Series D Preferred Stock Follow-On Offering January 2018 Think Retail. Think Wheeler.® Nasdaq: whlr Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Relating to Preliminary Prospectus Supplement dated January 9, 2018 to Prospectus dated September 6, 2016 Registration No. 333-213294

SAFE HARBOR Wheeler Real Estate Investment Trust, Inc. (the “Company”) believes this presentation contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that expected results will be achieved, and actual results may differ materially from expectations. Specifically, the Company’s statements regarding: (i) the Company’s pending acquisition of the retail shopping center located in Norfolk, Virginia known as JANAF Shopping Yard (“JANAF”), including the Company’s ability to consummate the JANAF acquisition and to integrate JANAF into the Company’s portfolio; (ii) the potential impact of the JANAF acquisition on the Company’s results of operations; (iii) the funding of the JANAF acquisition; (iv) the anticipated implementation of the Company’s growth, acquisition and disposition strategy; (v) the future generation of value to the Company from the acquisition of service-oriented retail properties in secondary and tertiary markets; (vi) the development and return on undeveloped properties; (vii) the amount of and the Company’s ability to obtain loans intended to fund acquisitions and development; (viii) guidance with respect to total revenues, net operating income (“NOI”), interest income, interest expense, 3rd party fees, general & administrative expenses, preferred dividends, Capex & TI reserves and pro forma adjusted funds from operations (“AFFO”); and (ix) anticipated dividend and cash flow coverage are forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this presentation. Additional factors that could cause the operations of the Company to differ materially from those listed in the forward-looking statements are discussed in the Company’s filings with the U.S. Securities and Exchange Commission, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward‐looking statements to reflect events or circumstances that arise after the date hereof. The offering is being made pursuant to the Company’s effective shelf registration statement filed with the U.S. Securities and Exchange Commission (“SEC”), which became effective on September 6, 2016. Before you invest, you should read the registration statement, preliminary prospectus supplement and the accompanying base prospectus and the other documents the Company has filed with the SEC for more complete information about the Company and this offering. Copies of these documents may be obtained from the SEC’s website at www.sec.gov or by contacting Ladenburg Thalmann & Co. Inc., Attention: Equity Syndicate, 570 Lexington Avenue, 12th Floor, New York, NY 10022 or by email: syndicate@ladenburg.com or BTIG, LLC, Attention: Equity Capital Markets, 825 3rd Avenue, 6th Floor, New York, NY 10022 or by email equitycapitalmarkets@btig.com or Wheeler Real Estate Investment Trust, Inc., Attention: Investor Relations, 2529 Virginia Beach Blvd., Virginia Beach, Virginia, 23452, or by email at info@whlr.us or, 757-627-9088.

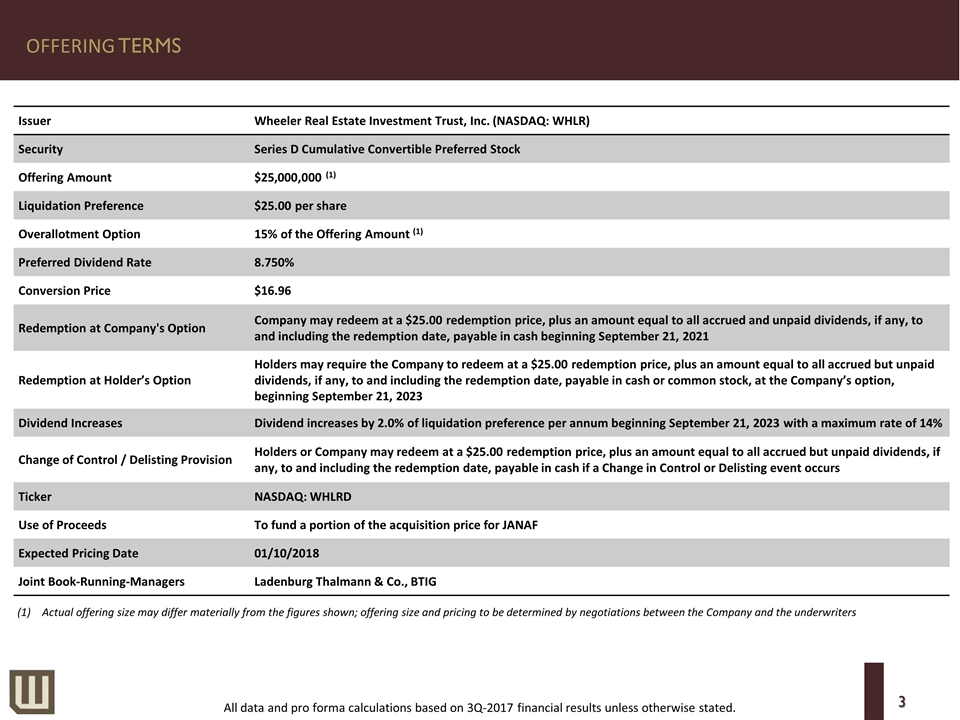

OFFERING TERMS All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated. Issuer Wheeler Real Estate Investment Trust, Inc. (NASDAQ: WHLR) Security Series D Cumulative Convertible Preferred Stock Offering Amount $25,000,000 (1) Liquidation Preference $25.00 per share Overallotment Option 15% of the Offering Amount (1) Preferred Dividend Rate 8.750% Conversion Price $16.96 Redemption at Company's Option Company may redeem at a $25.00 redemption price, plus an amount equal to all accrued and unpaid dividends, if any, to and including the redemption date, payable in cash beginning September 21, 2021 Redemption at Holder’s Option Holders may require the Company to redeem at a $25.00 redemption price, plus an amount equal to all accrued but unpaid dividends, if any, to and including the redemption date, payable in cash or common stock, at the Company’s option, beginning September 21, 2023 Dividend Increases Dividend increases by 2.0% of liquidation preference per annum beginning September 21, 2023 with a maximum rate of 14% Change of Control / Delisting Provision Holders or Company may redeem at a $25.00 redemption price, plus an amount equal to all accrued but unpaid dividends, if any, to and including the redemption date, payable in cash if a Change in Control or Delisting event occurs Ticker NASDAQ: WHLRD Use of Proceeds To fund a portion of the acquisition price for JANAF Expected Pricing Date 01/10/2018 Joint Book-Running-Managers Ladenburg Thalmann & Co., BTIG (1)Actual offering size may differ materially from the figures shown; offering size and pricing to be determined by negotiations between the Company and the underwriters

