UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

SCHEDULE 14A

(Rule 14a-101)

__________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

S |

|

|

Filed by a Party other than the Registrant |

£ |

Check the appropriate box:

|

£ |

Preliminary Proxy Statement |

|

|

£ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

S |

Definitive Proxy Statement |

|

|

£ |

Definitive Additional Materials |

|

|

£ |

Soliciting Material Pursuant to Section 240.14a-12 |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Name of Registrant as Specified in its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

S |

No fee required. |

|||

|

£ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

|||

|

|

||||

|

(2) |

Aggregate number of securities to which transaction applies: |

|||

|

|

||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

|

|

||||

|

(4) |

Proposed maximum aggregate value of transaction: |

|||

|

|

||||

|

(5) |

Total fee paid: |

|||

|

|

||||

|

£ |

Fee paid previously with preliminary materials. |

|||

|

£ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

|

|

||||

|

(2) |

Form, Schedule or Registration Statement No.: |

|||

|

|

||||

|

(3) |

Filing Party: |

|||

|

|

||||

|

(4) |

Date Filed: |

|||

|

|

||||

Riversedge North

2529 Virginia Beach Boulevard, Suite 200

Virginia Beach, Virginia 23452

April 28, 2021

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”) to be held on July 15, 2021 at 9:30 a.m., Eastern Time. The Annual Meeting will be held as a virtual meeting of stockholders. You will be able to attend the Annual Meeting, vote and submit questions during the Annual Meeting via a live webcast by visiting www.meetingcenter.io/215588904 and entering the control number provided with your proxy materials. Prior to the Annual Meeting, you will be able to authorize a proxy to vote your shares on the matters submitted for stockholder approval at www.investorvote.com/whlr, or by telephone or mail, and we encourage you to do so. Stockholders who wish to observe the Annual Meeting (without being able to vote or submit questions) may also do so by following the instructions in this Proxy Statement.

The enclosed Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting. Directors and officers of the Company will be present to answer any questions that you and other stockholders may have. Also available online for your review is our Annual Report on Form 10-K, which contains detailed information concerning the activities and operating performance of the Company.

The business to be conducted at the Annual Meeting consists of:

• the election of eight members of the Board of Directors;

• the approval, on an advisory basis, of named executive officer compensation for fiscal year 2020;

• the approval of a standalone equity compensation plan for our Chief Executive Officer, in the form of a one-time Stock Appreciation Rights Agreement; and

• the ratification of the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

The Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interest of Wheeler Real Estate Investment Trust, Inc. and its stockholders, and the Board of Directors unanimously recommends a vote “FOR” all proposals.

Please indicate your vote by internet or telephone or, if you received your materials by mail, by using the enclosed proxy card. Your vote is important, and it is important that we receive your vote as soon as possible.

Sincerely,

|

Stefani Carter |

Daniel Khoshaba |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 15, 2021

Wheeler Real Estate Investment Trust, Inc. will hold its Annual Meeting on July 15, 2021, at 9:30 a.m., Eastern Time, via webcast at meetingcenter.io/215588904. The purpose of the meeting is to:

• elect a Board of Directors of eight directors to serve until the next annual meeting and until their successors are duly-elected and qualified;

• approve, on an advisory basis, named executive officer compensation for fiscal year 2020;

• approve a standalone equity compensation plan for our Chief Executive Officer, in the form of a one-time Stock Appreciation Rights Agreement; and

• ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

Only stockholders of record at the close of business on April 19, 2021, will be entitled to vote at the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares on the Internet or by telephone, or, if you received the proxy materials by mail, you may also authorize a proxy to vote your shares by mail. Your vote will ensure your representation at the Annual Meeting regardless of whether you attend via webcast on July 15, 2021.

Dated: April 28, 2021

|

By order of the Board of Directors, |

||

|

Angelica Beltran |

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on July 15, 2021

This proxy statement and the Company’s 2020 Annual Report on Form 10-K are available at

www.investorvote.com/whlr.

|

Page |

||

|

1 |

||

|

1 |

||

|

1 |

||

|

1 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

4 |

||

|

4 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

6 |

||

|

7 |

||

|

8 |

||

|

8 |

||

|

8 |

||

|

8 |

||

|

9 |

||

|

10 |

||

|

10 |

||

|

10 |

||

|

11 |

||

|

11 |

||

|

11 |

||

|

Employment Agreements with the Company’s Named Executive Officers |

11 |

|

|

11 |

||

|

11 |

||

|

12 |

||

|

13 |

||

|

13 |

||

|

14 |

||

|

15 |

||

|

Security Ownership of Certain Beneficial Owners and Management |

15 |

|

|

16 |

||

|

19 |

||

|

19 |

||

|

19 |

||

|

19 |

||

|

20 |

||

|

20 |

i

|

Page |

||

|

24 |

||

|

25 |

||

|

27 |

||

|

PROPOSAL 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

29 |

|

|

31 |

||

|

31 |

||

|

31 |

||

|

31 |

||

|

A-1 |

ii

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement before voting. The approximate date on which this Proxy Statement and form of proxy are first being provided to stockholders, or being made available through the internet for those stockholders receiving proxy materials electronically, is April 28, 2021.

2021 Annual Meeting of Stockholders

|

Date and Time: |

July 15, 2021 at 9:30 am, Eastern Time |

|

|

Place: |

Via webcast, at www.meetingcenter.io/215588904 |

|

|

Record Date: |

April 19, 2021 |

Voting Matters and Board of Directors Recommendation

|

Items of Business |

Board of Directors Recommendation |

|

|

1. Election of Eight Directors |

FOR |

|

|

2. Advisory Vote to Approve 2020 Executive Compensation |

FOR |

|

|

3. Approval of a Standalone Equity Compensation Plan for Our Chief Executive Officer, in the Form of a One-Time Stock Appreciation Rights Agreement |

FOR |

|

|

4. Ratification of Cherry Bekaert LLP as the Independent Registered Public Accounting Firm |

FOR |

iii

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 15, 2021

The Board of Directors of Wheeler Real Estate Investment Trust, Inc. (the “Company” or “we” or “us”) is soliciting proxies to be used at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”). Beginning on or about April 28, 2021, we will send Notices of Internet Availability of Proxy Materials (each, a “Notice”) by mail to stockholders entitled to notice of the Annual Meeting.

Record holders of Common Stock, $0.01 par value per share (“Common Stock”) of the Company at the close of business on April 19, 2021 (the “Record Date”) may vote at the Annual Meeting. On the Record Date, 9,706,738 shares of Common Stock were outstanding. Each share is entitled to cast one vote.

How You Can Attend the Annual Meeting

The Annual Meeting will be a virtual meeting of stockholders held via live webcast, which will be accessible at www.meetingcenter.io/215588904 at the date and time given above. The live webcast will provide stockholders with the opportunity to vote and ask questions.

The process for attending the Annual Meeting depends on how your Common Stock is held. Generally, you may hold Common Stock in your name as a “record holder” or in an account with a bank, broker, or other nominee (i.e., in “street name”).

