UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |

| x | Definitive Proxy Statement. | |

| ¨ | Definitive Additional Materials. | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12. | |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Riversedge North

2529 Virginia Beach Boulevard, Suite 200

Virginia Beach, Virginia 23452

November 22, 2013

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Wheeler Real Estate Investment Trust, Inc. Our Annual Meeting with be held at the Cavalier Golf & Yacht Club, 1052 Cardinal Road, Virginia Beach, Virginia 23451, on December 20, 2013 at 9:30 a.m., local Virginia Beach, Virginia time.

The enclosed Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting, which includes a report on the operations of the Company. Directors and officers of the Company will be present to answer any questions that you and other stockholders may have. Also enclosed for your review is our Annual Report on Form 10-K, which contains detailed information concerning the activities and operating performance of the Company.

The business to be conducted at the Annual Meeting consists of the reelection of eight members of the Board of Directors and the reappointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. The Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interest of Wheeler Real Estate Investment Trust, Inc., and its stockholders, and the Board of Directors unanimously recommends a vote “FOR” the reelection of the director nominees as well as the reappointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013.

Please indicate your vote by using the enclosed proxy card or by voting by Telephone or Internet, even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted. Your vote is important.

Sincerely,

Jon S. Wheeler

Chairman and Chief Executive Officer

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 20, 2013

Wheeler Real Estate Investment Trust, Inc. will hold its Annual Meeting of Stockholders on Friday, December 20, 2013, at 9:30 a.m., local Virginia Beach, Virginia time, Cavalier Golf & Yacht Club, 1052 Cardinal Road, Virginia Beach, VA 23451. The purpose of the meeting is to:

| • | Elect a Board of eight directors to serve until the next Annual Meeting of Stockholders and until their successors are duly-elected and qualified. |

| • | Ratify the appointment of Cherry Bekaert LLP as the independent registered public accounting firm. |

| • | Act upon such other matters as may properly be presented at the Annual Meeting. |

Only Stockholders of record at the close of business on November 19, 2013, will be entitled to vote at the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card in the accompanying envelope provided. Your completed proxy will not prevent you from attending the meeting and voting in person should you choose.

Dated: November 22, 2013

| By order of the Board of Directors, |

|

| Robin Hanisch |

| Corporate Secretary |

This Proxy Statement is available at www.whlr.us. Among other things, the Proxy Statement contains information regarding

| • The date, time and location of the meeting

• A list of the matters being submitted to Stockholders

• Information concerning voting in person |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 20, 2013

The Board of Directors of Wheeler Real Estate Investment Trust, Inc. (the “Company” or “we” or “us”) is soliciting proxies to be used at the Annual Meeting of Stockholders following the fiscal year ended December 31, 2012 (the “Annual Meeting”). Distribution of this Proxy Statement and a Proxy Form is scheduled to begin on November 22, 2013. The mailing address of the Company’s principal executive office is Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452.

About the Meeting

Who Can Vote

Record holders of Common Stock of the Company at the close of business on Tuesday, November 19, 2013, (the “Record Date”) may vote at the Annual Meeting. On that date, 7,121,000 shares of Common Stock were outstanding. Each share is entitled to cast one vote.

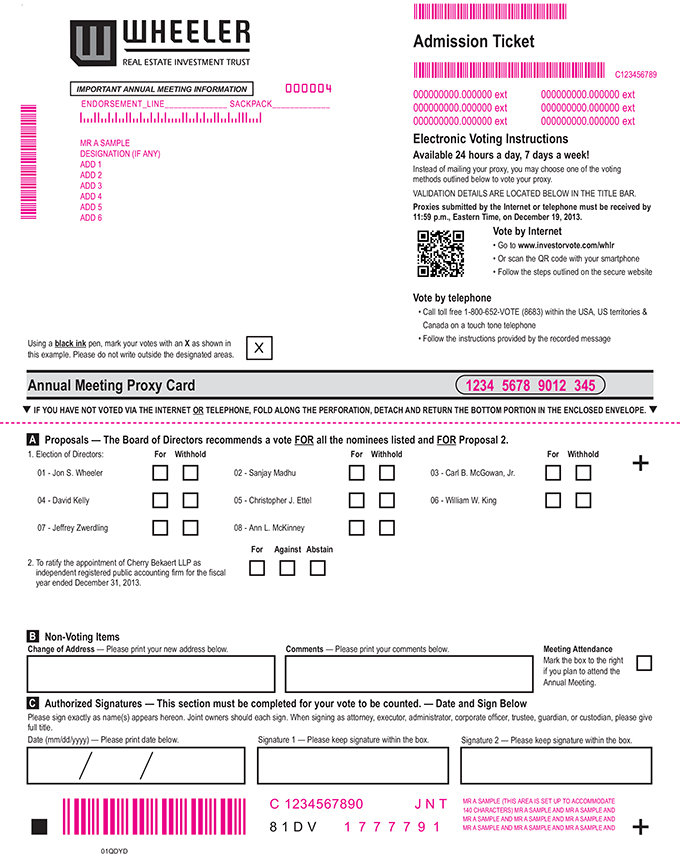

How Can You Vote

If you return your signed proxy before the Annual Meeting, we will vote your shares as you direct. You can specify whether your shares should be voted for all, some or none of the nominees for director. You can also specify whether you approve, disapprove or abstain from the other proposal to ratify the selection of auditors. You can also vote by Internet, at the address shown on your proxy card or by Phone, at 1-800-652-VOTE (8683).

If a proxy is executed and returned but no instructions are given, the shares will be voted according to the recommendations of the Board of Directors. The Board of Directors recommends a vote FOR Proposals 1 and 2.

Revocation of Proxies

You may revoke your proxy at any time before it is exercised by (a) delivering a written notice of revocation to the Corporate Secretary, (b) delivering another proxy that is dated later than the original proxy, or (c) casting your vote in person at the Annual Meeting. Your last vote will be the vote that is counted.

What am I voting on?

You will be voting on the following:

| (1) | The reelection of eight members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Shareholders in 2014 or until their successors are duly elected and qualified; |

| (2) | The reappointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. |

2

Vote Required

The holders of a majority of the shares entitled to vote who are either present in person or represented by a proxy at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. As of November 19, 2013, there were 7,121,000 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of stockholders entitled to cast at least 3,560,501 votes constitutes a quorum for adopting the proposals at the Annual Meeting. If you have properly signed and returned your proxy card by mail or voted by internet or phone, you will be considered part of the quorum, and the persons named on the proxy card will vote your shares as you have instructed. If the broker holding your shares in “street” name indicates to us on a proxy card that the broker lacks discretionary authority to vote your shares, we will not consider your shares as present or entitled to vote for any purpose.