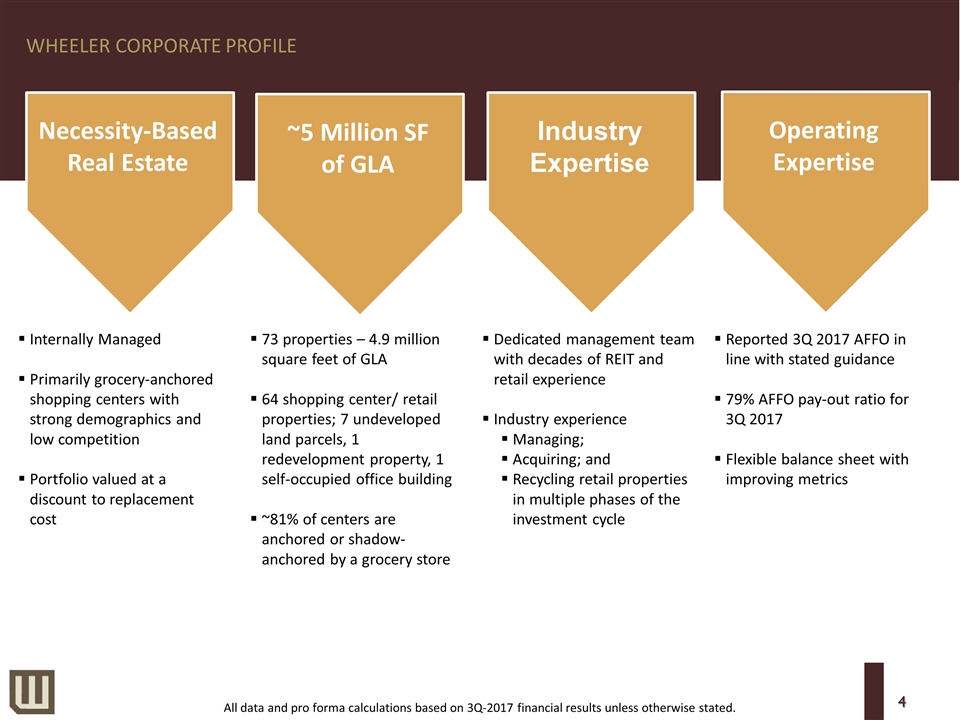

WHEELER CORPORATE PROFILE Internally Managed Primarily grocery-anchored shopping centers with strong demographics and low competition Portfolio valued at a discount to replacement cost 73 properties – 4.9 million square feet of GLA 64 shopping center/ retail properties; 7 undeveloped land parcels, 1 redevelopment property, 1 self-occupied office building ~81% of centers are anchored or shadow-anchored by a grocery store Dedicated management team with decades of REIT and retail experience Industry experience Managing; Acquiring; and Recycling retail properties in multiple phases of the investment cycle Reported 3Q 2017 AFFO in line with stated guidance 79% AFFO pay-out ratio for 3Q 2017 Flexible balance sheet with improving metrics ~5 Million SF of GLA Necessity-Based Real Estate Industry Expertise Operating Expertise All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

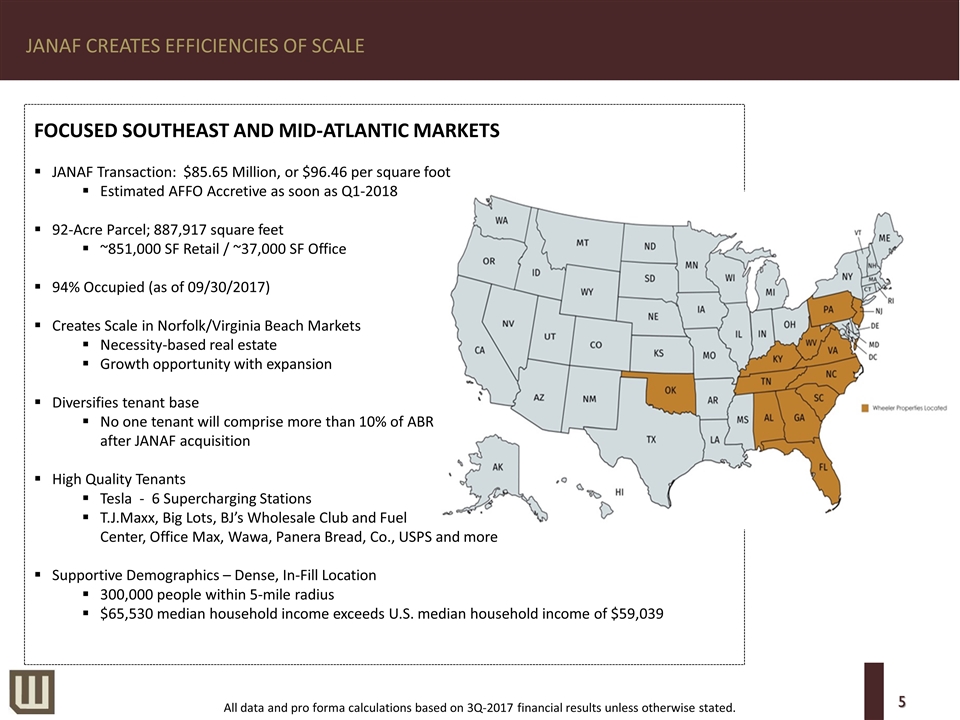

JANAF CREATES EFFICIENCIES OF SCALE FOCUSED SOUTHEAST AND MID-ATLANTIC MARKETS JANAF Transaction: $85.65 Million, or $96.46 per square foot Estimated AFFO Accretive as soon as Q1-2018 92-Acre Parcel; 887,917 square feet ~851,000 SF Retail / ~37,000 SF Office 94% Occupied (as of 09/30/2017) Creates Scale in Norfolk/Virginia Beach Markets Necessity-based real estate Growth opportunity with expansion Diversifies tenant base No one tenant will comprise more than 10% of ABR after JANAF acquisition High Quality Tenants Tesla - 6 Supercharging Stations T.J.Maxx, Big Lots, BJ’s Wholesale Club and Fuel Center, Office Max, Wawa, Panera Bread, Co., USPS and more Supportive Demographics – Dense, In-Fill Location 300,000 people within 5-mile radius $65,530 median household income exceeds U.S. median household income of $59,039 All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