If you are a record stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the internet. Record stockholders should follow the instructions provided on their Notice and in their proxy materials.

If you hold your shares in “street name,” you must register in advance to attend and vote at the virtual Annual Meeting webcast. If you hold your shares in “street name” and do not register, you may still listen to the Annual Meeting webcast by visiting www.meetingcenter.io/215588904 but you will not be able to participate or vote in the meeting. To register, you must obtain a “legal proxy” from the bank, broker or other nominee of your shares and submit the legal proxy to Computershare in order to be entitled to vote those shares electronically. Please note that obtaining a legal proxy may take several days. Registration requests must be received no later than 5:00 p.m. Eastern Time on July 12, 2021. You will receive a confirmation of your registration by email. Requests must include your legal proxy (an image of the legal proxy or a forward of the email from your broker including the legal proxy are acceptable) and be sent by email to legalproxy@computershare.com with the subject “Legal Proxy” or by mail to Computershare, Wheeler Real Estate Investment Trust, Inc. Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001. If you wish to observe the Annual Meeting (without being able to vote or submit questions) you may do so by visiting the above website and using your name and email address.

Please note that you may vote by proxy prior to July 15, 2021 and still attend the Annual Meeting. Even if you currently plan to attend the Annual Meeting webcast, we strongly recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. If you hold your shares in street name, we urge you to submit your proxy in advance as described below.

How You Can Access the Proxy Materials

We are providing access to our proxy materials (including this proxy statement, notice of annual meeting and our 2020 annual report on Form 10-K) over the Internet pursuant to rules adopted by the Securities and Exchange Commission (“SEC”). Beginning on or about April 28, 2021, we will send Notices by mail to stockholders entitled to

1

notice of the Annual Meeting. The Notice includes instructions on how to view the electronic proxy materials on the Internet, which will be available to all stockholders beginning on or about April 28, 2021. The Notice also includes instructions on how to elect to receive future proxy materials by email. If you choose to receive future proxy materials by email, next year you will receive an email with a link to the proxy materials and proxy voting site and will continue to receive proxy materials in this manner until you terminate your election. We encourage you to take advantage of the availability of our proxy materials on the Internet.

If you wish to receive a printed copy of the proxy materials, including the proxy card, you may request that they be mailed to you at no cost by following the instructions on the Notice. In addition, you may choose to receive future proxy materials by mail by following the instructions on the Notice.

The process for voting your Common Stock depends on how your Common Stock is held.

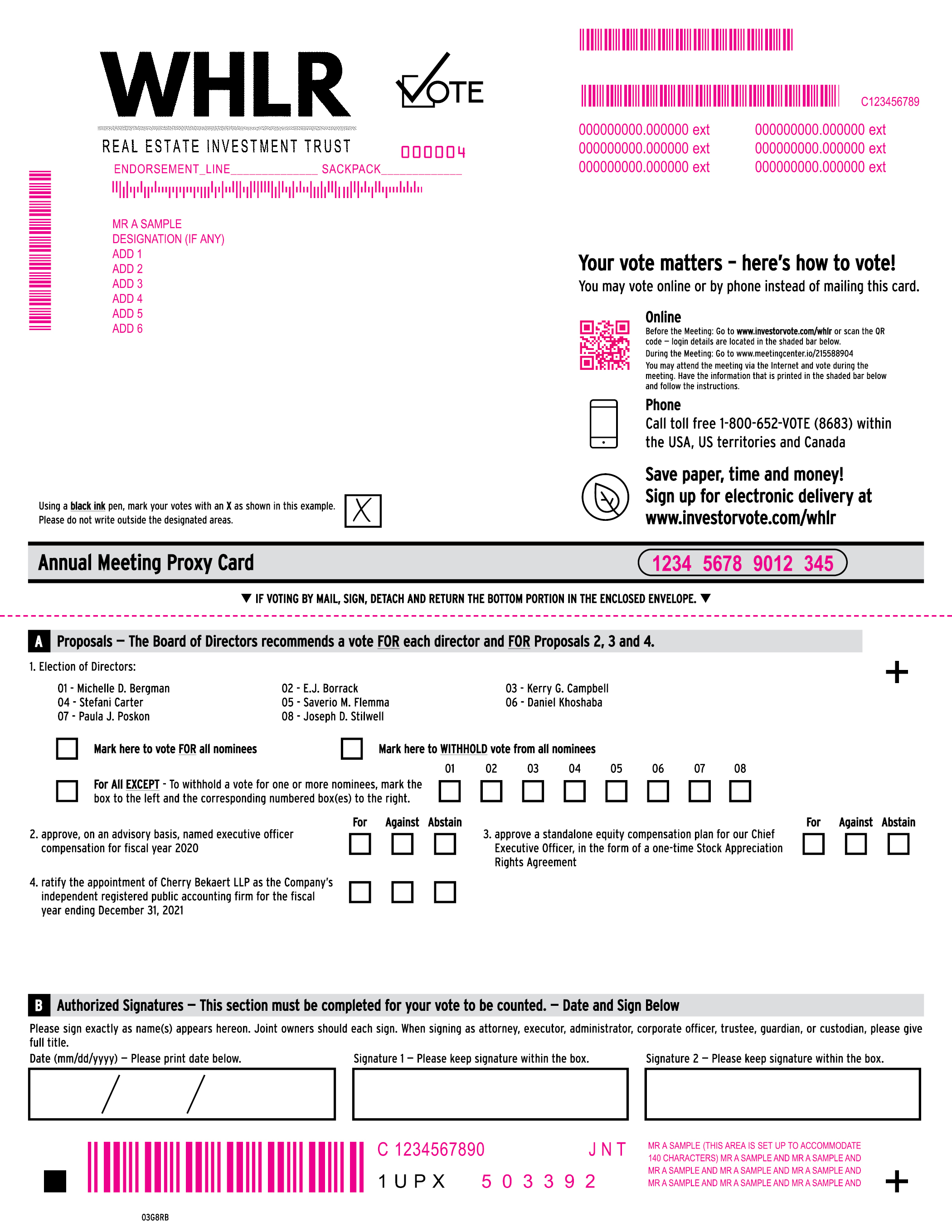

If you are a record holder, you can vote your shares by going to www.investorvote.com/whlr, or by calling the toll-free number (for residents of the United States and Canada) listed on your proxy card, using the 16-digit control number on your proxy card. If you chose to receive proxy materials by mail, you can also complete, sign and date the enclosed proxy card and mail it in the enclosed postage-paid envelope. If you vote online or by phone, there is no need to return a proxy card by mail. The proxy you submit will be voted in accordance with your instructions.

If you hold your shares in “street name,” you must follow the voting instructions provided by your bank, broker or other nominee to ensure that your shares are represented and voted at the Annual Meeting.

Please note voting in advance by telephone and Internet will not be available after 11:59 p.m., Eastern Time, on July 14, 2021.