A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected to that slot. A proxy that has properly withheld authority with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

For the other proposal, the affirmative vote of the holders of a majority of the shares represented in person or by proxy entitled to vote on the proposal will be required for approval. An abstention with respect to such proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

As of the Record Date, affiliates held 357,558 shares representing approximately 5.02% of the shares outstanding. These affiliates have advised the Company that they currently intend to vote all of their shares in favor of the approval of both proposals.

If you received multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different names. You should vote each of the proxy cards to ensure that all your shares are voted.

Other Matters to be Acted Upon at the Annual Meeting

We do not know of any other matters to be validly presented or acted upon at the Annual Meeting. If any other matter is presented at the Annual Meeting on which a vote may be properly taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

Expenses of Solicitation

The Company is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, by telephone or mail. Proxy materials will also be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares held in their names.

Available Information

Our internet website address is www.whlr.us. We make available free of charge through our website our most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange Commission (the “SEC”). In addition, we have posted the Charters of our Audit Committee, Compensation Committee, and Nominating Committee, as well as our Code of Business Conduct and Ethics, Corporate Governance Principles including guidelines on director independence, and Inside Trading Policy all under separate headings. These charters and principles are not incorporated in this instrument by reference. We will also provide a copy of these documents free of charge to stockholders upon written request.

3

Multiple Stockholders Sharing the Same Address

The SEC rules allow for the delivery of a single copy of an annual report and proxy statement to any household at which two or more stockholders reside, if it is believed the stockholders are members of the same family. Duplicate account mailings will be eliminated by allowing stockholders to consent to such elimination, or through implied consent if a stockholder does not request continuation of duplicate mailings. Depending upon the practices of your broker, bank or other nominee, you may need to contact them directly to continue duplicate mailings to your household. If you wish to revoke your consent to householding, you must contact your broker, bank or other nominee.

If you hold shares of common stock in your own name as a holder of record, householding will not apply to your shares.

If you wish to request extra copies free of charge of any annual report, proxy statement or information statement, please send your request to Wheeler Real Estate Investment Trust, Inc., Attention: Secretary, Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452.

Questions

You may call our Investor Relations Department at 757-627-9088 if you have any questions.

PLEASE VOTE—YOUR VOTE IS IMPORTANT

4

Corporate Governance and Board Matters

The affairs of the Company are managed by the Board of Directors. The Directors are elected at the annual meeting of stockholders each year or appointed by the incumbent Board of Directors and serve until the next annual meeting of stockholders or until a successor has been elected or approved.

Current members of the Board

The members of the Board of Directors on the date of this proxy statement, and the committees of the Board on which they serve, are identified below:

| Director |

Audit Committee | Compensation Committee |

Governance and Nominating Committee |

Real Estate Committee | ||||

| Jon S. Wheeler |

— | — | — | — | ||||

| Sanjay Madhu |

Member | — | Chairperson | — | ||||

| Carl B. McGowan, Jr. |

Chairperson | — | — | Member | ||||

| David Kelly |

— | — | — | — | ||||

| Christopher J. Ettel |

— | Member | Member | Member | ||||

| William W. King |

Member | Chairperson | Member | — | ||||

| Jeffrey Zwerdling |

— | Member | — | Chairperson | ||||

| Ann L. McKinney |

— | — | — | — |

Role of the Board’s Committees

The Board of Directors has standing Audit, Compensation, Governance and Nominating Committees and Real Estate Committees.

Audit Committee. The functions of the Audit Committee are described below under the heading “Report of the Audit Committee.” The charter of the Audit Committee was adopted on November 16, 2012, and is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. Dr. McGowan, a member and Chair of the Audit Committee, is qualified as an “audit committee financial expert” within the meaning of SEC regulations and the Board has determined that he has accounting and related financial management expertise within the meaning of the listing standards of the Nasdaq Stock Market. All of the members of the Audit Committee meet the independence and experience requirements of the listing standards of the Nasdaq Stock Market. As we only recently became a public-reporting company in November 2012, the Audit Committee did not meet in 2012.

Governance and Nominating Committee. The Governance and Nominating Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Guidelines. In addition, the Governing and Nominating Committee develops and reviews background information on candidates for the Board and makes recommendations to the Board regarding such candidates. The Governing and Nominating Committee also prepares and supervises the Board’s annual review of director independence and the Board’s performance self-evaluation. The charter of the Governance and Nominating Committee was adopted on November 16, 2012, and is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Governing and Nominating Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. As we only recently became a public-reporting company in November 2012, the Nominating and Corporate Governance Committee did not meet in 2012.

5

Compensation Committee. The Compensation Committee is responsible for overseeing the policies of the Company relating to compensation to be paid by the Company to the Company’s principal executive officer and any other officers designated by the Board and make recommendations to the Board with respect to such policies, produce necessary reports on executive compensation for inclusion in the Company’s proxy statement in accordance with applicable rules and regulations and to monitor the development and implementation of succession plans for the principal executive officer and other key executives and make recommendations to the Board with respect to such plans. The charter of the Compensation Committee was adopted on November 16, 2012, and is available on the Company’s Investor Relations website (www.whlr.us). All of the members of the Compensation Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Compensation Committee is to be comprised of at least two directors who are independent of management and the Company. The Compensation Committee may not delegate its authority to other persons. The Compensation Committee has not engaged a compensation consultant to assist in the determination of executive compensation issues. While the Company’s executives will communicate with the Compensation Committee regarding executive compensation issues, the Company’s executive officers do not participate in any executive compensation decisions. As we only recently became a public-reporting company in November 2012, the Compensation Committee did not meet in 2012.

Real Estate Committee. The Real Estate Committee is responsible for reviewing and analyzing strategic real estate acquisitions and investments. In addition, the Real Estate Committee makes recommendations to the Board regarding the potential real estate acquisitions and investments. The Real Estate Committee was recently formed on September 25, 2013 and has not adopted a charter. All of the members of the Real Estate Committee are independent within the meaning of the listing standards of the Nasdaq Stock Market and the Company’s Corporate Governance Principles. The Real Estate Committee did not meet in 2012 because it was not formed until 2013.

Board Leadership Structure

Mr. Wheeler currently holds both the positions of Chief Executive Officer and Chairman of the Board. These two positions have not been consolidated into one position; Mr. Wheeler simply holds both positions at this time. The Board of Directors believes that Mr. Wheeler’s service as both Chief Executive Officer and Chairman of the Board is in the best interests of the Company and its shareholders. Mr. Wheeler possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its business and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s shareholders, employees, customers and suppliers.

We do not have a lead independent director because of the foregoing reasons and also because we believe our independent directors are encouraged to freely voice their opinions on a relatively small company board. We believe this leadership structure is appropriate because we are a smaller reporting company and as such we deem it appropriate to be able to benefit from the guidance of Mr. Wheeler as both our Chief Executive Officer and Chairman of the Board.

