NASDAQ: WHLR May 2017 Exhibit 99.1

SAFE HARBOR This presentation may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions it can give no assurance that expected results will be achieved, and actual results may differ materially from expectations. Specifically, the Company’s statements regarding: (i) the anticipated implementation and the ability to create value through the Company’s growth, acquisition, leasing and disposition strategy; (ii) the future generation of value to the Company from the acquisition of service orientated retail properties in secondary and tertiary markets, and the ability of the Company to acquire service oriented retail properties, including the current pipeline of assets; (iii) the development and return on undeveloped properties (iv); the expected revenue from the Sea Turtle Marketplace re-development; and (v) Second Quarter 2017 AFFO guidance are forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. For additional factors that could cause the operations of the Company to differ materially from those listed in the forward-looking statements are discussed in the Company's filings with the U.S. Securities and Exchange Commission, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward‐looking statements to reflect events or circumstances that arise after the date hereof.

COMPANY OVERVIEW Wheeler is an internally-managed REIT focused on acquiring well-located, necessity-based retail properties In November 2012, the Company listed on the NASDAQ exchange with eight assets and a market cap of $15.8 million Targets grocery-anchored shopping centers in secondary and tertiary markets with strong demographics and low competition Acquires properties at attractive yields and significant discount to replacement cost Current portfolio of 74 properties with approximately 4.9 million square feet of Gross Leasable Area 64 shopping center/retail properties, 8 undeveloped land parcels, one redevelopment property and one self-occupied office building Approximately 90% of centers are anchored or shadow-anchored by a grocery store Dedicated management team with strong track record of acquiring and selling retail properties through multiple phases of the investment cycle Predecessor firm achieved an average IRR of approximately 28% on 11 dispositions Wheeler Real Estate Investment Trust Exchange: NASDAQ Ticker: WHLR Market Cap(1): $129.4 million Stock Price(1): $13.84 Common Shares and Operating partnership Units Outstanding: 9.35 million Annualized Dividend: $1.68 As of 03/31/2017 Butler Square 1

Nine Directors – 7 Independent Directors and 2 Non-Independent Directors Representation from Westport Capital Partners as well as former, highly regarded REIT executives KEY INVESTMENT HIGHLIGHTS National and Regional merchants represent majority of Wheeler’s tenants Predominately grocery-anchored portfolio with diverse tenant base 74 properties across 12 states in the Mid-Atlantic, Northeast, Southeast and Southwest Wheeler properties serve the essential day-to-day shopping needs of the surrounding communities Majority of tenants provide non-cyclical consumer goods and services that are less impacted by fluctuations in the economy and E-commerce High Quality Existing Portfolio Second Quarter Guidance of $0.40-$0.42 re-affirmed following preliminary review of April 2017 results General and Administrative expense reduced from approximately $7 million in 2015 to $5 million per 2017 guidance Reverse stock split at a one-for-eight ratio, was made effective March 31, 2017 Quarterly dividend payments in lieu of monthly dividend payments align WHLR with peers Necessity-Based Retail Industry leading leased and occupied rates of approximately 94.2% and 93.0%, respectively, for WHLR properties versus the shopping center industry average1 of 93.17% occupied, as of March 31, 2017 Rent spread of 3.5% on 179,121 square feet of renewals for the months ended March 31, 2017 Active portfolio management with leasing services, property and asset management disciplines in-house Experienced management team with over 150 years of real estate experience Looking Ahead Operational Excellence Board of Directors Predominantly fixed rate, long-term debt Well laddered debt maturity schedule Increased Key Bank line of credit to $75 million at a rate of 30-day LIBOR + 250 Debt Profile Source: ICSC http://quickstats.icsc.org/ViewSeries.aspx?id=12738 For a definition of AFFO and Core FFO, please see the Appendix

Wilkes Graham Chief Financial Officer Over 17 years experience in the real estate and financial services industries Previously served as Director of Research and as a Senior Sell-Side Equity Research Analyst at Compass Point Research & Trading, LLC As a Real Estate Analyst, he forecasted earnings and predicted the stock performance for over 30 publicly traded REITs, real estate operating companies and homebuilders and conducted due diligence on over 35 capital market transactions MBA, Kenan Flagler Business School, UNC (2012) Jon S. Wheeler Chairman and CEO Over 35 years of experience in the real estate industry focused solely on retail In 1999, founded Wheeler Interests, LLC (“Wheeler Interests”), a company which we consider our predecessor firm, and oversaw the acquisition and development of 60 shopping centers totaling 4 million square feet Has overseen the acquisition of over 70 properties in 12 states since going public in 2012 WHLR’s executive officers, together with the management teams of its service companies, have an aggregate of over 150 years of experience in the real estate industry. EXPERIENCED Management Team Dave Kelly Chief Investment Officer Over 25 years of experience in the real estate industry Previously served 13 years as Director of Real Estate for Supervalu, Inc., a Fortune 100 supermarket retailer Focused on site selection and acquisition for Supervalu from New England to the Carolinas completing transactions totaling over $500 million Andy Franklin SVP, Operations 18 years of experience in the commercial real estate industry Previously served as Acquisitions Officer for Phillips Edison & Company, specializing in asset and property management 2018 MBA Candidate, Fox School of Business, Temple University

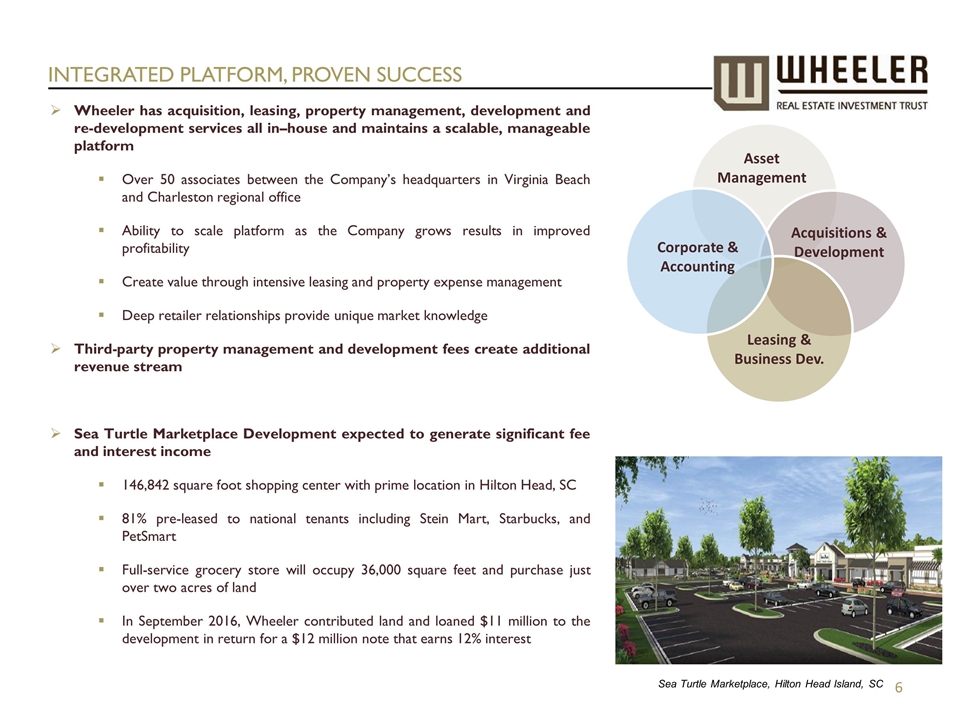

Integrated Platform, Proven Success Wheeler has acquisition, leasing, property management, development and re-development services all in–house and maintains a scalable, manageable platform Over 50 associates between the Company’s headquarters in Virginia Beach and Charleston regional office Ability to scale platform as the Company grows results in improved profitability Create value through intensive leasing and property expense management Deep retailer relationships provide unique market knowledge Third-party property management and development fees create additional revenue stream Sea Turtle Marketplace Development expected to generate significant fee and interest income 146,842 square foot shopping center with prime location in Hilton Head, SC 81% pre-leased to national tenants including Stein Mart, Starbucks, and PetSmart Full-service grocery store will occupy 36,000 square feet and purchase just over two acres of land In September 2016, Wheeler contributed land and loaned $11 million to the development in return for a $12 million note that earns 12% interest Asset Management Acquisitions & Development Leasing & Business Dev. Corporate & Accounting Sea Turtle Marketplace, Hilton Head Island, SC

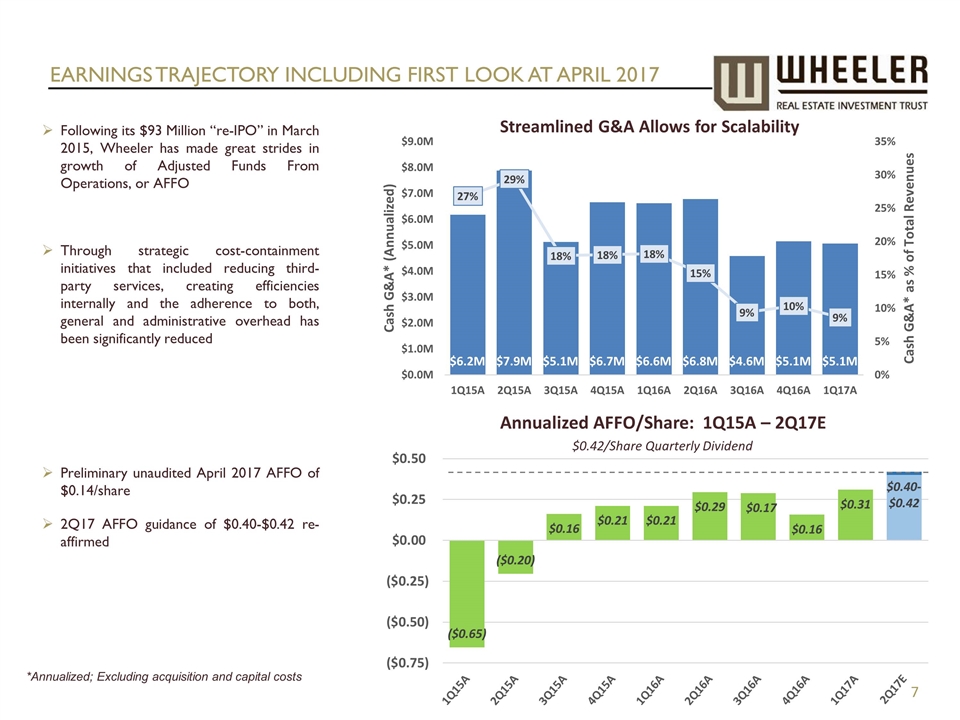

EARNINGS TRAJECTORY INCLUDING FIRST LOOK AT APRIL 2017 Following its $93 Million “re-IPO” in March 2015, Wheeler has made great strides in growth of Adjusted Funds From Operations, or AFFO Through strategic cost-containment initiatives that included reducing third-party services, creating efficiencies internally and the adherence to both, general and administrative overhead has been significantly reduced Preliminary unaudited April 2017 AFFO of $0.14/share 2Q17 AFFO guidance of $0.40-$0.42 re-affirmed *Annualized; Excluding acquisition and capital costs