If a proxy is executed and returned but no instructions are given, the shares will be voted according to the recommendations of the Board of Directors. The Board of Directors unanimously recommends a vote FOR all of Proposals 1, 2, 3 and 4.

How You Can Vote Electronically at the Annual Meeting

If you are a record holder, in order to vote and/or submit a question during the Annual Meeting, you will need to follow the instructions posted at www.investorvote.com/whlr and will need the control number included in the Notice sent to you.

If you hold your shares in street name, you must obtain a “legal proxy” from the bank, broker or other nominee of your shares and send the “legal proxy” to Computershare as described above.

If you submit your proxy over the Internet, by telephone or by mail, you may change your voting instructions by subsequently properly submitting a new proxy. Only your most recent proxy will be exercised and all others will be disregarded, regardless of the method by which the proxies were authorized. You may also revoke your earlier proxy by voting in person at the Annual Meeting. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request. If you hold your shares in “street name,” you should follow the instructions provided by your bank, broker or other nominee to revoke your proxy.

Notices of revocation of proxies delivered by mail must be delivered by July 14, 2021 to the Company’s principal offices at Riversedge North, 2529 Virginia Beach Blvd., Virginia Beach, VA 23452, Attention: Angelica Beltran, Corporate Secretary.

You will be voting on the following:

(1) The election of eight members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Stockholders in 2022 or until their successors are duly elected and qualified;

2

(2) To approve, on an advisory basis, named executive officer compensation for fiscal year 2020;

(3) To approve a standalone equity compensation plan for our Chief Executive Officer, in the form of a one-time Stock Appreciation Rights Agreement; and

(4) To ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

The Board of Directors, on behalf of the Company, is soliciting your proxy to vote your shares of our Common Stock on all matters scheduled to come before the Annual Meeting, whether or not you attend in person. By submitting your proxy and voting instructions by telephone or via the Internet, or if you have chosen to receive your proxy materials by mail, by completing, signing, dating and returning the proxy card or voting instruction form, you are authorizing the persons named as proxies to vote your shares of our Common Stock at the Annual Meeting as you have instructed.

The holders of a majority of the shares entitled to vote who are either present in person or represented by a proxy at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. As of April 19, 2021, there were 9,706,738 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of a majority of stockholders entitled to cast votes at the meeting will constitute a quorum for adopting the proposals at the Annual Meeting. If you have properly signed and returned your proxy card by mail or voted by internet or phone, you will be considered part of the quorum, and the persons named on the proxy card will vote your shares as you have instructed. If the broker holding your shares in “street” name indicates to us on a proxy card that the broker has discretionary authority to vote your shares on any proposal, we will consider your shares as present and entitled to vote for the purposes of determining the presence of a quorum.

Election of Directors (Proposal 1). A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected to that slot. In voting on the election of directors, you may vote “FOR” or “WITHHOLD” from voting as to each director nominee. A proxy that has properly withheld authority with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. For purposes of this vote, abstentions and broker non-votes will not count as votes cast and will not affect the outcome of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Advisory Vote to Approve Executive Compensation (Proposal 2). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Approval of a Standalone Equity Compensation Plan for Our Chief Executive Officer, in the Form of a One-Time Stock Appreciation Rights Agreement (Proposal 3). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Ratification of the Appointment of Cherry Bekaert LLP (Proposal 4). The affirmative vote of a majority of the votes cast on this matter is required to approve this proposal. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum. We do not expect there to be any broker non-votes with respect to Proposal 4, as brokers are entitled to vote on the ratification of independent registered accounting firms.

A broker nominee generally may not vote on “non-routine” matters without receiving your specific voting instructions. A “broker non-vote” occurs when a broker nominee holding shares in street name votes shares on some matters at the meeting but not others. Your broker nominee will not be able to submit a vote on the Election of

3

Directors (Proposal 1), the Advisory Vote to Approve Executive Compensation (Proposal 2) and the Approval of a Standalone Equity Compensation Plan for our Chief Executive Officer, in the Form of a One-Time Stock Appreciation Rights Agreement (Proposal 3), unless it receives your specific instructions.

The Company’s Bylaws do not require that stockholders ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm. The Audit Committee will consider the outcome of this vote in its decision to appoint an independent registered public accounting firm next year. The Company, however, is not bound by the stockholders’ decision. Even if the selection is ratified, the Audit Committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

If you received multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different names. You should vote each of the proxy cards to ensure that all your shares are voted.

Other Matters to Be Acted Upon at the Annual Meeting

We do not know of any other matters to be validly presented or acted upon at the Annual Meeting. If any other matter is presented at the Annual Meeting on which a vote may be properly taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

The Company is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, by telephone or mail.

Our internet website address is www.whlr.us. We make available free of charge through our website our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange Commission (the “SEC”). In addition, we have posted the Charters of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, as well as our Code of Business Conduct and Ethics and Corporate Governance Principles, including guidelines on director independence, all under separate headings. These documents are not incorporated in this instrument by reference. We will also provide a copy of these documents free of charge to stockholders upon written request.

You may call our Investor Relations Department at 757-627-9088 if you have any questions.

PLEASE VOTE — YOUR VOTE IS IMPORTANT

4

CORPORATE GOVERNANCE AND BOARD MATTERS

The affairs of the Company are managed by the Board of Directors. Directors are elected at the annual meeting of stockholders each year or, in the event of a vacancy, appointed by the incumbent Board of Directors, and serve until the next annual meeting of stockholders or until a successor has been elected or approved.

Our Board of Directors currently consists of eight directors. All of the directors, except Daniel Khoshaba, Chief Executive Officer, are independent as determined in accordance with the listing standards established by the NASDAQ Capital Market, and our Board of Directors makes an affirmative determination as to the independence of each of our directors on an annual basis. We have adopted a Code of Business Conduct and Ethics and Corporate Governance Principles which are available on our website.

Role of the Board of Directors in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from four of its standing committees: the Executive Committee, the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee, each of which addresses risks specific to their respective areas of oversight. The Executive Committee acts with full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. The Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our Corporate Governance Principles, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Members of the Board of Directors

The members of the Board of Directors on the date of this proxy statement, and the committees of the Board of Directors on which they serve, are identified below:

|

Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Executive Committee |

||||

|

Clayton Andrews |

Member |

— |

— |

— |

||||

|

Kerry G. Campbell |

Chair |

— |

Member |

— |

||||

|

Stefani Carter |

— |

Chair |

Member |

— |

||||

|

Andrew R. Jones |

— |

Member |

— |

— |

||||

|

Daniel Khoshaba, |

— |

— |

— |

Chair |

||||

|

Paula J. Poskon(1) |

Member |

— |

— |

— |

||||

|

Joseph D. Stilwell |

— |

Member |

Chair |

Member |

||||

|

E.J. Borrack |

— |

Member |

— |

— |

____________

(1) Following the conclusion of the 2021 Annual Meeting, Ms. Poskon will be designated Chair of the Compensation Committee.