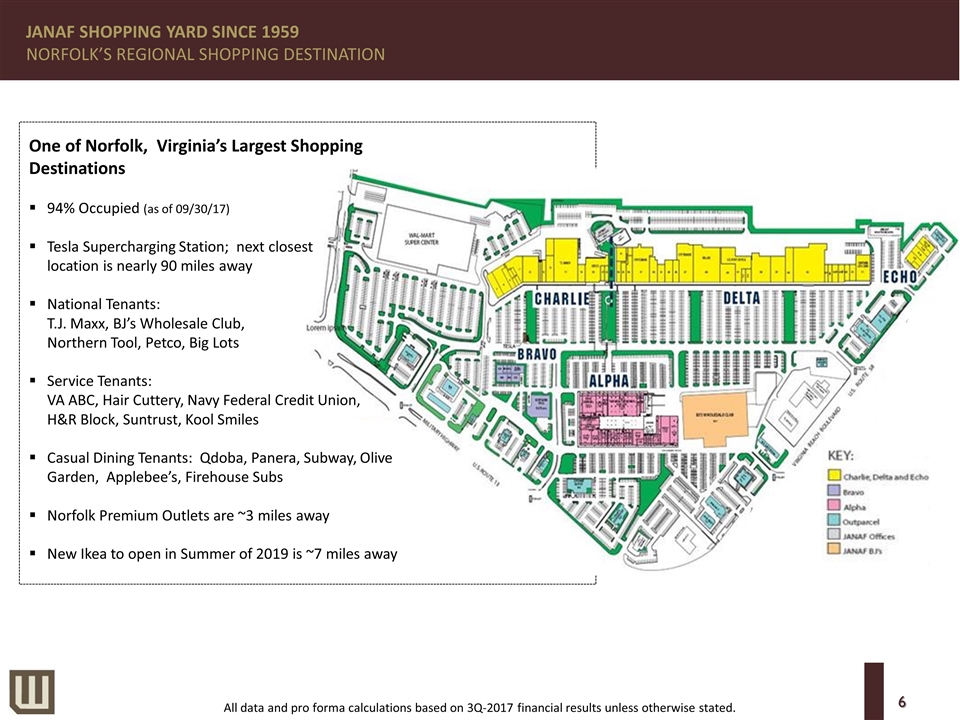

JANAF SHOPPING YARD SINCE 1959 NORFOLK’S REGIONAL SHOPPING DESTINATION One of Norfolk, Virginia’s Largest Shopping Destinations 94% Occupied (as of 09/30/17) Tesla Supercharging Station; next closest location is nearly 90 miles away National Tenants: T.J. Maxx, BJ’s Wholesale Club, Northern Tool, Petco, Big Lots Service Tenants: VA ABC, Hair Cuttery, Navy Federal Credit Union, H&R Block, Suntrust, Kool Smiles Casual Dining Tenants: Qdoba, Panera, Subway, Olive Garden, Applebee’s, Firehouse Subs Norfolk Premium Outlets are ~3 miles away New Ikea to open in Summer of 2019 is ~7 miles away All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

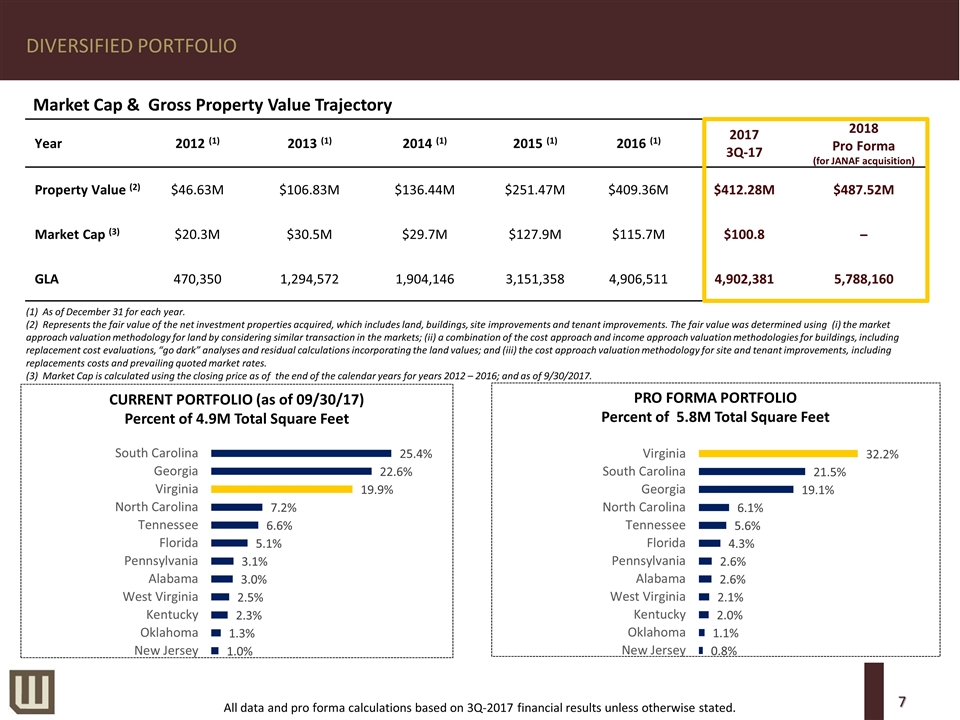

DIVERSIFIED PORTFOLIO CURRENT PORTFOLIO (as of 09/30/17) Percent of 4.9M Total Square Feet PRO FORMA PORTFOLIO Percent of 5.8M Total Square Feet Market Cap & Gross Property Value Trajectory Year 2012 (1) 2013 (1) 2014 (1) 2015 (1) 2016 (1) 2017 3Q-17 2018 Pro Forma (for JANAF acquisition) Property Value (2) $46.63M $106.83M $136.44M $251.47M $409.36M $412.28M $487.52M Market Cap (3) $20.3M $30.5M $29.7M $127.9M $115.7M $100.8 ̶ GLA 470,350 1,294,572 1,904,146 3,151,358 4,906,511 4,902,381 5,788,160 All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated. (1) As of December 31 for each year. (2) Represents the fair value of the net investment properties acquired, which includes land, buildings, site improvements and tenant improvements. The fair value was determined using (i) the market approach valuation methodology for land by considering similar transaction in the markets; (ii) a combination of the cost approach and income approach valuation methodologies for buildings, including replacement cost evaluations, “go dark” analyses and residual calculations incorporating the land values; and (iii) the cost approach valuation methodology for site and tenant improvements, including replacements costs and prevailing quoted market rates. (3) Market Cap is calculated using the closing price as of the end of the calendar years for years 2012 – 2016; and as of 9/30/2017.