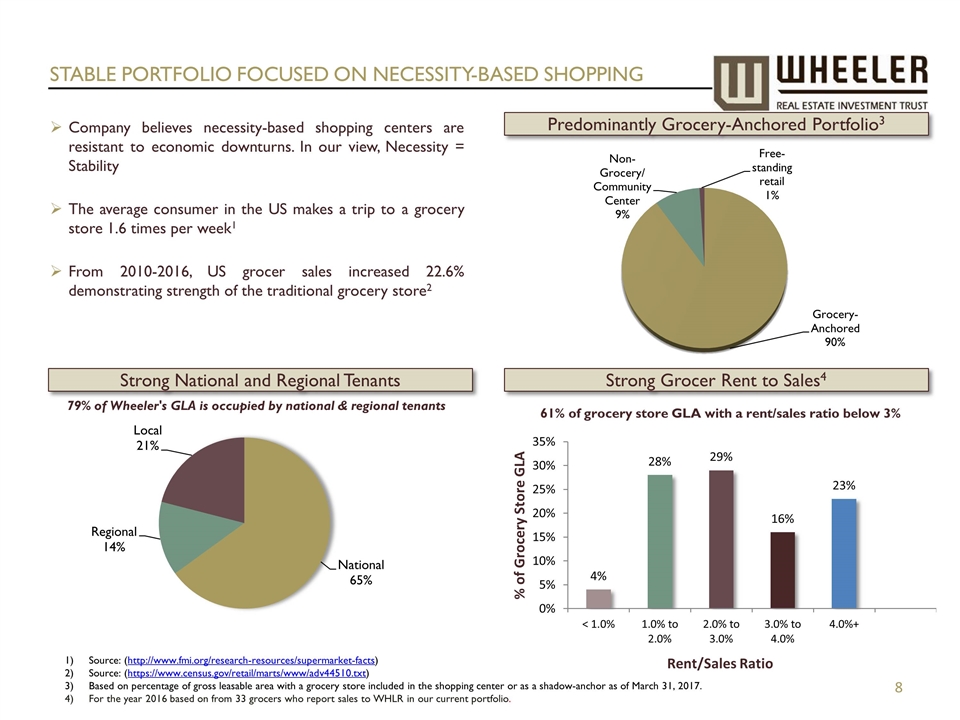

STABLE PORTFOLIO FOCUSED ON NECESSITY-BASED SHOPPING Predominantly Grocery-Anchored Portfolio3 Strong Grocer Rent to Sales4 61% of grocery store GLA with a rent/sales ratio below 3% Company believes necessity-based shopping centers are resistant to economic downturns. In our view, Necessity = Stability The average consumer in the US makes a trip to a grocery store 1.6 times per week1 From 2010-2016, US grocer sales increased 22.6% demonstrating strength of the traditional grocery store2 Strong National and Regional Tenants 79% of Wheeler's GLA is occupied by national & regional tenants Source: (http://www.fmi.org/research-resources/supermarket-facts) Source: (https://www.census.gov/retail/marts/www/adv44510.txt) Based on percentage of gross leasable area with a grocery store included in the shopping center or as a shadow-anchor as of March 31, 2017. For the year 2016 based on from 33 grocers who report sales to WHLR in our current portfolio.

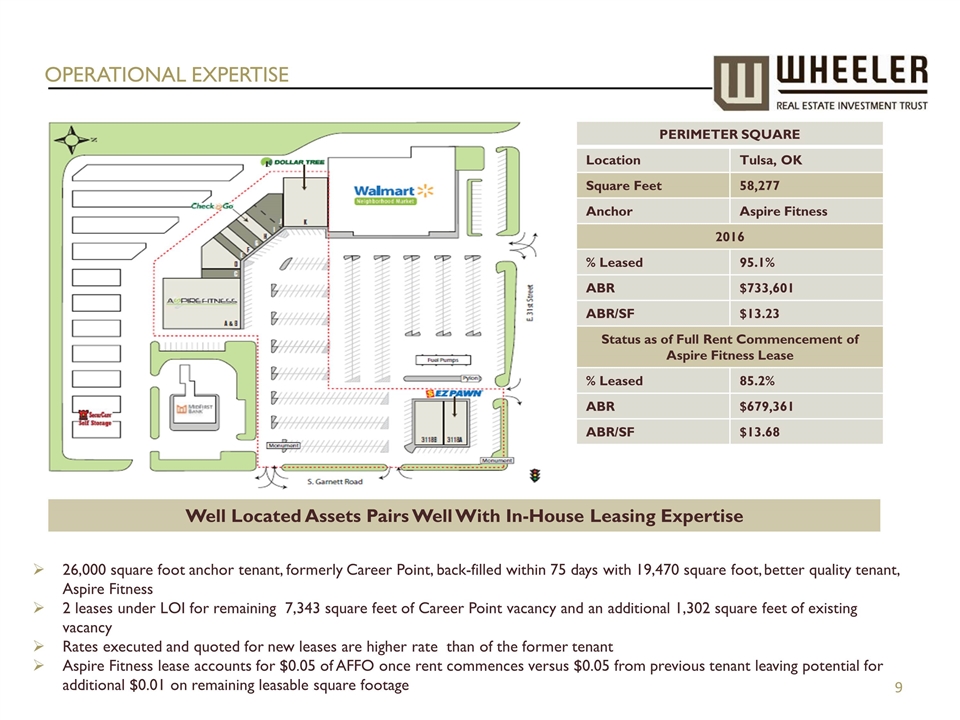

OPERATIONAL EXPERTISE PERIMETER SQUARE Location Tulsa, OK Square Feet 58,277 Anchor Aspire Fitness 2016 % Leased 95.1% ABR $733,601 ABR/SF $13.23 Status as of Full Rent Commencement of Aspire Fitness Lease % Leased 85.2% ABR $679,361 ABR/SF $13.68 26,000 square foot anchor tenant, formerly Career Point, back-filled within 75 days with 19,470 square foot, better quality tenant, Aspire Fitness 2 leases under LOI for remaining 7,343 square feet of Career Point vacancy and an additional 1,302 square feet of existing vacancy Rates executed and quoted for new leases are higher rate than of the former tenant Aspire Fitness lease accounts for $0.05 of AFFO once rent commences versus $0.05 from previous tenant leaving potential for additional $0.01 on remaining leasable square footage Well Located Assets Pairs Well With In-House Leasing Expertise

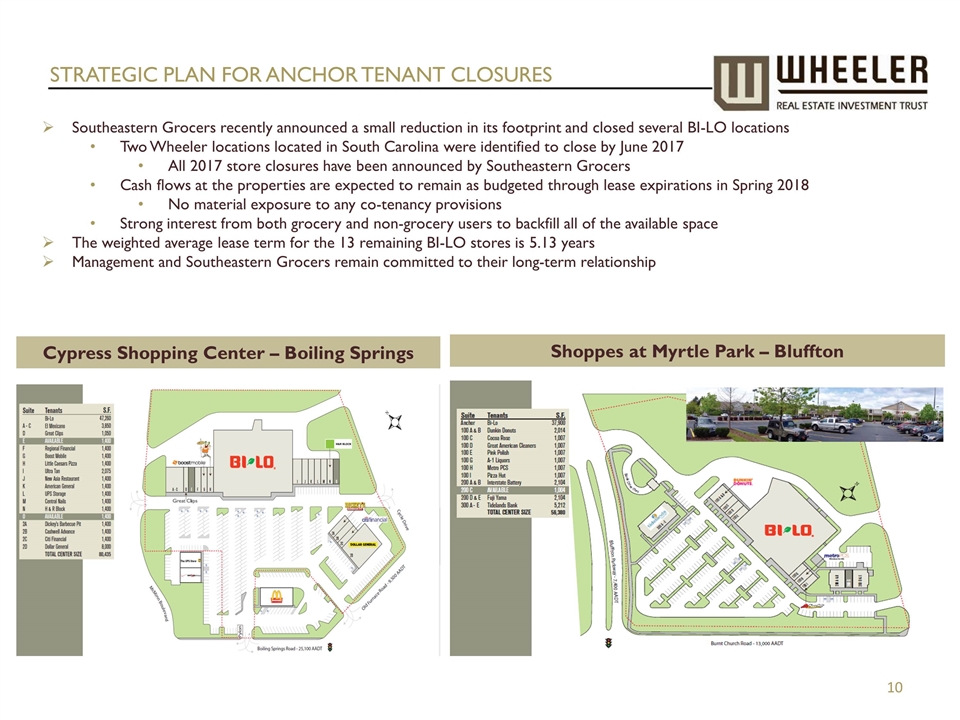

STRATEGIC PLAN FOR ANCHOR TENANT CLOSURES Southeastern Grocers recently announced a small reduction in its footprint and closed several BI-LO locations Two Wheeler locations located in South Carolina were identified to close by June 2017 All 2017 store closures have been announced by Southeastern Grocers Cash flows at the properties are expected to remain as budgeted through lease expirations in Spring 2018 No material exposure to any co-tenancy provisions Strong interest from both grocery and non-grocery users to backfill all of the available space The weighted average lease term for the 13 remaining BI-LO stores is 5.13 years Management and Southeastern Grocers remain committed to their long-term relationship Cypress Shopping Center – Boiling Springs Shoppes at Myrtle Park – Bluffton