Our Board of Directors has established four standing committees: an Audit Committee, a Nominating and Corporate Governance Committee, a Compensation Committee and an Executive Committee. The principal functions of each committee are briefly described below. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of our company.

5

Audit Committee. Our Audit Committee consists of three of our independent directors: Kerry G. Campbell, Paula J. Poskon and Clayton Andrews. Mr. Campbell, the Chair of our Audit Committee, qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NASDAQ Capital Market corporate governance requirements. In addition, each of the Audit Committee members is “financially sophisticated” as that term is defined by the NASDAQ Capital Market corporate governance requirements. The functions of the Audit Committee are described below under the heading “Report of the Audit Committee.” The charter of the Audit Committee is available on the Company’s Investor Relations tab of our website (www.whlr.us). All of the members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Audit Committee met five times in 2020.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of three of our independent directors: Joseph D. Stilwell, Stefani Carter and Kerry G. Campbell. Mr. Stilwell has been designated as the Chair of this committee. The Nominating and Corporate Governance Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Principles. In addition, the Nominating and Corporate Governance Committee develops and reviews background information on candidates for the Board of Directors and makes recommendations to the Board of Directors regarding such candidates. The Nominating and Corporate Governance Committee also prepares and supervises the Board of Directors’ annual review of director independence and the Board of Directors’ performance self-evaluation. The charter of the Nominating and Corporate Governance Committee is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Nominating and Corporate Governance Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Nominating and Corporate Governance Committee met two times in 2020.

Compensation Committee. Our Compensation Committee consists of four of our independent directors: Stefani Carter, Andrew R. Jones, E.J. Borrack and Joseph D. Stilwell. Ms. Carter has been designated as the Chair of the Compensation Committee. Following the conclusion of the 2021 Annual Meeting, Ms. Poskon will be designated as the Chair of the Compensation Committee. The Compensation Committee is responsible for overseeing the policies of the Company relating to compensation to be paid by the Company to the Company’s principal executive officer and any other officers designated by the Board of Directors, and to make recommendations to the Board of Directors with respect to such policies, produce necessary reports on executive compensation for inclusion in the Company’s proxy statement in accordance with applicable rules and regulations and to monitor the development and implementation of succession plans for the principal executive officer and other key executives and make recommendations to the Board of Directors with respect to such plans. The charter of the Compensation Committee is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Compensation Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Compensation Committee may not delegate its authority to other persons. While the Company’s executives will communicate with the Compensation Committee regarding executive compensation issues, the Company’s executive officers do not participate in any executive compensation decisions. The Compensation Committee did not engage a compensation consultant in fiscal year 2020. The Compensation Committee met four times in 2020.

Executive Committee. Our Executive Committee consists of two directors: Daniel Khoshaba and Joseph D. Stilwell. Mr. Khoshaba has been designated as the Chair of this committee. The purpose of the Executive Committee is to generally act with full authority of the Board of Directors, in intervals between meetings of the Board of Directors, particularly when there is a need for prompt review and action of the Board of Directors and it is impractical to arrange a meeting of the Board of Directors within the time reasonably available. However, the Executive Committee does not have the authority to act on any matters that are expressly delegated to other committees of the Board of Directors or are under active review by the Board of Directors or another committee of the Board of Directors. The Executive Committee may be delegated specific actions and authority from time to time by the Board of Directors. The Executive Committee was formed in February 2020. Joseph D. Stilwell is independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles.

Board of Directors Leadership Structure

The Board of Directors does not have a policy to separate the roles of Chief Executive Officer and Chair of the Board of Directors, as it believes it should have the flexibility to make this determination from time to time in order to best provide appropriate leadership in different circumstances. At present, the Board of Directors believes that it

6

is in the best interests of the Company that these roles be separate, in order to permit each person to focus on his or her primary role, and provides an appropriate balance between the managerial responsibilities of the Chief Executive Officer and the independent oversight and strategic direction provided by our Board of Directors. The current Chair of the Board of Directors is Stefani Carter.

Selection of Nominees for the Board of Directors

The Nominating and Corporate Governance Committee will consider candidates for Board of Directors membership suggested by its members and other members of the Board of Directors, as well as management and stockholders. The committee may also retain a third-party executive search firm to identify candidates upon request of the committee from time to time. A stockholder who wishes to recommend a prospective nominee for the Board of Directors should notify the Company’s Corporate Secretary or any member of the Nominating and Corporate Governance Committee in writing with supporting material that the stockholder considers appropriate. The Nominating and Corporate Governance Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of the Company’s Bylaws relating to stockholder nominations.

Once the Nominating and Corporate Governance Committee has identified a prospective nominee, the committee will make an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination will be based on a number of factors and the information provided to the committee with the recommendation of the prospective candidate will be important. The preliminary determination will be based primarily on the need for additional members of the Board of Directors to fill vacancies or the need to expand the size of the Board of Directors, as well as the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the committee determines, in consultation with the Chair of the Board of Directors and other members of the Board of Directors as appropriate, that additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the committee. The committee will then evaluate the prospective nominee against the standards and qualifications generally set out in the Company’s Corporate Governance Guidelines, including:

• whether the prospective nominee is a stockholder of the Company;

• the ability of the prospective nominee to represent the interests of the stockholders of the Company;

• the prospective nominee’s standards of integrity, commitment and independence of thought and judgment;

• the prospective nominee’s ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Guidelines;

• the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board of Directors;

• the extent to which the prospective nominee helps the Board of Directors reflect the diversity of the Company’s stockholders, employees, customers, guests and communities; and

• the willingness of the prospective nominee to meet any minimum equity interest holding guideline.

The Nominating and Corporate Governance Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board of Directors, the need for Audit Committee expertise and evaluations of other prospective nominees. In connection with this evaluation, the Nominating and Corporate Governance Committee determines whether to interview the prospective nominee and, if warranted, one or more members of the committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Nominating and Corporate Governance Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors, and the Board of Directors determines the nominees after considering the recommendation and report of the committee.

Stockholders who wish to recommend nominees for election as directors should provide those recommendations in writing to our Corporate Secretary, specifying the nominee’s name and qualifications for membership on the Board of Directors.

7

For a stockholder to nominate a director candidate, the stockholder must comply with the advance notice provisions and other requirements of Section 11 of Article II of our Bylaws.

We urge any stockholder who intends to recommend a director candidate to the Nominating and Corporate Governance Committee for consideration to review thoroughly our Nominating and Corporate Governance Committee Charter and Section 11 of Article II of our Bylaws. Copies of our Nominating and Corporate Governance Committee Charter and our Bylaws are available upon written request to Angelica Beltran, Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Boulevard, Virginia Beach, Virginia 23452.

Determinations of Director Independence

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law and listing standards. Other than with respect to the Company’s Chief Executive Officer, the Company believes that its Board of Directors consists of directors who are independent under the definition of independence provided by NASDAQ Listing Rule 5605(a)(2).

Board of Directors Meetings During Fiscal 2020

The Board of Directors met fifteen (15) times during fiscal year 2020.

