UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-35713

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | 45-2681082 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 2529 Virginia Beach Blvd., Suite 200 Virginia Beach. Virginia |

23452 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(757) 627-9088

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Common stock, $0.01 par value (NASDAQ Capital Market)

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated file | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant was not a publicly-traded company on the last business day of the registrant’s most recent second fiscal quarter. As such, the required calculation of public float cannot be made. The registrant does not have any non-voting common equity.

As of March 27, 2013, there were 3,301,502 shares of common stock, $0.01 par value per share, outstanding.

| 2 | ||||||

| Item 1. |

2 | |||||

| Item 1A. |

8 | |||||

| Item 1B. |

9 | |||||

| Item 2. |

9 | |||||

| Item 3. |

20 | |||||

| Item 4. |

21 | |||||

| 21 | ||||||

| Item 5. |

21 | |||||

| Item 6. |

23 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 | ||||

| Item 7A. |

32 | |||||

| Item 8. |

32 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

32 | ||||

| Item 9A. |

33 | |||||

| Item 9B. |

33 | |||||

| 33 | ||||||

| Item 10. |

33 | |||||

| Item 11. |

39 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

42 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

43 | ||||

| Item 14. |

44 | |||||

| Item 15. |

44 | |||||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Wheeler Real Estate Investment Trust, Inc. contains forward-looking statements, including discussion and analysis of our financial condition, anticipated capital expenditures required to complete projects, amounts of anticipated cash distributions to our shareholders in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” or the negative of such terms and variations of these words and similar expressions. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements, which reflect our management’s view only as of the date of this Annual Report on Form 10-K. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Factors that could cause actual results to differ materially from any forward-looking statements made in this Annual Report on Form 10-K include:

| • | the imposition of federal taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; |

| • | uncertainties related to the national economy, the real estate industry in general and in our specific markets; |

| • | legislative or regulatory changes, including changes to laws governing REITs; |

| • | adverse economic or real estate developments in Virginia, Florida, Georgia, South Carolina, North Carolina or Oklahoma; |

| • | increases in interest rates and operating costs; |

| • | inability to obtain necessary outside financing; |

| • | litigation risks; |

| • | lease-up risks; |

| • | inability to obtain new tenants upon the expiration of existing leases; |

| • | inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; and |

| • | the need to fund tenant improvements or other capital expenditures out of operating cash flow. |

These forward-looking statements should be read in light of these factors.

| Item 1. | Business |

INDUSTRY BACKGROUND AND MARKET OPPORTUNITY

The retail shopping center industry is one of the largest industries in the United States. The retail shopping center industry had annual revenue of approximately $2.29 trillion in 2010, a year over year percentage increase of 3.5% from 2009, according to the International Council of Shopping Centers (the “ICSC”). In order to support such strong demand, the shopping center space market has grown to 7.3 billion square feet of gross leasable area (“GLA”) in 2011 from 2.1 billion square feet in 1970, and there are currently over 107,823 shopping centers in the United States according to the latest data provided by the ICSC and CoStar Realty.

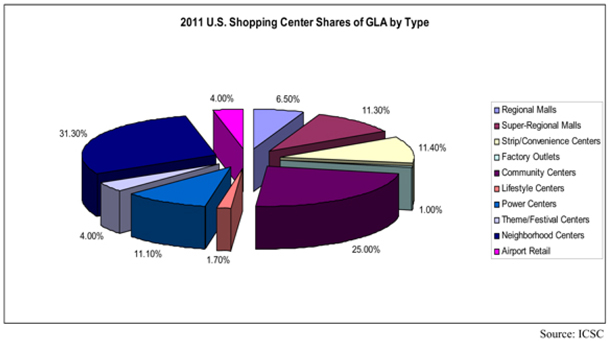

The ICSC has defined ten principal shopping center types that include: (1) neighborhood; (2) community; (3) regional; (4) superregional; (5) lifestyle; (6) power; (7) theme/festival; (8) outlets; (9) airport retail; and (10) convenience/strip centers. According to ICSC, the centers are distinguished primarily by their merchandise orientation (i.e., the type of goods and services sold) and the size of the center. Other characteristics include the number and type of anchor tenants and the anchor ratio (i.e., the share of a center’s total square footage that is attributable to its anchors) and the primary trade area (i.e., the area from which 60% to 80% of the center’s sales originate). Regional and superregional centers, or enclosed malls, comprise approximately 17% of the total shopping center market, while the eight other types of centers make up the remaining 83% on a square footage basis.

We focus on owning and managing income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. We believe that these property types are the most stable assets within the retail sector. Consumer spending on goods offered by such retailers does not experience significant fluctuations. As of July 2011, convenience/strip centers, neighborhood and community shopping centers made up approximately 11.4%, 31.3% and 25.0% of the open-air shopping center space market based on a square footage basis.