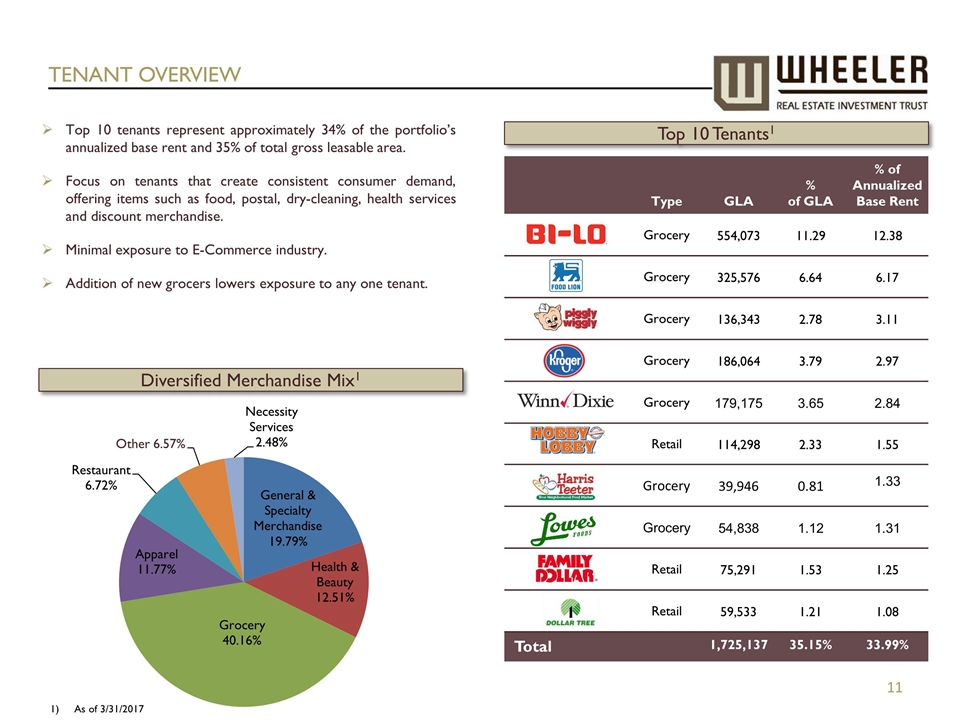

Type GLA % of GLA % of Annualized Base Rent Grocery 554,073 11.29 12.38 Grocery 325,576 6.64 6.17 Grocery 136,343 2.78 3.11 Grocery 186,064 3.79 2.97 Grocery 179,175 3.65 2.84 Retail 114,298 2.33 1.55 Grocery 39,946 0.81 1.33 Grocery 54,838 1.12 1.31 Retail 75,291 1.53 1.25 Retail 59,533 1.21 1.08 Total 1,725,137 35.15% 33.99% TENANT OVERVIEW Top 10 tenants represent approximately 34% of the portfolio’s annualized base rent and 35% of total gross leasable area. Focus on tenants that create consistent consumer demand, offering items such as food, postal, dry-cleaning, health services and discount merchandise. Minimal exposure to E-Commerce industry. Addition of new grocers lowers exposure to any one tenant. As of 3/31/2017 Top 10 Tenants1 Diversified Merchandise Mix1

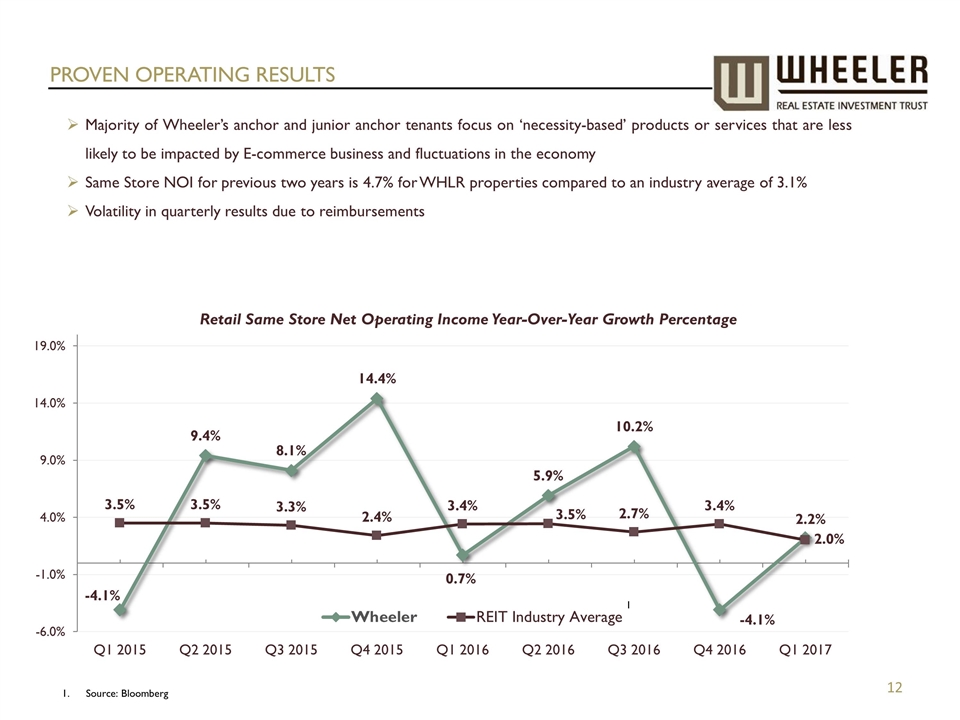

Majority of Wheeler’s anchor and junior anchor tenants focus on ‘necessity-based’ products or services that are less likely to be impacted by E-commerce business and fluctuations in the economy Same Store NOI for previous two years is 4.7% for WHLR properties compared to an industry average of 3.1% Volatility in quarterly results due to reimbursements PROVEN OPERATING RESULTS Source: Bloomberg

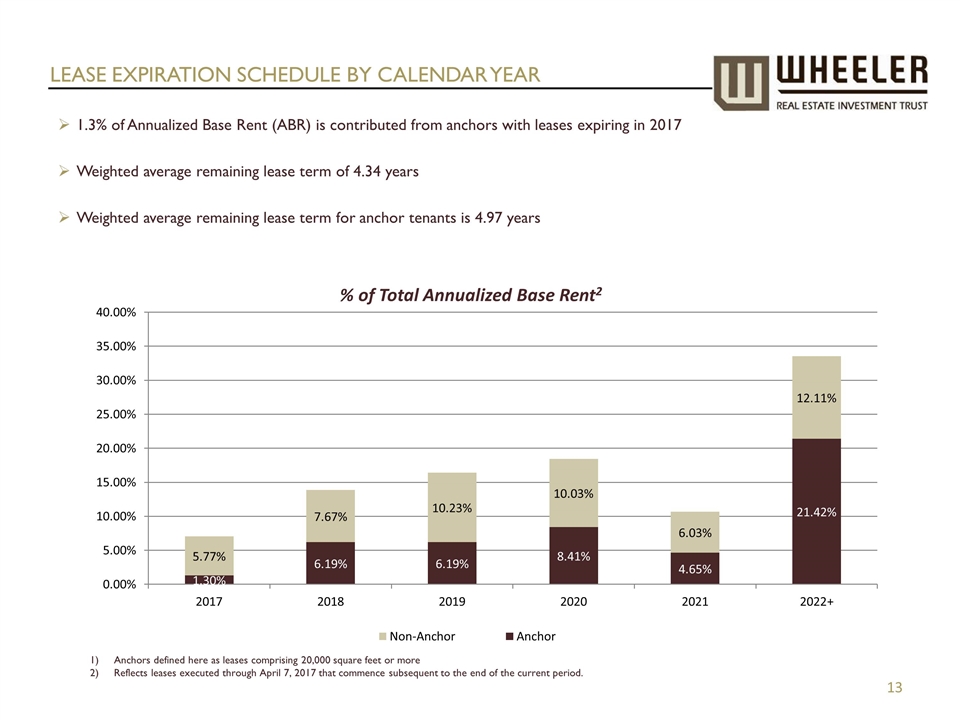

LEASE EXPIRATION SCHEDULE BY CALENDAR YEAR 1.3% of Annualized Base Rent (ABR) is contributed from anchors with leases expiring in 2017 Weighted average remaining lease term of 4.34 years Weighted average remaining lease term for anchor tenants is 4.97 years Anchors defined here as leases comprising 20,000 square feet or more Reflects leases executed through April 7, 2017 that commence subsequent to the end of the current period.

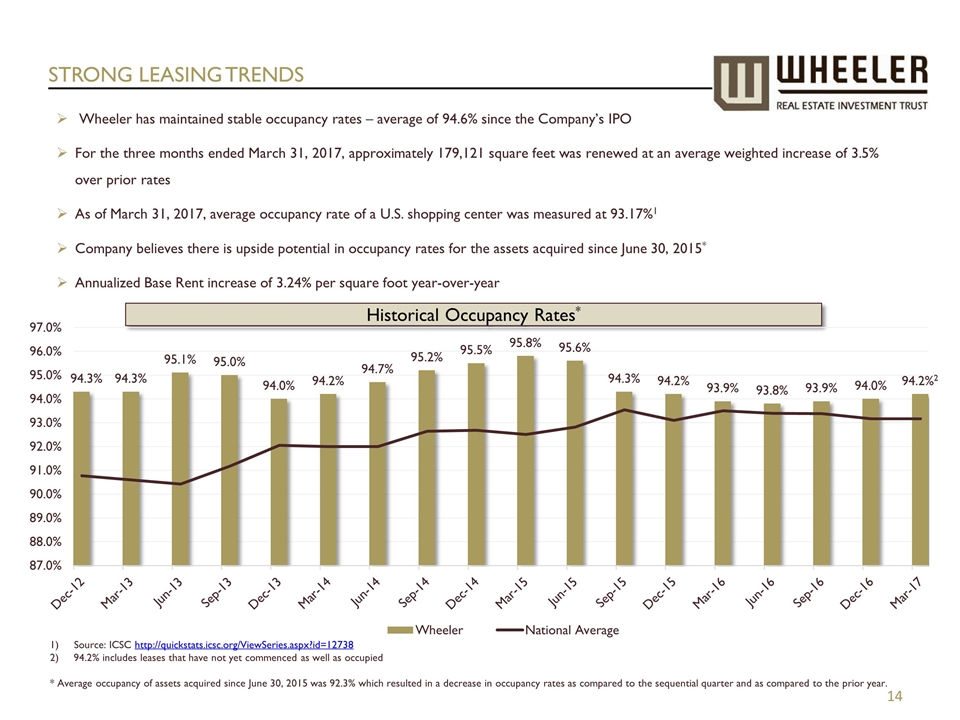

STRONG LEASING TRENDS Wheeler has maintained stable occupancy rates – average of 94.6% since the Company’s IPO For the three months ended March 31, 2017, approximately 179,121 square feet was renewed at an average weighted increase of 3.5% over prior rates As of March 31, 2017, average occupancy rate of a U.S. shopping center was measured at 93.17%1 Company believes there is upside potential in occupancy rates for the assets acquired since June 30, 2015* Annualized Base Rent increase of 3.24% per square foot year-over-year Historical Occupancy Rates* Source: ICSC http://quickstats.icsc.org/ViewSeries.aspx?id=12738 2) 94.2% includes leases that have not yet commenced as well as occupied * Average occupancy of assets acquired since June 30, 2015 was 92.3% which resulted in a decrease in occupancy rates as compared to the sequential quarter and as compared to the prior year.

