Exhibit 4.3

|

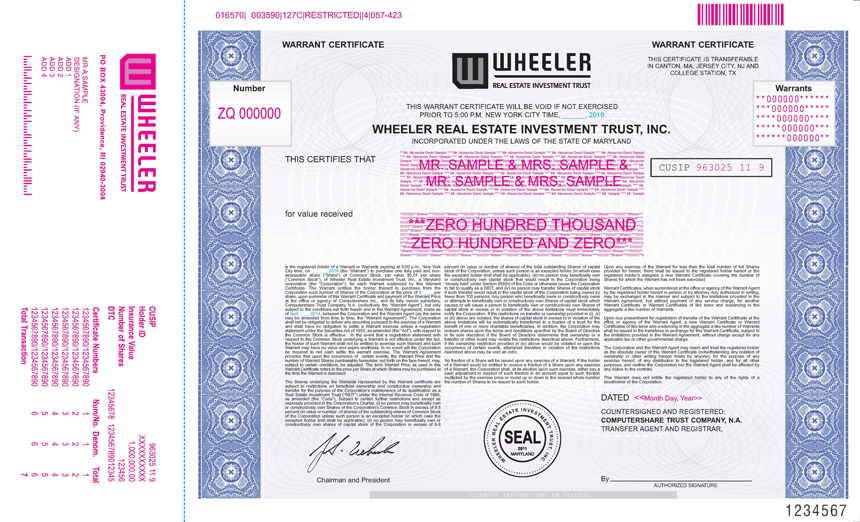

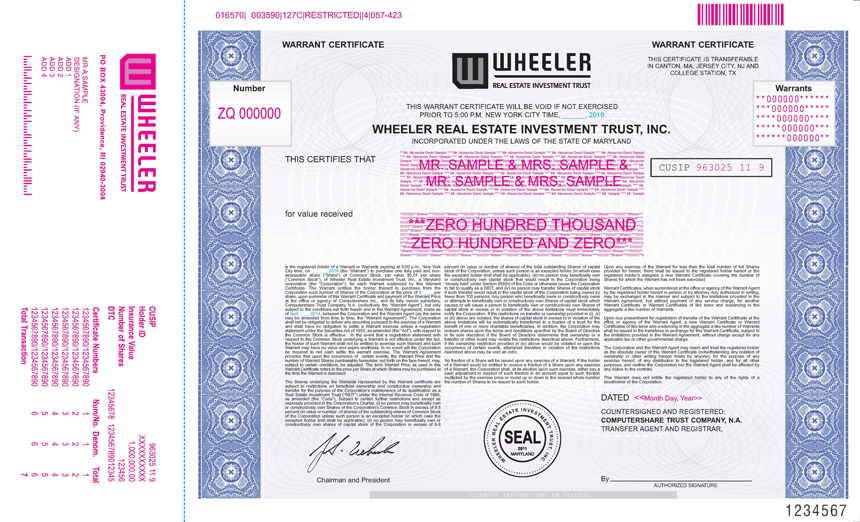

016570| 003590|127C|RESTRICTED||4|057-423

WARRANT CERTIFICATE

WARRANT CERTIFICATE

THIS CERTIFICATE IS TRANSFERABLE IN CANTON, MA, JERSEY CITY, NJ AND

COLLEGE STATION, TX

Warrants

* * 000000 ******

* * * 000000 *****

**** 000000 ****

***** 000000* * *

****** 000000* *

Number ZQ 000000

THIS WARRANT CERTIFICATE WILL BE VOID IF NOT EXERCISED PRIOR TO 5:00 P.M. NEW YORK CITY TIME, , 2019

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

INCORPORATED UNDER THE LAWS OF THE STATE OF MARYLAND

THIS CERTIFIES THAT

for value received

**** Mr. Alexander David Sample **** Mr. Alexander David Sample

**Shares****000000**Shares****000000**Shares

is the registered holder of a Warrant or Warrants expiring at 5:00 p.m., New York City time, on , 2019 (the “Warrant”) to purchase one fully paid and non-assessable share (“Share”) of Common Stock, par value $0.01 per share (“Common Stock”), of Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Corporation”), for each Warrant evidenced by this Warrant Certificate. The Warrant entitles the holder thereof to purchase from the Corporation such number of Shares of the Corporation at the price of $ per share, upon surrender of this Warrant Certificate and payment of the Warrant Price at the office or agency of Computershare Inc., and its fully owned subsidiary, Computershare Trust Company N.A. (collectively the “Warrant Agent”), but only subject to the conditions set forth herein and in the Warrant Agreement, made as of April , 2014, between the Corporation and the Warrant Agent (as the same may be amended from time to time, the “Warrant Agreement”). The Corporation shall not be obligated to deliver any securities pursuant to the exercise of a Warrant and shall have no obligation to settle a Warrant exercise unless a registration statement under the Securities Act of 1933, as amended (the “Act”), with respect to the Common Stock is effective. In the event that a registration statement with respect to the Common Stock underlying a Warrant is not effective under the Act, the holder of such Warrant shall not be entitled to exercise such Warrant and such Warrant may have no value and expire worthless. In no event will the Corporation be required to net cash settle the warrant exercise. The Warrant Agreement provides that upon the occurrence of certain events, the Warrant Price and the number of Warrant Shares purchasable hereunder, set forth on the face hereof, may, subject to certain conditions, be adjusted. The term Warrant Price as used in this Warrant Certificate refers to the price per Share at which Shares may be purchased at the time the Warrant is exercised. The Shares underlying the Warrants represented by this Warrant certificate are subject to restrictions on beneficial ownership and constructive ownership and transfer for the purpose of the Corporation’s maintenance of its qualification as a Real Estate Investment Trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). Subject to certain further restrictions and except as expressly provided in the Corporation’s Charter, (i) no person may beneficially own or constructively own Shares of the Corporation’s Common Stock in excess of 9.8 percent (in value or number of shares) of the outstanding shares of Common Stock of the Corporation unless such person is an excepted holder (in which case the excepted holder limit shall be applicable); (ii) no person may beneficially own or constructively own shares of capital stock of the Corporation in excess of 9.8

