 |

216,346 |

57,200 |

(4) |

8,717 |

282,263 |

|||||

|

Chief Financial Officer |

2020 |

194,308 |

— |

|

7,778 |

202,086 |

|||||

|

Daniel Khoshaba(3) |

2021 |

— |

— |

|

— |

— |

|||||

|

Former Chief Executive Officer |

2020 |

— |

— |

|

— |

— |

|||||

____________

(1) Mr. Franklin was appointed as Interim Chief Executive Officer in July 2021 and Chief Executive Officer and President in October 2021. Prior to such appointments, he served as the Chief Operating Officer.

(2) Ms. Plum was appointed as Chief Financial Officer in February 2020. Prior to her appointment, she served as the Vice President of Financial Reporting and Corporate Accounting.

(3) Mr. Khoshaba was appointed as Chief Executive Officer in April 2020 and he resigned for personal reasons in July 2021. Mr. Khoshaba did not receive any cash compensation in fiscal 2020 or 2021 in respect of his employment as our Chief Executive Officer. Prior to his appointment as Chief Executive Officer, he served as a non-employee director on the Board of Directors. Mr. Khoshaba also waived any compensation as a non-employee director prior to his appointment as our Chief Executive Officer. Please see below under “Director Compensation” for a description of our non-employee director compensation arrangements. On August 4, 2020, the Board of Directors approved a stock appreciation award to Mr. Khoshaba with respect to 5,000,000 shares of common stock of the Company, at a strike price of $1.85 per share. This award was a standalone, one-time award made to Mr. Khoshaba conditioned upon stockholder approval which was obtained at the Company’s 2021 annual meeting. The award would vest if the average closing price of the Company’s common stock over all trading days in a consecutive twenty business day period was equal to or greater than $20.00 and Mr. Khoshaba was employed with the Company at such time. Upon Mr. Khoshaba’s cessation of employment, the award was forfeited for no consideration.

(4) Represents an award of 5,000 unrestricted and 15,000 shares of restricted common stock valued at the closing trading price on the date of grant.

|

Outstanding Equity Awards at 2021 Fiscal Year-End |

||||

|

|

Equity Incentive |

Equity Incentive |

||

|

Crystal Plum |

15,000 |

29,100 |

||

__________

(1) Represents shares of restricted common stock granted on August 13, 2021, subject to vesting in three equal installments on each anniversary of the grant date subject generally to both continued employment through the applicable vesting date and the average closing price per share of the Company’s common stock over all trading days in any consecutive 20-business day period during the three-year period following the grant date equaling at least $6.25.

(2) Based on the closing price per share of the Company’s common stock on December 31, 2021 ($1.94).

Pursuant to our 2015 Long-Term Incentive Plan, we may award incentives covering an aggregate of 125,000 shares of our Common Stock. As of March 21, 2022, we have issued 83,896 shares under the plan to employees, directors, and outside contractors for services provided.

12

Pursuant to our 2016 Long-Term Incentive Plan, we may award incentives covering an aggregate of 625,000 shares of our Common Stock. As of March 21, 2022, we have issued 497,293 shares under the plan to employees, directors, and outside contractors for services provided.

Employment Agreements with the Company’s Named Executive Officers

In February 2018, we entered into an employment agreement with M. Andrew Franklin, who was at that time our Chief Operating Officer. In October 2021, Mr. Franklin was appointed as our Chief Executive Officer and President. Mr. Franklin’s employment agreement continued in effect as described below. In August 2021, we entered into an employment agreement with Crystal Plum, our Chief Financial Officer, as further described below.

Employment Agreement of M. Andrew Franklin

General Terms. On February 14, 2018, the Company, on its own behalf and on behalf of its subsidiaries, including Wheeler REIT, L.P., entered into an employment agreement with M. Andrew Franklin (the “Franklin Employment Agreement”) for a period of three years beginning on February 14, 2018, and ending on February 13, 2021 (the “Initial Term”). At the end of the Initial Term, the Franklin Employment Agreement automatically renews for subsequent one-year terms on a year-over-year basis unless terminated pursuant to the terms of the Franklin Employment Agreement. Under the terms of the Franklin Employment Agreement, Mr. Franklin is entitled to the following compensation:

• Base salary of $250,000 per annum (subsequently increased to $400,000 effective upon Mr. Franklin’s appointment as Chief Executive Officer and President); and

• Reimbursement of reasonable and necessary business expenses, and eligibility to participate in any current or future bonus, incentive, and other compensation and benefit plans available to the Company’s executives.