2

Our Markets

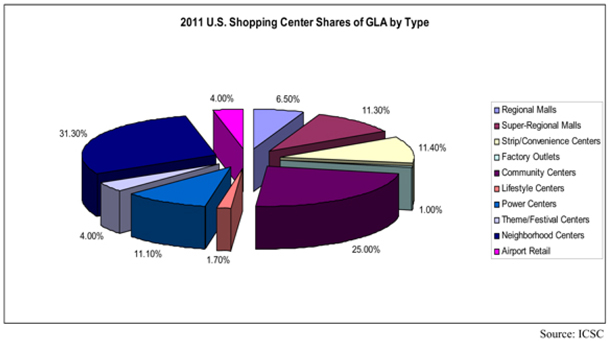

We primarily target markets in the Mid-Atlantic, Southeast and Southwest that exhibit attractive economic fundamentals and have favorable long-term supply-demand characteristics. Specifically, five of our eleven properties in our portfolio are currently located in Virginia, one is located in North Carolina, one is located in Florida, one is located in Georgia, one is located in South Carolina and two are located in Oklahoma.

As shown in the 2010 U.S. Census population change map below, the center of gravity of the U.S. population continues to shift toward the southwest and southeast, continuing a decade long shift of the U.S. population toward these areas. The Southwest and Southeast comprise two of our markets and we believe that our network of relationships in the retail industry in these geographic areas position us to take advantage of the on-going population shift toward the Southwest and Southeast.

Market Opportunity

Shopping center GLA grew by only 0.25% in 2010 and growth in 2011 continues to be sluggish to date as well. The slow growth in U.S. shopping-center space reflects lagging adjustments resulting from the severe business cycle downturn between 2007 and 2009. However, one effect of such slowed growth has been to bolster the shopping center industry’s fundamentals relative to other property classes. For instance, the shopping center vacancy rate in the first quarter of 2011 was 10.9%, considerably lower than that of 15.2% for office properties. We believe that the retail and shopping center industries are poised for a period of growth as the U.S. economy recovers from a period of global economic decline. Additionally, we believe that our company is positioned to take advantage of this coming period of growth.

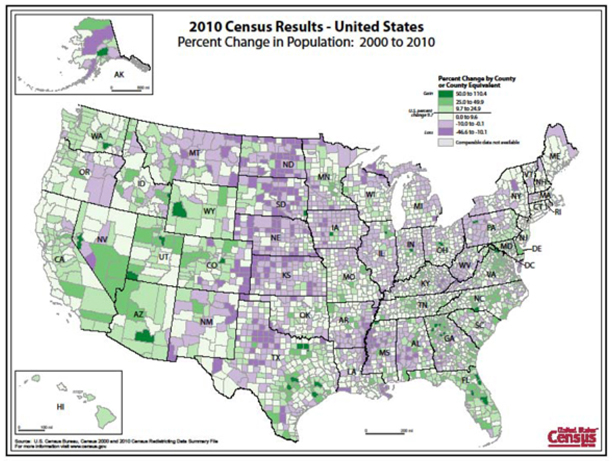

Retail property values appear to be at their cyclical lows and we believe the ensuing rebound may be similar to those of past economic downturns, which are illustrated in the chart below. Retail sales recorded average year-over-year growth rates of 6.4%, 6.4% and 5.1% during the three years following the recessions of 1982, 1990 and 2001, respectively; however, there is no guarantee that comparable growth rates will occur in the future. We

3

believe that the recent lack of construction combined with the anticipated economic recovery will yield an environment of increasing rents and therefore increasing operating cash flows and property values. The chart below shows retail sales growth following recent recessions.

Over the longer-term, we believe population growth will continue to support commercial real estate, including retail properties. According to the U.S. Census, annual population growth will remain near historical averages at approximately 1%. Moreover, the number of 25- to 44-year-old consumers, one of the primary drivers of household formation, is expected to grow from 83 million in 2010 to approximately 90 million by 2020. We believe that new household formation is a primary demand driver for consumer goods that are sold at our target assets.

Our management team has had success in identifying and capitalizing on opportunities that arise during times of economic weakness and the expansion periods that follow. Accordingly, we believe that in the short to intermediate term we will be able to capitalize on opportunities to purchase properties that meet our investment criteria. We will seek properties in potentially dominant locations in secondary and tertiary markets whose vacancies stem from recent retail dislocations or mismanagement rather than weak property fundamentals.

BUSINESS AND PROPERTIES

Overview

We are a Maryland corporation formed with the principal objective of acquiring, financing, developing, leasing, owning and managing income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. We target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. We generally lease our properties to national and regional retailers that offer consumer goods and generate regular consumer traffic. We believe our tenants carry goods that are less impacted by fluctuations in the broader U.S. economy and consumers’ disposable income, generating more predictable property-level cash flows.

We currently own a portfolio consisting of seven retail shopping centers, three free-standing retail properties, and one office property, totaling 470,350 net rentable square feet of which were approximately 94.3% leased as of December 31, 2012.

We believe the current market environment creates a substantial number of favorable investment opportunities with attractive yields on investment and significant upside potential. We believe the markets we plan to pursue of the Mid-Atlantic, Southeast and Southwest are characterized by strong demographics and dynamic, diversified economies that will continue to generate jobs and future demand for commercial real estate. We

4

anticipate that the depth and breadth of our real estate experience allows us to capitalize on revenue-enhancing opportunities in our portfolio and source and execute new acquisition and development opportunities in our markets, while maintaining stable cash flows throughout various business and economic cycles.

Jon S. Wheeler, our Chairman and President, has 30 years of experience in the real estate sector with particular experience in strategic financial and market analyses and assessments of new or existing properties to maximize returns. We have an integrated team of professionals with experience across all stages of the real estate investment cycle.