percent (in value or number of shares) of the total outstanding Shares of capital stock of the Corporation, unless such person is an excepted holder (in which case the excepted holder limit shall be applicable); (iii) no person may beneficially own or constructively own capital stock that would result in the Corporation being “closely held” under Section 856(h) of the Code or otherwise cause the Corporation to fail to qualify as a REIT; and (iv) no person may transfer Shares of capital stock if such transfer would result in the capital stock of the Corporation being owned by fewer than 100 persons. Any person who beneficially owns or constructively owns or attempts to beneficially own or constructively own Shares of capital stock which causes or will cause a person to beneficially own or constructively own Shares of capital stock in excess or in violation of the above limitations must immediately notify the Corporation. If the restrictions on transfer or ownership provided in (i), (ii) or (iii) above are violated, the shares of capital stock in excess or in violation of the above limitations will be automatically transferred to a trustee of a trust for the benefit of one or more charitable beneficiaries. In addition, the Corporation may redeem shares upon the terms and conditions specified by the Board of Directors in its sole discretion if the Board of Directors determines that ownership or a transfer or other event may violate the restrictions described above. Furthermore, if the ownership restriction provided in (iv) above would be violated or upon the occurrence of certain events, attempted transfers in violation of the restrictions described above may be void ab initio. No fraction of a Share will be issued upon any exercise of a Warrant. If the holder of a Warrant would be entitled to receive a fraction of a Share upon any exercise of a Warrant, the Corporation shall, at its election upon such exercise, either pay a cash adjustment in respect of such fraction in an amount equal to such fraction multiplied by the exercise price or round up or down to the nearest whole number the number of Shares to be issued to such holder. Upon any exercise of the Warrant for less than the total number of full Shares provided for herein, there shall be issued to the registered holder hereof or the registered holder’s assignee a new Warrant Certificate covering the number of Shares for which the Warrant has not been exercised. Warrant Certificates, when surrendered at the office or agency of the Warrant Agent by the registered holder hereof in person or by attorney duly authorized in writing, may be exchanged in the manner and subject to the limitations provided in the Warrant Agreement, but without payment of any service charge, for another Warrant Certificate or Warrant Certificates of like tenor and evidencing in the aggregate a like number of Warrants. Upon due presentment for registration of transfer of the Warrant Certificate at the office or agency of the Warrant Agent, a new Warrant Certificate or Warrant Certificates of like tenor and evidencing in the aggregate a like number of Warrants shall he issued to the transferee in exchange for this Warrant Certificate, subject to the limitations provided in the Warrant Agreement, without charge except for any applicable tax or other governmental charge.

