As filed with the Securities and Exchange Commission on July 12, 2013

Registration No. 333-189363

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1 to

Form S-11

REGISTRATION STATEMENT

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Wheeler Real Estate Investment Trust, Inc.

(Exact Name of Registrant as Specified in Its Governing Instruments)

Riversedge North

2529 Virginia Beach Blvd., Suite 200

Virginia Beach, Virginia 23452

(757) 627-9088

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(800) 624-0909

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Bradley A. Haneberg, Esq. Kaufman & Canoles, P.C. Two James Center 1021 East Cary Street, Suite 1400 Richmond, Virginia 23219 (804) 771-5700 – telephone (804) 771-5777 – facsimile |

Theodore Grannatt, Esq. Benjamin H. Hron, Esq. McCarter & English, LLP 265 Franklin Street Boston, Massachusetts, 02110 (617) 449-6599 – telephone (617) 607-6026 – facsimile |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement of the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 12, 2013

PRELIMINARY PROSPECTUS

10,000,000 Shares

Wheeler Real Estate Investment Trust, Inc.

Common Stock

We are offering 10,000,000 shares of our common stock, par value $0.01 per share, at a price of $ per share. We are a Maryland corporation that operates as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”).

Our common stock is currently listed on the NASDAQ Capital Market under the symbol “WHLR”. On July , 2013, the last reported sale price of our common stock was $ per share.

Investing in our common stock involves risks. You should read the section entitled “Risk Factors” beginning on page 21 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common stock.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount and commissions(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” beginning on page 93 for disclosure regarding the underwriting discounts and expenses payable to the underwriters by us. |

The shares of common stock are being offered through the underwriters on a firm commitment basis. We and three shareholders have granted the underwriters a 45 day option to purchase up to 1,500,000 additional shares of common stock at the same price, and on the same terms, solely to cover are over-allotments, if any. It is expected that delivery of the shares will be made in New York, New York on or about , 2013. See “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Maxim Group LLC | Newbridge Securities Corporation | |

The date of this prospectus is , 2013.

| 1 | ||||

| 21 | ||||

| 40 | ||||

| 41 | ||||

| 61 | ||||

| 62 | ||||

| 64 | ||||

| Material Provisions of Maryland Law and Our Charter and Bylaws |

68 | |||

| 73 | ||||

| 75 | ||||

| 90 | ||||

| 93 | ||||

| 97 | ||||

| 97 | ||||

| 97 | ||||

| 97 | ||||

| 99 | ||||

| Audited and Other Financial Information of Contemplated Properties |

A-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

We use market data, demographic data, industry forecasts and projections throughout this prospectus. We have obtained certain market and industry data from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on historical market data, and there is no assurance that any of the projected amounts will be achieved. We believe that the market and industry research others have performed are reliable, but we have not independently verified this information.

i

You should read the following summary together with the more detailed information regarding our company and the historical and pro forma financial statements appearing elsewhere in this prospectus, including under the caption “Risk Factors.” References in this prospectus to “we,” “our,” “us” and “our company” refer to Wheeler Real Estate Investment Trust, Inc., a Maryland corporation, together with our consolidated subsidiaries, including Wheeler REIT, L.P., a Virginia limited partnership, of which we are the sole general partner (our “Operating Partnership”). Unless otherwise indicated, the information contained in this prospectus is as of March 31, 2013 and assumes : (1) the acquisition of the Contemplated Properties for cash; (2) the issuance of 10,000,000 shares of common stock at $ per share and the application of the proceeds as described herein; and (3) the conversion of our Series A Preferred Stock into 656,998 shares of common stock automatically upon the completion of the offering contemplated by this prospectus. We have not assumed the exercise of the underwriters’ over-allotment option. For the meanings of all defined term used herein, please refer to the Glossary at page 99.

Overview

We are a Maryland corporation formed with the principal objective of acquiring, financing, developing, leasing, owning and managing income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. We target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. We generally lease our properties to national and regional retailers that offer consumer goods and generate regular consumer traffic. We believe our tenants carry goods that are less impacted by fluctuations in the broader U.S. economy and consumers’ disposable income, generating more predictable property-level cash flows.

We currently own a portfolio consisting of twelve properties including seven retail shopping centers, four free-standing retail properties, and one office property, totaling 545,350 net rentable square feet of which approximately 95.1% were leased as of March 31, 2013.

We believe the current market environment creates a substantial number of favorable investment opportunities with attractive yields on investment and significant upside potential. We believe the markets we plan to pursue in the Mid-Atlantic, Southeast and Southwest have strong demographics and dynamic, diversified economies that will continue to generate jobs and future demand for commercial real estate. We anticipate that the depth and breadth of our real estate experience allows us to capitalize on revenue-enhancing opportunities in our portfolio and source and execute new acquisition and development opportunities in our markets, while maintaining stable cash flows throughout various business and economic cycles.

Jon S. Wheeler, our Chairman and Chief Executive Officer, has 31 years of experience in the real estate sector with particular experience in strategic financial and market analyses and assessments of new or existing properties to maximize returns. We have an integrated team of professionals with experience across all stages of the real estate investment cycle.

We were organized as a Maryland corporation on June 23, 2011 and intend to elect to be taxed as a REIT beginning with our taxable year ended December 31, 2012. We conduct substantially all of our business through our Operating Partnership. We are structured as an UPREIT, which means that we will own most of our properties through our Operating Partnership and its subsidiaries. As an UPREIT, we may be able to acquire properties on more attractive terms from sellers who can defer tax obligations by contributing properties to our Operating Partnership in exchange for Operating Partnership units, which will be redeemable for cash or exchangeable for shares of our common stock at our election.

WHLR Management, LLC (our “Administrative Service Company”), which is wholly owned by Mr. Wheeler, provides administrative services to our company. Pursuant to the terms of an administrative services agreement between our Administrative Service Company and us, our Administrative Service Company is responsible for identifying targeted real estate investments; handling the disposition of the real estate investments our board of directors has chosen to sell; and administering our day-to-day business operations, including but not limited to, leasing duties, property management, payroll and accounting functions. We also benefit from Mr. Wheeler’s partially or wholly owned related business and platform that specializes in retail real estate investment and management. Mr. Wheeler’s organization includes (i) Wheeler Interests, LLC, an acquisition and asset management firm, (ii) Wheeler Real Estate, LLC, a real estate leasing management and administration firm, (iii) Wheeler Development, LLC, a full service real estate development firm, (iv) Wheeler Capital, LLC, a capital investment firm specializing in venture capital, financing, and small business loans, (v) Site Applications, LLC, a full service facility company equipped to handle all levels of building maintenance and (vi) TESR, LLC, a tenant coordination company specializing in tenant relations and community events (collectively, our “Services Companies”). Our headquarters is located at Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. Our telephone number is (757) 627-9088. Our website is located at WHLR.us. Our Internet website and the information contained therein or connected thereto do not constitute a part of this prospectus or any amendment or supplement hereto.