Severance Terms. Under the Franklin Employment Agreement, if Mr. Franklin’s employment were terminated by the Company without “Cause” (as defined in the Franklin Employment Agreement), then Mr. Franklin would generally be entitled to severance pay of the greater of (i) salary continuation payments at Mr. Franklin’s current salary, less mandatory deductions, for six (6) months plus one (1) additional month for each full calendar quarter remaining in the then-current term of Mr. Franklin’s employment or (ii) salary continuation for a period equal to the remainder of the term of the Franklin Employment Agreement. Mr. Franklin would also be entitled to any annual bonuses that would have been earned based solely on his continued employment for the remainder of the term of the Franklin Employment Agreement. In addition, Mr. Franklin would be entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

In the event that Mr. Franklin terminated his employment with “Good Reason” (as defined in the Franklin Employment Agreement), Mr. Franklin would generally be entitled to current base salary, less mandatory deductions for twelve (12) months, plus any earned but unpaid bonus for the fiscal year prior to the year in which termination occurs. In addition, Mr. Franklin would be entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

In the event that Mr. Franklin terminated his employment with Good Reason following a “Change in Control” (as defined in the Franklin Employment Agreement) or was terminated by the Company without Cause and such termination occurred within six (6) months of a Change in Control, Mr. Franklin would generally be entitled to a lump sum payment equal to 2.99 times Mr. Franklin’s annual base salary less mandatory deductions payable within ninety (90) calendar days of the termination (and, in the case of such a termination without Cause, a bonus amount

13

based on any bonus determined by the Board of Directors and payable to other executives of the Company during the twelve (12) months after the Change in Control). In addition, Mr. Franklin would be entitled to health care coverage pursuant to COBRA at Mr. Franklin’s expense for up to eighteen (18) months.

Mr. Franklin would not be entitled to any severance benefits under the Franklin Employment Agreement in the case of the Company terminating his employment for Cause or Mr. Franklin terminating his employment without Good Reason.

Death and Disability. In the event of a termination of employment on account of death, then Mr. Franklin’s estate would generally be entitled to: (a) Mr. Franklin’s regular base salary (determined on the date of death) for a period of twelve (12) months following death; (b) the amount of any bonus remaining payable by the Company to Mr. Franklin for its fiscal year prior to death; and (c) any accrued and unpaid bonus determined by the Board of Directors for the year in which the death occurs prorated for the number of completed calendar months served prior to death.

In the event of a “Disability” (as defined in the Franklin Employment Agreement) by Mr. Franklin for one hundred twenty (120) consecutive days or longer at any point during his employment, then the Company would pay to Mr. Franklin his regular base salary for a twelve (12)-month period following the date on which the Disability first begins, net of any benefits received by Mr. Franklin under any disability policy obtained by the Company or Mr. Franklin, the premiums for which were paid by the Company. Mr. Franklin would also be entitled to any bonus remaining payable to Mr. Franklin for his fiscal year prior to the date the Disability began and any unpaid bonus for the fiscal year in which the disability occurred prorated for the number of completed calendar months served prior to the date of Disability.

Miscellaneous Provisions. The Franklin Employment Agreement provides for confidentiality and nondisclosure provisions, and also contains a non-solicitation of employees clause for a duration of eighteen (18) months following the last day of Mr. Franklin’s employment with the Company.

Employment Agreement of Crystal Plum

On August 13, 2021, the Company, on its own behalf and on behalf of its subsidiaries, including Wheeler REIT, L.P., entered into an amended and restated employment agreement with Crystal Plum (the “Plum Employment Agreement”) for a three-year term. Under the terms of the Plum Employment Agreement, Ms. Plum is entitled to the following compensation:

• Base salary of $250,000 per annum;

• A grant of 20,000 shares of common stock (the “Initial Equity Award”), 5,000 of which were vested upon grant and 15,000 of which were subject to vesting conditions as described above under “Outstanding Equity Awards at 2021 Fiscal Year-End”; and

• Reimbursement of reasonable and necessary business expenses, and eligibility to participate in any current or future bonus, incentive, and other compensation and benefit plans available to the Company’s executives.