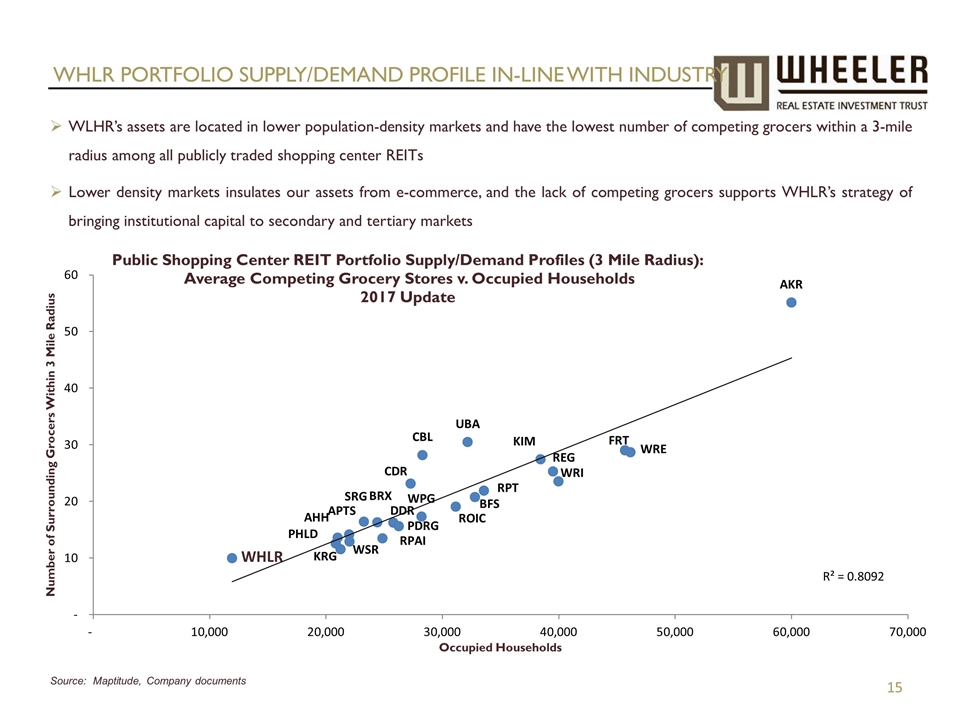

WHLR PORTFOLIO SUPPLY/DEMAND PROFILE IN-LINE WITH INDUSTRY WLHR’s assets are located in lower population-density markets and have the lowest number of competing grocers within a 3-mile radius among all publicly traded shopping center REITs Lower density markets insulates our assets from e-commerce, and the lack of competing grocers supports WHLR’s strategy of bringing institutional capital to secondary and tertiary markets Source: Maptitude, Company documents

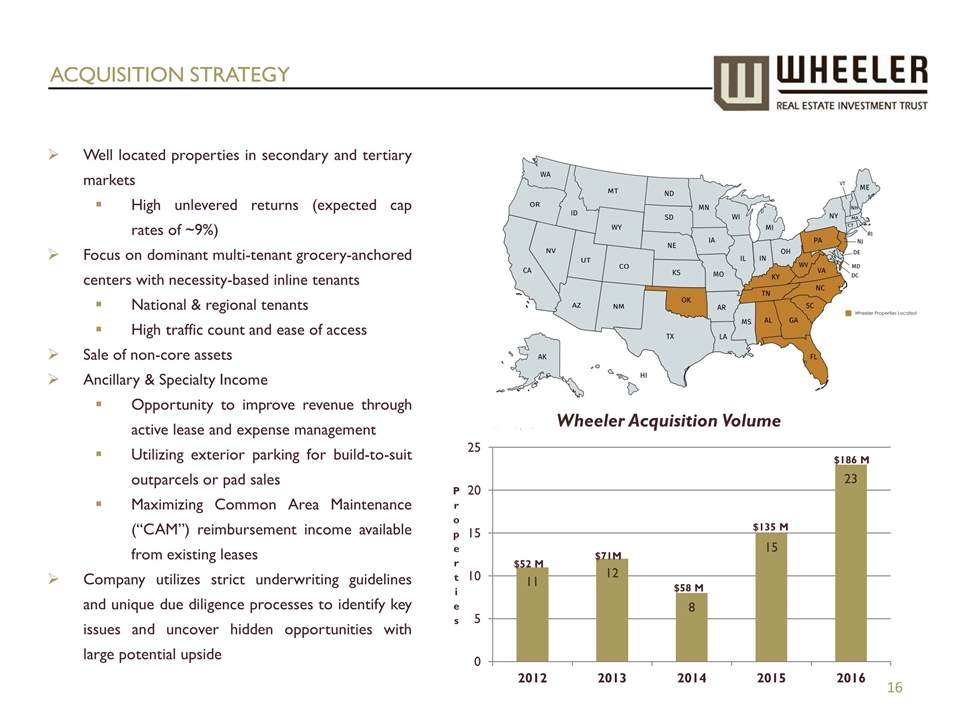

ACQUISITION STRATEGY Well located properties in secondary and tertiary markets High unlevered returns (expected cap rates of ~9%) Focus on dominant multi-tenant grocery-anchored centers with necessity-based inline tenants National & regional tenants High traffic count and ease of access Sale of non-core assets Ancillary & Specialty Income Opportunity to improve revenue through active lease and expense management Utilizing exterior parking for build-to-suit outparcels or pad sales Maximizing Common Area Maintenance (“CAM”) reimbursement income available from existing leases Company utilizes strict underwriting guidelines and unique due diligence processes to identify key issues and uncover hidden opportunities with large potential upside

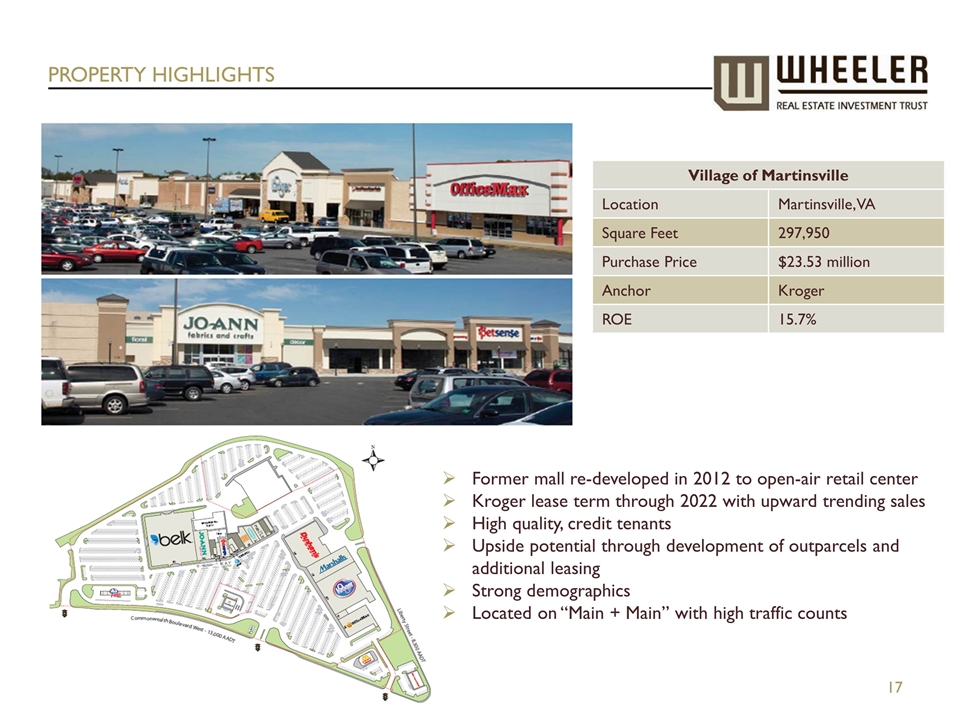

PROPERTY HIGHLIGHTS Village of Martinsville Location Martinsville, VA Square Feet 297,950 Purchase Price $23.53 million Anchor Kroger ROE 15.7% Former mall re-developed in 2012 to open-air retail center Kroger lease term through 2022 with upward trending sales High quality, credit tenants Upside potential through development of outparcels and additional leasing Strong demographics Located on “Main + Main” with high traffic counts

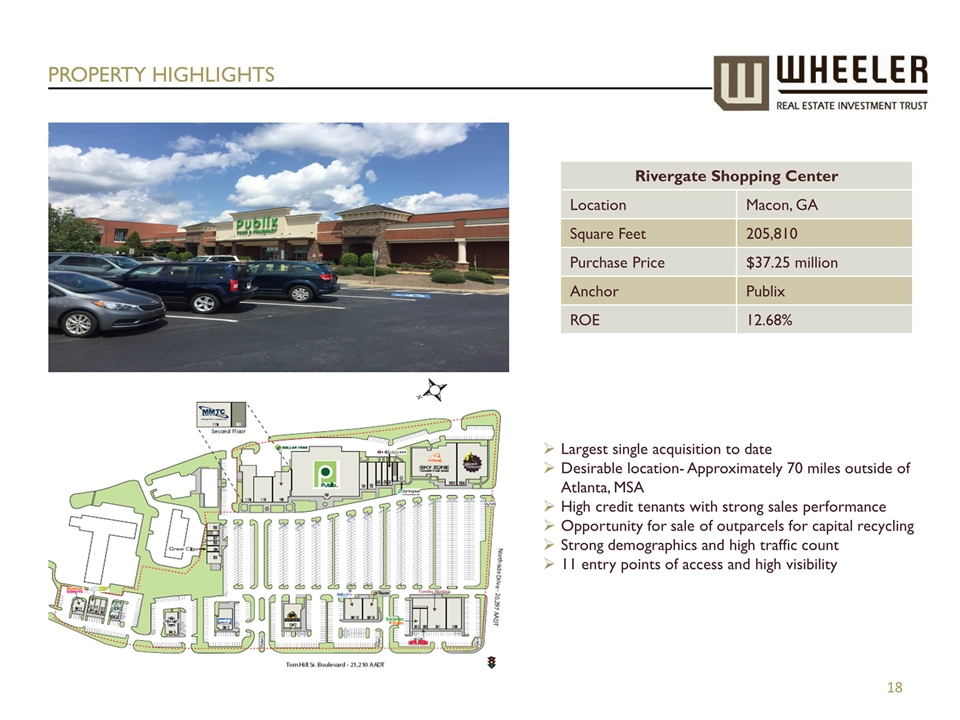

PROPERTY HIGHLIGHTS Rivergate Shopping Center Location Macon, GA Square Feet 205,810 Purchase Price $37.25 million Anchor Publix ROE 12.68% Largest single acquisition to date Desirable location- Approximately 70 miles outside of Atlanta, MSA High credit tenants with strong sales performance Opportunity for sale of outparcels for capital recycling Strong demographics and high traffic count 11 entry points of access and high visibility