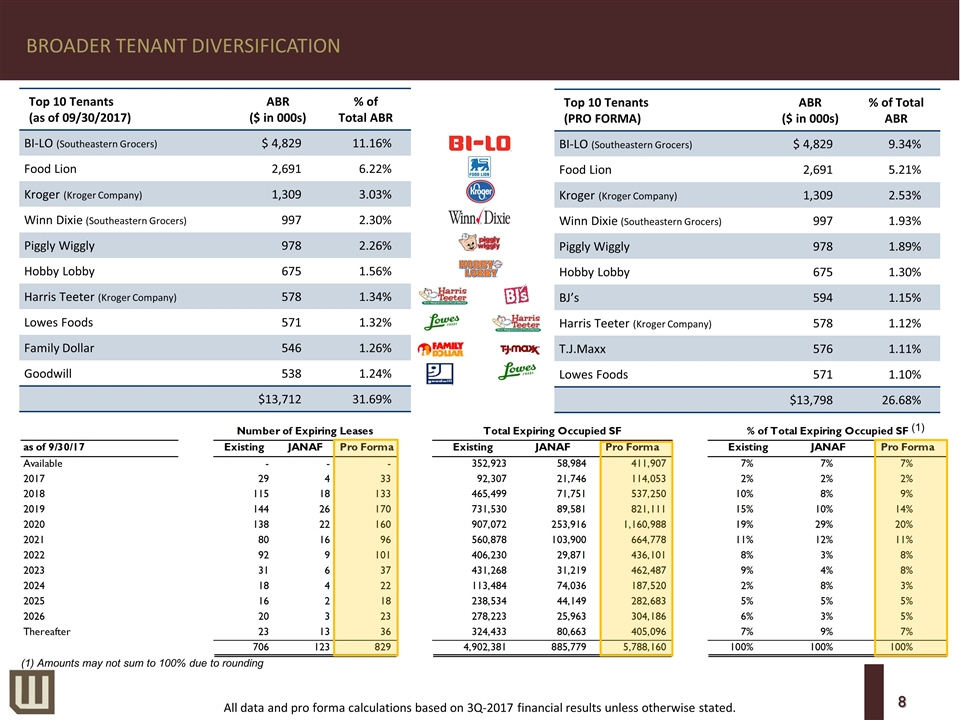

BROADER TENANT DIVERSIFICATION Top 10 Tenants (as of 09/30/2017) ABR ($ in 000s) % of Total ABR BI-LO (Southeastern Grocers) $ 4,829 11.16% Food Lion 2,691 6.22% Kroger (Kroger Company) 1,309 3.03% Winn Dixie (Southeastern Grocers) 997 2.30% Piggly Wiggly 978 2.26% Hobby Lobby 675 1.56% Harris Teeter (Kroger Company) 578 1.34% Lowes Foods 571 1.32% Family Dollar 546 1.26% Goodwill 538 1.24% $13,712 31.69% Top 10 Tenants (PRO FORMA) ABR ($ in 000s) % of Total ABR BI-LO (Southeastern Grocers) $ 4,829 9.34% Food Lion 2,691 5.21% Kroger (Kroger Company) 1,309 2.53% Winn Dixie (Southeastern Grocers) 997 1.93% Piggly Wiggly 978 1.89% Hobby Lobby 675 1.30% BJ’s 594 1.15% Harris Teeter (Kroger Company) 578 1.12% T.J.Maxx 576 1.11% Lowes Foods 571 1.10% $13,798 26.68% All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated. (1) Amounts may not sum to 100% due to rounding (1)

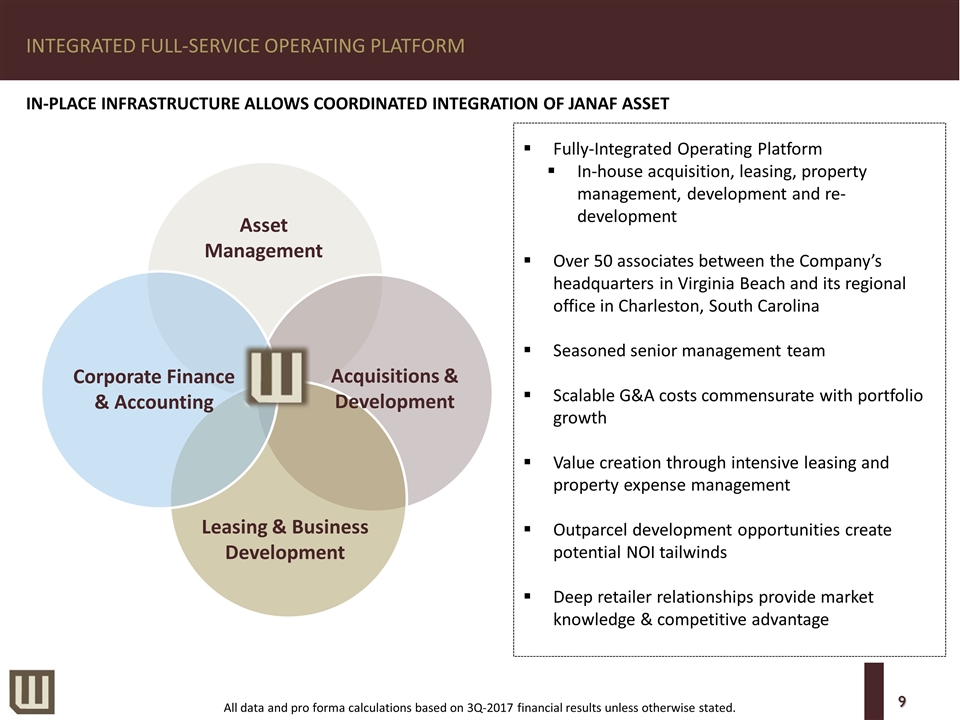

INTEGRATED FULL-SERVICE OPERATING PLATFORM Asset Management Acquisitions & Development Leasing & Business Development Corporate Finance & Accounting IN-PLACE INFRASTRUCTURE ALLOWS COORDINATED INTEGRATION OF JANAF ASSET Fully-Integrated Operating Platform In-house acquisition, leasing, property management, development and re-development Over 50 associates between the Company’s headquarters in Virginia Beach and its regional office in Charleston, South Carolina Seasoned senior management team Scalable G&A costs commensurate with portfolio growth Value creation through intensive leasing and property expense management Outparcel development opportunities create potential NOI tailwinds Deep retailer relationships provide market knowledge & competitive advantage All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