No director attended fewer than 75%, in the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served). Under the Company’s Corporate Governance Guidelines, each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including by attending meetings of the stockholders of the Company, the Board of Directors and Committees of which he or she is a member.

Although we do not have a policy requiring director attendance at an annual meeting of stockholders, directors are encouraged to attend the annual meeting of stockholders. All of our director nominees that were directors at the time of our 2020 annual meeting of stockholders attended the meeting.

Stockholder Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the Board of Directors, including communications regarding concerns relating to accounting, internal accounting controls or audit measures, or fraud or unethical behavior, may do so by writing to the directors at the following address: Wheeler Real Estate Investment Trust, Inc., Attention: Corporate Secretary, Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. The Nominating and Corporate Governance Committee of the Board of Directors has approved a process for handling letters received by the Company and addressed to members of the Board of Directors but received at the Company. Under that process, the Corporate Secretary of the Company reviews all such correspondence and regularly forwards to the Board of Directors a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board of Directors or committees thereof or that she otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board of Directors and received by the Company and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chair of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

The Company has adopted a Code of Business Conduct and Ethics for Members of the Board of Directors, and a Code of Business Conduct and Ethics for Employees, Officers, Agents and Representatives (collectively, our “Code of Business Conduct and Ethics”). These documents are available on the Investor Relations tab of our website (www.whlr.us). The Company will post any amendments to or waivers from its Code of Business Conduct and Ethics (to the extent applicable to the Company’s Chief Executive Officer and Chief Financial Officer) on its website.

8

Daniel Khoshaba

Chief Executive Officer since April 2020

Age — 61

Daniel Khoshaba, was appointed Chief Executive Officer in April 2020 and has served as a director since February 2020. Mr. Khoshaba has over thirty years of experience as a real estate investor, developer and founder of companies in multiple industries including manufacturing, finance and real estate. Prior to joining us, Mr. Khoshaba co-founded City Sunstone Properties (“CSP”) in 2012. Between 2012 and 2016, CSP acquired retail strip malls, shopping centers, office complexes, and raw land for development. The company’s portfolio primarily consisted of properties in sub-markets with strong demographics and high traffic counts. In 2004, Mr. Khoshaba founded KSA Capital Partners, a long/short equity hedge fund which became one of the top performing funds in the industry as noted by Barron’s magazine. In 2013, Hedge Funds Review voted KSA the Best Long/Short equity hedge fund in the Americas. Prior to starting the hedge fund, Mr. Khoshaba was a Managing Director at Bankers Trust and at Salomon Brothers. Mr. Khoshaba earned a bachelor’s degree from DePaul University and an MBA from the University of Chicago.

Crystal Plum

Chief Financial Officer since February 2020

Age — 39

Crystal Plum was appointed as Chief Financial Officer in February 2020. She most recently served as the Vice President of Financial Reporting and Corporate Accounting for the Company from March 2018 to February 2020 and as Director of Financial Reporting for the Company from September 2016 to March 2018. Prior to that time, she served as Manager at Dixon Hughes Goodman LLP from September 2014 to August 2016 and as Supervisor at Dixon Hughes Goodman LLP from 2008 to September 2014. Ms. Plum has experience reviewing and performing audits, reviews, compilations and tax engagements for a diverse group of clients, as well as banking experience. Ms. Plum is a Certified Public Accountant and has a Bachelor of Science in Business Administration — Accounting and Finance from Old Dominion University.

M. Andrew Franklin

Chief Operating Officer since February 2018

Age — 40

Andrew Franklin was appointed as Chief Operating Officer in February 2018. He previously served as the Senior Vice President of Operations since January 2017. Mr. Franklin has over 18 years of commercial real estate experience. Mr. Franklin is responsible for overseeing the property management, lease administration and leasing divisions of our growing portfolio of commercial assets. Prior to joining us, Mr. Franklin was a partner with Broad Reach Retail Partners where he ran the day-to-day operations of the company, managing the leasing team as well as overseeing the asset, property and construction management of the portfolio with assets totaling $50 million. Mr. Franklin is a graduate of the University of Maryland, with a Bachelor of Science degree in Finance.

9

The table below summarizes the total compensation for the fiscal years indicated paid or awarded to each of our named executive officers, calculated in accordance with SEC rules and regulations.

|

Name and Principal Position |

Fiscal Year |

Salary |

Option |

All Other Compensation ($) |

Total |

||||||||

|

Daniel Khoshaba |

2020 |

— |

(2) |

— |

(3) |

— |

|

— |

|||||

|

Chief Executive Officer(1) |

|

|

|

||||||||||

|

Crystal Plum |

2020 |

194,308 |

|

|

12,295 |

(5) |

206,603 |

||||||

|

Chief Financial Officer(4) |

|

|

|

||||||||||

|

M. Andrew Franklin |

2020 |

250,000 |

|

|

40,970 |

(6) |

290,970 |

||||||

|

Chief Operating Officer |

2019 |

250,000 |

|

|

23,461 |

(6) |

273,461 |

||||||

|

David Kelly |

2020 |

124,615 |

|

|

6,504 |

(5) |

131,119 |

||||||

|

Former Chief Executive Officer(7) |

2019 |

400,000 |

|

|

8,437 |

(5) |

408,437 |

||||||

____________

(1) Mr. Khoshaba was appointed to this position in April 2020. Prior to his appointment, he served as a non-employee director on the Board of Directors. Mr. Khoshaba also waived any compensation as a non-employee director prior to his appointment as our Chief Executive Officer. Please see below under “Director Compensation” for a description of our non-employee director compensation arrangements.

(2) Mr. Khoshaba did not receive any cash compensation from us in fiscal 2020 in respect of his employment as our Chief Executive Officer. Mr. Khoshaba’s sole compensation in respect of his role as our Chief Executive Officer in fiscal 2020 was in the form of a one-time stock appreciation rights (“SAR”) award, which is subject to stockholder approval at the Annual Meeting, as further described below under “Khoshaba SAR Award” and in Proposal 3 set forth elsewhere in this Proxy Statement.

(3) In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Mr. Khoshaba’s one-time SAR award is not deemed “granted” until stockholder approval is obtained (as further described in Proposal 3 set forth elsewhere in this Proxy Statement). Therefore, no grant date fair value is reported in this column (but will be reported in the fiscal 2021 Summary Compensation Table, assuming such stockholder approval is obtained).

(4) Ms. Plum was appointed to this position in February 2020. Prior to her appointment, she served as our Vice President of Financial Reporting and Corporate Accounting.

(5) This amount includes the Company’s matching contributions to our 401(k) plan and other Company-provided benefits (e.g., Group Term Life, Short-term and Long-term Disability, and Medical Coverage) available to all employees.

(6) This amount includes a housing allowance, the Company’s matching contributions to our 401(k) plan, and other Company-provided benefits (e.g., Group Term Life, Short-term and Long-term Disability, and Medical Coverage) available to all employees.