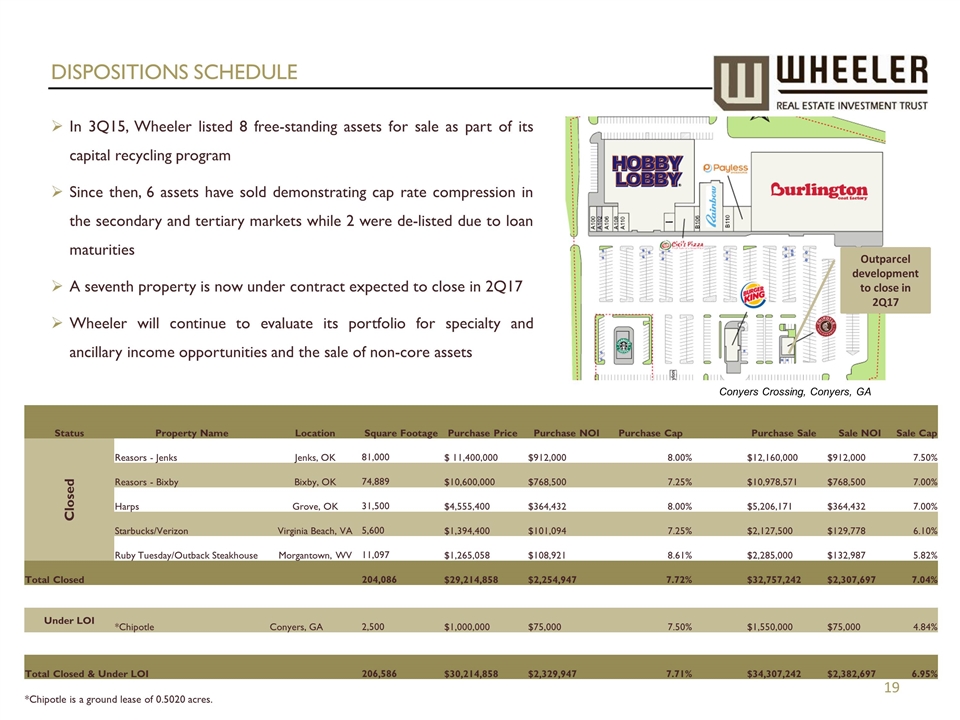

DISPOSITIONS SCHEDULE In 3Q15, Wheeler listed 8 free-standing assets for sale as part of its capital recycling program Since then, 6 assets have sold demonstrating cap rate compression in the secondary and tertiary markets while 2 were de-listed due to loan maturities A seventh property is now under contract expected to close in 2Q17 Wheeler will continue to evaluate its portfolio for specialty and ancillary income opportunities and the sale of non-core assets Outparcel development to close in 2Q17 Conyers Crossing, Conyers, GA Status Property Name Location Square Footage Purchase Price Purchase NOI Purchase Cap Purchase Sale Sale NOI Sale Cap Closed Reasors - Jenks Jenks, OK 81,000 $ 11,400,000 $912,000 8.00% $12,160,000 $912,000 7.50% Reasors - Bixby Bixby, OK 74,889 $10,600,000 $768,500 7.25% $10,978,571 $768,500 7.00% Harps Grove, OK 31,500 $4,555,400 $364,432 8.00% $5,206,171 $364,432 7.00% Starbucks/Verizon Virginia Beach, VA 5,600 $1,394,400 $101,094 7.25% $2,127,500 $129,778 6.10% Ruby Tuesday/Outback Steakhouse Morgantown, WV 11,097 $1,265,058 $108,921 8.61% $2,285,000 $132,987 5.82% Total Closed 204,086 $29,214,858 $2,254,947 7.72% $32,757,242 $2,307,697 7.04% Under LOI *Chipotle Conyers, GA 2,500 $1,000,000 $75,000 7.50% $1,550,000 $75,000 4.84% Total Closed & Under LOI 206,586 $30,214,858 $2,329,947 7.71% $34,307,242 $2,382,697 6.95% *Chipotle is a ground lease of 0.5020 acres.

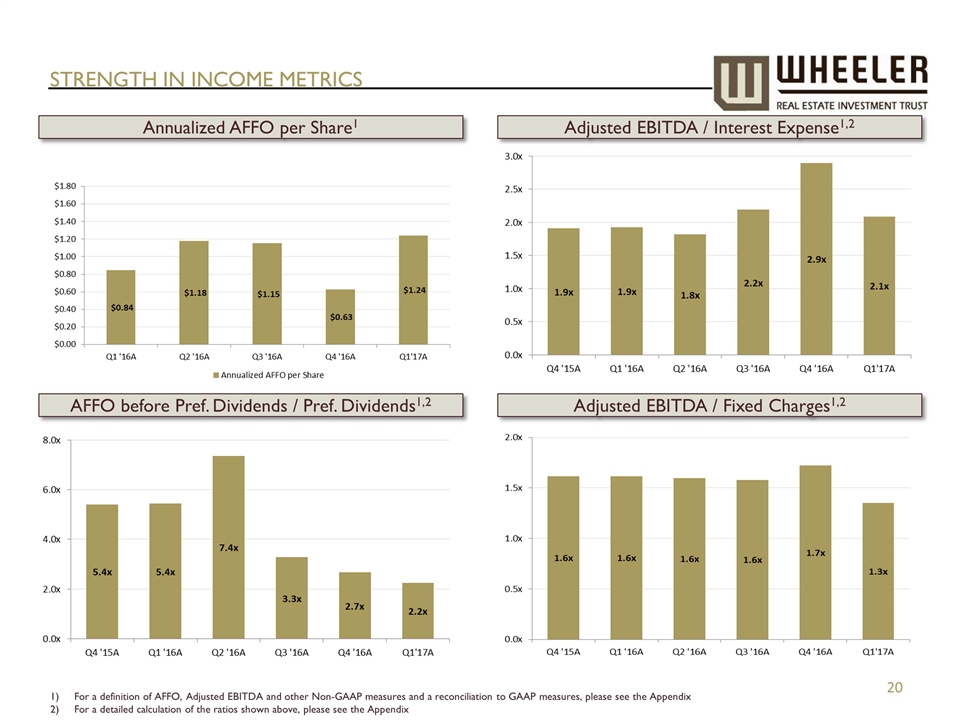

STRENGTH IN INCOME METRICS Butler Square Adjusted EBITDA / Interest Expense1,2 Adjusted EBITDA / Fixed Charges1,2 AFFO before Pref. Dividends / Pref. Dividends1,2 Annualized AFFO per Share1 For a definition of AFFO, Adjusted EBITDA and other Non-GAAP measures and a reconciliation to GAAP measures, please see the Appendix For a detailed calculation of the ratios shown above, please see the Appendix

Appendix

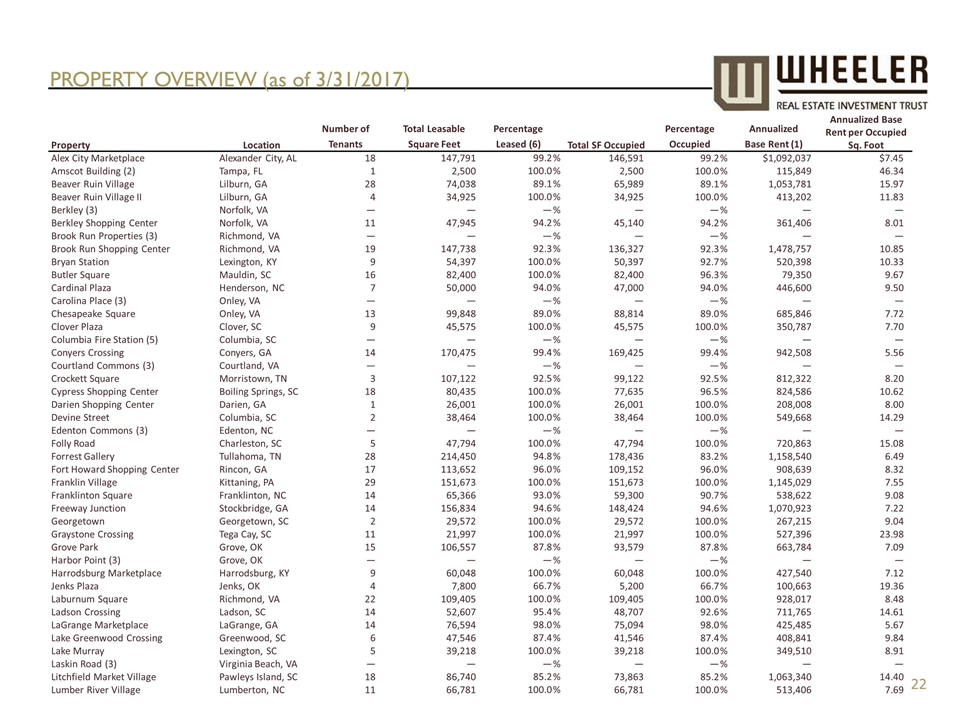

PROPERTY OVERVIEW (as of 3/31/2017) Property Location Number of Tenants Total Leasable Square Feet Percentage Leased (6) Total SF Occupied Percentage Occupied Annualized Base Rent (1) Annualized Base Rent per Occupied Sq. Foot Alex City Marketplace Alexander City, AL 18 147,791 99.2 % 146,591 99.2 % $1,092,037 $7.45 Amscot Building (2) Tampa, FL 1 2,500 100.0 % 2,500 100.0 % 115,849 46.34 Beaver Ruin Village Lilburn, GA 28 74,038 89.1 % 65,989 89.1 % 1,053,781 15.97 Beaver Ruin Village II Lilburn, GA 4 34,925 100.0 % 34,925 100.0 % 413,202 11.83 Berkley (3) Norfolk, VA — — — % — — % — — Berkley Shopping Center Norfolk, VA 11 47,945 94.2 % 45,140 94.2 % 361,406 8.01 Brook Run Properties (3) Richmond, VA — — — % — — % — — Brook Run Shopping Center Richmond, VA 19 147,738 92.3 % 136,327 92.3 % 1,478,757 10.85 Bryan Station Lexington, KY 9 54,397 100.0 % 50,397 92.7 % 520,398 10.33 Butler Square Mauldin, SC 16 82,400 100.0 % 82,400 96.3 % 79,350 9.67 Cardinal Plaza Henderson, NC 7 50,000 94.0 % 47,000 94.0 % 446,600 9.50 Carolina Place (3) Onley, VA — — — % — — % — — Chesapeake Square Onley, VA 13 99,848 89.0 % 88,814 89.0 % 685,846 7.72 Clover Plaza Clover, SC 9 45,575 100.0 % 45,575 100.0 % 350,787 7.70 Columbia Fire Station (5) Columbia, SC — — — % — — % — — Conyers Crossing Conyers, GA 14 170,475 99.4 % 169,425 99.4 % 942,508 5.56 Courtland Commons (3) Courtland, VA — — — % — — % — — Crockett Square Morristown, TN 3 107,122 92.5 % 99,122 92.5 % 812,322 8.20 Cypress Shopping Center Boiling Springs, SC 18 80,435 100.0 % 77,635 96.5 % 824,586 10.62 Darien Shopping Center Darien, GA 1 26,001 100.0 % 26,001 100.0 % 208,008 8.00 Devine Street Columbia, SC 2 38,464 100.0 % 38,464 100.0 % 549,668 14.29 Edenton Commons (3) Edenton, NC — — — % — — % — — Folly Road Charleston, SC 5 47,794 100.0 % 47,794 100.0 % 720,863 15.08 Forrest Gallery Tullahoma, TN 28 214,450 94.8 % 178,436 83.2 % 1,158,540 6.49 Fort Howard Shopping Center Rincon, GA 17 113,652 96.0 % 109,152 96.0 % 908,639 8.32 Franklin Village Kittaning, PA 29 151,673 100.0 % 151,673 100.0 % 1,145,029 7.55 Franklinton Square Franklinton, NC 14 65,366 93.0 % 59,300 90.7 % 538,622 9.08 Freeway Junction Stockbridge, GA 14 156,834 94.6 % 148,424 94.6 % 1,070,923 7.22 Georgetown Georgetown, SC 2 29,572 100.0 % 29,572 100.0 % 267,215 9.04 Graystone Crossing Tega Cay, SC 11 21,997 100.0 % 21,997 100.0 % 527,396 23.98 Grove Park Grove, OK 15 106,557 87.8 % 93,579 87.8 % 663,784 7.09 Harbor Point (3) Grove, OK — — — % — — % — — Harrodsburg Marketplace Harrodsburg, KY 9 60,048 100.0 % 60,048 100.0 % 427,540 7.12 Jenks Plaza Jenks, OK 4 7,800 66.7 % 5,200 66.7 % 100,663 19.36 Laburnum Square Richmond, VA 22 109,405 100.0 % 109,405 100.0 % 928,017 8.48 Ladson Crossing Ladson, SC 14 52,607 95.4 % 48,707 92.6 % 711,765 14.61 LaGrange Marketplace LaGrange, GA 14 76,594 98.0 % 75,094 98.0 % 425,485 5.67 Lake Greenwood Crossing Greenwood, SC 6 47,546 87.4 % 41,546 87.4 % 408,841 9.84 Lake Murray Lexington, SC 5 39,218 100.0 % 39,218 100.0 % 349,510 8.91 Laskin Road (3) Virginia Beach, VA — — — % — — % — — Litchfield Market Village Pawleys Island, SC 18 86,740 85.2 % 73,863 85.2 % 1,063,340 14.40 Lumber River Village Lumberton, NC 11 66,781 100.0 % 66,781 100.0 % 513,406 7.69