1

Business and Growth Strategies

Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. Specifically, we intend to pursue the following strategies to achieve these objectives:

| • | Maximize value through proactive asset management. We believe our market expertise, targeted leasing strategies and proactive approach to asset management will enable us to maximize the operating performance of our portfolio. We will continue to implement an active asset management program to increase the long-term value of each of our properties. This may include expanding existing tenants, re-entitling site plans to allow for additional outparcels, which are small tracts of land used for freestanding development not attached to the main buildings, and repositioning tenant mixes to maximize traffic, tenant sales and percentage rents. As we grow our portfolio, we will seek to maintain a diverse pool of assets with respect to both geographic distribution and tenant mix, helping to minimize our portfolio risk. We will utilize our experience and market knowledge to effectively allocate capital to implement our investment strategy. We continually monitor our markets for opportunities to selectively dispose of properties where returns appear to have been maximized and redeploy proceeds into new acquisitions that have greater return prospects. |

| • | Pursue value oriented investment strategy targeting properties fitting within our acquisition profile. We believe the types of retail properties we seek to acquire will provide better risk-adjusted returns compared to other properties in the retail asset class, as well as other property types in general, due to the anticipated improvement in consumer spending habits resulting from a strengthening economy coupled with the long-term nature of the underlying leases and predictability of cash flows. We will acquire retail properties based on identified market and property characteristics, including: |

| • | Property type. We focus our investment strategy on income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. We will target these types of properties because they tend to be more focused on consumer goods as opposed to enclosed malls, which we believe are more oriented to discretionary spending that is susceptible to cyclical fluctuations. |

| • | Strip center. A strip center is an attached row of stores or service outlets managed as a coherent retail entity, with on-site parking usually located in front of the stores. Open canopies may connect the store fronts, but a strip center does not have enclosed walkways linking the stores. A strip center may be configured in a straight line or have an “L” or “U” shape. |

| • | Neighborhood centers. A neighborhood center is designed to provide convenience shopping for the day-to-day needs of consumers in the immediate neighborhood. Neighborhood centers are often anchored by a supermarket or drugstore. The anchors are supported by outparcels typically occupied by restaurants, fast food operators, financial institutions and in-line stores offering various products and services ranging from soft goods, healthcare and electronics. |

| • | Community centers. A community center typically offers a wider range of apparel and other soft goods relative to a neighborhood center and in addition to supermarkets and drugstores, can include discount department stores as anchor tenants. |

| • | Freestanding retail properties. A freestanding retail property constitutes any retail building that is typically occupied by a single tenant. The lease terms are generally structured as triple-net with the tenant agreeing to pay rent as well as all taxes, insurance and maintenance expenses that arise from the use of the property. |

| • | Anchor tenant type. We will target properties with anchor tenants that offer consumer goods that are less impacted by fluctuations in consumers’ disposable income. We believe nationally and regionally recognized anchor tenants that offer consumer goods provide more predictable property-level cash flows as they are typically higher credit quality tenants that generate stable revenues. We feel these properties will act as a catalyst for incremental leasing demand through increased property foot traffic. We will identify the credit quality of our anchor tenants by conducting a thorough analysis including, but not limited to, a review of tenant operating performance, liquidity and balance sheet strength. |

| • | Lease terms. In the near term, we intend to acquire properties that feature one or more of the following characteristics in their tenants’ lease structure: properties with long-term leases (10 years remaining on the primary lease term) for anchor tenants; properties under triple-net leases, which are leases where the tenant agrees to pay rent as well as all taxes, insurance and maintenance expenses that arise from |

2

| the use of the property; thereby minimizing our expenses; and properties with leases which incorporate gross percentage rent and/or rental escalations that act as an inflation hedge while maximizing operating cash flows. As a longer-term strategy, we will look to acquire properties with shorter-term lease structures (2-3 years) for in-line tenants, which are tenants that rent smaller spaces around the anchor tenants within a property, that have below market rents that can be renewed at higher market rates. |

| • | Geographic markets and demographics. We plan to seek investment opportunities throughout the United States; however, we will focus on the Mid-Atlantic, Southeast and Southwest, which are characterized by attractive demographic and property fundamental trends. We will target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. These communities will also have a combination of the following characteristics: |

| • | established trade areas with high barriers to entry, |

| • | high population base with expected annual growth rate higher than the national average, |

| • | high retail sales per square foot compared to the national average, |

| • | above average household income and expected growth, |

| • | above-average household density, |

| • | favorable infrastructure such as schools to retain and attract residents, and |

| • | below-average unemployment rate. |

| • | Capitalize on network of relationships to pursue transactions. We plan to pursue transactions in our target markets through the relationships we have developed. Leveraging these relationships, we will target property owners that our management team has transacted with previously, many of whom, we feel, will consider us a preferred counterparty due to our track record of completing fair and timely transactions. We believe this dynamic gives us a competitive advantage in negotiating and executing favorable acquisitions. |

| • | Leverage our experienced property management platform. Our executive officers, together with the management teams of our Services Companies, have over 150 years of combined experience managing, operating and leasing retail properties. We consider our Services Companies to be in the best position to oversee the day-to-day operations of our properties, which in turn helps us service our tenants. We feel this generates higher renewal and occupancy rates, minimizes rent interruptions, reduces renewal costs and helps us achieve stronger operating results. Along with this, a major component of our leasing strategy is to cultivate long-term relationships through consistent tenant dialogue in conjunction with a proactive approach to meeting the space requirements of our tenants. |

| • | Grow our platform through a comprehensive financing strategy. We believe our capital structure will provide us with sufficient financial capacity and flexibility to fund future growth. Based on our current capitalization, we believe we will have access to multiple sources of financing that are currently unavailable to many of our private market peers or overleveraged public competitors, which will provide us with a competitive advantage. Over time, these financing alternatives may include follow-on offerings of our common stock, unsecured corporate level debt, preferred equity and credit facilities. We have a ratio of debt to total market capitalization of approximately 45%. Although we are not required by our governing documents to maintain this ratio at any particular level, our Board of Directors will review our ratio of debt to total capital on a quarterly basis, with the goal of maintaining a reasonable rate consistent with our expected ratio of debt to total market capitalization going forward. This strategy will enable us to continue to grow our asset base well into the future. |

Our Competitive Strengths

We believe the following competitive strengths distinguish us from other owners and operators of commercial real estate and will enable us to take advantage of new acquisition and development opportunities, as well as growth opportunities within our portfolio:

| • | Cornerstone Portfolio of Retail Properties. We have acquired and developed a portfolio of properties located in business centers in Virginia, Florida, Georgia, South Carolina, North Carolina, and Oklahoma. We believe many of our properties currently achieve rental and occupancy rates equal to or above those typically prevailing in their respective markets due to their desirable and competitively advantageous locations within their submarkets, as well as our hands-on management approach. The retail |