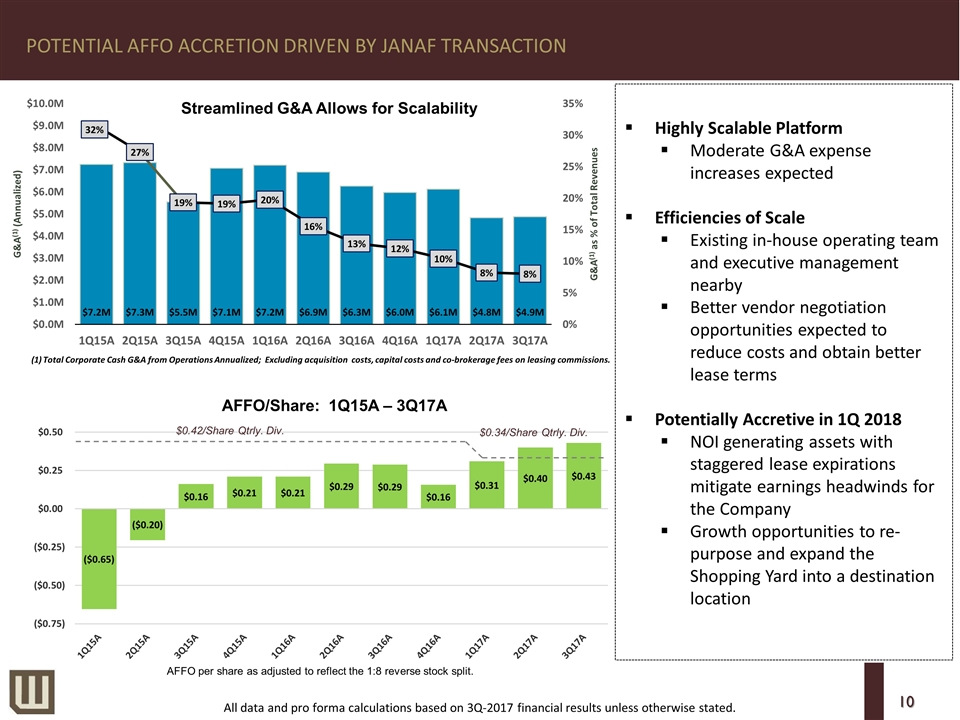

POTENTIAL AFFO ACCRETION DRIVEN BY JANAF TRANSACTION Highly Scalable Platform Moderate G&A expense increases expected Efficiencies of Scale Existing in-house operating team and executive management nearby Better vendor negotiation opportunities expected to reduce costs and obtain better lease terms Potentially Accretive in 1Q 2018 NOI generating assets with staggered lease expirations mitigate earnings headwinds for the Company Growth opportunities to re-purpose and expand the Shopping Yard into a destination location Total Corporate Cash G&A from Operations Annualized; Excluding acquisition costs, capital costs and co-brokerage fees on leasing commissions. All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated. AFFO per share as adjusted to reflect the 1:8 reverse stock split.

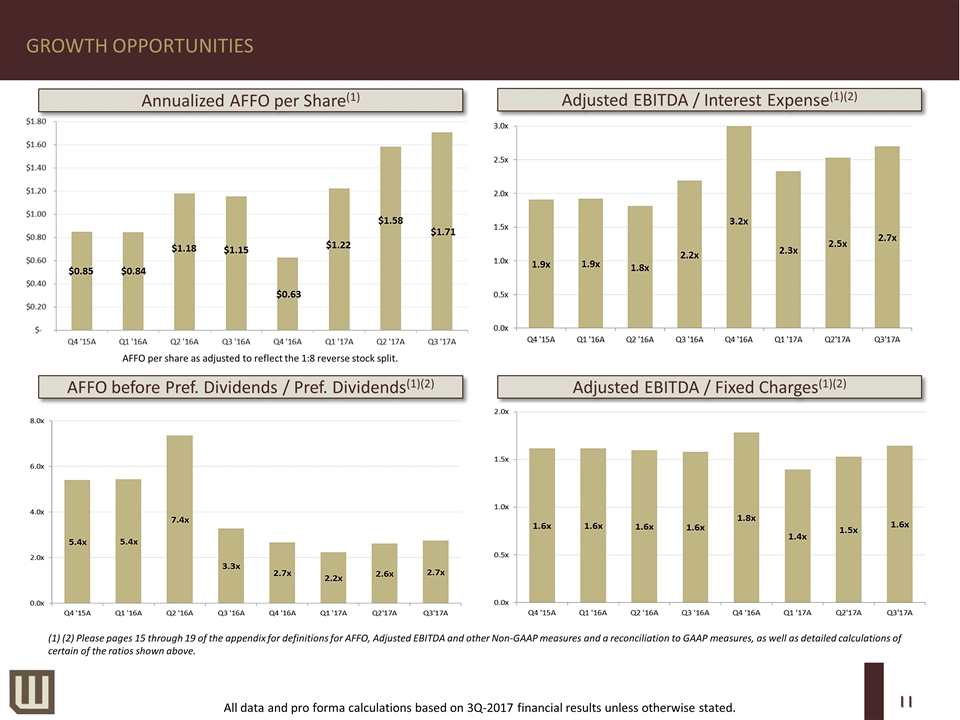

AFFO per share as adjusted to reflect the 1:8 reverse stock split. Adjusted EBITDA / Interest Expense(1)(2) Adjusted EBITDA / Fixed Charges(1)(2) AFFO before Pref. Dividends / Pref. Dividends(1)(2) Annualized AFFO per Share(1) (1) (2) Please pages 15 through 19 of the appendix for definitions for AFFO, Adjusted EBITDA and other Non-GAAP measures and a reconciliation to GAAP measures, as well as detailed calculations of certain of the ratios shown above. GROWTH OPPORTUNITIES All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