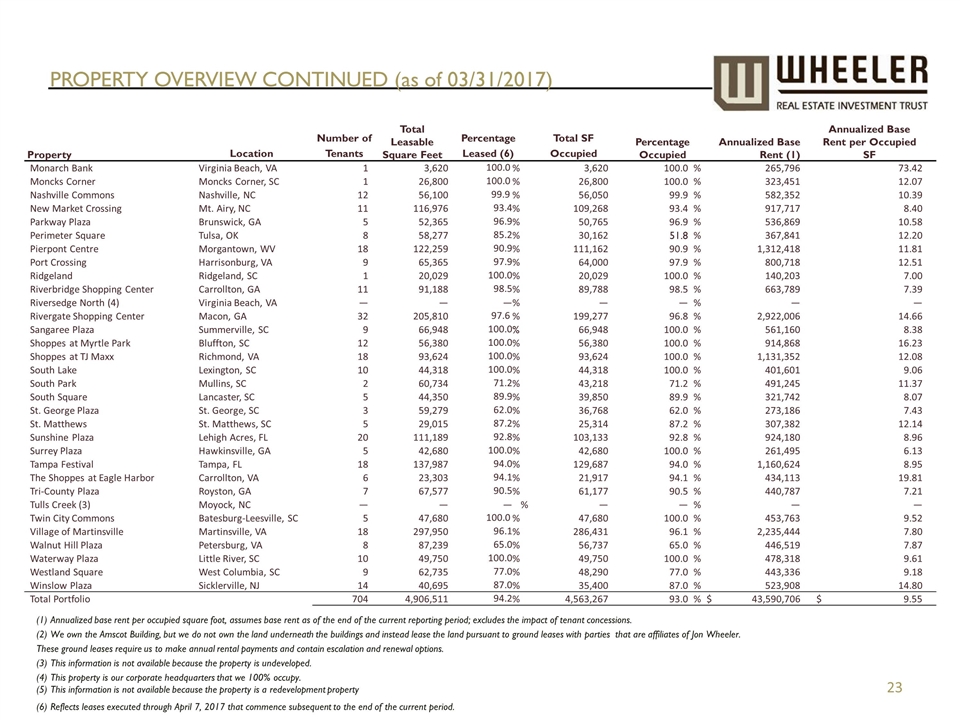

PROPERTY OVERVIEW CONTINUED (as of 03/31/2017) Property Location Number of Tenants Total Leasable Square Feet Percentage Leased (6) Total SF Occupied Percentage Occupied Annualized Base Rent (1) Annualized Base Rent per Occupied SF Monarch Bank Virginia Beach, VA 1 3,620 100.0 % 3,620 100.0 % 265,796 73.42 Moncks Corner Moncks Corner, SC 1 26,800 100.0 % 26,800 100.0 % 323,451 12.07 Nashville Commons Nashville, NC 12 56,100 99.9 % 56,050 99.9 % 582,352 10.39 New Market Crossing Mt. Airy, NC 11 116,976 93.4 % 109,268 93.4 % 917,717 8.40 Parkway Plaza Brunswick, GA 5 52,365 96.9 % 50,765 96.9 % 536,869 10.58 Perimeter Square Tulsa, OK 8 58,277 85.2 % 30,162 51.8 % 367,841 12.20 Pierpont Centre Morgantown, WV 18 122,259 90.9 % 111,162 90.9 % 1,312,418 11.81 Port Crossing Harrisonburg, VA 9 65,365 97.9 % 64,000 97.9 % 800,718 12.51 Ridgeland Ridgeland, SC 1 20,029 100.0 % 20,029 100.0 % 140,203 7.00 Riverbridge Shopping Center Carrollton, GA 11 91,188 98.5 % 89,788 98.5 % 663,789 7.39 Riversedge North (4) Virginia Beach, VA — — — % — — % — — Rivergate Shopping Center Macon, GA 32 205,810 97.6 % 199,277 96.8 % 2,922,006 14.66 Sangaree Plaza Summerville, SC 9 66,948 100.0 % 66,948 100.0 % 561,160 8.38 Shoppes at Myrtle Park Bluffton, SC 12 56,380 100.0 % 56,380 100.0 % 914,868 16.23 Shoppes at TJ Maxx Richmond, VA 18 93,624 100.0 % 93,624 100.0 % 1,131,352 12.08 South Lake Lexington, SC 10 44,318 100.0 % 44,318 100.0 % 401,601 9.06 South Park Mullins, SC 2 60,734 71.2 % 43,218 71.2 % 491,245 11.37 South Square Lancaster, SC 5 44,350 89.9 % 39,850 89.9 % 321,742 8.07 St. George Plaza St. George, SC 3 59,279 62.0 % 36,768 62.0 % 273,186 7.43 St. Matthews St. Matthews, SC 5 29,015 87.2 % 25,314 87.2 % 307,382 12.14 Sunshine Plaza Lehigh Acres, FL 20 111,189 92.8 % 103,133 92.8 % 924,180 8.96 Surrey Plaza Hawkinsville, GA 5 42,680 100.0 % 42,680 100.0 % 261,495 6.13 Tampa Festival Tampa, FL 18 137,987 94.0 % 129,687 94.0 % 1,160,624 8.95 The Shoppes at Eagle Harbor Carrollton, VA 6 23,303 94.1 % 21,917 94.1 % 434,113 19.81 Tri-County Plaza Royston, GA 7 67,577 90.5 % 61,177 90.5 % 440,787 7.21 Tulls Creek (3) Moyock, NC — — — % — — % — — Twin City Commons Batesburg-Leesville, SC 5 47,680 100.0 % 47,680 100.0 % 453,763 9.52 Village of Martinsville Martinsville, VA 18 297,950 96.1 % 286,431 96.1 % 2,235,444 7.80 Walnut Hill Plaza Petersburg, VA 8 87,239 65.0 % 56,737 65.0 % 446,519 7.87 Waterway Plaza Little River, SC 10 49,750 100.0 % 49,750 100.0 % 478,318 9.61 Westland Square West Columbia, SC 9 62,735 77.0 % 48,290 77.0 % 443,336 9.18 Winslow Plaza Sicklerville, NJ 14 40,695 87.0 % 35,400 87.0 % 523,908 14.80 Total Portfolio 704 4,906,511 94.2 % 4,563,267 93.0 % $ 43,590,706 $ 9.55 (1) Annualized base rent per occupied square foot, assumes base rent as of the end of the current reporting period; excludes the impact of tenant concessions. (2) We own the Amscot Building, but we do not own the land underneath the buildings and instead lease the land pursuant to ground leases with parties that are affiliates of Jon Wheeler. These ground leases require us to make annual rental payments and contain escalation and renewal options. (3) This information is not available because the property is undeveloped. (4) This property is our corporate headquarters that we 100% occupy. (5) This information is not available because the property is a redevelopment property (6) Reflects leases executed through April 7, 2017 that commence subsequent to the end of the current period.