(7) Mr. Kelly was appointed to this position in 2018. Mr. Kelly’s employment was terminated on April 13, 2020 with immediate effect.

Outstanding Equity Awards at Fiscal-Year End

|

Name |

Equity Incentive Plan Awards: Number of |

Options/SARs Exercise Price ($) |

Option/SARs Expiration Date |

|||

|

Daniel Khoshaba(1) |

5,000,000 |

1.85 |

8/4/2030 |

|||

|

Crystal Plum |

— |

— |

— |

|||

|

M. Andrew Franklin |

— |

— |

— |

|||

|

David Kelly |

— |

— |

— |

____________

(1) Represents the one-time standalone SAR award to Mr. Khoshaba approved by the Board of Directors on August 4, 2020, subject to stockholder approval as further described in Proposal 3 set forth elsewhere in this Proxy Statement. If so approved, the SAR will only be exercisable upon the achievement of certain stock price hurdles, as further described in “Khoshaba SAR Award,” below, subject to Mr. Khoshaba’s continued employment through the date of such achievement.

10

Pursuant to our 2015 Long-Term Incentive Plan, we may award incentives covering an aggregate of 125,000 shares of our Common Stock. As of April 19, 2021, we have issued 83,896 shares under the plan to employees, directors, and outside contractors for services provided.

Pursuant to our 2016 Long-Term Incentive Plan, we may award incentives covering an aggregate of 625,000 shares of our Common Stock. As of April 19, 2021, we have issued 492,293 shares under the plan to employees, directors, and outside contractors for services provided.

Employment Agreements with the Company’s Named Executive Officers

In 2018, we entered into employment agreements with David Kelly, our former Chief Executive Officer, and M. Andrew Franklin, our Chief Operating Officer. The employment agreement for Mr. Kelly was terminated on April 13, 2020 with immediate effect. Mr. Kelly did not receive any severance pay or benefits in connection with the termination of his employment. We entered into an employment agreement with Crystal Plum, our Chief Financial Officer, in February 2020, which has since expired, but which, while in effect, would have provided Ms. Plum with three (3) months of base salary as severance upon a termination without “cause.” Mr. Franklin’s employment agreement remained in effect as of December 31, 2020, as further described below under “Employment Agreement of M. Andrew Franklin.” We do not have an employment agreement with Mr. Khoshaba, our current Chief Executive Officer, but the Board of Directors has approved the one-time SAR grant to Mr. Khoshaba described below under “Khoshaba SAR Award,” subject to stockholder approval as described in Proposal 3 set forth elsewhere in this Proxy Statement.

Employment Agreement of M. Andrew Franklin

General Terms. On February 14, 2018, the Company, on its own behalf and on behalf of its subsidiaries, including Wheeler REIT, L.P., entered into an employment agreement with M. Andrew Franklin (the “Franklin Employment Agreement”) for a period of three years beginning on February 14, 2018, and ending on February 13, 2021 (the “Initial Term”). At the end of the Initial Term, the Franklin Employment Agreement automatically renewed for a subsequent one-year term, and would have continued to renew on a year-over-year basis unless terminated pursuant to the terms of the Franklin Employment Agreement. Under the terms of the Franklin Employment Agreement, Mr. Franklin was entitled to the following compensation:

• Base salary of $250,000 per annum; and

• Reimbursement of reasonable and necessary business expenses, and eligibility to participate in any current or future bonus, incentive, and other compensation and benefit plans available to the Company’s executives.

Severance Terms. Under the Franklin Employment Agreement, if Mr. Franklin’s employment were terminated by the Company without “Cause” (as defined in the Franklin Employment Agreement), then Mr. Franklin would generally have been entitled to severance pay of the greater of (i) salary continuation payments at Mr. Franklin’s current salary, less mandatory deductions, for six (6) months plus one (1) additional month for each full calendar quarter remaining in the then-current term of Mr. Franklin’s employment or (ii) salary continuation for a period equal to the remainder of the term of the Franklin Employment Agreement. Mr. Franklin would also be entitled to any annual bonuses that would have been earned based solely on his continued employment for the remainder of the term of the Franklin Employment Agreement. In addition, Mr. Franklin would have been entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

11

In the event that Mr. Franklin terminated his employment with “Good Reason” (as defined in the Franklin Employment Agreement), Mr. Franklin would have generally been entitled to the greater of current base salary, less mandatory deductions (i) for the remainder of the term or (ii) twelve (12) months, plus any earned but unpaid bonus for the fiscal year prior to the year in which termination occurs. In addition, Mr. Franklin would have been entitled to disability, accident, and health insurance for a twelve (12)-month period following termination substantially similar to those insurance benefits Mr. Franklin was receiving immediately prior to the date of termination or the cash equivalent, offset by any comparable benefits actually received by Mr. Franklin.

In the event that Mr. Franklin terminated his employment with Good Reason following a “Change in Control” (as defined in the Franklin Employment Agreement) or was terminated by the Company without Cause and such termination occurred within six (6) months of a Change in Control, Mr. Franklin would generally have been entitled to a lump sum payment equal to 2.99 times Mr. Franklin’s annual base salary less mandatory deductions payable within ninety (90) calendar days of the termination (and, in the case of such a termination without Cause, a bonus amount based on any bonus determined by the Board of Directors and payable to other executives of the Company during the twelve (12) months after the Change in Control). In addition, Mr. Franklin would have been entitled to health care coverage pursuant to COBRA at Mr. Franklin’s expense for up to eighteen (18) months.

Mr. Franklin would not have been entitled to any severance benefits under the Franklin Employment Agreement in the case of the Company terminating his employment for Cause or Mr. Franklin terminating his employment without Good Reason.

Death and Disability. In the event of a termination of employment on account of death, then Mr. Franklin’s estate would generally have been entitled to: (a) Mr. Franklin’s regular base salary (determined on the date of death) for a period of twelve (12) months following death; (b) the amount of any bonus remaining payable by the Company to Mr. Franklin for its fiscal year prior to death; and (c) any accrued and unpaid bonus determined by the Board of Directors for the year in which the death occurs prorated for the number of completed calendar months served prior to death.

In the event of a “Disability” (as defined in the Franklin Employment Agreement) by Mr. Franklin for one hundred twenty (120) consecutive days or longer at any point during his employment, then the Company would have paid to Mr. Franklin his regular base salary for a twelve (12)-month period following the date on which the Disability first begins, net of any benefits received by Mr. Franklin under any disability policy obtained by the Company or Mr. Franklin, the premiums for which were paid by the Company. Mr. Franklin would also have been entitled to any bonus remaining payable to Mr. Franklin for his fiscal year prior to the date the Disability began and any unpaid bonus for the fiscal year in which the disability occurred prorated for the number of completed calendar months served prior to the date of Disability.

Miscellaneous Provisions. The Franklin Employment Agreement provided for confidentiality and nondisclosure provisions, and also contained a non-solicitation of employee’s clause for a duration of eighteen (18) months following the last day of Mr. Franklin’s employment with the Company.