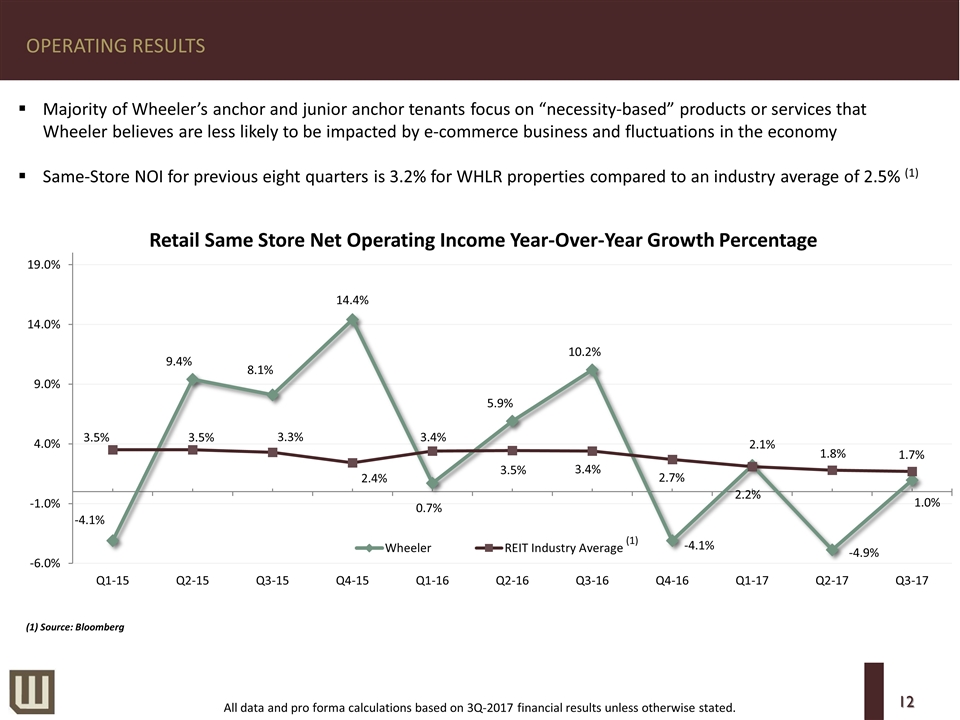

(1) Source: Bloomberg OPERATING RESULTS Majority of Wheeler’s anchor and junior anchor tenants focus on “necessity-based” products or services that Wheeler believes are less likely to be impacted by e-commerce business and fluctuations in the economy Same-Store NOI for previous eight quarters is 3.2% for WHLR properties compared to an industry average of 2.5% (1) All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

Appendix

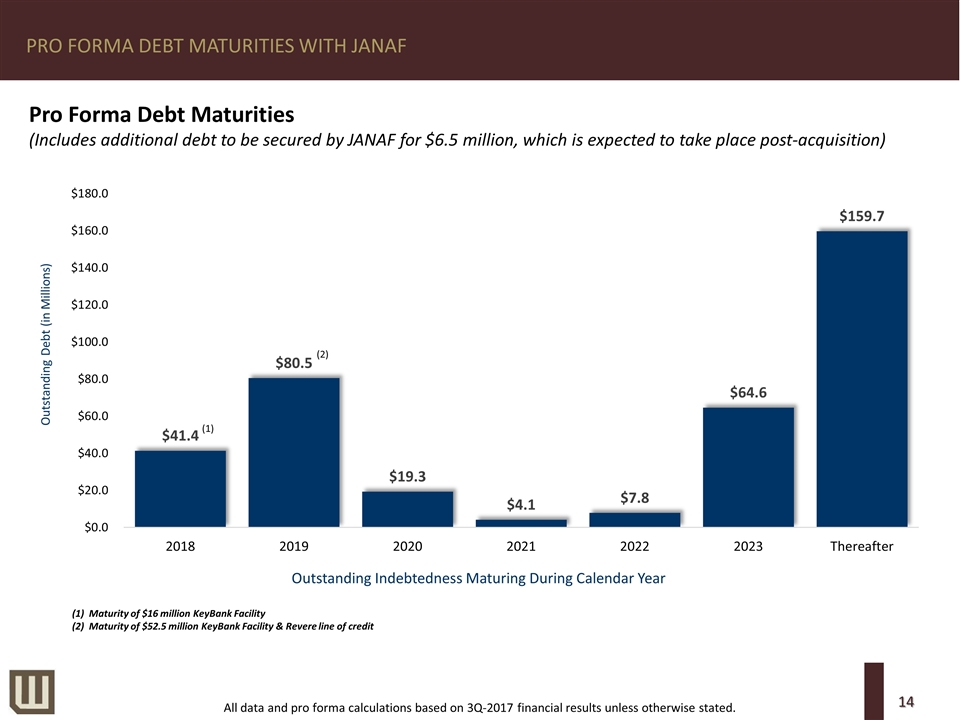

PRO FORMA DEBT MATURITIES WITH JANAF (1) Maturity of $16 million KeyBank Facility (2) Maturity of $52.5 million KeyBank Facility & Revere line of credit Outstanding Debt (in Millions) Outstanding Indebtedness Maturing During Calendar Year (1) (2) Pro Forma Debt Maturities (Includes additional debt to be secured by JANAF for $6.5 million, which is expected to take place post-acquisition) All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