We were organized as a Maryland corporation on June 23, 2011 and intend to elect to be taxed as a REIT beginning with our taxable year ending December 31, 2012. We conduct substantially all of our business through Wheeler Real Estate Investment Trust, L.P., a Virginia limited partnership, of which we are the sole general partner (our “Operating Partnership”). We are structured as an UPREIT, which means that we will own most of our properties through our Operating Partnership and its subsidiaries. As an UPREIT, we may be able to acquire properties on more attractive terms from sellers who can defer tax obligations by contributing properties to our Operating Partnership in exchange for Operating Partnership units, which will be redeemable for cash or exchangeable for shares of our common stock at our election.

WHLR Management, LLC (our “Administrative Service Company”), which is wholly owned by Mr. Wheeler, provides administrative services to our company. Pursuant to the terms of an administrative services agreement between our Administrative Service Company and us, our Administrative Service Company is responsible for identifying targeted real estate investments; handling the disposition of the real estate investments our board of directors has chosen to sell; and administering our day-to-day business operations, including but not limited to, leasing duties, property management, payroll and accounting functions. We also benefit from Mr. Wheeler’s partially or wholly owned related business and platform that specializes in retail real estate investment and management. Mr. Wheeler’s organization includes (i) Wheeler Interests, LLC, an acquisition and asset management firm, (ii) Wheeler Real Estate, LLC, a real estate leasing management and administration firm, (iii) Wheeler Development, LLC, a full service real estate development firm, (iv) Wheeler Capital, LLC, a capital investment firm specializing in venture capital, financing, and small business loans, (v) Site Applications, LLC, a full service facility company equipped to handle all levels of building maintenance and (vi) TESR, LLC, a tenant coordination company specializing in tenant relations and community events (collectively, our “Services Companies”). Our headquarters is located at Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. Our telephone number is (757) 627-9088. Our website is located at WHLR.us. Our Internet website and the information contained therein or connected thereto does not constitute a part of this Form 10-K or any amendment or supplement hereto.

Our Competitive Strengths

We believe the following competitive strengths distinguish us from other owners and operators of commercial real estate and will enable us to take advantage of new acquisition and development opportunities, as well as growth opportunities within our portfolio:

| • | Cornerstone Portfolio of Retail Properties. We believe we have acquired and developed a portfolio of properties located in business centers in Virginia, Florida, Georgia, South Carolina, North Carolina, and Oklahoma. We believe many of our properties currently achieve rental and occupancy rates equal to or above those typically prevailing in their respective markets due to their desirable and competitively advantageous locations within their submarkets, as well as our hands-on management approach. The retail properties comprising our portfolio fit within our property acquisition profile of income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. These properties are located in local markets that exhibit stable demographics and have historically exhibited favorable trends, such as strong population and income growth. These properties represent the initial base of the larger portfolio that we expect to build over time. |

| • | Experienced Management Team. Our executive officers and the members of the management teams of our Services Companies have significant experience in all aspects of the commercial real estate industry, specifically in our markets. They have overseen the acquisition or development and operation of more than 60 shopping centers, representing over 4 million rentable square feet of |

5

| retail property, including all of the properties in our portfolio. Mr. Wheeler and the real estate professionals employed by our Services Companies have in-depth knowledge of our assets, markets and future growth opportunities, as well as substantial expertise in all aspects of leasing, asset and property management, marketing, acquisitions, redevelopment and facility engineering and financing, all of which we believe provides us with a significant competitive advantage. |

| • | Access to a Pipeline of Acquisition and Leasing Opportunities. We believe that market knowledge and network of relationships with real estate owners, developers, brokers, national and regional lenders and other market participants provides us access to an ongoing pipeline of attractive acquisition and investment opportunities in and near our markets. In addition, we have a network of relationships with numerous national and regional tenants in our markets, many of whom currently are tenants in our retail buildings, which we expect will enhance our ability to retain and attract high quality tenants, facilitate our leasing efforts and provide us with opportunities to increase occupancy rates at our properties, thereby allowing us to maximize cash flows from our properties. We have successfully converted many of our strong relationships with our retail tenants into leasing opportunities at our properties. |

| • | Broad Real Estate Expertise with Retail Focus. Our management team has experience and capabilities across the real estate sector with experience and expertise particularly in the retail asset class, which we believe provides for flexibility in pursuing attractive acquisition, development, and repositioning opportunities. Since varying market conditions create opportunities at different times across property types, we believe our expertise enables us to target relatively more attractive investment opportunities throughout economic cycles. In addition, our fully integrated platform with in-house development capabilities allows us to pursue development and redevelopment projects with multiple uses. We believe that our ability to pursue these types of opportunities differentiates us from many competitors in our markets. |