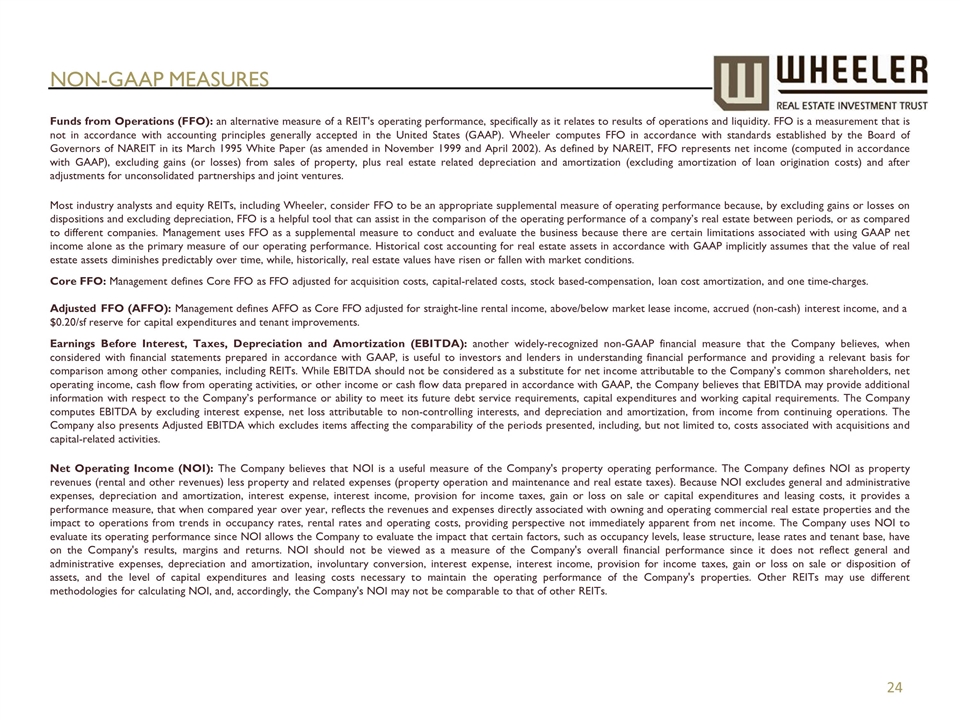

NON-GAAP MEASURES Funds from Operations (FFO): an alternative measure of a REIT's operating performance, specifically as it relates to results of operations and liquidity. FFO is a measurement that is not in accordance with accounting principles generally accepted in the United States (GAAP). Wheeler computes FFO in accordance with standards established by the Board of Governors of NAREIT in its March 1995 White Paper (as amended in November 1999 and April 2002). As defined by NAREIT, FFO represents net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus real estate related depreciation and amortization (excluding amortization of loan origination costs) and after adjustments for unconsolidated partnerships and joint ventures. Most industry analysts and equity REITs, including Wheeler, consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions and excluding depreciation, FFO is a helpful tool that can assist in the comparison of the operating performance of a company’s real estate between periods, or as compared to different companies. Management uses FFO as a supplemental measure to conduct and evaluate the business because there are certain limitations associated with using GAAP net income alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time, while, historically, real estate values have risen or fallen with market conditions. Core FFO: Management defines Core FFO as FFO adjusted for acquisition costs, capital-related costs, stock based-compensation, loan cost amortization, and one time-charges. Adjusted FFO (AFFO): Management defines AFFO as Core FFO adjusted for straight-line rental income, above/below market lease income, accrued (non-cash) interest income, and a $0.20/sf reserve for capital expenditures and tenant improvements. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): another widely-recognized non-GAAP financial measure that the Company believes, when considered with financial statements prepared in accordance with GAAP, is useful to investors and lenders in understanding financial performance and providing a relevant basis for comparison among other companies, including REITs. While EBITDA should not be considered as a substitute for net income attributable to the Company’s common shareholders, net operating income, cash flow from operating activities, or other income or cash flow data prepared in accordance with GAAP, the Company believes that EBITDA may provide additional information with respect to the Company’s performance or ability to meet its future debt service requirements, capital expenditures and working capital requirements. The Company computes EBITDA by excluding interest expense, net loss attributable to non-controlling interests, and depreciation and amortization, from income from continuing operations. The Company also presents Adjusted EBITDA which excludes items affecting the comparability of the periods presented, including, but not limited to, costs associated with acquisitions and capital-related activities. Net Operating Income (NOI): The Company believes that NOI is a useful measure of the Company's property operating performance. The Company defines NOI as property revenues (rental and other revenues) less property and related expenses (property operation and maintenance and real estate taxes). Because NOI excludes general and administrative expenses, depreciation and amortization, interest expense, interest income, provision for income taxes, gain or loss on sale or capital expenditures and leasing costs, it provides a performance measure, that when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from net income. The Company uses NOI to evaluate its operating performance since NOI allows the Company to evaluate the impact that certain factors, such as occupancy levels, lease structure, lease rates and tenant base, have on the Company's results, margins and returns. NOI should not be viewed as a measure of the Company's overall financial performance since it does not reflect general and administrative expenses, depreciation and amortization, involuntary conversion, interest expense, interest income, provision for income taxes, gain or loss on sale or disposition of assets, and the level of capital expenditures and leasing costs necessary to maintain the operating performance of the Company's properties. Other REITs may use different methodologies for calculating NOI, and, accordingly, the Company's NOI may not be comparable to that of other REITs.

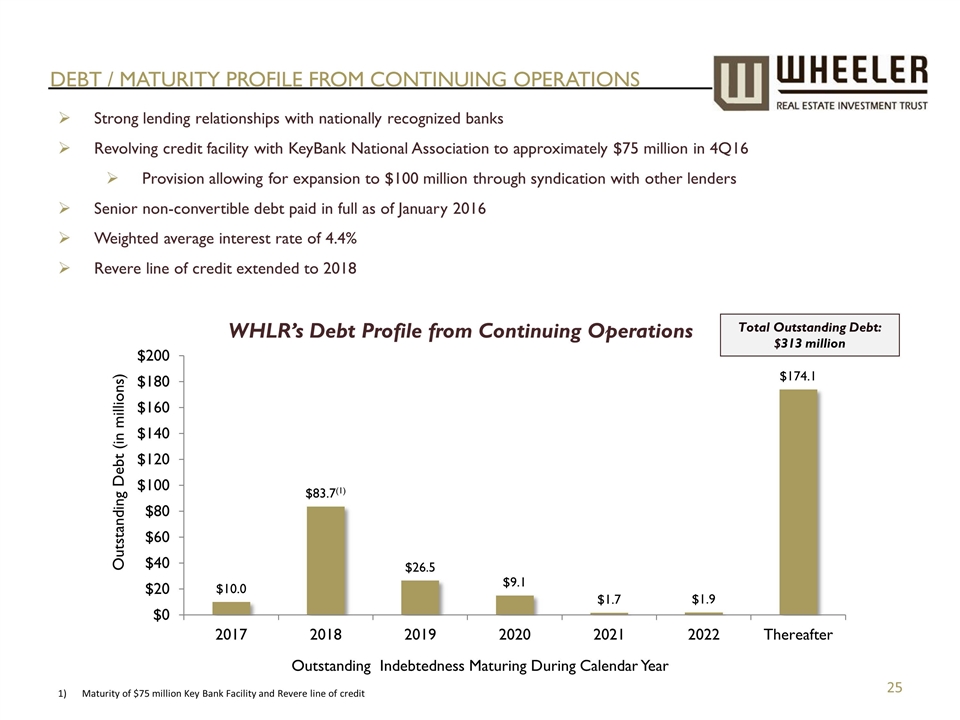

Strong lending relationships with nationally recognized banks Revolving credit facility with KeyBank National Association to approximately $75 million in 4Q16 Provision allowing for expansion to $100 million through syndication with other lenders Senior non-convertible debt paid in full as of January 2016 Weighted average interest rate of 4.4% Revere line of credit extended to 2018 WHLR’s Debt Profile from Continuing Operations Debt / Maturity profile FROM CONTINUING OPERATIONS Total Outstanding Debt: $313 million Maturity of $75 million Key Bank Facility and Revere line of credit

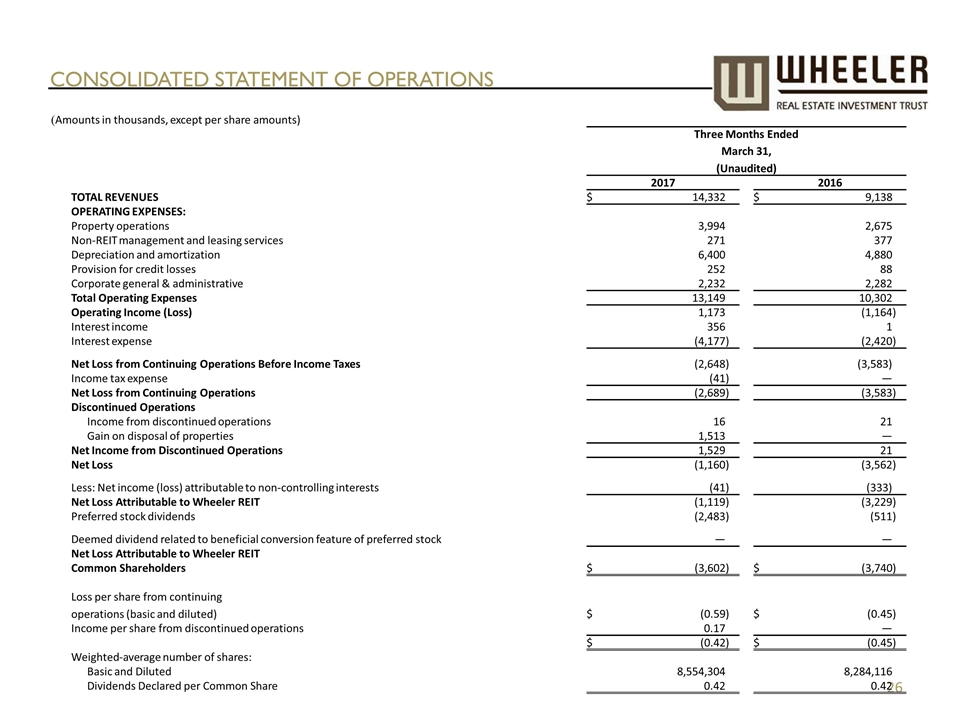

CONSOLIDATED STATEMENT OF OPERATIONS (Amounts in thousands, except per share amounts) Three Months Ended March 31, (Unaudited) 2017 2016 TOTAL REVENUES $ 14,332 $ 9,138 OPERATING EXPENSES: Property operations 3,994 2,675 Non-REIT management and leasing services 271 377 Depreciation and amortization 6,400 4,880 Provision for credit losses 252 88 Corporate general & administrative 2,232 2,282 Total Operating Expenses 13,149 10,302 Operating Income (Loss) 1,173 (1,164 ) Interest income 356 1 Interest expense (4,177 ) (2,420 ) Net Loss from Continuing Operations Before Income Taxes (2,648 ) (3,583) Income tax expense (41 ) — Net Loss from Continuing Operations (2,689 ) (3,583 ) Discontinued Operations Income from discontinued operations 16 21 Gain on disposal of properties 1,513 — Net Income from Discontinued Operations 1,529 21 Net Loss (1,160 ) (3,562 ) Less: Net income (loss) attributable to non-controlling interests (41 ) (333) Net Loss Attributable to Wheeler REIT (1,119 ) (3,229 ) Preferred stock dividends (2,483 ) (511 ) Deemed dividend related to beneficial conversion feature of preferred stock — — Net Loss Attributable to Wheeler REIT Common Shareholders $ (3,602 ) $ (3,740 ) Loss per share from continuing operations (basic and diluted) $ (0.59 ) $ (0.45 ) Income per share from discontinued operations 0.17 — $ (0.42 ) $ (0.45 ) Weighted-average number of shares: Basic and Diluted 8,554,304 8,284,116 Dividends Declared per Common Share 0.42 0.42