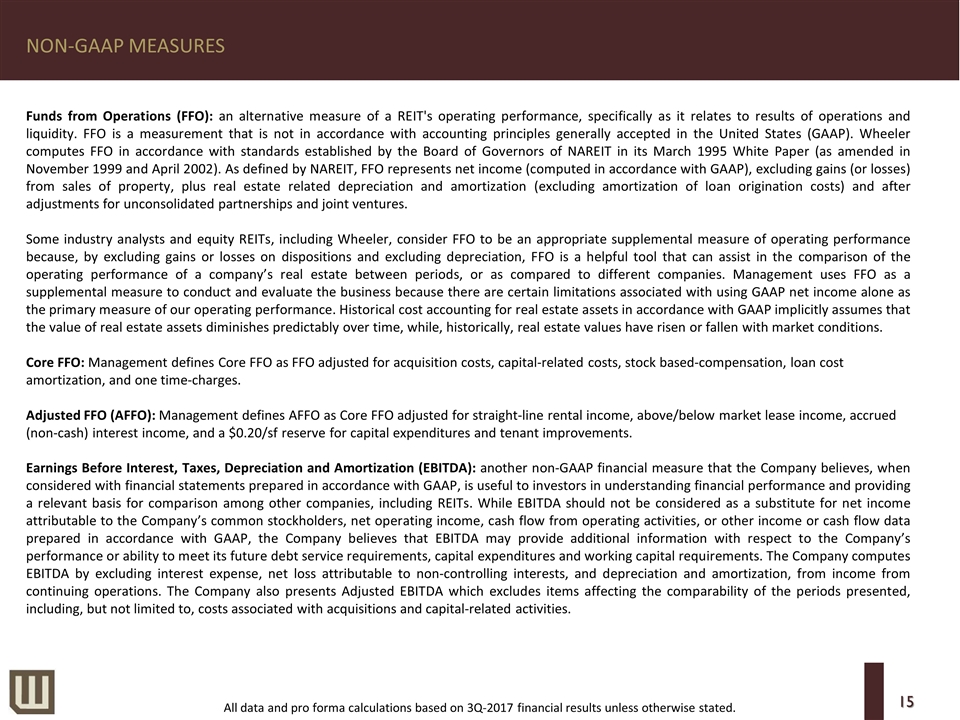

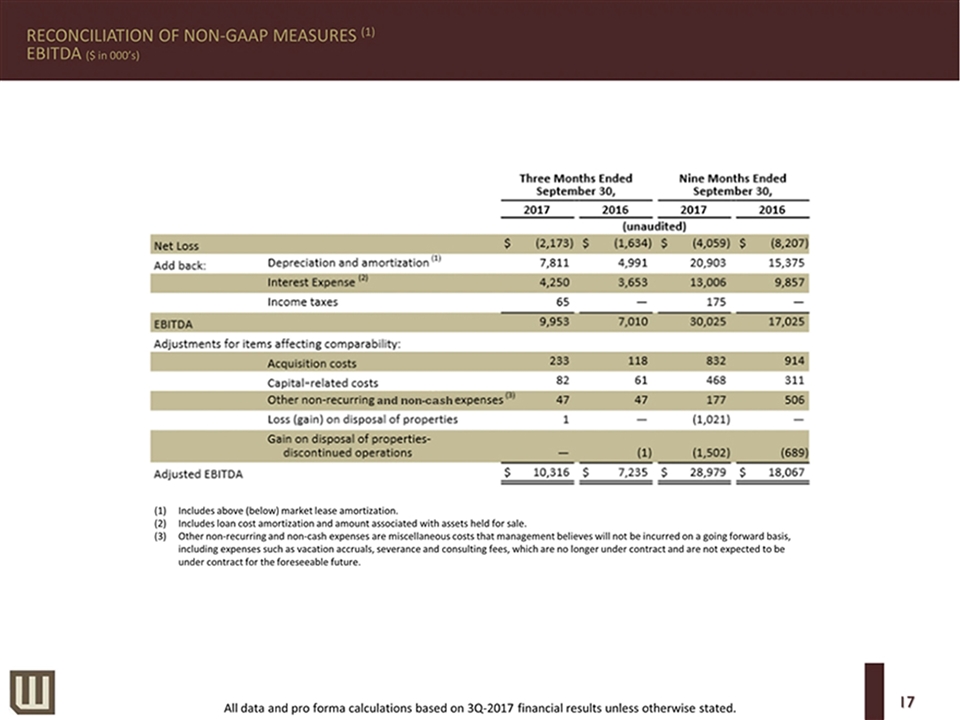

NON-GAAP MEASURES Funds from Operations (FFO): an alternative measure of a REIT's operating performance, specifically as it relates to results of operations and liquidity. FFO is a measurement that is not in accordance with accounting principles generally accepted in the United States (GAAP). Wheeler computes FFO in accordance with standards established by the Board of Governors of NAREIT in its March 1995 White Paper (as amended in November 1999 and April 2002). As defined by NAREIT, FFO represents net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus real estate related depreciation and amortization (excluding amortization of loan origination costs) and after adjustments for unconsolidated partnerships and joint ventures. Some industry analysts and equity REITs, including Wheeler, consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions and excluding depreciation, FFO is a helpful tool that can assist in the comparison of the operating performance of a company’s real estate between periods, or as compared to different companies. Management uses FFO as a supplemental measure to conduct and evaluate the business because there are certain limitations associated with using GAAP net income alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time, while, historically, real estate values have risen or fallen with market conditions. Core FFO: Management defines Core FFO as FFO adjusted for acquisition costs, capital-related costs, stock based-compensation, loan cost amortization, and one time-charges. Adjusted FFO (AFFO): Management defines AFFO as Core FFO adjusted for straight-line rental income, above/below market lease income, accrued (non-cash) interest income, and a $0.20/sf reserve for capital expenditures and tenant improvements. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): another non-GAAP financial measure that the Company believes, when considered with financial statements prepared in accordance with GAAP, is useful to investors in understanding financial performance and providing a relevant basis for comparison among other companies, including REITs. While EBITDA should not be considered as a substitute for net income attributable to the Company’s common stockholders, net operating income, cash flow from operating activities, or other income or cash flow data prepared in accordance with GAAP, the Company believes that EBITDA may provide additional information with respect to the Company’s performance or ability to meet its future debt service requirements, capital expenditures and working capital requirements. The Company computes EBITDA by excluding interest expense, net loss attributable to non-controlling interests, and depreciation and amortization, from income from continuing operations. The Company also presents Adjusted EBITDA which excludes items affecting the comparability of the periods presented, including, but not limited to, costs associated with acquisitions and capital-related activities. All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