Severance Terms. Under the Plum Employment Agreement, if Ms. Plum’s employment were terminated by the Company without “Cause” or by Ms. Plum for “Good Reason” (as those terms are defined in the Plum Employment Agreement), then, subject to execution of a release of claims, Ms. Plum would generally be entitled to (i) salary continuation payments at Ms. Plum’s current salary, less mandatory deductions, for twelve (12) months, (ii) health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Ms. Plum was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Ms. Plum, and (iii) eligibility to vest in a prorated portion of the Initial Equity Award scheduled to vest on the next scheduled vesting date, subject to satisfaction of the applicable performance vesting condition. Ms. Plum would not be entitled to any severance benefits under the Plum Employment Agreement in the case of the Company terminating her employment for Cause or Ms. Plum terminating her employment without Good Reason.

14

Death and Disability. In the event of a termination of employment on account of death or “Disability” (as defined in the Plum Employment Agreement), then Ms. Plum (or her estate, as the case may be) would generally be entitled to any accrued but unpaid salary and employee benefits and the amount of any earned but unpaid bonus for any completed fiscal year of the Company prior to the termination.

Miscellaneous Provisions. The Plum Employment Agreement provides for a perpetual nondisclosure covenant, a non-solicit of employees, service providers, and customers that applies during Ms. Plum’s employment and for eighteen (18) months thereafter, a non-compete that applies during Ms. Plum’s employment and for twelve (12) months thereafter, and a customary non-disparagement covenant.

Potential Payments Upon Termination or Change in Control

See “Employment Agreements with the Company’s Named Executive Officers” above.

15

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information regarding the beneficial ownership of shares of our common stock as of March 21, 2022 (the Record Date) for (1) each person known by us to be the beneficial owner of 5% or more of our outstanding common stock, (2) each of our directors and our named executive officers, and (3) all of our directors and all of our named executive officers as a group. Each person or entity named in the tables has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the tables.

Unless otherwise indicated, the address of each named person is c/o Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452.

|

Number of |

Percentage of |

|||||

|

Directors and Named Executive Officers |

|

|

||||

|

M. Andrew Franklin |

8,767 |

(2) |

* |

|

||

|

Crystal Plum |

22,022 |

(3) |

* |

|

||

|

Michelle D. Bergman |

— |

|

— |

|

||

|

E.J. Borrack |

— |

|

— |

|

||

|

Kerry G. Campbell |

116,507 |

(4) |

1.2 |

% |

||

|

Stefani D. Carter |

1,800 |

|

* |

|

||

|

Saverio M. Flemma |

— |

|

— |

|

||

|

Paula J. Poskon |

76,095 |

(5) |

* |

|

||

|

Joseph D. Stilwell |

5,308,299 |

(6) |

38.3 |

% |

||

|

All directors and named executive officers as a group (9 persons) |

5,533,490 |

|

40.62 |

% |

||

____________

* Less than 1.0%

(1) Based upon 9,720,532 shares of Common Stock outstanding on March 21, 2022. In addition, amounts assume that all convertible securities held by the stockholder are converted into Common Stock.

(2) Includes (i) 4,356 shares of Common Stock, (ii) 7.00% Senior Subordinated Convertible Notes Due 2031 (“Notes”) convertible into 4,276 shares of Common Stock and (iii) 92 shares of Series D Cumulative Convertible Preferred Stock (“Series D Stock”) convertible into 135 shares of Common Stock.

(3) Includes 20,000 shares of restricted stock granted by the Company on August 13, 2021. Of this grant, 5,000 shares were vested immediately upon grant, and the remaining 15,000 shares are subject to vesting in three equal installments on each anniversary of the grant date (each, a “Vesting Date”), subject to both (1) Ms. Plum’s continued employment through the applicable Vesting Date and (2) the average closing price per share of the Company’s common stock over all trading days in any consecutive 20-business day period during the three-year period following the grant date (the “Performance Period”) being equal to or greater than $6.25 (the “Price Target”). In the event of certain terminations of employment, Ms. Plum is eligible for pro-rated vesting, provided the Price Target is achieved during the Performance Period.

(4) Includes (i) 100,000 shares of Common Stock, (ii) Notes convertible into 16,000 shares of Common Stock, and (iii) 344 shares of Series D Stock convertible into 507 shares of Common Stock.