3

| properties comprising our portfolio fit within our property acquisition profile of income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. These properties are located in local markets that exhibit stable demographics and have historically exhibited favorable trends, such as strong population and income growth. These properties represent the initial base of the larger portfolio that we expect to build over time. |

| • | Experienced Management Team. Our executive officers and the members of the management teams of our Services Companies have significant experience in all aspects of the commercial real estate industry, specifically in our markets. They have overseen the acquisition or development and operation of more than 60 shopping centers, representing over 4 million rentable square feet of retail property, including all of the properties in our portfolio. Mr. Wheeler and the real estate professionals employed by our Services Companies have in-depth knowledge of our assets, markets and future growth opportunities, as well as substantial expertise in all aspects of leasing, asset and property management, marketing, acquisitions, redevelopment and facility engineering and financing, all of which we believe provides us with a significant competitive advantage. |

| • | Access to a Pipeline of Acquisition and Leasing Opportunities. We believe that market knowledge and network of relationships with real estate owners, developers, brokers, national and regional lenders and other market participants provides us access to an ongoing pipeline of attractive acquisition and investment opportunities in and near our markets. In addition, we have a network of relationships with numerous national and regional tenants in our markets, many of whom currently are tenants in our retail buildings, which we expect will enhance our ability to retain and attract high quality tenants, facilitate our leasing efforts and provide us with opportunities to increase occupancy rates at our properties, thereby allowing us to maximize cash flows from our properties. We have successfully converted many of our strong relationships with our retail tenants into leasing opportunities at our properties. |

| • | Broad Real Estate Expertise with Retail Focus. Our management team has experience and capabilities across the real estate sector with experience and expertise particularly in the retail asset class, which we believe provides for flexibility in pursuing attractive acquisition, development, and repositioning opportunities. Since varying market conditions create opportunities at different times across property types, we believe our expertise enables us to target relatively more attractive investment opportunities throughout economic cycles. In addition, our fully integrated platform with in-house development capabilities allows us to pursue development and redevelopment projects with multiple uses. We believe that our ability to pursue these types of opportunities differentiates us from many competitors in our markets. |

Summary Risk Factors

You should consider carefully the risks discussed below and under the heading “Risk Factors” beginning on page 18 of this prospectus before purchasing our common stock. If any of these risks occur, our business, prospects, financial condition, liquidity, results of operations and ability to make distributions to our stockholders could be materially and adversely affected. In that case, the trading price of our common stock could decline and you could lose some or all of your investment. These risks include, among others, the following:

| • | We have a limited history as a REIT and as a publicly traded company. We have limited financing sources and may not be able to successfully operate as a REIT or a publicly traded company. |

| • | Our portfolio is dependent upon regional and local economic conditions and is geographically concentrated in the Mid-Atlantic, Southeast and Southwest. |

| • | Our estimated cash available for distribution is insufficient to cover our anticipated annual dividend, which will require us to use proceeds from this offering to fund distributions. |

| • | We expect to have approximately $38.5 million of indebtedness outstanding following this offering ($92.9 million following the acquisition of the Contemplated Properties), which may expose us to the risk of default under our debt obligations. |

| • | Our success depends on key personnel and the loss of such key personnel could adversely affect our ability to manage our business or implement our growth strategies. |

4

| • | Our Administrative Services Company will face conflicts of interest caused by its arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders. |

| • | Failure to qualify as a REIT would have significant adverse consequences to us and the value of our common stock. |

Real estate investments are subject to various risks and fluctuations and cycles in value and demand, many of which are beyond our control. Our economic performance and the value of our properties can be affected by many of these factors, including, among others, the following:

| • | adverse changes in financial conditions of buyers, sellers and tenants of our properties, including bankruptcies, financial difficulties, or lease defaults by our tenants; |

| • | local real estate conditions, such as an oversupply of, or a reduction in demand for, retail space or retail goods, and the availability and creditworthiness of current and prospective tenants; |

| • | vacancies or ability to rent space on favorable terms, including possible market pressures to offer tenants rent abatements, tenant improvements, early termination rights or below-market renewal options; |

| • | changes in operating costs and expenses, including, without limitation, increasing labor and material costs, insurance costs, energy prices, environmental restrictions, real estate taxes, and costs of compliance with laws, regulations and government policies, which we may be restricted from passing on to our tenants; |

| • | fluctuations in interest rates, which could adversely affect our ability, or the ability of buyers and tenants of properties, to obtain financing on favorable terms or at all; and |

| • | competition from other real estate investors with significant capital, including other real estate operating companies, publicly traded REITs and institutional investment funds. |

5

Our Properties

Our Portfolio

We currently own twelve properties located in Virginia, North Carolina, South Carolina, Florida, Georgia and Oklahoma, containing a total of approximately 545,350 rentable square feet of retail space, which we refer to as our portfolio. The following table presents an overview of our portfolio, based on information as of March 31, 2013.

Portfolio

| Property |

Location | Year Built/ Renovated |

Number of Tenants |

Net Rentable Square Feet |

Percentage Leased |

Annualized Base Rent |

Annualized Base Rent per Leased Square Foot (1) |

|||||||||||||||||||

| The Shoppes at TJ Maxx |

Richmond, VA | 1982/1999 | 14 | 93,552 | 90.6 | % | $ | 950,040 | $ | 11.21 | ||||||||||||||||

| Walnut Hill Plaza |

Petersburg, VA | 1959/2006/2008 | 11 | 89,907 | 82.7 | % | 550,247 | 7.40 | ||||||||||||||||||

| Lumber River Plaza |

Lumberton, NC | |

1985/1997-98 (expansion)/ 2004 |

|

12 | 66,781 | 100.0 | % | 514,810 | 7.71 | ||||||||||||||||

| Perimeter Square |

Tulsa, OK | 1982-83 | 8 | 58,277 | 95.7 | % | 691,977 | 12.41 | ||||||||||||||||||

| The Shoppes at Eagle Harbor |

Carrollton, VA | 2009 | 7 | 23,303 | 100.0 | % | 472,561 | 20.28 | ||||||||||||||||||

| Harps At Harbor Point |

Grove, OK | 2012 | 1 | 31,500 | 100.0 | % | 364,432 | 11.57 | ||||||||||||||||||

| Twin City Crossing |

Batesburg- Leesville, SC |

1998/2002 | 5 | 47,680 | 100.0 | % | 446,590 | 9.37 | ||||||||||||||||||

| Surrey Plaza |

Hawkinsville, GA | 1993 | 5 | 42,680 | 100.0 | % | 302,595 | 7.09 | ||||||||||||||||||

| Bixby Commons |

Bixby, OK | 2012 | 1 | 75,000 | 100.0 | % | 768,500 | 10.25 | ||||||||||||||||||

| Riversedge North |

Virginia Beach, VA |

2007 | 1 | 10,550 | 100.0 | % | 302,539 | 28.68 | ||||||||||||||||||

| Monarch Bank |

Virginia Beach, VA |

2002 | 1 | 3,620 | 100.0 | % | 250,740 | 69.27 | ||||||||||||||||||

| Amscot Building |

Tampa, FL | 2004 | 1 | 2,500 | 100.0 | % | 101,395 | 40.56 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Portfolio |

67 | 545,350 | 95.1 | % | $ | 5,716,426 | $ | 11.03 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Annualized base rent per leased square foot includes the impact of tenant concessions. |