Business and Growth Strategies

Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. Specifically, we intend to pursue the following strategies to achieve these objectives:

| • | Maximize value through proactive asset management. We believe our market expertise, targeted leasing strategies and proactive approach to asset management will enable us to maximize the operating performance of our portfolio. We will continue to implement an active asset management program to increase the long-term value of each of our properties. This may include expanding existing tenants, re-entitling site plans to allow for additional outparcels, which are small tracts of land used for freestanding development not attached to the main buildings, and repositioning tenant mixes to maximize traffic, tenant sales and percentage rents. As we grow our portfolio, we will seek to maintain a diverse pool of assets with respect to both geographic distribution and tenant mix, helping to minimize our portfolio risk. We will utilize our experience and market knowledge to effectively allocate capital to implement our investment strategy. We continually monitor our markets for opportunities to selectively dispose of properties where returns appear to have been maximized and redeploy proceeds into new acquisitions that have greater return prospects. |

| • | Pursue value oriented investment strategy targeting properties fitting within our acquisition profile. We believe the types of retail properties we seek to acquire will provide better risk-adjusted returns compared to other properties in the retail asset class, as well as other property types in general, due to the anticipated improvement in consumer spending habits resulting from a strengthening economy coupled with the long-term nature of the underlying leases and predictability of cash flows. We will acquire retail properties based on identified market and property characteristics, including: |

| • | Property type. We focus our investment strategy on income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. We will target these types of properties because they tend to be more focused on consumer goods as opposed to enclosed malls, which we believe are more oriented to discretionary spending that is susceptible to cyclical fluctuations. |

| • | Strip center. A strip center is an attached row of stores or service outlets managed as a coherent retail entity, with on-site parking usually located in front of the stores. Open canopies may connect the store fronts, but a strip center does not have enclosed walkways linking the stores. A strip center may be configured in a straight line or have an “L” or “U” shape. |

6

| • | Neighborhood centers. A neighborhood center is designed to provide convenience shopping for the day-to-day needs of consumers in the immediate neighborhood. Neighborhood centers are often anchored by a supermarket or drugstore. The anchors are supported by outparcels typically occupied by restaurants, fast food operators, financial institutions and in-line stores offering various products and services ranging from soft goods, healthcare and electronics. |

| • | Community centers. A community center typically offers a wider range of apparel and other soft goods relative to a neighborhood center and in addition to supermarkets and drugstores, can include discount department stores as anchor tenants. |

| • | Freestanding retail properties. A freestanding retail property constitutes any retail building that is typically occupied by a single tenant. The lease terms are generally structured as triple-net with the tenant agreeing to pay rent as well as all taxes, insurance and maintenance expenses that arise from the use of the property. |

| • | Anchor tenant type. We will target properties with anchor tenants that offer consumer goods that are less impacted by fluctuations in consumers’ disposable income. We believe nationally and regionally recognized anchor tenants that offer consumer goods provide more predictable property-level cash flows as they are typically higher credit quality tenants that generate stable revenues. We feel these properties will act as a catalyst for incremental leasing demand through increased property foot traffic. We will identify the credit quality of our anchor tenants by conducting a thorough analysis including, but not limited to, a review of tenant operating performance, liquidity and balance sheet strength. |

| • | Lease terms. In the near term, we intend to acquire properties that feature one or more of the following characteristics in their tenants’ lease structure: properties with long-term leases (10 years remaining on the primary lease term) for anchor tenants; properties under triple-net leases, which are leases where the tenant agrees to pay rent as well as all taxes, insurance and maintenance expenses that arise from the use of the property; thereby minimizing our expenses; and properties with leases which incorporate gross percentage rent and/or rental escalations that act as an inflation hedge while maximizing operating cash flows. As a longer-term strategy, we will look to acquire properties with shorter-term lease structures (2-3 years) for in-line tenants, which are tenants that rent smaller spaces around the anchor tenants within a property, that have below market rents that can be renewed at higher market rates. |

| • | Geographic markets and demographics. We plan to seek investment opportunities throughout the United States; however, we will focus on the Mid-Atlantic, Southeast and |

7

| Southwest, which are characterized by attractive demographic and property fundamental trends. We will target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. These communities will also have a combination of the following characteristics: |

| • | established trade areas with high barriers to entry, |

| • | high population base with expected annual growth rate higher than the national average, |

| • | high retail sales per square foot compared to the national average, |

| • | above average household income and expected growth, |

| • | above-average household density, |

| • | favorable infrastructure such as schools to retain and attract residents, and |

| • | below-average unemployment rate. |

| • | Capitalize on network of relationships to pursue transactions. We plan to pursue transactions in our target markets through the relationships we have developed. Leveraging these relationships, we will target property owners that our management team has transacted with previously, many of whom, we feel, will consider us a preferred counterparty due to our track record of completing fair and timely transactions. We believe this dynamic gives us a competitive advantage in negotiating and executing favorable acquisitions. |

| • | Leverage our experienced property management platform. Our executive officers, together with the management teams of our Services Companies, have over 150 years of combined experience managing, operating and leasing retail properties. We consider our Services Companies to be in the best position to oversee the day-to-day operations of our properties, which in turn helps us service our tenants. We feel this generates higher renewal and occupancy rates, minimizes rent interruptions, reduces renewal costs and helps us achieve stronger operating results. Along with this, a major component of our leasing strategy is to cultivate long-term relationships through consistent tenant dialogue in conjunction with a proactive approach to meeting the space requirements of our tenants. |

| • | Grow our platform through a comprehensive financing strategy. We believe our capital structure will provide us with sufficient financial capacity and flexibility to fund future growth. Based on our current capitalization, we believe we will have access to multiple sources of financing that are currently unavailable to many of our private market peers or overleveraged public competitors, which will provide us with a competitive advantage. Over time, these financing alternatives may include follow-on offerings of our common stock, unsecured corporate level debt, preferred equity and credit facilities. We have a ratio of debt to total market capitalization of approximately 51%. Although we are not required by our governing documents to maintain this ratio at any particular level, our Board of Directors will review our ratio of debt to total capital on a quarterly basis, with the goal of maintaining a reasonable rate consistent with our expected ratio of debt to total market capitalization going forward. This strategy will enable us to continue to grow our asset base well into the future. |

| Item 1A. | Risk Factors. |

Not applicable.