The Corporation and the Warrant Agent may deem and treat the registered holder as the absolute owner of this Warrant Certificate (notwithstanding any notation of ownership or other writing hereon made by anyone), for the purpose of any exercise hereof, of any distribution to the registered holder, and for all other purposes, and neither the Corporation nor the Warrant Agent shall be affected by any notice to the contrary. This Warrant does not entitle the registered holder to any of the rights of a stockholder of the Corporation.

DATED <<Month Day, Year>>

COUNTERSIGNED AND REGISTERED:

COMPUTERSHARE TRUST COMPANY, N.A.

TRANSFER AGENT AND REGISTRAR,

Chairman and President

By

AUTHORIZED SIGNATURE

1234567

PO BOX 43004, Providence, RI 02940-3004

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

CUSIP 911963025 Holder ID XXXXXXXXXX

Insurance Value 00.1,000,000 Number of Shares 123456

DTC 12345678901234512345678

Certificate Numbers Num/No Denom. Total.

1234567890/1234567890

Total Transaction 7

|

|

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

SUBSCRIPTION FORM

To Be Executed by the Registered Holder in Order to Exercise Warrants

The undersigned Registered Holder irrevocably elects to exercise

Warrants represented by this Warrant Certificate, and to

purchase the shares of Common Stock issuable upon the exercise of such Warrants, and requests that Certificates for such shares shall be issued in the name of

(PLEASE TYPE OR PRINT NAME AND ADDRESS)

and be delivered to

(SOCIAL SECURITY OR TAX IDENTIFICATION NUMBER)

(PLEASE TYPE OR PRINT NAME AND ADDRESS)

and, if such number of Warrants shall not be all the Warrants evidenced by this Warrant Certificate, that a new Warrant Certificate for the balance of such Warrants be registered in the name of, and delivered to, the Registered Holder at the address stated below:

Dated:

Signature:

Address:

Tax Identification Number:

ASSIGNMENT

To Be Executed by the Registered Holder in Order to Assign Warrants

For value received,

hereby sell, assign and transfer unto

(PLEASE TYPE OR PRINT NAME AND ADDRESS)

and be delivered to

(SOCIAL SECURITY OR TAX IDENTIFICATION NUMBER)

(PLEASE TYPE OR PRINT NAME AND ADDRESS)

of the Warrants represented by this Warrant Certificate, and hereby irrevocably constitute and appoint Attorney to transfer this Warrant Certificate on the books of the Corporation, with full power of substitution in the premises.

Dated:

Signature:

THE SIGNATURE TO THE ASSIGNMENT OF THE SUBSCRIPTION

FORM MUST CORRESPOND TO THE NAME WRITTEN UPON THE FACE OF THIS WARRANT CERTIFICATE IN EVERY PARTICULAR, WITHOUT ALTERATION OR ENLARGEMENT OR ANY CHANGE WHATSOEVER, AND MUST BE GUARANTEED BY A COMMERCIAL BANK OR TRUST COMPANY OR A MEMBER FIRM OF THE AMERICAN STOCK EXCHANGE, NASDAQ, NEW YORK STOCK EXCHANGE, PACIFIC STOCK EXCHANGE OR CHICAGO STOCK EXCHANGE.

Signature(s) Guaranteed: Medallion Guarantee Stamp

THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (Banks, Stockbrokers, Savings and Loan Associations and Credit Unions) WITH MEMBERSHIP IN AN APPROVED SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15.

The IRS requires that we report the cost basis of certain shares acquired after January 1, 2011. If your shares were covered by the legislation and you have sold or transferred the shares and requested a specific cost basis calculation method, we have processed as requested. If you did not specify a cost basis calculation method, we have defaulted to the first in, first out (FIFO) method. Please visit our website or consult your tax advisor if you need additional information about cost basis.

If you do not keep in contact with us or do not have any activity in your account for the time periods specified by state law, your property could become subject to state unclaimed property laws and transferred to the appropriate state.