6

With the proceeds of this offering, we anticipate acquiring the following additional properties (the “Contemplated Properties”).

| Property |

Location | Year Built/ Renovated |

Number of Tenants |

Net Rentable Square Feet |

Percentage Leased |

Annualized Base Rent |

Annualized Base Rent per Leased Square Foot (1) |

|||||||||||||||||

| Winslow Plaza |

Sicklerville, NJ | 1990 | 16 | 40,695 | 94.10 | % | $ | 552,213 | $ | 14.42 | ||||||||||||||

| Forrest Gallery |

Tullahoma, TN | 1987 | 27 | 214,451 | 92.75 | 1,187,421 | 5.97 | |||||||||||||||||

| Warren Commons |

Warren County, PA | 2006 | 12 | 46,465 | 84.50 | 522,225 | 13.37 | |||||||||||||||||

| Brook Run |

Richmond, VA | 1990 | 20 | 147,738 | 95.02 | 1,655,245 | 11.79 | |||||||||||||||||

| Northeast Plaza |

Lumberton, NC | 2000 | 8 | 54,511 | 92.83 | 458,436 | 9.06 | |||||||||||||||||

| Port Crossing |

Harrisonburg, VA | 1999/2009 | 9 | 65,365 | 90.57 | 808,672 | 13.66 | |||||||||||||||||

| Jenks Plaza |

Jenks, OK | 2007 | 5 | 7,800 | 100.00 | 133,458 | 17.11 | |||||||||||||||||

| Tampa Festival |

Tampa, FL | 1965/2009/2012 | 21 | 141,628 | 95.60 | 1,109,301 | 8.19 | |||||||||||||||||

| Jenks Reasor’s |

Jenks, OK | 2011 | 1 | 81,000 | 100.00 | 912,000 | 11.26 | |||||||||||||||||

| Starbuck’s/Verizon |

Virginia Beach, VA | 1985/2012 | 2 | 5,600 | 100.00 | 197,616 | 35.29 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

121 | 805,253 | 95.60 | % | $ | 7,536,587 | $ | 9.97 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Annualized base rent per leased square foot includes the impact of tenant concessions. |

Structure of Our Company

Our Operating Entities

Our Operating Partnership

Substantially all of our assets are held by, and our operations are conducted through, the Operating Partnership. As the sole general partner of the Operating Partnership, we generally have the exclusive power under the Amended and Restated Agreement of Limited Partnership of Wheeler REIT, L.P. (the “Partnership Agreement”) to manage and conduct the business and affairs of the Operating Partnership, subject to certain limited approval and voting rights of the limited partners. Our board of directors will manage our business and affairs.

Because we conduct substantially all of our operations through the Operating Partnership, we are considered an UPREIT. UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” An UPREIT is a REIT that holds all or substantially all of its properties through a partnership in which the REIT holds a general partner and/or limited partner interest generally based on the value of capital raised by the REIT through sales of its capital stock. Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of unfavorable tax results. Generally, a sale or contribution of property directly to a REIT is a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may contribute the property to the UPREIT in exchange for limited partnership units in the partnership and defer taxation of gain until the seller later exchanges his limited partnership units on a one-for-one basis for REIT shares or for cash pursuant to the terms of the limited partnership agreement or the UPREIT sells the property.

7

Our Administrative Service Company

We entered into an Administrative Services Agreement with our Administrative Service Company, pursuant to which, our Administrative Service Company provides us with appropriate support personnel to assist our executive management team and performs certain services for us, subject to the oversight of our board of directors and our executive officers. Our Administrative Service Company is responsible for, among other duties (1) performing and administering our day-to-day operations, (2) determining investment criteria in conjunction with our board of directors, (3) sourcing, analyzing and executing asset acquisitions approved by our board of directors, sales and financings, (4) performing asset management duties, (5) performing property management duties, (6) performing leasing duties, and (7) performing financial and accounting management. Our Administrative Service Company currently receives an administrative services fee of $440,000 per year plus $20,000 per year for each additional property we acquire subsequent to the completion of this offering. Additionally, Wheeler Real Estate, LLC receives a property management fee at a rate of 3% of our annual gross revenue and Wheeler Interests, LLC receives an asset management fee at a rate of 2% of our annual gross revenue. Additionally, we reimburse our Administrative Service Company for all reasonable out-of-pocket expenses incurred on our behalf, including but not limited to travel and general office expenses, such as copying and telephone usage. Our executive management team consists of our Chairman/Chief Executive Officer, Chief Financial Officer, and Secretary. The salaries of such officers are paid by our Administrative Service Company. They are also eligible to receive additional compensation in the form of stock incentive awards granted under our 2012 Share Incentive Plan.

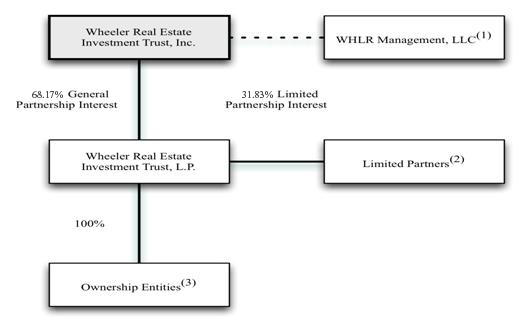

Our Structure

The following diagram depicts the ownership structure of Wheeler Real Estate Investment Trust, Inc. upon the completion of offering contemplated hereby.

| (1) | WHLR Management, LLC, which is wholly-owned by Jon S. Wheeler, will provide administrative services to Wheeler Real Estate investment Trust, Inc. |

| (2) | Prior Investors received 1,858,068 limited partnership units in Wheeler REIT, L.P. in exchange for the contribution of their membership interests in the entities previously acquired by our company. Of those 1,858,068 limited partnership units, 341,765 are owned by Jon. S. Wheeler, 3,185 are owned by Robin Hanisch, our Secretary, and 7,863 are owned by Ann L. McKinney, one of our directors. |

| (3) | Our Operating Partnership owns 100% of the membership interests of each of the entities that own the properties in our portfolio. |

8

Restrictions on Transfer

Under the Partnership Agreement, holders of common units do not have redemption or exchange rights, except under limited circumstances, for a period of 12 months, and may not otherwise transfer their units, except under certain limited circumstances, for a period of 12 months following issuance. After the expiration of this 12-month period, transfers of units by limited partners and their assignees are subject to various conditions, including our right of first refusal. In addition, each of our executive officers, directors and director nominees and their affiliates, have agreed not to sell or otherwise transfer or encumber any shares of our common stock or securities convertible or exchangeable into our common stock (including common units) owned by them at the completion of this offering or thereafter acquired by them for a period of 180 days after the date of this prospectus.

Restrictions on Ownership of our Stock

Due to limitations on the concentration of ownership of REIT stock imposed by the Internal Revenue Code of 1986, as amended (the “Code”), our charter generally prohibits any person from actually, beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock or more than 9.8% in value of the aggregate outstanding shares of all classes and series of our stock (the “Ownership Limits”). See “Description of Securities—Restrictions on Ownership and Transfer.”