(5) Includes (i) 50,200 shares of Common Stock, (ii) Notes convertible into 25,100 shares of Common Stock, and (iii) 540 shares of Series D Stock convertible into 795 shares of Common Stock.

(6) Includes (i) 1,181,336 shares of Common Stock, (ii) Notes convertible into 3,999,980 shares of Common Stock, and (iii) 86,150 shares of Series D Stock convertible into 126,983 shares of Common Stock. Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., Stilwell Value LLC, Stilwell Value Partners VII, L.P. and Joseph Stilwell each possess shared voting and investment power over 5,308,299 shares of Common Stock (assuming conversion of the Notes and Series D Stock into Common Stock). Mr. Stilwell is the managing member and owner of Stilwell Value LLC, which is the general partner of Stilwell Value Partners VII, L.P., Stilwell Activist Fund, L.P. and Stilwell Activist Investments, L.P.

16

Based upon our records and the information reported in filings with the SEC, the following were beneficial owners of more than 5% of our shares of Common Stock as of March 21, 2022 (the Record Date) (in addition to those noted above).

|

Name and Address of Beneficial Owner |

Number of |

Percentage of |

|||

|

Magnetar Financial LLC(2) |

1,786,068 |

15.5 |

% |

||

|

1603 Orrington Avenue, 13th Floor |

|

||||

|

William Carlton Derrick(3) |

1,189,017 |

11.59 |

% |

||

|

3900 Essex Lane, Suite 340 |

|

||||

|

Eidelman Virant Capital, Inc.(4) |

680,000 |

6.9 |

% |

||

|

8000 Maryland Avenue, Suite 600 |

|

||||

|

Steamboat Capital Partners LLC(5) |

776,920 |

7.4 |

% |

||

|

31 Old Wagon Road |

|

||||

|

Daniel Khoshaba(6) |

1,105,924 |

11.4 |

% |

||

|

Alexander Palm Road |

|

||||

____________

(1) Based upon 9,720,532 shares of Common Stock outstanding on March 21, 2022. In addition, amounts assume that all convertible securities held by the stockholder are converted into Common Stock. All beneficial ownership identified on this table is held by the beneficial owners with sole voting power and sole investment power unless otherwise indicated.

(2) Based solely upon the Schedule 13G/A filed with the SEC by the beneficial owner on February 14, 2022, reporting beneficial ownership as of December 31, 2021. Magnetar Financial LLC (“Magnetar”) possesses shared voting power and shared investment power over (i) Common Stock Purchase Warrants that are exercisable for 998,547 shares of Common Stock, (ii) Notes convertible into 763,292 shares of Common Stock and (iii) 16,439 shares of Series D Stock convertible into 24,229 shares of Common Stock. Includes the shares reported by Magnetar Capital Partners LP, Supernova Management LLC and Alec N. Litowitz. Mr. Litowitz is the manager of Supernova Management LLC, which is the general partner of Magnetar Capital Partners LP. Magnetar Capital Partners LP is the sole member of Magnetar.

(3) Based solely upon the Schedule 13G/A filed jointly by William Carlton Derrick and Bruce William Derrick with the SEC on February 14, 2022, reporting beneficial ownership as of February 14, 2022. Includes (i) 653,173 shares of Common Stock, (ii) Notes convertible into 112,108 shares of Common Stock, (iii) 274,933 shares of Series D Stock convertible into 405,267 shares of Common Stock, and (iv) 29,550 shares of Series B Convertible Preferred Stock (“Series B Stock”) convertible into 18,469 shares of Common Stock. William Carlton Derrick and Bruce William Derrick collectively beneficially own 1,189,017 of these shares. William Carlton Derrick possesses sole voting power and sole dispositive power over 596,890 of these shares, and Bruce William Derrick possesses sole voting power and sole dispositive power over 592,127 of these shares.

(4) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on February 2, 2022, reporting beneficial ownership as of December 31, 2021 of 680,000 shares of Common Stock.

(5) Based solely upon the Schedule 13D/A filed jointly by Steamboat Capital Partners, LLC and Parsa Kiai with the SEC on October 29, 2021, reporting beneficial ownership as of October 29, 2021. Includes (i) 430,526 shares of Series D Stock and (ii) 227,652 shares of Series B Stock, which are convertible into Common Stock.