Selection of Nominees for the Board

The Governance and Nominating Committee will consider candidates for Board membership suggested by its members and other Board members, as well as management and stockholders. The committee may also retain a third-party executive search firm to identify candidates upon request of the committee from time to time. A stockholder who wishes to recommend a prospective nominee for the Board should notify the Company’s Corporate Secretary or any member of the Governance and Nominating Committee in writing with whatever supporting material the stockholder considers appropriate. The Governance and Nominating Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of the Company’s Bylaws relating to stockholder nominations.

Once the Governance and Nominating Committee has identified a prospective nominee, the committee will make an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination will be based on whatever information is provided to the committee with the recommendation of the prospective candidate, as well as the committee’s own knowledge of the prospective candidate, which may be supplemented by

6

inquiries to the person making the recommendation or others. The preliminary determination will be based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the committee. The committee will then evaluate the prospective nominee against the standards and qualifications generally set out in the Company’s Corporate Governance Guidelines, including:

| • | the ability of the prospective nominee to represent the interests of the stockholders of the Company; |

| • | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| • | the prospective nominee’s ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Guidelines; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; |

| • | the extent to which the prospective nominee helps the Board reflect the diversity of the Company’s stockholders, employees, customers, guests and communities; and |

| • | the willingness of the prospective nominee to meet any minimum equity interest holding guideline. |

The Governance and Nominating Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Governance and Nominating Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Governance and Nominating Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the committee.

The Bylaws of the Company provide that any stockholder entitled to vote at the Annual Meeting in the election of directors generally may nominate one or more persons for election as directors at a meeting only if written notice of such stockholders’ intention to make such nomination has been delivered personally to, or has been mailed to and received by the Secretary at the principal office of the Company not later than 10 days following the notice this annual meeting. If a stockholder has a suggestion for candidates for election, the stockholder should follow this procedure. Each notice from a stockholder must set forth (i) the name and address of the stockholder who intends to make the nomination and the name of the person to be nominated, (ii) the class and number of shares of stock held of record, owned beneficially and represented by proxy by such stockholder as of the record date for the meeting and as of the date of such notice, (iii) a representation that the stockholder intends to appear in person or by proxy at the meeting to nominate the person specified in the notice, (iv) a description of all arrangements or understandings between such stockholder and each nominee and any other person (naming those persons) pursuant to which the nomination is to be made by such stockholder, (v) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules, and (vi) the consent of each nominee to serve as a director of the Company if so elected. The chairman of the Annual Meeting may refuse to acknowledge the nomination of any person not made in compliance with this procedure.

7

Determinations of Director Independence

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law, listing standards and the Company’s director independence standards. The Company believes that it maintains a majority of independent directors who are deemed to be independent under the definition of independence provided by NASDAQ Listing Rule 5605(a)(2).

Board Meetings During Fiscal 2012

The Board met once during the fiscal year 2012. No incumbent director attended fewer than 100% of the meetings of the Board, and each director attended all of the meetings of the Committees on which he or she served. Under the Company’s Corporate Governance Guidelines, each Director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including by attending meetings of the stockholders of the Company, the Board and Committees of which he or she is a member.

| Director Compensation (1) | ||||||||||||||||||||||||||||

| Name | Fees earned or paid in cash ($) |

Stock ($) |

Option awards ($) |

Non-equity ($) |

Nonqualified deferred compensation earnings ($) |

All other ($) |

Total ($) |

|||||||||||||||||||||

| (a) |

(b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||||

| Christopher Ettel |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| David Kelly |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| William W. King |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| Sanjay Madhu |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| John McAuliffe (2) |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| Ann L. McKinney |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| Carl B. McGowan, Jr. (3) |

0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||

| Jeffrey Zwerdling |

1,875 | 0 | 0 | 0 | 0 | 0 | 1,875 | |||||||||||||||||||||

| (1) | This table does not include Jon Wheeler, our Chairman and CEO, because his compensation is fully reflected in the Summary Compensation Table. |

| (2) | Mr. McAuliffe resigned as a director in 2013. |

| (3) | Mr. McGowan became a director in 2013 and did not earn or receive compensation in 2012. |

Stockholder Communications with the Board

Stockholders and other parties interested in communicating directly with board of directors, including communications regarding concerns relating to accounting, internal accounting controls or audit measures, or fraud or unethical behavior, may do so by writing to the directors at the following address: Wheeler Real Estate Investment Trust, Inc., Attention: Secretary, Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. The Governance and Nominating Committee of the Board also approved a process for handling letters received by the Company and addressed to members of the Board but received at the Company. Under that process, the Corporate Secretary of the Company reviews all such correspondence and regularly forwards to the Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that she otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board and received by the Company and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chairman of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

8

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics, which applies to all directors, officers and employees. The text of the document is available on the Company’s Investor Relations website (www.whlr.us). The Company intends to post amendments to or waivers from its Code of Ethics (to the extent applicable to the Company’s Chief Executive Officer and Chief Financial Offer) at this location on its website.

Compliance with Section 16(a) of Reporting Requirements

Section 16(a) under the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and any persons holding 10% or more of the Company’s shares of Common Stock to report their ownership of the Company’s shares of Common Stock and any changes in that ownership to the SEC on specified report forms. Specific due dates for these reports have been established, and the Company is required to report any failure to file by these dates during each fiscal year. All of these filing requirements were satisfied by the Company’s directors and executive officers and holders of more than 10% of the Company’s Common Stock during the fiscal year ended December 31, 2012. In making these statements, the Company has relied upon the written representations of its directors and executive officers and the holders of 10% or more of the Company’s Common Stock and copies of the reports that each has filed with the SEC.

Management—Business History of Executive Officers

For information as to the business history of our Chief Executive Officer Mr. Wheeler, see the section “Proposal One: Election of Directors” elsewhere in this Proxy Statement.

Steven M. Belote

Age — 48

Mr. Belote is a Certified Public Accountant, has served as our Chief Financial Officer (CFO) since August 2011. After receiving a Bachelor’s of Science Degree in Accounting from Virginia Tech, he spent seven years working in Washington, DC with BDO Seidman, LLP, a large international public accounting and consulting firm. In June 1995, he joined Shore Bank as their CFO, subsequently playing a significant role in taking the bank public in 1997. Mr. Belote served as CFO for the bank’s publicly-traded bank holding company, Shore Financial Corporation, until the company was purchased in June 2008. Mr. Belote continued as the bank’s CFO until becoming its president in June 2009; a role he held until December 2010. Mr. Belote has been affiliated with and held various roles in many organizations, including: the Melfa Rotary Club from 1996-2010, serving as the club’s president from 1998-1999; the Eastern Shore of Virginia Chamber of Commerce Board of Directors from 2004-2010, serving as treasurer from 2009-2010; the Eastern Shore of Virginia United Way from 2000-2008, serving as campaign chair during 2000 and serving on the board of directors from 2001-2008, including the role of president from 2004-2006; the Virginia Bankers Association CFO Committee from 1999-2009, serving as chair from 2003-2006; a member of the Maryland Financial Bank advisory board from 2005-present; and as a member of the Bay Beyond, Inc. (Blue Crab Bay Co.) advisory board from 1997 through 2005, among others.