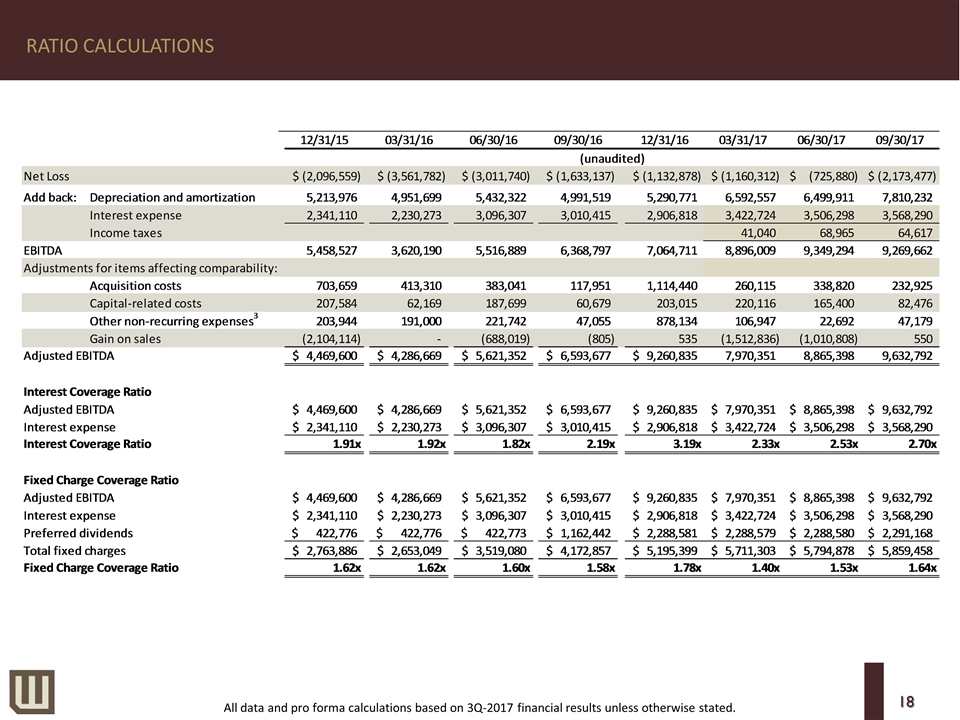

RATIO CALCULATIONS All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

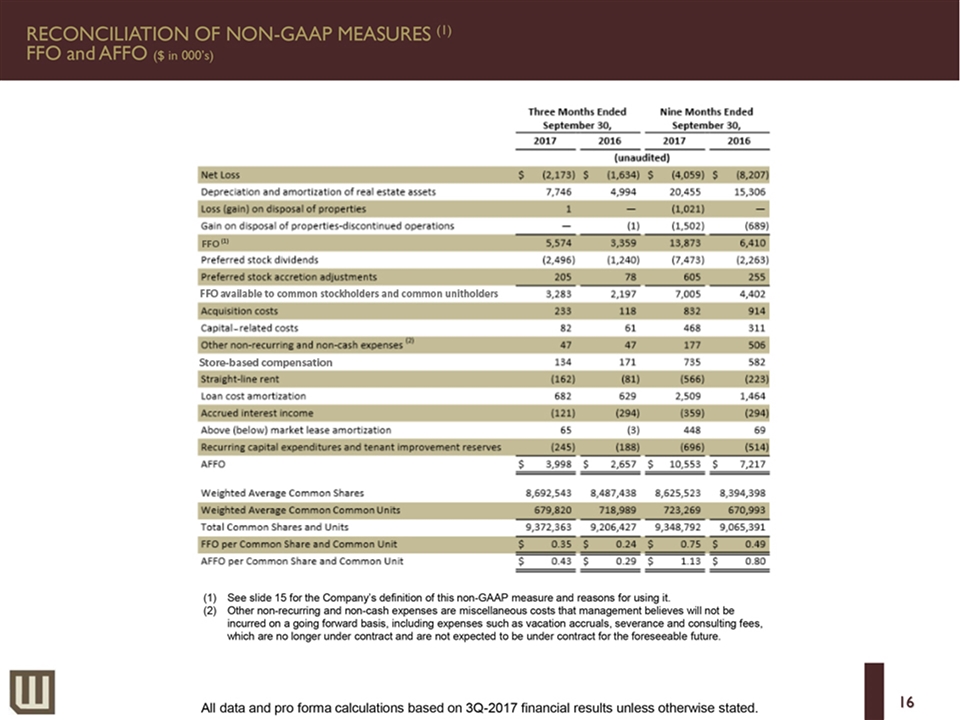

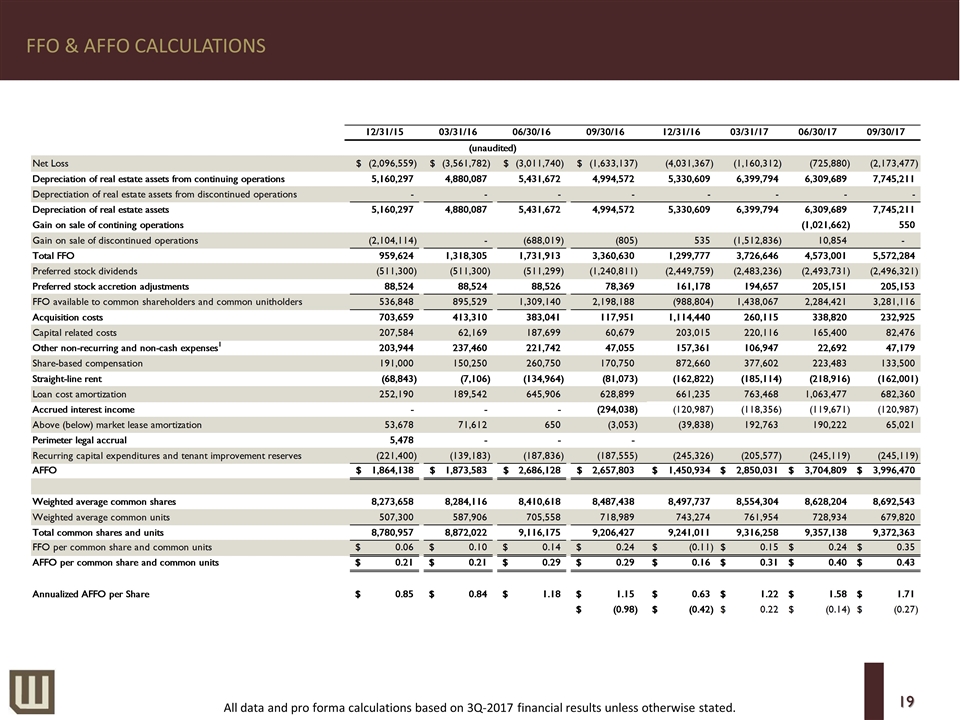

FFO & AFFO CALCULATIONS All data and pro forma calculations based on 3Q-2017 financial results unless otherwise stated.

Think Retail. Think Wheeler.® Nasdaq: whlr