8

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

Our Portfolio

We currently own eleven properties located in Virginia, North Carolina, South Carolina, Florida, Georgia and Oklahoma, containing a total of approximately 470,350 million rentable square feet of retail space, which we refer to as our portfolio. The following table presents an overview of our portfolio, based on information as of December 31, 2012.

Portfolio

| Property |

Location | Year Built/ Renovated |

Number of Tenants |

Net Rentable Square Feet |

Percentage Leased |

Annualized Base Rent |

Annualized Base Rent per Leased Square Foot (1) |

|||||||||||||||||

| The Shoppes at TJ Maxx |

Richmond, VA | 1982/1999 | 14 | 93,552 | 90.6 | % | $ | 950,040 | $ | 11.21 | ||||||||||||||

| Walnut Hill Plaza |

Petersburg, VA | 1959/2006/2008 | 11 | 89,907 | 82.7 | % | 550,247 | 7.40 | ||||||||||||||||

| Lumber River Plaza |

Lumberton, NC | 1985/1997-98 (expansion)/ 2004 |

12 | 66,781 | 100.0 | % | 514,810 | 7.71 | ||||||||||||||||

| Perimeter Square |

Tulsa, OK | 1982-83 | 8 | 58,277 | 95.7 | % | 691,977 | 12.41 | ||||||||||||||||

| The Shoppes at Eagle Harbor |

Carrollton, VA | 2009 | 7 | 23,303 | 100.0 | % | 472,561 | 20.28 | ||||||||||||||||

| Harps At Harbor Point |

Grove, OK | 2012 | 1 | 31,500 | 100.0 | % | 364,432 | 11.57 | ||||||||||||||||

| Twin City Crossing |

Batesburg- Leesville, SC |

1998/2002 | 5 | 47.680 | 100.0 | % | 446,590 | 9.37 | ||||||||||||||||

| Surrey Plaza |

Hawkinsville, GA | 1993 | 5 | 42,680 | 100.0 | % | 302,595 | 7.09 | ||||||||||||||||

| Riversedge North |

Virginia Beach, VA |

2007 | 1 | 10,550 | 100.0 | % | 302,539 | 28.68 | ||||||||||||||||

| Monarch Bank |

Virginia Beach, VA |

2002 | 1 | 3,620 | 100.0 | % | 250,740 | 69.27 | ||||||||||||||||

| Amscot Building |

Tampa, FL | 2004 | 1 | 2,500 | 100.0 | % | 101,395 | 40.56 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Portfolio |

66 | 470,350 | 94.3 | % | $ | 4,947,926 | $ | 11.16 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Annualized base rent per leased square foot includes the impact of tenant concessions. |

Description of Our Properties

The following properties comprise our current portfolio of eleven properties:

Shoppes at TJ Maxx

The Shoppes at TJ Maxx is a 93,552 square foot community shopping center built in 1982 and renovated in 1999, and anchored by TJ Maxx. The property is located in Richmond, Virginia on the West Broad Street shopping corridor and is occupied by 14 primarily retail and restaurant tenants.

9

TJ Maxx

| • | TJ Maxx leases 32,400 square feet of net rentable square feet, representing 34.63% of the net rentable square feet of the Shoppes at TJ Maxx. |

| • | Annual rent under the TJ Maxx lease is $294,192. |

| • | The TJ Maxx lease expires on April 30, 2019 and has one renewal option for five years. |

Cannon’s Online Auctions

| • | Cannon’s Online Auctions leases 14, 000 square feet of net rentable square feet, representing 14.96% of the net rentable square feet of the Shoppes at TJ Maxx. |

| • | Annual rent under the Cannon’s Online Auctions lease is $84,000. |

| • | The Cannon’s Online Auctions lease expires on September 30, 2015 and is not currently subject to any renewal options. |

The following table sets forth the percentage leased and annualized rent per leased square foot for Shoppes at TJ Maxx as of the indicated dates:

| Date |

Percent Leased | Annualized Rent Per Leased Square Foot(1) |

||||||

| December 31, 2012 |

90.60 | % | $ | 11.21 | ||||

| December 31, 2011 |

81.20 | 12.24 | ||||||

| December 31, 2010 |

79.82 | 11.77 | ||||||

| December 31, 2009 |

88.35 | 10.85 | ||||||

| December 31, 2008 |

98.15 | 10.22 | ||||||

| (1) | Annualized rent per leased square foot is calculated by dividing (i) annualized base rent, by (ii) square footage leased. |

The following table sets forth the lease expirations for leases in place at Shoppes at TJ Maxx as of December 31, 2012, assuming that tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Square Footage of Expiring Leases |