Employment Agreement of Crystal Plum

We entered into an employment agreement with Crystal Plum, our Chief Financial Officer, in February 2020, which has since expired, but which, while in effect, would have provided Ms. Plum with three (3) months of base salary as severance upon a termination without “cause.”

As described above, Mr. Khoshaba’s sole compensation in fiscal 2020 was in the form of the one-time SAR award described below. The Board of Directors believes that the SAR will provide Mr. Khoshaba with long-term exposure to our performance and align his interests with those of our stockholders, by requiring challenging stock price thresholds to be hit before the SAR may be exercised and provide Mr. Khoshaba with any value, as further described below.

Grant. On August 4, 2020, the Board of Directors approved a SAR award to Mr. Khoshaba with respect to 5,000,000 shares of common stock of the Company, at a strike price of $1.85 per share, pursuant to a Stock Appreciation Rights Agreement. The SAR award is a standalone, one-time award made to Mr. Khoshaba outside of the Company’s other stockholder-approved equity compensation plans, and is therefore subject to and conditioned upon stockholder approval at the Annual Meeting as further described in Proposal 3 set forth elsewhere in this Proxy Statement.

12

Term; Expiration. The SAR has a ten (10)-year term, expiring on August 4, 2030. However, any unvested or unexercised portion of the SAR will immediately terminate and be forfeited for no consideration upon Mr. Khoshaba’s cessation of employment with us for any reason.

Performance Condition. The SAR will vest if (A) the average closing price of our common stock over all trading days in a consecutive twenty (20)-business day period is equal to or greater than $20.00 (the “Price Target”) and (B) Mr. Khoshaba is employed with the Company at such time.

Exercise and Settlement. Once the performance condition has been satisfied, the SAR will vest and be automatically exercised. Upon exercise, Mr. Khoshaba will be entitled to receive a total amount equal to the product of (x) 5,000,000, and (y) the excess of the fair market value of a share of our common stock on the exercise date over the strike price. Such amount will be paid to Mr. Khoshaba in cash, shares of our common stock, or a combination thereof in the discretion of the Compensation Committee of the Board (but in no event will the Company issue shares with respect to the SAR if such issuance would cause the Company to be “closely held” within the meaning of Section 856(h) of the Internal Revenue Code of 1986, as amended).

Adjustments to Price Target. If the Company pays cash dividends on our common stock, the Price Target shall be correspondingly reduced by the amount of any such cash dividend. Stock issuances by the Company for consideration (outside of a “change of control”) or stock offerings by the Company shall not require an adjustment.

Temporary Lock-Up. Two-thirds (2/3) of any shares of our common stock issued to Mr. Khoshaba upon exercise of the SAR will be subject to a temporary lockup, during which Mr. Khoshaba cannot sell, exchange, transfer, assign, pledge, hedge, or otherwise dispose of such shares. The lockup will be released with respect to fifty percent (50%) of those locked-up shares on the first (1st) anniversary of achievement of the Price Target, and the remaining fifty percent (50%) of those locked-up shares will be released on the second (2nd) anniversary of achievement of the Price Target. Notwithstanding the foregoing, Mr. Khoshaba can sell shares to satisfy any withholding taxes due upon exercise of the SAR without violating the lockup, as long as any such withholding taxes are first satisfied to the maximum extent possible by reducing any cash paid to Mr. Khoshaba upon exercise of the SAR.

Change of Control. If there is a “change of control” (as defined in the 2016 Long-Term Incentive Plan) of the Company during the ten (10)-year term of the SAR, and Mr. Khoshaba remains employed with the Company through the date of such “change of control” transaction, then a portion of the SAR will be eligible to vest upon the consummation of such “change of control” transaction as follows: (i) if the price per share of our common stock received by the holders of common stock (the “COC Price”) equals or exceeds $10.00, but is less than $15.00, then one-third (1/3) of the SAR will vest, (ii) if the COC Price equals or exceeds $15.00, but is less than $20.00, then two-thirds (2/3) of the SAR will vest, and (iii) if the COC Price equals or exceeds $20.00, then all of the SAR will vest.

Stockholder Approval Required. The SAR was granted expressly subject to and conditioned upon (and may not be exercised, in whole or in part, until) approval by the Company’s stockholders at the Annual Meeting, as further described in Proposal 3 set forth elsewhere in this Proxy Statement. If such stockholder approval is not obtained, then Mr. Khoshaba’s SAR will be immediately forfeited for no consideration immediately following the Annual Meeting.

Potential Payments Upon Termination or Change in Control

See “Employment Agreements with the Company’s Named Executive Officers” and “Khoshaba SAR Award,” each as set forth above.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee consists of four of our independent directors: Stefani Carter, Andrew R. Jones, E.J. Borrack and Joseph D. Stilwell. Ms. Carter has been designated as the Chair of the Compensation Committee. None of these directors is a former or current officer or employee of the Company or any of its subsidiaries. During fiscal year 2020, none of our executive officers served as a member of the compensation committee (or other committee performing similar functions) or as a director of any other entity of which an executive officer served on our Board of Directors or Compensation Committee. None of the directors who served on our Compensation Committee during fiscal 2020 has any relationship requiring disclosure under this caption under SEC rules.

13

Directors who are officers of our Company do not receive any compensation for their services. For fiscal year 2020, non-employee directors were entitled to annual cash compensation in the amount of $60,000 for their services as directors, with an additional cash retainer of $40,000 for service as Chair, to be paid quarterly. Directors are permitted to elect a lower compensation amount.

We reimburse each of our directors for his or her travel expenses incurred in connection with his or her attendance at full Board of Directors and committee meetings.

The following table summarizes our directors’ compensation for 2020:

|

Name |

Fees Earned or Paid in Cash |

Stock |

Total |

|||||

|

Andrew R. Jones |

$ |

76,374 |

— |

$ |

76,374 |

|||

|

Stefani Carter |

|

83,626 |

— |

|

83,626 |

|||

|

Clayton Andrews |

|

60,000 |

— |

|

60,000 |

|||

|

Deborah Markus(1) |

|

24,561 |

— |

|

24,561 |

|||

|

Joseph D Stilwell |

|

40,000 |

— |

|

40,000 |

|||

|

Paula J. Poskon |

|

60,000 |

— |

|

60,000 |

|||

|

Kerry G. Campbell |

|

60,000 |

— |

|

60,000 |

|||

|

Daniel Khoshaba(2) |

|

— |

— |

|

— |

|||

|

E.J. Borrack(3) |

|

31,978 |

— |

|

31,978 |

|||

____________

(1) Left the Board of Directors in May 2020.

(2) Mr. Khoshaba waived any compensation for his service as a non-employee director. Please refer to the “Executive Compensation” discussion elsewhere in this proxy statement for Mr. Khoshaba’s compensation as our Chief Executive Officer following his appointment to that position in April 2020.

(3) Appointed to the Board in June 2020.