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. We do not know if some investors will find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we elected to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Conflicts of Interest

Following the completion of this offering, conflicts of interest may arise between the holders of units and our stockholders with respect to certain transactions, such as the sale of any properties or a reduction of indebtedness, which could have adverse tax consequences to holders of units, including Mr. Wheeler, thereby making those transactions less desirable to such holders. In the event of such a conflict, we are under no obligation to give priority to the separate interests of our company or our stockholders.

Distribution Policy

We intend to pay cash dividends to holders of our common stock on a monthly basis. We intend to make dividend distributions that will enable us to meet the distribution requirements applicable to REITs and to eliminate or minimize our obligation to pay income and excise taxes. Initially, we will be required to use a portion of the net proceeds from this offering to make such

9

distributions. We may in the future also choose to pay dividends in shares of our common stock. See “Federal Income Tax Considerations—Federal Income Tax Considerations for Holders of Our Common Stock—Taxation of Taxable U.S. Stockholders” and “Risk Factors—Risks Related to Our Status as a REIT—We may in the future choose to pay dividends in shares of our common stock, in which case you may be required to pay tax in excess of the cash you receive.”

Additionally, we agreed with our underwriters in our initial public offering that any common units held by Jon S. Wheeler, directly or indirectly or through his spouse, children or affiliated entities, are contractually subordinated to the remaining common units and common stock as it relates to dividend payments to be received by the holders of common units and the holders of common stock.

Our Tax Status

We intend to elect to be taxed and to operate in a manner that will allow us to qualify as a REIT for federal income tax purposes. We believe that our organization and proposed method of operation will enable us to meet the requirements for qualification and taxation as a REIT. To maintain REIT status, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income to our stockholders.

Corporate Information

Our principal executive office is located at Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. Our telephone number is 757-627-9088. Our website is located at www.WHLR.us. The information on, or accessible through, our website is not incorporated into and does not constitute a part of this prospectus or any other report or document we file with or furnish to the Securities and Exchange Commission (the “SEC”).

This Offering

| Common stock offered by us: |

10,000,000 shares |

| Common stock to be outstanding after this offering: |

13,958,500 shares |

| Common stock and common units to be outstanding after this offering: |

15,816,568 shares and common units(1) |

| Use of proceeds: |

We estimate that the net proceeds of this offering, after deducting the placement fee and commissions and estimated expenses, will be approximately $ . We will contribute the net proceeds of this offering to our Operating Partnership. Our Operating Partnership intends to use the net proceeds of this offering as follows: |

| • | approximately $7.1 million to repay outstanding indebtedness. |

| • | approximately $21.5 million to acquire the Contemplated Properties. |

| • | approximately $ for other future acquisitions. |

| • | approximately $10.0 million for general working capital. |

| Risk Factors: |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 21 and other information included in this prospectus before investing in our common stock. |

| Nasdaq Capital Market symbol: |

“WHLR” |

| CUSIP Number: |

963025 101 |

| (1) | Includes 1,858,068 outstanding common units, which may, subject to certain limitations, be redeemed for cash or, at our option, exchanged for shares of common stock on a one-for-one basis. |

10

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Financial Statements

The following unaudited pro forma condensed consolidated financial statements set forth on a pro forma basis for our company giving effect to this offering, the June 2013 preferred stock offering, using a portion of the proceeds from this offering to acquire the Contemplated Properties and using a portion of the proceeds to repay debt as described elsewhere in this Registration Statement. You should read the following unaudited pro forma condensed consolidated financial statements in conjunction with our financial statements and the related notes and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our December 31, 2012 Annual Report on Form 10-K (“2012 Form 10-K”) filed with the Securities and Exchange Commission (“SEC”) on April 1, 2013 and in our March 31, 2013 Quarterly Report on Form 10-Q (“March 2013 Form 10-Q”) filed with the SEC on May 15, 2013. Additionally, you should refer to financial information filed on Form 8-K in relation to the property acquisitions as required under Rule 3-14 of Regulation S-X as promulgated by the SEC that are included as exhibits to this Registration Statement.

The Contemplated Properties consist of the following properties which are described in more detail elsewhere in this Registration Statement.

Starbucks/Verizon Building (Virginia Beach, VA)

Jenks Plaza Shopping Center (Jenks, OK)

Port Crossing Shopping Center (Harrisonburg, VA)

Northeast Plaza Shopping Center (Lumberton, NC)

Brook Run Shopping Center (Richmond, VA)

Jenks Reasor’s Shopping Center (Jenks, OK)

Warren Commons Shopping Center (Warren County, PA)

Winslow Plaza Shopping Center (Sicklerville, NJ)

Forrest Gallery Shopping Center (Tullahoma, TN)

Tampa Festival Centre (Tampa, FL)

The acquisition of the Contemplated Properties as defined above and the Bixby Commons property will be accounted for as an acquisition under the purchase accounting method and recognized at the estimated fair value of acquired assets and assumed liabilities on the date of such contribution or acquisition. The preliminary estimated fair value of these assets and liabilities has been allocated in accordance with Accounting Standards Codification (“ASC”) section 805-10, Business Combinations. Our methodology of allocating the cost of acquisitions to assets acquired and liabilities assumed is based on estimated fair values, replacement cost and appraised values. We estimated the fair value of acquired tangible assets (consisting of land, building and improvements), identified intangible lease assets and liabilities (consisting of acquired above-market leases, acquired in-place lease value and acquired below-market leases) and assumed debt.

The value allocated to in-place leases is amortized over the related lease term and reflected as depreciation and amortization. The value of above- and below-market in place leases are amortized over the related lease term and reflected as either an increase (for below-market leases) or a decrease (for above-market leases) to rental income. The fair value of the debt assumed is determined using current market interest rates for comparable debt financings. The estimated purchase price of the acquired properties for pro forma purposes is based on a relative equity evaluation analysis of the properties which incorporates cash flows and outstanding mortgage debt of the properties.

11

The following unaudited pro forma condensed consolidated financial information sets forth:

| • | the condensed consolidated financial information of our company as of and for the three months ended March 31, 2013 (unaudited) as provided in our financial statements included in our March 2013 Form 10-Q and for the year ended December 31, 2012 (audited) as derived from our financial statements included in our 2012 Form 10-K; |

| • | pro forma adjustments related to the issuance of 4,500 shares of Series A Convertible Preferred Stock at $1,000 on June 10, 2013 as if the transaction was completed as of March 31, 2013 for purposes of the unaudited pro forma condensed consolidated balance sheet and as of January 1, 2012 for purposes of the unaudited pro forma condensed consolidated statements of operations; |

| • | pro forma adjustments related to the offering contemplated in this Registration Statement and the effect of converting 3,476 of the preferred stock into 656,998 as if the transactions were completed as of March 31, 2013 for purposes of the unaudited pro forma condensed consolidated balance sheet and as of January 1, 2012 for purposes of the unaudited pro forma condensed consolidated statements of operations; |

| • | the estimated fair value balance sheet for eight of the Contemplated Properties (see discussion below) as of March 31, 2013 and their estimated pro forma results of operations for the three months ended March 31, 2013 (unaudited) and for the year ended December 31, 2012 (audited, if applicable); and |

| • | pro forma adjustments related to the repayment of debt and the acquired properties as of March 31, 2013 for purposes of the unaudited pro forma condensed consolidated balance sheet and as of January 1, 2012 for purposes of the unaudited pro forma condensed consolidated statements of operations. |