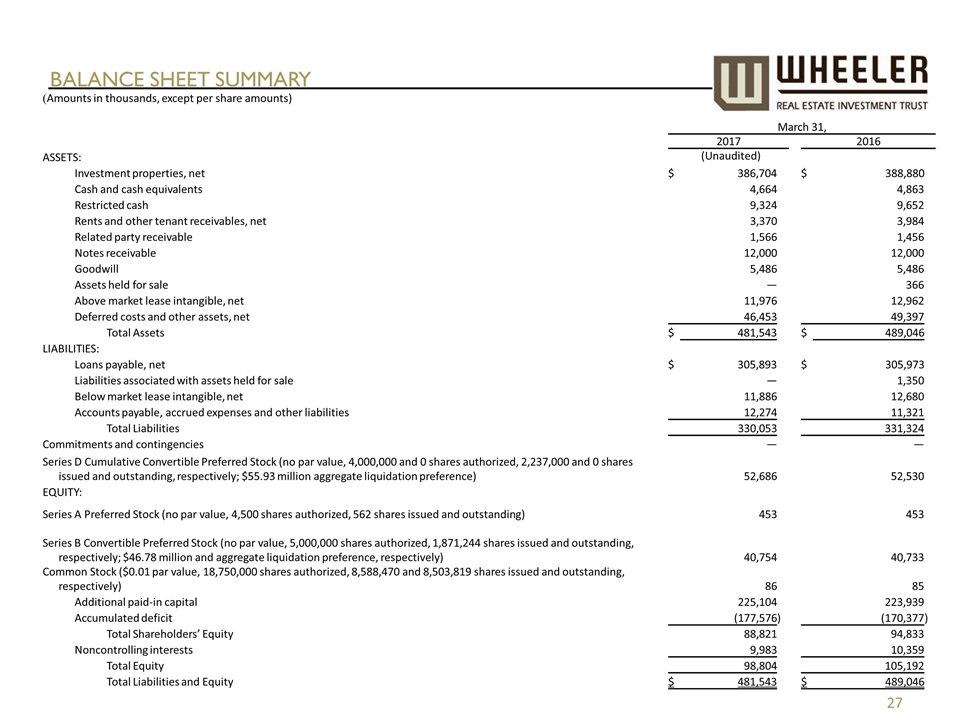

Balance sheet summary (Amounts in thousands, except per share amounts) March 31, 2017 2016 ASSETS: (Unaudited) Investment properties, net $ 386,704 $ 388,880 Cash and cash equivalents 4,664 4,863 Restricted cash 9,324 9,652 Rents and other tenant receivables, net 3,370 3,984 Related party receivable 1,566 1,456 Notes receivable 12,000 12,000 Goodwill 5,486 5,486 Assets held for sale — 366 Above market lease intangible, net 11,976 12,962 Deferred costs and other assets, net 46,453 49,397 Total Assets $ 481,543 $ 489,046 LIABILITIES: Loans payable, net $ 305,893 $ 305,973 Liabilities associated with assets held for sale — 1,350 Below market lease intangible, net 11,886 12,680 Accounts payable, accrued expenses and other liabilities 12,274 11,321 Total Liabilities 330,053 331,324 Commitments and contingencies — — Series D Cumulative Convertible Preferred Stock (no par value, 4,000,000 and 0 shares authorized, 2,237,000 and 0 shares issued and outstanding, respectively; $55.93 million aggregate liquidation preference) 52,686 52,530 EQUITY: Series A Preferred Stock (no par value, 4,500 shares authorized, 562 shares issued and outstanding) 453 453 Series B Convertible Preferred Stock (no par value, 5,000,000 shares authorized, 1,871,244 shares issued and outstanding, respectively; $46.78 million and aggregate liquidation preference, respectively) 40,754 40,733 Common Stock ($0.01 par value, 18,750,000 shares authorized, 8,588,470 and 8,503,819 shares issued and outstanding, respectively) 86 85 Additional paid-in capital 225,104 223,939 Accumulated deficit (177,576 ) (170,377 ) Total Shareholders’ Equity 88,821 94,833 Noncontrolling interests 9,983 10,359 Total Equity 98,804 105,192 Total Liabilities and Equity $ 481,543 $ 489,046

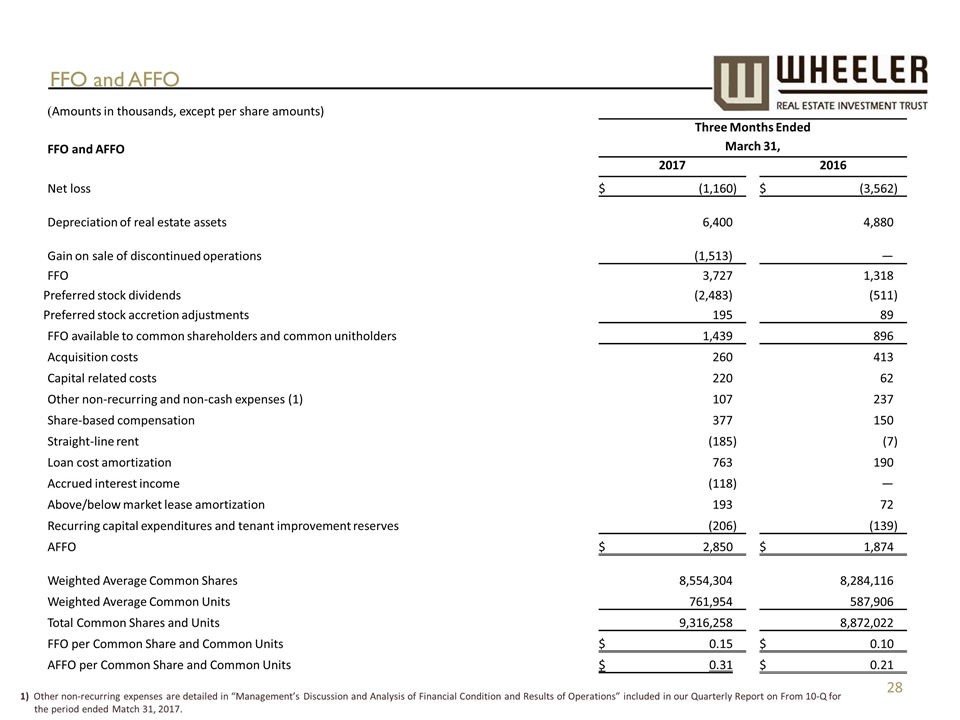

FFO and AFFO (Amounts in thousands, except per share amounts) FFO and AFFO Three Months Ended March 31, 2017 2016 Net loss $ (1,160 ) $ (3,562 ) Depreciation of real estate assets 6,400 4,880 Gain on sale of discontinued operations (1,513) — FFO 3,727 1,318 Preferred stock dividends (2,483) (511 ) Preferred stock accretion adjustments 195 89 FFO available to common shareholders and common unitholders 1,439 896 Acquisition costs 260 413 Capital related costs 220 62 Other non-recurring and non-cash expenses (1) 107 237 Share-based compensation 377 150 Straight-line rent (185 ) (7 ) Loan cost amortization 763 190 Accrued interest income (118 ) — Above/below market lease amortization 193 72 Recurring capital expenditures and tenant improvement reserves (206 ) (139 ) AFFO $ 2,850 $ 1,874 Weighted Average Common Shares 8,554,304 8,284,116 Weighted Average Common Units 761,954 587,906 Total Common Shares and Units 9,316,258 8,872,022 FFO per Common Share and Common Units $ 0.15 $ 0.10 AFFO per Common Share and Common Units $ 0.31 $ 0.21 1) Other non-recurring expenses are detailed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Quarterly Report on From 10-Q for the period ended Match 31, 2017.

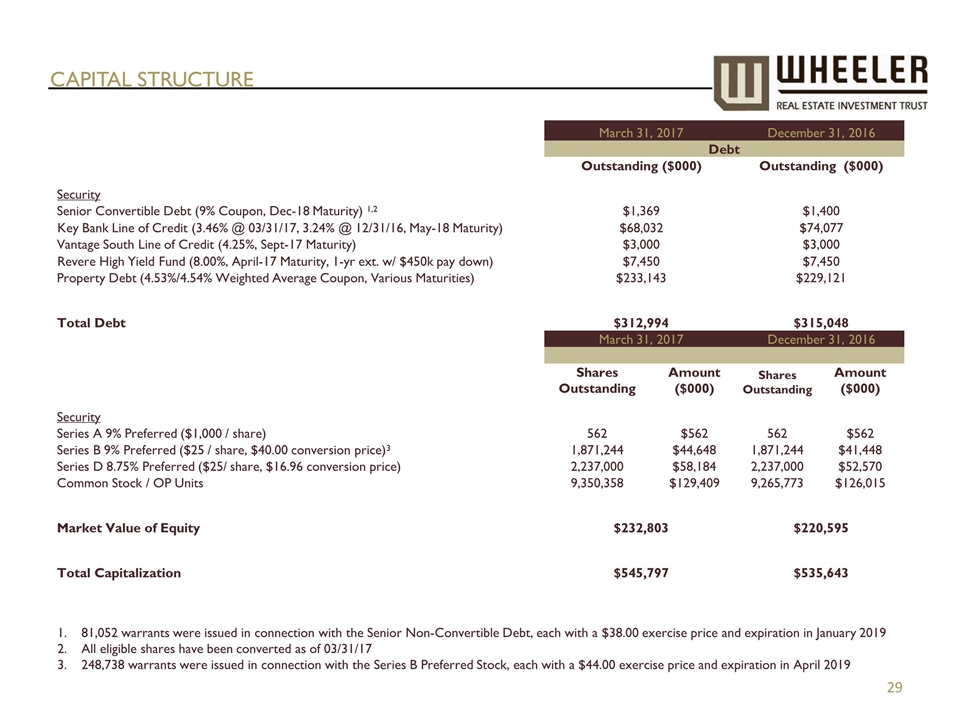

CAPITAL STRUCTURE March 31, 2017 December 31, 2016 Debt Outstanding ($000) Outstanding ($000) Security Senior Convertible Debt (9% Coupon, Dec-18 Maturity) 1,2 $1,369 $1,400 Key Bank Line of Credit (3.46% @ 03/31/17, 3.24% @ 12/31/16, May-18 Maturity) $68,032 $74,077 Vantage South Line of Credit (4.25%, Sept-17 Maturity) $3,000 $3,000 Revere High Yield Fund (8.00%, April-17 Maturity, 1-yr ext. w/ $450k pay down) $7,450 $7,450 Property Debt (4.53%/4.54% Weighted Average Coupon, Various Maturities) $233,143 $229,121 Total Debt $312,994 $315,048 March 31, 2017 December 31, 2016 Shares Outstanding Amount ($000) Shares Outstanding Amount ($000) Security Series A 9% Preferred ($1,000 / share) 562 $562 562 $562 Series B 9% Preferred ($25 / share, $40.00 conversion price)3 1,871,244 $44,648 1,871,244 $41,448 Series D 8.75% Preferred ($25/ share, $16.96 conversion price) 2,237,000 $58,184 2,237,000 $52,570 Common Stock / OP Units 9,350,358 $129,409 9,265,773 $126,015 Market Value of Equity $232,803 $220,595 Total Capitalization $545,797 $535,643 81,052 warrants were issued in connection with the Senior Non-Convertible Debt, each with a $38.00 exercise price and expiration in January 2019 All eligible shares have been converted as of 03/31/17 248,738 warrants were issued in connection with the Series B Preferred Stock, each with a $44.00 exercise price and expiration in April 2019

NASDAQ: WHLR Think Retail. Think Wheeler.®