Robin Hanisch

Age — 56

Ms. Hanisch currently serves as the Corporate Secretary for WHLR. Ms. Hanisch has served as an Associate at Wheeler Interests since 2000, where she oversees Human Resources and Investor Relations. Ms. Hanisch has been the main point of contact for investors in Wheeler Interests. Prior to joining Wheeler Interests, Ms. Hanisch worked in fund development and marketing for a national non-profit organization. She graduated from the University of Hawaii with a degree in merchandising.

9

Employment Agreements With The Company’s Named Executive Officers

Generally

We have entered into employment agreements with each of our executive officers. We believe that the protections contained in these employment agreements help to ensure the day-to-day stability necessary to our executives to enable them to properly focus their attention on their duties and responsibilities with the Company and provide security with regard to some of the most uncertain events relating to continued employment, thereby limiting concern and uncertainty and promoting productivity. Each of our employment agreements with our executive officers provides for an initial term of one year. Upon a termination of employment by reason of death or disability, such terminated executive officer or his estate will be entitled to regular base salary payments for a period of two (2) months. Such employment agreements also contain customary confidentiality and non-solicitation provisions. The following is a summary of the material terms of the agreements.

Jon S. Wheeler

Under the terms of Mr. Wheeler’s employment agreement, Mr. Wheeler is required to devote his best efforts and a significant portion of his time to our business and affairs and in return will be entitled to the following:

| • | Base compensation of $18,750 per month, which is paid by WHLR Management, LLC (our “Administrative Service Company”). |

| • | Reimbursement of reasonable expenses including but not limited to cell phone, mileage, toll and travel expenses, as well as travel expenses necessary to enhance Mr. Wheeler’s skills and visibility in the real estate industry. |

| • | Various benefits equal to the benefits provided to similar situated employees of the Company’s related businesses. |

Under Mr. Wheeler’s employment agreement, if he is terminated without “cause” (as defined in the employment agreement) then, in addition to accrued amounts, Mr. Wheeler shall be entitled to his regular base salary payable in regular periodic installments (i) for a period of twenty-six (26) weeks, if during the initial term of the employment agreement, or (ii) a period of eight (8) weeks if the initial term of the employment agreement has been completed. If Mr. Wheeler is terminated for “cause” (as defined in his employment agreement), Mr. Wheeler shall be entitled to receive any base salary earned and benefits accrued as of the date of his termination, and the Company shall have no further obligation to Mr. Wheeler.

Steven M. Belote

Under the terms of Mr. Belote’s employment agreement, Mr. Belote is required to devote his best efforts and a significant portion of his time to our business and affairs and in return will be entitled to the following:

| • | Mr. Belote’s base compensation is $12,000 per month, which is paid by our Administrative Service Company; |

| • | Reimbursement of reasonable expenses including but not limited to cell phone, mileage, toll and travel expenses, as well as travel expenses necessary to enhance Mr. Belote’s skills and visibility in the real estate industry; and |

| • | Various benefits equal to the benefits provided to similar situated employees of the Company’s related businesses, not to include healthcare. |

10

Under Mr. Belote’s employment agreement, if he is terminated without “cause” (as defined in the employment agreement) then, in addition to accrued amounts, Mr. Belote shall be entitled to his regular base salary payable in regular periodic installments (i) for a period of twenty-six (26) weeks, if during the initial term of the employment agreement, or (ii) a period of eight (8) weeks if the initial term of the employment agreement has been completed. If Mr. Belote is terminated for “cause” as defined in his employment agreement, Mr. Belote shall be entitled to receive any base salary earned and benefits accrued as of the date of his termination, and the Company shall have no further obligation to Mr. Belote.

Robin Hanisch

Under the terms of Ms. Hanisch’s employment agreement, Ms. Hanisch is required to devote her best efforts and a significant portion of her time to our business and affairs and in return will be entitled to the following:

| • | Base compensation of $1,250 per month, which will be paid by our Administrative Service Company; |

| • | Reimbursement of reasonable expenses including but not limited to cell phone, mileage, toll and travel expenses, as well as travel expenses necessary to enhance Ms. Hanisch’s skills and visibility in the real estate industry; and |

| • | Various benefits equal to the benefits provided to similar situated employees of the Company’s related businesses, not to include healthcare. |

Under Ms. Hanisch’s employment agreement, if she is terminated without “cause” (as defined in the employment agreement) then, in addition to accrued amounts, Ms. Hanisch shall be entitled to her regular base salary payable in regular periodic installments (i) for a period of twenty-six (26) weeks, if during the initial term of the employment agreement, or (ii) a period of eight (8) weeks if the initial term of the employment agreement has been completed. If Ms. Hanisch is terminated for “cause” as defined in her employment agreement, Ms. Hanisch shall be entitled to receive any base salary earned and benefits accrued as of the date of her termination, and the Company shall have no further obligation to Ms. Hanisch.

Summary Compensation Table

The table below only shows compensation received by our Chief Executive Officer and Chief Financial Officer in 2011 and 2012. No other officers received compensation in excess of $100,000 in any year.

| Name and Principal Position |

Fiscal Year |

Salary ($) | Bonus | Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

All Other Compensation |

Total ($) | ||||||||||||||||||||||||

| Jon S. Wheeler |

2012 | 225,000 | — | — | — | — | — | 225,000 | ||||||||||||||||||||||||

| Chief Executive Officer |

2011 | 98,147 | — | — | — | — | — | 98,147 | ||||||||||||||||||||||||

| Steven M. Belote |

2012 | 121,846 | — | — | — | — | — | 121,846 | ||||||||||||||||||||||||

| Chief Financial Officer |

2011 | 46,154 | — | — | — | — | — | 46,154 | ||||||||||||||||||||||||

Outstanding Equity Awards at Fiscal-Year End

The Company has no outstanding Equity Awards at the end of the 2012 fiscal year-end.

Share Incentive Plan

Pursuant to our 2012 Share Incentive Plan, we may award incentives covering our aggregate of 500,000 shares of our common stock. The options will vest at a rate of 20% per year for five years and have a per share exercise price equal to the fair market value of one of our common shares on the date of grant. We have not yet determined the recipients of any such grants.