The following Contemplated Properties are not included in the unaudited pro forma condensed consolidated financial information. These three properties have been excluded from the unaudited pro forma condensed consolidated financial information as management has determined that their inclusion would not be meaningful due to the lack of or limited operating history available.

| • | Bixby Common Shopping Center (Bixby, OK) |

| • | Jenks Reasors Shopping Center (Jenks, OK) |

| • | Starbucks/Verizon Building (Virginia Beach, VA) |

The Bixby Commons Shopping Center, a 75,000 square foot shopping center located in Bixby, Oklahoma, was purchased by the company on June 11, 2013 for approximately $10.6 million. In conjunction with this acquisition, we raised $4.16 million in net proceeds in a preferred stock offering. The property is leased to Associated Wholesale Grocers (AWG) who in turn subleases 100% of the property to a Reasor’s Foods grocery store. The property was originally leased to AWG pursuant to a Build and Lease Agreement between the seller and AWG. Construction of the property was completed during late 2012 and Reasor’s Foods opened their store during November 2012. Accordingly, there is limited operating history for the property. Upon closing the acquisition, Reasor’s signing an amendment to the original AWG sublease that created a new 20 year, triple-net operating lease subject to annual rental payments of $769,000. Under the lease agreement, Reasor’s is responsible for all expenses associated with the property, including taxes, insurance, roof and structure.

The Jenks Reasor’s Shopping Center, an 81,000 square foot shopping center located in Jenks, Oklahoma, is owned and 100% occupied by a Reasor’s Foods grocery store. We have entered into a sale-leaseback purchase contract to acquire the property for approximately $11.4 million. The acquisition will be subject to Reasor’s signing a 20 year, triple-net operating lease with annual rental payments of approximately $912,000. Since the property is currently owner-occupied, there is no rental history available.

The Starbucks/Verizon building is a 5,600 square foot free-standing building located in Virginia Beach, Virginia that was significantly renovated during 2012 to accommodate a Starbucks coffeehouse and a Verizon Wireless store, both of which opened their stores during the fourth quarter of 2012. The Starbucks coffeehouse occupies approximately 2,165 square feet of the building under a 10 year, 5 month lease expiring in 2023 which includes three renewal options and is subject to annual rental payments of $79,000. The Verizon Wireless store occupies approximately 3,435 square feet of the building under a 10 year lease expiring in 2022 which includes three renewal options and is subject to annual rental payments of $118,000. The property is subject to a 10 year ground lease with Fairfield Shopping Center, a related party, expiring in 2022. Prior to Starbucks and Verizon Wireless occupying the building, the building had not been occupied since July 2011 at which time it was part of the Fairfield Shopping Center. Accordingly, there is very limited recent rental history available on the property.

The unaudited pro forma condensed consolidated balance sheet is presented for illustrative purposes only and is not necessarily indicative of what the actual financial position would have been had the transactions referred to above occurred on March 31, 2013, nor does it purport to represent the future financial position of the company. The unaudited pro forma condensed consolidated statements of operations are presented for illustrative purposes only and is not necessarily indicative of what the actual results of operations would have been had the transactions referred to above occurred on January 1, 2012, nor does it purport to represent the future results of operations of the company.

The Bixby Commons property and the Contemplated Properties to be acquired may be reassessed for property tax purposes after completing the acquisitions. Therefore, the amount of property taxes we pay in the future may increase from what we have paid in the past. Given the uncertainty of the amounts involved, we have not included any property tax increase in our pro forma financial statements.

12

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Balance Sheet

March 31, 2013

| Pro Forma Transactions | ||||||||||||||||||||||||

| WHLR, Inc. & Subsidiaries |

Prefered Stock Offering |

Proposed Offering Transactions |

Acquisition of Contemplated Properties |

Other Pro Forma Transactions |

WHLR, Inc. & Subsidiaries Consolidated Pro Forma |

|||||||||||||||||||

| (1) | (2) | (4) | (3) | (5) | ||||||||||||||||||||

| ASSETS: |

||||||||||||||||||||||||

| Investment properties, net at cost |

$ | 43,135,493 | $ | — | $ | — | $ | 63,788,000 | $ | — | $ | 106,923,493 | ||||||||||||

| Cash and cash equivalents |

1,053,480 | 4,157,000 | 50,130,000 | (16,370,000 | ) | (7,100,000 | ) | 31,870,480 | ||||||||||||||||

| Rents and other tenant receivables, net |

815,658 | — | — | 954,000 | — | 1,769,658 | ||||||||||||||||||

| Deferred costs and other assets |

6,360,737 | — | — | 7,117,000 | — | 13,477,737 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Assets |

$ | 51,365,368 | $ | 4,157,000 | $ | 50,130,000 | $ | 55,489,000 | $ | (7,100,000 | ) | $ | 154,041,368 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES: |

||||||||||||||||||||||||

| Mortgages and other indebtedness |

$ | 31,821,342 | $ | — | $ | — | $ | 53,904,000 | $ | (7,100,000 | ) | $ | 78,625,342 | |||||||||||

| (Above)/Below market lease intangible, net |

3,523,869 | — | — | (79,000 | ) | — | 3,444,869 | |||||||||||||||||

| Accounts payable, accrued expenses and other liabilities |

808,792 | — | — | 1,664,000 | — | 2,472,792 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Liabilities |

36,154,003 | — | — | 55,489,000 | (7,100,000 | ) | 84,543,003 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EQUITY: |

||||||||||||||||||||||||

| Series A convertible preferred stock (no par value, 500,000 shares authorized, 1,024 shares issued and outstanding, respectively) |

— | 4,157,000 | (3,210,606 | ) | 946,394 | |||||||||||||||||||

| Common stock ($0.01 par value, 75,000,000 shares authorized, 13,958,500 shares issued and outstanding, respectively) |

33,015 | — | 106,570 | — | 139,585 | |||||||||||||||||||

| Additional paid-in capital |

14,097,453 | — | 53,234,036 | — | 67,331,489 | |||||||||||||||||||

| Accumulated deficit |

(6,418,537 | ) | — | — | — | — | (6,418,537 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Shareholders’ Equity |

7,711,931 | 4,157,000 | 50,130,000 | — | — | 61,998,931 | ||||||||||||||||||

| Noncontrolling interests |

7,499,434 | — | — | — | — | 7,499,434 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Equity |

15,211,365 | 4,157,000 | 50,130,000 | — | — | 69,498,365 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Liabilities and Equity |

$ | 51,365,368 | $ | 4,157,000 | $ | 50,130,000 | $ | 55,489,000 | $ | (7,100,000 | ) | $ | 154,041,368 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

See accompanying notes and management’s assumptions to unaudited pro forma condensed consolidated financial statements.