14

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information regarding the beneficial ownership of shares of our common stock as of April 19, 2021 for (1) each person who is the beneficial owner of 5% or more of our outstanding common stock, (2) each of our directors, director nominees and named executive officers, and (3) all of our directors, director nominees and executive officers as a group. Each person or entity named in the tables has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the tables.

Unless otherwise indicated, the address of each named person is c/o Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Suite 200, Virginia Beach, Virginia 23452.

|

Number of |

Percentage of |

|||||

|

M. Andrew Franklin |

4,882 |

|

* |

|

||

|

Crystal Plum |

2,022 |

|

* |

|

||

|

Andrew R. Jones |

58,404 |

(2) |

* |

|

||

|

Stefani Carter |

— |

|

— |

|

||

|

Clayton Andrews |

— |

|

— |

|

||

|

Joseph D. Stilwell |

1,281,481 |

(3) |

13.2 |

% |

||

|

Paula J. Poskon |

50,200 |

|

* |

|

||

|

Daniel Khoshaba |

1,068,952 |

|

11.0 |

% |

||

|

Kerry G. Campbell |

100,000 |

|

1.0 |

% |

||

|

E.J. Borrack |

— |

|

— |

|

||

|

All directors, director nominees and executive officers as a group (10 persons) |

2,565,941 |

|

26.4 |

% |

||

____________

* Less than 1.0%

(1) Based upon 9,706,738 shares of Common Stock outstanding on April 19, 2021. In addition, amounts assume that all Series B Convertible Preferred Stock (“Series B Preferred Stock”) and Series D Cumulative Convertible Preferred Stock (“Series D Preferred Stock”) held by the stockholder are converted into Common Stock.

(2) Includes 45,335 shares of Series B Preferred Stock convertible into 28,334 shares of Common Stock and 20,400 shares of Series D Preferred Stock convertible into 30,070 shares of Common Stock. These securities are held by various investment partnerships, funds and managed accounts, of which NS Advisors, LLC (“NS Advisors”) serves as the investment manager. Mr. Jones is the managing member of NS Advisors and has sole voting and investment authority over the shares.

(3) Includes 67,941 shares of Series D Preferred Stock convertible into 100,145 shares of Common Stock. Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., Stilwell Value LLC and Joseph Stilwell possess shared voting and dispositive power over 1,181,336 shares with Stilwell Value Partners VII, L.P. Mr. Stilwell is the managing member and owner of Stilwell Value LLC, which is the general partner of Stilwell Value Partners VII, L.P., Stilwell Activist Fund, L.P. and Stilwell Activist Investments, L.P.; accordingly, Mr. Stilwell has sole voting and investment authority over the shares. This amount excludes cash settled swaps representing economic exposure to an aggregate of 34,822 shares of Series D Preferred Stock.

15

Based upon our records and the information reported in filings with the SEC, the following were beneficial owners of more than 5% of our shares of Common Stock as of April 19, 2021 (in addition to those noted above).

|

Name and Address of Beneficial Owner |

Number of |

Percentage of |

|||

|

Steamboat Capital Partners LLC(2) |

1,323,044 |

13.6 |

% |

||

|

420 Lexington Ave., Suite 2300 |

|

||||

|

Richard S. Strong(3) |

945,000 |

9.7 |

% |

||

|

c/o Godfrey & Kahn, S.C |

|

||||

|

Morgan Stanley(4) |

717,938 |

7.4 |

% |

||

|

1585 Broadway |

|

||||

|

Eidelman Virant Capital, Inc.(5) |

686,687 |

7.1 |

% |

||

|

8000 Maryland Ave, Suite 600 |

|

||||

|

FMR, LLC(6) |

522,276 |

5.4 |

% |

||

|

245 Summer Street |

|

||||

____________

(1) Based upon 9,706,738 shares of Common Stock outstanding on April 19, 2021. In addition, amounts assume that all Series B Preferred Stock and Series D Preferred Stock held by the stockholder are converted into Common Stock.

(2) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on February 16, 2021 reporting beneficial ownership as of February 15, 2021 of preferred stock convertible into 1,323,044 shares of Common Stock. Includes the shares reported by Parsa Kiai, Steamboat Capital Partners GP, LLC, Steamboat Capital Partners Master Fund, LP and Steamboat Capital Partners II, LP. Parsa Kiai is the Managing Member of Steamboat Capital Partners, LLC and the Managing Member of Steamboat Capital Partners GP, LLC, which is the general partner of Steamboat Capital Partners Master Fund, LP and Steamboat Capital Partners II, LP.

(3) Based solely upon the Schedule 13G/A filed with the SEC by the beneficial owner on February, 8, 2021 reporting beneficial ownership as of February 8, 2021. Mr. Strong possesses shared voting power over 945,000 of the shares with Calm Waters Partnership, of which he is the Managing Partner.

(4) Based solely upon the Schedule 13G/A filed with the SEC by the beneficial owner on February 12, 2021 reporting beneficial ownership as of February 12, 2021.

(5) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on January 27, 2021 reporting beneficial ownership as of January 26, 2021.

(6) Based solely upon the Schedule 13G filed with the SEC by the beneficial owner on April 12, 2021 reporting beneficial ownership as of April 9, 2021 of 522,276 shares. Includes the shares reported by Abigail Johnson and Fidelity Real Estate Income Fund.

The primary responsibility of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Company’s financial statements and the independence of its external auditors. The Company believes that each of the members of the Audit Committee is “independent” and that Mr. Campbell qualifies as an “audit committee financial expert” in accordance with applicable Nasdaq Stock Market listing standards. In carrying out its responsibility, the Audit Committee undertakes to:

• Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the Company;

• Meet with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors;

16

• Review with the independent auditors and financial and accounting personnel the adequacy and effectiveness of the accounting and financial controls of the Company. The Audit Committee elicits recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. The Audit Committee emphasizes the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper;

• Review the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans with the Company’s independent auditors;

• Review the financial statements contained in the annual report to stockholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the stockholders;

• Provide sufficient opportunity for the independent auditors to meet with the members of the Audit Committee without members of management present. Among the items discussed in these meetings are the independent auditors’ evaluation of the Company’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit;

• Review accounting and financial staffing and organizational reporting lines;

• Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board of Directors; and

• Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if, in its judgment, that is appropriate.

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee operates under a written charter adopted by the Board of Directors. The Committee’s responsibilities are set forth in this charter which is available on our website at www.whlr.us.

The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of the Company’s financial statements, the adequacy of the Company’s system of internal controls, the Company’s risk management, the Company’s compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of the Company’s independent auditors. The Audit Committee has sole authority over the selection of the Company’s independent auditors and manages the Company’s relationship with its independent auditors. The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and receive appropriate funding, as determined by the Audit Committee, from the Company for such advice and assistance.

The Audit Committee met five times during 2020. The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Audit Committee’s meetings include private sessions with the Company’s independent auditors without the presence of the Company’s management, as well as executive sessions consisting of only Audit Committee members. The Audit Committee also meets with senior management from time to time.