11

Compensation Committee Interlocks and Insider Participation

None of the members of the Board of Directors who served on the Compensation Committee during the fiscal year ended December 31, 2012 were officers or employees of the Company or any of its subsidiaries or had any relationship with the Company requiring disclosure under SEC regulations.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of shares of our common stock and shares of common stock into which common units are exchangeable for (1) each person who is the beneficial owner of 5% or more of our outstanding common stock, (2) each of our directors and named executive officers, and (3) all of our directors and executive officers as a group. Each person named in the table has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. The extent to which a person will hold shares of common stock as opposed to units is set forth in the footnotes below.

Unless otherwise indicated, the address of each named person is c/o Wheeler Real Estate Investment Trust, Inc., Riversedge North, 2529 Virginia Beach Blvd., Suite 200, Virginia Beach, Virginia 23452.

| Number of Shares and Common Units Beneficially Owned |

Percentage of All Shares(1) |

Percentage of All Shares and Common Units(2) |

||||||||||

| Jon S. Wheeler |

468,742 | (3) | 6.58 | % | 5.12 | % | ||||||

| Steven M. Belote |

5,500 | (4) | * | * | ||||||||

| Robin Hanisch |

28,185 | (5) | * | * | ||||||||

| Carl B. McGowan, Jr. |

300 | (6) | * | * | ||||||||

| Ann L. McKinney |

9,149 | (7) | * | * | ||||||||

| Christopher J. Ettel |

200 | (8) | * | * | ||||||||

| David Kelly |

2,200 | (9) | * | * | ||||||||

| William W. King |

200 | (10) | * | * | ||||||||

| Sanjay Madhu |

5,500 | (11) | * | * | ||||||||

| Jeffrey Zwerdling |

231,000 | (12) | 3.24 | 2.52 | ||||||||

| All directors, director nominees and executive officers as a group (10 persons) |

750,976 | (13) | 10.55 | % | 8.21 | % | ||||||

| * | Less than 1.0% |

| (1) | Based upon 7,121,000 shares of common stock outstanding on November 19, 2013. In addition, amounts for individuals assume that all common units held by the person are exchanged for shares of our common stock, and amounts for all directors, director nominees and executive officers as a group assume all common units held by them are exchanged for shares of our common stock in each case, regardless of when such common units are currently exchangeable. The total number of shares of our common stock outstanding used in calculating this percentage assumes that none of the common units held by other persons are exchanged for shares of our common stock. |

| (2) | Based upon 7,121,000 shares of our common stock and 2,027,681 common units, which units may be redeemed for cash or, at our option, exchanged for shares of our common stock outstanding on November 19, 2013, subject to certain lock-up agreements. |

| (3) | Includes 86,372 shares of common stock and 382,370 common units. |

| (4) | Represents 5,500 shares of common stock. |

| (5) | Includes 25,000 shares of common stock and 3,185 common units. |

| (6) | Represents 300 shares of common stock. |

| (7) | Includes 1,286 shares of common stock and 7,863 common units. |

| (8) | Represents 200 shares of common stock. |

| (9) | Represents 2,200 shares of common stock. |

| (10) | Represents 200 shares of common stock. |

| (11) | Represents 5,500 shares of common stock. |

| (12) | Represents 231,000 shares of common stock. |

| (13) | Includes 357,558 shares of common stock and 393,418 common units. |

12

PROPOSAL 1

ELECTION OF DIRECTORS

Eight directors are to be elected at the Annual Meeting. Each director elected will hold office until the Annual Meeting following the fiscal year ending December 31, 2013. All of the nominees for director are now serving as directors of the Company. Each of the nominees has consented to being named in this proxy statement as a nominee and has agreed to serve as a director if elected. The persons named on the proxy card will vote for all of the nominees for director listed unless you withhold authority to vote for one or more of the nominees. The nominees receiving a plurality of votes cast at the Annual Meeting will be elected as directors. Abstentions and broker non-votes will not be treated as a vote for or against any particular nominee and will not affect the outcome of the election of directors. Cumulative voting for the election of directors is not permitted. If any director is unable to stand for re-election, the Board will designate a substitute. If a substitute nominee is named, the persons named on the proxy card will vote for the election of the substitute director.

The nominees for directors are listed below, together with their ages, terms of service, all positions and offices with the Company, other principal occupations, business experience and directorships with other companies during the last five years or more. The designation “affiliated” when used below with respect to a director means that the director is an officer, director or employee of the Company.

Jon S. Wheeler

Chairman and CEO

Age — 52

Director since 2011

Mr. Wheeler has served as our Chairman since our formation in June of 2011. In addition, Mr. Wheeler served as our President from our formation until January 2013 when his title was changed from President to Chief Executive Officer. Mr. Wheeler has also served as the President and CEO of Wheeler Interests since its inception in 1999. Mr. Wheeler has over thirty years of real estate experience with an extensive background in strategic financial and market analyses. Mr. Wheeler has substantial experience in assessing new or existing properties to maximize returns, which are then positioned for acquisition, growth and disposition. Since founding Wheeler Interests in 1999, Mr. Wheeler has helped Wheeler Interests to acquire over sixty shopping centers in New York, Maryland, Virginia, West Virginia, North Carolina, South Carolina, Tennessee, Georgia, Florida, Oklahoma and Texas, representing over four million square feet of improved real estate property. Mr. Wheeler holds a Bachelor of Arts degree in political science from Southern Methodist University. Mr. Wheeler was selected as our Chairman because of his experience in retail leasing, marketing, acquisition, development, financing, management and disposition of strip centers, neighborhood centers, community centers, power centers and mixed-use retail space in both the urban and suburban markets within the Northeast, Mid-Atlantic, Southeast and Southwest regions of the United States. Mr. Wheeler was chosen as a director because he is the founder of the Company and we believe his knowledge of the Company and years of experience in our industry give him the ability to guide the Company as a director.

Christopher J. Ettel

Independent Director

Age — 53

Director since 2011

Mr. Ettel serves as a director of the Company. In 1988, Mr. Ettel founded VB Homes, LLC, a residential design-build firm, specializing in high quality residential renovations and additions as well as new construction. Mr. Ettel has served as the Managing Partner of VB Homes, LLC since its inception. Mr. Ettel has been a Virginia Real Estate Broker since 1990. He currently serves on the Board of Directors of the Tidewater Builders Association and the Virginia Beach Advisory Board of Monarch Bank. He also previously served as the Chairman of the Tidewater Builders Association Remodeler’s Council and the President of the Board for the Virginia Beach Public Schools Education Foundation. Mr. Ettel received his Bachelor of Science degree from James Madison University in 1982. Mr. Ettel was selected as a director because of his years of experience in the real estate and construction industries as well as his management experience.