13

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Operations

Three Months Ended March 31, 2013

| Pro Forma Transactions | ||||||||||||||||

| WHLR, Inc. & Subsidiaries |

Contemplated Properties |

Other Pro Forma Transactions |

WHLR, Inc. & Subsidiaries Consolidated Pro Forma |

|||||||||||||

| (6) | (7) | (8) | ||||||||||||||

| REVENUE: |

||||||||||||||||

| Rental revenues |

$ | 1,393,032 | $ | 1,569,000 | $ | (45,900 | ) | $ | 2,916,132 | |||||||

| Other revenues |

224,884 | 473,000 | — | 697,884 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Revenue |

1,617,916 | 2,042,000 | (45,900 | ) | 3,614,016 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Property operations |

300,702 | 553,800 | — | 854,202 | ||||||||||||

| Depreciation and amortization |

648,132 | — | 1,448,400 | 2,096,532 | ||||||||||||

| Provision for credit losses |

15,000 | — | — | 15,000 | ||||||||||||

| Corporate general & administrative |

583,792 | 86,300 | — | 670,092 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,547,626 | 640,100 | 1,448,400 | 3,636,126 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Income (Loss) |

70,290 | 1,401,900 | (1,494,300 | ) | (22,110 | ) | ||||||||||

| Interest expense |

(549,628 | ) | (680,300 | ) | 149,200 | (1,080,728 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income (Loss) |

$ | (479,338 | ) | $ | (721,600 | ) | $ | (1,345,100 | ) | (1,102,838 | ) | |||||

|

|

|

|

|

|

|

|||||||||||

| Less: Net loss attributable to noncontrolling interests |

(118,902 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Net Loss Attributable to Wheeler REIT |

(938,936 | ) | ||||||||||||||

| Pro forma preferred stock dividends |

20,927 | (13) | ||||||||||||||

|

|

|

|||||||||||||||

| Net Loss Attributable to Wheeler REIT Common Shareholders |

(1,004,863 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Loss per share: |

||||||||||||||||

| Basic and Diluted |

$ | (0.07 | ) | |||||||||||||

|

|

|

|||||||||||||||

| Weighted-average number of shares: |

||||||||||||||||

| Basic and Diluted |

13,958,500 | |||||||||||||||

|

|

|

|||||||||||||||

See accompanying notes and management’s assumptions to unaudited pro forma condensed consolidated financial statements.

14

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Operations

Year Ended December 31, 2012

| Pro Forma Transactions | ||||||||||||||||||||

| WHLR, Inc. & Subsidiaries |

2012 Acquisitions |

Contemplated Properties |

Other Pro Forma Transactions |

WHLR, Inc. & Subsidiaries Consolidated Pro Forma |

||||||||||||||||

| (9) | (10) | (11) | (12) | |||||||||||||||||

| REVENUE: |

||||||||||||||||||||

| Rental revenues |

$ | 1,963,681 | $ | 3,483,896 | $ | 6,276,000 | $ | (183,400 | ) | $ | 11,540,177 | |||||||||

| Other revenues |

470,298 | 721,388 | 1,892,000 | — | 3,083,686 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenue |

2,433,979 | 4,205,284 | 8,168,000 | (183,400 | ) | 14,623,863 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| OPERATING EXPENSES: |

||||||||||||||||||||

| Property operations |

519,220 | 725,921 | 2,215,000 | — | 3,460,141 | |||||||||||||||

| Depreciation and amortization |

822,152 | 1,871,643 | — | 5,793,400 | 8,487,195 | |||||||||||||||

| Provision for credit losses |

25,000 | 29,230 | — | — | 54,230 | |||||||||||||||

| Corporate general & administrative |

1,307,151 | 315,128 | 345,000 | — | 1,967,279 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Operating Expenses |

2,673,523 | 2,941,922 | 2,560,000 | 5,793,400 | 13,968,845 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating Income (Loss) |

(239,544 | ) | 1,263,362 | 5,608,000 | (5,976,800 | ) | 655,018 | |||||||||||||

| Interest expense |

(966,113 | ) | (1,079,634 | ) | (2,721,000 | ) | 596,800 | (4,169,947 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

$ | (1,205,657 | ) | $ | 183,728 | $ | 2,887,000 | $ | (5,380,000 | ) | (3,514,929 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Net loss attributable to noncontrolling interests |

(315,164 | ) | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Net Loss Attributable to Wheeler REIT |

(3,199,765 | ) | ||||||||||||||||||

| Pro forma preferred stock dividends |

90,613 | (13) | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Net Loss Attributable to Wheeler REIT Common Shareholders |

$ | (3,290,378 | ) | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Loss per share: |

||||||||||||||||||||

| Basic and Diluted |

$ | (0.24 | ) | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Weighted-average number of shares: |

||||||||||||||||||||

| Basic and Diluted |

13,958,500 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

See accompanying notes and management’s assumptions to unaudited pro forma condensed consolidated financial statements.

15

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Notes and Management’s Assumptions to Unaudited Pro Forma

Condensed Consolidated Financial Statements

A. Basis of Presentation

The accompanying unaudited pro forma condensed consolidated financial statements are presented to reflect:

| • | the effect of preferred stock offering that closed on June 10, 2013, resulting in the issuance of 4,500 shares of Series A Convertible Preferred Stock at $1,000 per share which generated $4.5 million in gross proceeds; |

| • | the effect of closing the contemplated offering, assuming we issue 10 million shares of $0.01 par value common stock at $5.57, which approximates a 30-day weighted average market value of the stock; |

| • | the effect of converting 3,476 of the preferred stock into 656,998 of common stock (maximum allowed per the preferred stock securities purchase agreement due to NASDAQ listing rules limitation) based on a $5.29 per common share conversion rate which is 95% (also provided for in the preferred stock securities purchase agreement ) of the $5.57 approximate 30-day weighted average market value of the common stock; |

| • | using approximately $16.4 million of the offering proceeds to acquire eight of the Contemplated Properties; |

| • | the estimated fair value for eight of the Contemplated Properties as of March 31, 2013 as accounted for under the purchase method of accounting in accordance with ASC Section 805, Business Combinations; |

| • | the pro forma impact on operations for eight of the Contemplated Properties assuming they were acquired on January 1, 2012; |

| • | the pro forma incremental impact on operations for the year ended December 31, 2012 of the properties acquired during the fourth quarter of 2012; and |

| • | using approximately $7.1 million of the net proceeds of this offering to repay outstanding indebtedness and the corresponding impact on interest expense. |

As previously disclosed, the pro forma financial statements exclude the impact of acquiring the Bixby Commons Shopping Center, the Jenks Reasor’s Shopping Center and the Starbucks/Verizon building.