Percentage of Property Leased Square Feet |

Annualized Base Rent (in 000s)(1) |

Percentage of Property Annualized Base Rent |

|||||||||||||||

| Available |

— | 8,815 | 9.42 | % | $ | — | — | % | ||||||||||||

| 2013 |

2 | 3,212 | 3.43 | 52 | 5.47 | |||||||||||||||

| 2014 |

2 | 3,612 | 3.86 | 61 | 6.44 | |||||||||||||||

| 2015 |

3 | 23,159 | 24.76 | 215 | 22.66 | |||||||||||||||

| 2016 |

3 | 6,993 | 7.47 | 126 | 13.29 | |||||||||||||||

| 2017 |

1 | 1,833 | 1.96 | 31 | 3.28 | |||||||||||||||

| 2018 |

1 | 6,325 | 6.76 | 86 | 8.99 | |||||||||||||||

| 2019 |

2 | 39,603 | 42.34 | 379 | 39.87 | |||||||||||||||

| 2020 |

— | — | — | — | — | |||||||||||||||

| 2021 |

— | — | — | — | — | |||||||||||||||

| 2022 and thereafter |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

14 | 93,552 | 100.0 | % | $ | 950 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized rent is calculated by multiplying (i) base rental payments for the month ended December 31, 2012 for the leases expiring during the applicable period, by (ii) 12. |

Walnut Hill Plaza

Walnut Hill Plaza is an 89,907 square foot neighborhood shopping center built in 1959 and most recently renovated in 2008 by Wheeler Development. The property is located in Petersburg, Virginia. The property is occupied by 11 tenants and features a variety of retailers including Maxway, Save-A-Lot, Rent-A-Center and Family Dollar.

10

The following tenants lease more than 10% of the net rentable square feet of Walnut Hill Plaza:

Variety Wholesalers

| • | Variety Wholesalers leases 15,000 square feet of net rentable square feet, representing 16.68% of the net rentable square feet of Walnut Hill Plaza. Variety Wholesalers operates a Maxway department store at this location. |

| • | Annual rent under the Variety Wholesalers lease is $72,300. |

| • | The Variety Wholesalers lease expires on February 28, 2018 and is not currently subject to any renewal options. |

Moran Foods, Inc.

| • | Moran Foods leases 14,812 square feet of net rentable square feet, representing 16.48% of the net rentable square feet of Walnut Hill Plaza. Moran Foods operates a Save-A-Lot grocery store at this location. |

| • | Annual rent under the Moran Foods lease is $97,759. |

| • | The Moran Foods lease expires on February 29, 2016 and has two renewal options remaining, for five years each. |

Beauty World

| • | Beauty World leases 11,780 net rentable square feet, representing 13.10% of the net rentable square feet of Walnut Hill Plaza. |

| • | Annual Rent under the Beauty World lease is $111,321. |

| • | The Beauty World lease expires on March 31, 2018 and has one renewal option for an additional five year period. |

Citi Trends

| • | Citi Trends clothing retailer leases 9,875 net rentable square feet, representing 10.98% of the net rentable square feet of Walnut Hill Plaza. |

| • | Annual rent under the Citi Trends lease is $45,425. |

| • | The Citi Trends lease is in the midst of its first and only renewal option period and the lease is currently set to expire on July 30, 2013. |

The following table sets forth the percentage leased and annualized rent per leased square foot for Walnut Hill Plaza as of the indicated dates:

| Date |

Percent Leased | Annualized Rent Per Leased Square Foot(1) |

||||||

| December 31, 2012 |

82.69 | % | $ | 7.40 | ||||

| December 31, 2011 |

82.69 | 7.31 | ||||||

| December 31, 2010 |

82.69 | 6.31 | ||||||

| December 31, 2009 |

81.86 | 6.23 | ||||||

| December 31, 2008 |

77.04 | 5.86 | ||||||

| (1) | Annualized rent per leased square foot is calculated by dividing (i) annualized base rent, by (ii) square footage leased. |

11

The following table sets forth the lease expirations for leases in place at Walnut Hill Plaza as of June 30, 2012, assuming that tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Square Footage of Expiring Leases |

Percentage of Property Leased Square Feet |

Annualized Base Rent (in 000s)(1) |

Percentage of Property Annualized Base Rent |

|||||||||||||||

| Available |

— | 15,562 | 17.31 | % | $ | — | — | % | ||||||||||||

| 2013 |

3 | 11,995 | 13.34 | 78 | 14.25 | |||||||||||||||

| 2014 |

3 | 9,758 | 10.85 | 89 | 16.18 | |||||||||||||||

| 2015 |

— | — | — | — | — | |||||||||||||||

| 2016 |

2 | 23,412 | 26.04 | 165 | 29.93 | |||||||||||||||

| 2017 |

— | — | — | — | — | |||||||||||||||

| 2018 |

2 | 26,780 | 29.79 | 184 | 33.38 | |||||||||||||||

| 2019 |

1 | 2,400 | 2.67 | 34 | 6.26 | |||||||||||||||

| 2020 |

— | — | — | — | — | |||||||||||||||

| 2021 |

— | — | — | — | — | |||||||||||||||

| 2022 and thereafter |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

11 | 89,907 | 100.0 | % | $ | 550 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized rent is calculated by multiplying (i) base rental payments for the month ended December 31, 2012 for the leases expiring during the applicable period, by (ii) 12. |

Lumber River Plaza

Lumber River Plaza is a 66,781 square foot neighborhood shopping center built in 1985, expanded in 1997-98 and renovated in 2004. The property is located in Lumberton, North Carolina and is currently occupied by 12 tenants, including Food Lion, Family Dollar, Rent-A-Center and CVS.