13

David Kelly

Independent Director

Age — 48

Director since 2011

Mr. Kelly serves as a director of the Company. Mr. Kelly has over twenty-five years of experience in the real estate industry. Mr. Kelly currently serves as Senior Vice President, Director of Acquisitions for Wheeler Interests, LLC. Prior to joining Wheeler Interests, Mr. Kelly served as a Principal with Kelly Development, LLC, a real estate development firm he founded in March 2011, which specializes in the acquisition and management of retail properties in the Mid-Atlantic region. Prior to founding Kelly Development, Mr. Kelly served as the Director of Real Estate for Supervalu, Inc., a Fortune 100 supermarket retailer, from 1998 through 2011. Prior to his time with Supervalu, Mr. Kelly served as an Asset Manager from 1993 through 1998. Mr. Kelly currently serves on the Board of Directors of the Norfolk, Virginia SPCA. He earned a Bachelor of Science in Finance degree from Bentley College (now Bentley University). Mr. Kelly was selected as a director because of his years of experience in the real estate industry as well as his real estate management experience within a publicly traded company.

William W. King

Independent Director

Age — 73

Director since 2011

Mr. King serves as a director of the Company. Mr. King currently serves, on a volunteer basis, as Executive Director of the Virginia Maritime Heritage Foundation, a 501(c)(3) corporation that owns and operates the schooner Virginia. He was appointed to that position in September 2009. From 1988 through 2008 Mr. King served as the headmaster of Norfolk Collegiate School, an independent, co-educational, K-12 college preparatory day school. He also remained employed by the Norfolk Collegiate School until June 2009 as a special assistant to the headmaster and served on its board of trustees from 1984-2009. Prior to his service at Norfolk Collegiate School, Mr. King was Executive Vice President of SRMS, a management consulting corporation that primarily contracted for services with the U.S. Navy and the U.S. Air Force. Mr. King served in the United States Navy from 1962 until 1984, when he retired with the rank of Captain. During his time in the United States Navy, he served in seven combatant ships, two of which he commanded, did several combat tours in Vietnam, served two tours in the Pentagon, including two years as aide to the Chief of Naval Operations, and was a Deputy Chief of Staff to the Commander of the United States Atlantic Command and the Commander-in-Chief of the United States Atlantic Fleet. Mr. King graduated from the University of Virginia in 1963 with a Bachelor of Science Degree in Finance, the Navy Postgraduate School in 1977 with a Master of Science in Financial Management, and from Old Dominion University in 1995 with a Certificate of Advanced Studies in Education Leadership and Administration. He currently serves on the Board of Directors of Chesapeake Bay Academy, the Future of Hampton Roads, Inc. and Horizons Hampton Roads. Mr. King was selected as a director because of his leadership experience.

Sanjay Madhu

Independent Director

Age — 47

Director since 2011

Mr. Madhu is the Chief Executive Officer and on the board of directors of Oxbridge Re Holdings Limited since July 2013, a company providing reinsurance in Florida and other Gulf states. He also serves on the board of directors of Homeowners Choice, Inc. a NYSE-listed insurance holding company headquartered in Tampa, Florida since May 2007. He became an executive officer of Homeowners Choice in February 2008 and has served in various capacities. In July 2011, he relinquished his role at Homeowners Choice, as Vice President of Marketing and took on the role of President of Real Estate Operations for the company and continues to serve as Vice President of Investor Relations. Mr. Madhu is also the principal of two companies that own and operate commercial real estate in

14

the Tampa, Florida area. From 1995 to 2010, Mr. Madhu served as President of J&S Development Group, Inc., doing business as The Mortgage Corporation Network. From 1994 to 1996, he was Vice President, Mortgage Division, First Trust Mortgage & Finance; from 1993 to 1994, he was Vice President, Residential First Mortgage Division, Continental Management Associates Limited, Inc.; and from 1991 to 1993; he was President, S&S Development, Inc. Mr. Madhu attended Northwest Missouri State University, where he studied marketing and management. Mr. Madhu was selected as a director because of his years of executive management experience and his experience managing a public company.

Carl B. McGowan, Jr.

Independent Director

Age — 65

Director since 2013

Dr. McGowan serves as a director of the Company. Dr. McGowan brings over 30 years of extensive financial experience to the Board. Dr. McGowan joined the faculty of Norfolk State University in 2005 and presently serves as the Faculty Distinguished Professor of Finance. From 2004-2005, Dr. McGowan served as a Visiting Associate Professor of Finance at the University of Sharjah in the United Arab Emirates. From 2003-2004, Dr. McGowan served as the RHB Bank Distinguished Chair in Finance at the University of Kebangsaan in Malaysia. Dr. McGowan has a Bachelor of Arts in International Relations (Syracuse), an MBA in Finance (Eastern Michigan), and a PhD in Business Administration (Michigan State). Dr. McGowan has conducted extensive research in the areas of corporate finance and international finance, with specific studies relating to real estate operations. In addition to over 150 conference presentations, Dr. McGowan has published 68 articles in numerous peer-reviewed journals including: The Journal of Real Estate Research, The American Journal of Business Education, Applied Financial Economics, Decision Science, Financial Practice and Education, The Financial Review, International Business and Economics Research Journal, The International Review of Financial Analysis, The Journal of Applied Business Research, The Journal of Business Case Studies, The Journal of Diversity Management, Managerial Finance, Managing Global Transitions, The Southwestern Economic Review, and Urban Studies. Dr. McGowan was selected as a director because of diverse experience and well-known authority in finance and economics, which will be valuable as we pursue the continued growth of the Company.

Ann L. McKinney

Age — 64

Director since 2012

Ms. McKinney serves as a director of the Company. Ms. McKinney was appointed President and Principal Broker of Wheeler Real Estate Company upon its formation in March, 2000. First licensed in 1974, Ms. McKinney currently holds a Real Estate Broker’s license in Virginia, North Carolina, South Carolina, Florida, Mississippi, Alabama, Oklahoma and Tennessee. Her responsibilities with Wheeler Real Estate Company include dispositions, marketing and public relations, and the management of all real estate licenses. Ms. McKinney was chosen as a director because of her real estate experience, leadership and management expertise.