(6) Based solely upon the Schedule 13D/A filed with the SEC by the beneficial owner on December 14, 2021, reporting beneficial ownership of 1,105,924 shares of Common Stock as of December 14, 2021.

To our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of the Company’s Common Stock.

17

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 31, 2021 regarding our compensation plans and the Common Stock we may issue under the plan.

|

Equity Compensation Plan Information Table |

|||||||

|

Plan Category |

Number of |

Weighted- |

Number of |

||||

|

Equity compensation plans approved by stockholders(1) |

15,000 |

(2) |

— |

153,811 |

|||

|

Equity compensation plans not approved by stockholders |

— |

|

— |

— |

|||

|

Total |

15,000 |

|

— |

153,811 |

|||

____________

(1) Includes our 2015 and 2016 Long-Term Incentive Plans, which authorized a maximum of 125,000 and 625,000 shares, respectively, of our Common Stock for issue. Awards are granted by the Compensation Committee.

(2) Includes 15,000 performance awards assuming maximum payout (as a result, this aggregate reported number may overstate actual dilution). Performance awards are not taken into account in the weighted-average exercise price as such awards have no exercise price.

Certain Relationships and Related Transactions

Our Code of Business Conduct and Ethics requires that our directors and all of our employees deal with the Company on an arms-length basis in any related party transaction. All transactions between us and any of our directors, named executive officers or other vice presidents, or between us and any entity in which any of our directors, named executive officers or other vice presidents is an officer or director or has an ownership interest, must be approved by the Board of Directors.

Reimbursement of Proxy Solicitation Expenses

On October 29, 2019, Stilwell Value Partners VII, L.P., Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., Stilwell Value LLC, and Joseph Stilwell (collectively, the “Stilwell Group”), a beneficial owner of our common stock, filed a proxy statement with the SEC in connection with the Company’s 2019 annual meeting (the “Stilwell Solicitation”). Current director Joseph Stilwell is the owner and managing member of Stilwell Value LLC, which is the general partner of Stilwell Value Partners VII, L.P., Stilwell Activist Fund, L.P., and Stilwell Activist Investments, L.P. At the 2019 annual meeting, stockholders elected three nominees designated by the Stilwell Group to the Board of Directors. The Stilwell Group disclosed in the Stilwell Solicitation that it intended to seek reimbursement of the expenses it incurred in connection with such solicitation. The Company agreed to reimburse the Stilwell Group for the approximate $440,000 of expenses it incurred in connection with the Stilwell Solicitation. Approximately $70,000 of such expenses were paid in 2020, and the balance was paid in 2021.

18

The primary responsibility of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Company’s financial statements and the independence of its external auditors. The Company believes that each of the members of the Audit Committee is “independent” and that Mr. Campbell qualifies as an “audit committee financial expert” in accordance with applicable Nasdaq Stock Market listing standards. In carrying out its responsibility, the Audit Committee undertakes to:

• Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the Company;

• Meet with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors;

• Review with the independent auditors and financial and accounting personnel the adequacy and effectiveness of the accounting and financial controls of the Company. The Audit Committee elicits recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. The Audit Committee emphasizes the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper;

• Review the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans with the Company’s independent auditors;

• Review the financial statements contained in the annual report to stockholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the stockholders;

• Provide sufficient opportunity for the independent auditors to meet with the members of the Audit Committee without members of management present. Among the items discussed in these meetings are the independent auditors’ evaluation of the Company’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit;

• Review accounting and financial staffing and organizational reporting lines;

• Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board of Directors; and

• Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if, in its judgment, that is appropriate.

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee operates under a written charter adopted by the Board of Directors. The Committee’s responsibilities are set forth in this charter which is available on our website at www.whlr.us.

The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of the Company’s financial statements, the adequacy of the Company’s system of internal controls, the Company’s risk management, the Company’s compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of the Company’s independent auditors. The Audit Committee has sole authority over the selection of the Company’s independent auditors and manages the Company’s relationship with its independent auditors. The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and receive appropriate funding, as determined by the Audit Committee, from the Company for such advice and assistance.

19

The Audit Committee met four times during 2021. The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Audit Committee’s meetings include private sessions with the Company’s independent auditors without the presence of the Company’s management, as well as executive sessions consisting of only Audit Committee members. The Audit Committee also meets with senior management from time to time.