The following tenants lease more than 10% of the net rentable square feet of Lumber River Plaza:

Food Lion

| • | Food Lion leases 30,280 net rentable square feet, representing 45.34% of the net rentable square feet of Lumber River Plaza. The Food Lion space recently underwent an interior and exterior renovation. |

| • | Annual rent under the Food Lion lease is $155,250. |

| • | The Food Lion lease expires on June 30, 2018 and has four renewal options for five years each. |

CVS

| • | CVS leases 9,100 net rentable square feet, representing 13.63% of the net rentable square feet of Lumber River Plaza. |

| • | Annual rent under the CVS lease is $63,700. |

| • | The CVS lease expires on September 30, 2015 and has one renewal option for an additional five year period. |

Family Dollar

| • | Family Dollar leases 8,001 net rentable square feet, representing 11.98% of the net rentable square feet of Lumber River Plaza. |

| • | Annual rent under the Family Dollar lease is $46,746. |

| • | The Family Dollar lease expires on December 31, 2017 and has one renewal option for five years. |

12

The following table sets forth the percentage leased and annualized rent per leased square foot for Lumber River Plaza as of the indicated dates:

| Date |

Percent Leased | Annualized Rent Per Leased Square Foot(1) |

||||||

| December 31, 2012 |

100.00 | % | $ | 7.71 | ||||

| December 31, 2011 |

100.00 | 7.80 | ||||||

| December 31, 2010 |

100.00 | 7.48 | ||||||

| December 31, 2009 |

100.00 | 7.39 | ||||||

| December 31, 2008 |

100.00 | 7.24 | ||||||

| (1) | Annualized rent per leased square foot is calculated by dividing (i) annualized base rent, by (ii) square footage leased. |

The following table sets forth the lease expirations for leases in place at Lumber River Plaza as of December 31, 2012, assuming that tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Square Footage of Expiring Leases |

Percentage of Property Leased Square Feet |

Annualized Base Rent (in 000s) (1) |

Percentage of Property Annualized Base Rent |

|||||||||||||||

| Available |

— | — | — | % | $ | — | — | % | ||||||||||||

| 2013 |

2 | 8,600 | 12.88 | 104 | 20.23 | |||||||||||||||

| 2014 |

3 | 2,400 | 3.59 | 40 | 7.81 | |||||||||||||||

| 2015 |

1 | 9,100 | 13.63 | 64 | 12.37 | |||||||||||||||

| 2016 |

2 | 5,400 | 8.09 | 63 | 12.21 | |||||||||||||||

| 2017 |

2 | 9,201 | 13.78 | 64 | 12.46 | |||||||||||||||

| 2018 |

2 | 32,080 | 48.03 | 180 | 34.92 | |||||||||||||||

| 2019 |

— | — | — | — | — | |||||||||||||||

| 2020 |

— | — | — | — | — | |||||||||||||||

| 2021 |

— | — | — | — | — | |||||||||||||||

| 2022 and thereafter |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

12 | 66,781 | 100.0 | % | $ | 515 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized rent is calculated by multiplying (i) base rental payments for the month ended December 31, 2012 for the leases expiring during the applicable period, by (ii) 12. |

Perimeter Square

Perimeter Square is a 58,227 square foot neighborhood shopping center built in 1982-83. The property is located in Tulsa, Oklahoma. The property is occupied by nine tenants, providing a variety of services, and is shadow-anchored by a Wal-Mart Village Market grocery store, which recently underwent an interior and exterior renovation.

The following tenants lease more than 10% of the GLA of Perimeter Square:

Career Point Business School

| • | Career Point Business School leases 26,813 net rentable square feet, representing 46.01% of the net rentable square feet of Perimeter Square. |

| • | Annual Rent under the Career Point Business School lease is $339,162. |

| • | The Career Point Business School lease expires on June 30, 2018 and is not currently subject to any renewal options. |

Dollar Tree

| • | Dollar Tree leases 10,754 net rentable square feet, representing 18.45% of the net rentable square feet of Perimeter Square. |

13

| • | Annual rent under the Dollar Tree lease is $95,173. |

| • | The Dollar Tree lease expires on July 31, 2015 and is not currently subject to any renewal options. |

The following table sets forth the percentage leased and annualized rent per leased square foot for Perimeter Square as of the indicated dates:

| Date |

Percent Leased | Annualized Rent Per Leased Square Foot(1) |

||||||

| December 31, 2012 |

95.70 | % | $ | 12.41 | ||||

| December 31, 2011 |

100.00 | 11.76 | ||||||

| December 31, 2010 |

100.00 | 10.87 | ||||||

| December 31, 2009 |

100.00 | 11.18 | ||||||

| December 31, 2008 |

90.91 | 11.02 | ||||||

| (1) | Annualized rent per leased square foot is calculated by dividing (i) annualized base rent, by (ii) square footage leased. |