Jeffrey M. Zwerdling

Independent Director

Age — 69

Director since 2013

Mr. Zwerdling is founder and managing partner of the law firm of Zwerdling, Oppleman & Adams which was formed in 1972 in Richmond, Virginia. Mr. Zwerdling’s areas of concentration include corporate law, commercial and residential real estate, personal estate planning, and general litigation. From 1999-2012 he served as President and Director of The Corporate Centre, a 225,000 square foot office park complex located in Richmond, Virginia. In May of 2013, Mr. Zwerdling was appointed to the Board of Directors of Capitol Securities Management Inc. (“CSM”). CSM is a Financial Industry Regulatory Authority registered broker dealer whose assets exceed $4 billion. Mr. Zwerdling was commissioned as a Second Lieutenant in the United States Army in 1967, served in the Army Reserve and Virginia National Guard, and received his honorable discharge after obtaining the rank of

15

Captain in 1981. Mr. Zwerdling holds a Bachelor of Science Degree from Virginia Commonwealth University and received a Juris Doctor Degree from the College of William and Mary School of Law. He was an organizational investor in Southern Community Bank & Trust, now Village Bank. In 1998, Mr. Zwerdling was elected to the Board of Directors of Supertel Hospitality, Inc., a public company which trades on the NASDAQ Stock Exchange. Supertel is a real estate investment trust (REIT) which is a focused-service segment of the lodging industry. During his tenure at Supertel, Mr. Zwerdling served on various committees, including the Acquisitions and Dispositions Committee, and was a member and former chairman of the Audit Committee. Prior to being appointed a Director of the Company in September 2013, Mr. Zwerdling served as a Board Observer for the Company. He is a Master Mason of Fraternal Lodge No. 53, belongs to the Scottish Rite of Freemasonry, and is a Noble of the Acca Temple Shrine of Richmond, Virginia. Mr. Zwerdling was chosen a director because of his legal experience in real estate matters and his vast experiences with real estate investment trusts.

The Board of Directors unanimously recommends a vote FOR

the election of all of the Nominees named above.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Cherry Bekaert LLP as the independent registered public accounting firm of the Company for the 2013 fiscal year and to conduct quarterly reviews through March 31, 2014. The Company’s Bylaws do not require that stockholders ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm. Cherry Bekaert LLP has served as the Company’s independent public accounting firm for each of the fiscal years ended December 31, 2011 through December 31, 2012. The Audit Committee will consider the outcome of this vote in its decision to appoint an independent registered public accounting firm next year, however, it is not bound by the stockholders’ decision. Even if the selection is ratified, the Audit Committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

A representative of Cherry Bekaert LLP will attend the Annual Meeting. The representative will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions from the stockholders.

The Board of Directors recommends a vote FOR the ratification of the

appointment of Cherry Bekaert LLP as the

Company’s independent registered public accounting firm.

2012 Fiscal Year Audit Firm Fee Summary

The following table sets forth the aggregate fees for professional services rendered to or for the Company for the 2012 fiscal year by Cherry Bekaert LLP:

| Type of Fee | 2012 Cherry Bekaert LLP |

|||

| Audit Fees |

$ | 120,000 | ||

| Audit-Related Fees |

$ | 145,800 | ||

| Tax Fees |

$ | 1,100 | ||

| All Other Fees |

— | |||

| Total |

$ | 266,900 | ||

16

The audit fees for 2012 were for professional services rendered for the audits and reviews of the consolidated financial statements of the Company. Tax fees for 2012 were for services related to federal and state compliance and advice.

All services rendered by the principal auditors are permissible under applicable laws and regulations and were pre-approved by either the Board of Directors or the Audit Committee, as required by law. The fees paid the principal auditors for services as described in the above table fall under the categories listed below:

Audit Fees. These are fees for professional services performed by the principal auditor for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s 10-Q filings and services that are normally provided in connection with statutory and regulatory filing or engagements.

Audit-Related Fees. These are fees for assurance and related services performed by the principal auditor that are reasonably related to the performance of the audit or review of the Company’s financial statements. These services include attestations by the principal auditor that are not required by statute or regulation and consulting on financial accounting/reporting standards.

Tax Fees. These are fees for professional services performed by the principal auditor with respect to tax compliance, tax planning, tax consultation, returns preparation and review of returns. The review of tax returns includes the Company and its consolidated subsidiaries.

All Other Fees. These are fees for other permissible work performed by the principal auditor that do not meet the above category descriptions.

These services are actively monitored (as to both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in the principal auditor’s core work, which is the audit of the Company’s consolidated financial statements.

Report of the Audit Committee

The primary responsibility of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Company’s financial statements and the independence of its external auditors. The Company believes that each of the members of the Audit Committee is “independent” and that Dr. McGowan qualifies as an “audit committee financial expert” in accordance with applicable NASDAQ Capital Market listing standards. In carrying out its responsibility, the Audit Committee undertakes to:

| • | Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the Company; |

| • | Meet with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors; |

| • | Review with the independent auditors and financial and accounting personnel the adequacy and effectiveness of the accounting and financial controls of the Company. The Audit Committee elicits recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. The Audit Committee emphasizes the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper; |

| • | Review the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans with the Company’s independent auditors; |

17

| • | Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the shareholders; |

| • | Provide sufficient opportunity for the independent auditors to meet with the members of the Audit Committee without members of management present. Among the items discussed in these meetings are the independent auditors’ evaluation of the Company’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit; |

| • | Review accounting and financial human resources and succession planning within the Company; |

| • | Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board of Directors; and |

| • | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if, in its judgment, that is appropriate. |

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee operates under a written charter adopted by the Board of Directors. The Committee’s responsibilities are set forth in this charter which is available on our website at www.whlr.us.

The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of the Company’s financial statements, the adequacy of the Company’s system of internal controls, the Company’s risk management, the Company’s compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of the Company’s independent auditors. The Audit Committee has sole authority over the selection of the Company’s independent auditors and manages the Company’s relationship with its independent auditors. The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and receive appropriate funding, as determined by the Audit Committee, from the Company for such advice and assistance.

As we only recently became a public-reporting company in November 2012, the Audit Committee did not meet in 2012. The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Audit Committee’s meetings include private sessions with the Company’s independent auditors without the presence of the Company’s management, as well as executive sessions consisting of only Audit Committee members. The Audit Committee also meets with senior management from time to time.

Management has the primary responsibility for the Company’s financial reporting process, including its system of internal control over financial reporting and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The Company’s independent auditors are responsible for auditing those financial statements in accordance with professional standards and expressing an opinion as to their material conformity with U.S. generally accepted accounting principles and for auditing management’s assessment of, and the effective operation of, internal control over financial reporting. The Audit Committee’s responsibility is to monitor and review the Company’s financial reporting process and discuss management’s report on the Company’s internal control over financial reporting. It is not the Audit Committee’s duty or responsibility to conduct audits or accounting reviews or procedures. The Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the opinion of the independent registered public accountants included in their report on the Audit Committee’s financial statements.

18

As part of its oversight of the Company’s financial statements, the Audit Committee reviews and discusses with both management and the Company’s independent registered public accountants all annual and quarterly financial statements prior to their issuance. During 2012, management advised the Audit Committee that each set of financial statements reviewed had been prepared in accordance with accounting principles generally accepted in the United States of America, and reviewed significant accounting and disclosure issues with the Audit Committee. These reviews include discussions with the independent accountants of the matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards), including the quality (not merely the acceptability) of the Company’s accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and disclosures related to critical accounting practices. The Audit Committee has also discussed with Cherry Bekaert LLP matters relating to its independence, including a review of audit and non-audit fees, and written disclosures from Cherry Bekaert LLP to the Company pursuant to Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee also considered whether non-audit services, provided by the independent accountants are compatible with the independent accountant’s independence. The Company also received regular updates on the amount of fees and scope of audit, audit-related and tax services provided.