The unaudited pro forma condensed consolidated balance sheet assumes the transactions described above occurred on March 31, 2013. The unaudited pro forma condensed consolidated statements of operations assume the transactions described above occurred on January 1, 2012. The unaudited pro forma condensed consolidated balance sheet is presented for illustrative purposes only and is not necessarily indicative of what the actual financial position would have been had the transactions referred to above occurred on March 31, 2013, nor does it purport to represent the future financial position of the company. The unaudited pro forma condensed consolidated statements of operations are presented for illustrative purposes only and is not necessarily indicative of what the actual results of operations would have been had the transactions referred to above occurred on January 1, 2012, nor does it purport to represent the future results of operations of the company. In the opinion of management, all material adjustments have been made to reflect the effects of transactions referred to above.

B. Management’s Assumptions to the Unaudited Pro Forma Condensed Consolidated Balance Sheet

| (1) | Represents the unaudited condensed consolidated financial information of our company as of March 31, 2013 as provided in our financial statements included in our March 2013 Form 10-Q. |

16

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Notes and Management’s Assumptions to Unaudited Pro Forma

Condensed Consolidated Financial Statements

| (2) | Represents the impact of the preferred stock offering calculated as follows: |

| Gross proceeds from the sale of 4,500 shares of preferred stock at $1,000 per share |

$ | 4,500,000 | ||

| Less: Placement fee and other offering costs incurred |

(343,000 | ) | ||

|

|

|

|||

| Estimated net cash proceeds from common stock and preferred stock offerings |

$ | 4,157,000 | ||

|

|

|

|||

| (3) | Represents the preliminary estimated fair values related to the anticipated acquisition of eight of the Contemplated Properties. The amounts presented reflect the initial allocation of the preliminary estimated fair values and will be finalized subsequent to consummation of the transactions. The following summarizes the estimated consideration to be paid and the preliminary estimated fair values of assets to be acquired and liabilities to be assumed in conjunction with the company acquiring the Contemplated Properties, along with a description of the methods used to estimate fair value. In estimating fair values, we considered many factors including, but not limited to, cash flows, market cap rates, location, occupancy rates, appraisals, other acquisitions and our knowledge of the current acquisition market for similar properties. |

| Contemplated Properties |

||||

| Preliminary estimated fair value of assets acquired and liabilities assumed: |

||||

| Investment property (a) |

$ | 63,788,000 | ||

| Tenant and other receivables and other assets (b) |

954,000 | |||

| Other lease intangibles (c) |

7,117,000 | |||

| Mortgage debt (d) |

(53,904,000 | ) | ||

| Accounts payable, accrued expenses and other liabilities (e) |

(1,664,000 | ) | ||

| Above/(below) market leases (f) |

79,000 | |||

|

|

|

|||

| Estimated fair value of net assets acquired |

$ | 16,370,000 | ||

|

|

|

|||

| Estimated purchase consideration: |

||||

| Estimated consideration paid with cash (g) |

$ | 16,370,000 | ||

|

|

|

|||

| a. | Represents the estimated fair value of the net investment properties acquired which includes land, buildings, site improvements and tenant improvements. The fair value was estimated using following approaches: |

| i. | the market approach valuation methodology for land by considering similar transactions in the markets; |

| ii. | a combination of the cost approach and income approach valuation methodologies for buildings, including replacement cost evaluations, “go dark” analyses and residual calculations incorporating the land values; |

| iii. | the cost approach valuation methodology for site and tenant improvements, including replacement costs and prevailing quoted market rates; and |

| iv. | the income approach valuation methodology for in place leases which considered estimated market rental rates, expenses reimbursements and time required to replace leases. |

17

Wheeler Real Estate Investment Trust, Inc. and Subsidiaries

Notes and Management’s Assumptions to Unaudited Pro Forma

Condensed Consolidated Financial Statements

| b. | Represents the estimated fair value of tenant and other receivables and other current assets. It was determined that carrying value approximated fair value for all amounts in these categories. |

| c. | Represents the estimated fair value of other lease intangibles which includes leasing commissions, legal and marketing fees associated with replacing existing leases and in place lease values. The income approach was used to estimate the fair value of these intangible assets which included estimated market rates and expenses. |

| d. | Represents the estimated fair value of mortgages payable which was calculated by performing a discounted cash flow analysis on debt service using current prevailing market interest on comparable debt. |

| e. | Represents the estimated fair value of accounts payable, accrued expenses and other liabilities. It was determined that carrying value approximated fair value for all amounts in these categories. |

| f. | Represents the estimated fair value of above/(below) market leases. The income approach was used to estimate the fair value of above/(below) market leases using market rental rates for similar properties. |

| g. | Represents the estimated purchase consideration to be paid. |

| h. | As disclosed earlier, the unaudited pro forma condensed consolidated financial information does not include the effect of the acquisitions of Bixby Commons, Jenks Reasor’s Shopping Center or the Starbucks/Verizon Building. Had these three properties been included, the impact on the balance sheet would be as follows: |

| Pro Forma Transactions | ||||||||||||||||||||||||||||

| WHLR, Inc.

& Subsidiaries |

Prefered Stock Offering |

Acquisition of Bixby Commons |

Proposed Offering Transactions |

Acquisition of Contemplated Properties |

Other Pro Forma Transactions |

WHLR, Inc.

& Subsidiaries Consolidated Pro Forma |

||||||||||||||||||||||

| ASSETS: |

||||||||||||||||||||||||||||

| Investment properties, net at cost |

$ | 43,135,493 | $ | — | $ | 8,837,700 | $ | — | $ | 74,516,000 | $ | — | $ | 126,489,193 | ||||||||||||||

| Cash and cash equivalents |

1,053,480 | 4,157,000 | (3,922,000 | ) | 50,130,000 | (21,542,700 | ) | (7,100,000 | ) | 22,775,780 | ||||||||||||||||||

| Rents and other tenant receivables, net |

815,658 | — | — | — | 954,000 | — | 1,769,658 | |||||||||||||||||||||

| Deferred costs and other assets |

6,360,737 | — | 1,762,300 | — | 9,182,100 | — | 17,305,137 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Assets |

$ | 51,365,368 | $ | 4,157,000 | $ | 6,678,000 | $ | 50,130,000 | $ | 63,109,400 | $ | (7,100,000 | ) | $ | 168,339,768 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| LIABILITIES: |

||||||||||||||||||||||||||||

| Mortgages and other indebtedness |

$ | 31,821,342 | $ | — | $ | 6,678,000 | $ | — | $ | 61,510,200 | $ | (7,100,000 | ) | $ | 92,909,542 | |||||||||||||

| (Above)/Below market lease intangible, net |

3,523,869 | — | — | — | (79,200 | ) | — | 3,444,669 | ||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities |

808,792 | — | — | — | 1,678,400 | — | 2,487,192 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Liabilities |

36,154,003 | — | 6,678,000 | — | 63,109,400 | (7,100,000 | ) | 98,841,403 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| EQUITY: |

||||||||||||||||||||||||||||

| Series A convertible preferred stock (no par value, 500,000 shares authorized, 1,024 shares issued and outstanding, respectively) |

— | 4,157,000 | (3,210,606 | ) | 946,394 | |||||||||||||||||||||||