In addition, the Audit Committee reviewed key initiatives and programs aimed at strengthening the effectiveness of the Company’s internal and disclosure control structure. As part of this process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal controls, reviewed staffing levels and steps taken to implement recommended improvements in any internal procedures and controls.

Based on the Audit Committee’s discussion with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants to the Board of Directors, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC. The Audit Committee and the Board of Directors have also selected Cherry Bekaert LLP as the Company’s independent registered public accountants and auditors for the fiscal year ending December 31, 2013. This report has been furnished by the members of the Audit Committee.

AUDIT COMMITTEE

| William W. King |

Sanjay Madhu | Carl B. McGowan, Jr. |

Under the Sarbanes-Oxley Act of 2002 (the “SO Act”), and the rules of the SEC, the Audit Committee of the Board of Directors is responsible for the appointment, compensation and oversight of the work of the independent auditor. The purpose of the provisions of the SO Act and the SEC rules for the Audit Committee role in retaining the independent registered public accounting firm is two-fold. First, the authority and responsibility for the appointment, compensation and oversight of the auditors should be with directors who are independent of management. Second, any non-audit work performed by the auditors should be reviewed and approved by these same independent directors to ensure that any non-audit services performed by the auditor do not impair the independence of the independent auditor. To implement the provisions of the SO Act, the SEC issued rules specifying the types of services that an independent auditor may not provide to its audit client, and governing the Audit Committee’s administration of the engagement of the independent auditor. As part of this responsibility, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent auditor in order to assure that they do not impair the auditor’s independence. Accordingly, the Audit Committee has adopted a written pre-approval policy of audit and non-audit services (the “Policy”), which sets forth the procedures and conditions pursuant to which services to be performed by the independent auditor are to be pre-approved. Consistent with the SEC rules establishing two different approaches to approving non-prohibited services, the policy of the Audit Committee covers pre-approval of audit services, audit-related services, international administration tax services, non-U.S. income tax compliance services, pension and benefit plan consulting and compliance services, and U.S. tax compliance and planning. At the beginning of each fiscal year, the Audit Committee will evaluate other known potential engagements of the independent auditor, including the scope of work proposed to be performed and the proposed fees, and approve or reject each service, taking into account whether services are permissible under applicable law and the possible impact of each non-audit service on the independent

19

auditor’s independence from management. Typically, in addition to the generally pre-approved services, other services would include due diligence for an acquisition that may or may not have been known at the beginning of the year. The Audit Committee has also delegated to any member of the Audit Committee designated by the Board or the financial expert member of the Audit Committee responsibilities to pre-approve services to be performed by the independent auditor not exceeding $25,000 in value or cost per engagement of audit and non-audit services, and such authority may only be exercised when the Audit Committee is not in session.

Certain Relationships and Related Transactions

Partnership Agreement

We entered into a partnership agreement with various persons receiving common units in the formation transactions, including Mr. Wheeler, his affiliates and certain other executive officers of the Company. As a result, these persons became limited partners of our Operating Partnership. Mr. Wheeler and his affiliates and our other directors and executive officers own 19.40% of the outstanding common units.

Pursuant to the Partnership Agreement, limited partners of our Operating Partnership and some assignees of limited partners will have the right, beginning 12 months after acquiring the common units, to require our Operating Partnership to redeem part or all of their common units for cash equal to the then-current market value of an equal number of shares of our common stock (determined in accordance with and subject to adjustment under the Partnership Agreement), or, at our election, to exchange their common units for shares of our common stock on a one-for-one basis, subject to certain adjustments and the restrictions on ownership and transfer of our stock set forth in our charter.

Other Related Party Transactions

Mr. Wheeler, when combined with his affiliates, represents the Company’s largest stockholder. Our Administrative Service Company, which is wholly owned by Mr. Wheeler, provides administrative services to the Company, including management, administrative, accounting, marketing, development and design services. The Company also benefits from Mr. Wheeler’s current organization and platform that specializes in retail real estate investment and management.

Wheeler Interests, LLC, a company controlled by Mr. Wheeler, leases our Riversedge property under a 10 year operating lease expiring in November 2017, with four five-year renewal options available. The lease currently requires monthly base rental payments of $23,600 and provides for annual increases throughout the term of the lease and subsequent option periods. Additionally, Wheeler Interests, LLC reimburses us for a portion of the property’s operating expenses and real estate taxes. We consider the terms of the lease agreement with Wheeler Interests, LLC to be comparable to those received by other nonrelated third parties.

20

The following summarizes related party activity of the combined Ownership Entities for the year ended December 31, 2012 and 2011.

| 2012 | 2011 | |||||||

| Amounts paid to Wheeler Interests and its affiliates: |

||||||||

| Wheeler Interests |

$ | 691,636 | $ | 337,292 | ||||

| Wheeler Development |

57,774 | 11,672 | ||||||

| Wheeler Real Estate |

50,998 | 76,220 | ||||||

| Site Applications |

67,746 | 73,314 | ||||||

| Creative Retail Works |

— | 5,621 | ||||||

| TESR |

22,011 | 19,152 | ||||||

|

|

|

|

|

|||||

| $ | 890,165 | $ | 523,271 | |||||

|

|

|

|

|

|||||

| Amounts due to Wheeler Interests and its affiliates: |

||||||||

| Wheeler Interests |

$ | 51,417 | $ | 9,738 | ||||

| Wheeler Development |

3,962 | — | ||||||

| Wheeler Real Estate |

31,496 | 15,719 | ||||||

| Site Applications |

1,150 | 6,096 | ||||||

| TESR |

— | 9,704 | ||||||

| WHLR Management |

15,308 | — | ||||||

| Jon Wheeler and affiliates |

86,836 | 1,131,489 | ||||||

|

|

|

|

|

|||||

| $ | 190,169 | $ | 1,172,746 | |||||

|

|

|

|

|

|||||

| Rent and reimbursement income received from Wheeler Interests |

$ | 406,300 | $ | 396,500 | ||||

|

|

|

|

|

|||||

| Rent and other tenant receivables due from Wheeler Interests |

$ | 250,063 | $ | 128,790 | ||||

OTHER MATTERS

The Board of Directors knows of no other matters that may be properly or should be brought before the Annual Meeting. However, if any other matters are properly brought before the Annual Meeting, the persons named in the enclosed proxy or their substitutes will vote in accordance with their best judgment on such matters.