The following table sets forth the lease expirations for leases in place at Perimeter Square as of June 30, 2012, assuming that tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Square Footage of Expiring Leases |

Percentage of Property Leased Square Feet |

Annualized Base Rent ($ in 000s)(1) |

Percentage of Property Annualized Base Rent |

|||||||||||||||

| Available |

— | 2,504 | 4.30 | % | $ | — | — | % | ||||||||||||

| 2013 |

— | — | — | — | — | |||||||||||||||

| 2014 |

1 | 1,978 | 3.39 | 22 | 3.22 | |||||||||||||||

| 2015 |

2 | 12,754 | 21.89 | 143 | 20.61 | |||||||||||||||

| 2016 |

— | — | — | — | — | |||||||||||||||

| 2017 |

1 | 1,535 | 2.63 | 20 | 2.88 | |||||||||||||||

| 2018 |

2 | 32,113 | 55.10 | 403 | 58.21 | |||||||||||||||

| 2019 |

1 | 2,966 | 5.09 | 40 | 5.79 | |||||||||||||||

| 2020 and thereafter |

1 | 4,427 | 7.60 | 64 | 9.29 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

8 | 58,277 | 100.0 | % | $ | 692 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized rent is calculated by multiplying (i) base rental payments for the month ended December 31, 2012 for the leases expiring during the applicable period, by (ii) 12. |

The Shoppes at Eagle Harbor

The Shoppes at Eagle Harbor is a 23,303 square foot strip center built by Wheeler Development in 2009. The property is located in Carrollton, Virginia and is occupied by seven tenants in a variety of businesses including retail, food service, and healthcare.

The following tenants lease more than 10% of the net rentable square feet of The Shoppes at Eagle Harbor:

Bon Secours Hampton Roads Health System

| • | Bon Secours leases 7,012 net rentable square feet, representing 30.09% of the net rentable square feet of The Shoppes at Eagle Harbor. |

| • | Annual rent under Bon Secours’ lease is $146,970. |

| • | The Bon Secours lease expires on September 30, 2015 and has four renewal options for three years each. |

A.J. Gators Sports Bar & Grill

| • | A.J. Gators Sports Bar & Grill currently leases 5,337 net rentable square feet, representing 22.90% of the net rentable square feet of The Shoppes at Eagle Harbor. |

14

| • | Annual rent under the A.J. Gators Sports Bar & Grill lease is $112,217. |

| • | The A.J. Gators Sports Bar & Grill lease expires on October 31, 2016 and has one renewal option for five years. |

Anytime Fitness

| • | Anytime Fitness leases 4,084 net rentable square feet, representing 17.53% of the net rentable square feet of The Shoppes at Eagle Creek. |

| • | Annual rent under the Anytime Fitness lease is $72,769. |

| • | The Anytime Fitness lease expires on January 31, 2014 and has two renewal options for five years each. |

Animal Clinic of Eagle Harbor

| • | The Animal Clinic of Eagle Harbor leases 2,812 net rentable square feet, representing 12.07% of the net rentable square feet of The Shoppes at Eagle Harbor. |

| • | Annual rent under the Animal Clinic of Eagle Harbor lease is $61,864. |

| • | The Animal Clinic of Eagle Harbor lease expires on July 31, 2014 and is not currently subject to any renewal options. |

The following table sets forth the percentage leased and annualized rent per leased square foot for The Shoppes at Eagle Harbor as of the indicated dates:

| Date |

Percent Leased | Annualized Rent Per Leased Square Foot(1) |

||||||

| December 31, 2012 |

100.00 | % | $ | 20.28 | ||||

| December 31, 2011 |

100.00 | 18.84 | ||||||

| December 31, 2010 |

94.05 | 20.50 | ||||||

| December 31, 2009 |

94.05 | 20.26 | ||||||

| December 31, 2008 |

48.19 | 20.49 | ||||||

| (1) | Annualized rent per leased square foot is calculated by dividing (i) annualized base rent, by (ii) square footage. |

The following table sets forth the lease expirations for leases in place at The Shoppes at Eagle Harbor as of December 31, 2012, assuming that tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Square Footage of Expiring Leases |

Percentage of Property Leased Square Feet |

Annualized Base Rent (in 000s)(1) |

Percentage of Property Annualized Base Rent |

|||||||||||||||

| Available |

— | — | — | % | $ | — | — | % | ||||||||||||

| 2013 |

1 | 1,386 | 5.95 | 29 | 6.13 | |||||||||||||||

| 2014 |

3 | 8,182 | 35.11 | 158 | 33.40 | |||||||||||||||

| 2015 |

2 | 8,398 | 36.04 | 174 | 36.79 | |||||||||||||||

| 2016 |

1 | 5,337 | 22.90 | 112 | 23.68 | |||||||||||||||

| 2017 |

— | — | — | — | — | |||||||||||||||

| 2018 |

— | — | — | — | — | |||||||||||||||

| 2019 |

— | — | — | — | — | |||||||||||||||

| 2020 and thereafter |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

7 | 23,303 | 100.0 | % | $ | 473 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized rent is calculated by multiplying (i) base rental payments for the month ended December 31, 2012 for the leases expiring during the applicable period, by (ii) 12. |

15

Harps at Harbor Point

Harps at Harbor Point is a 31,500 square foot shopping center built in 2012 and was acquired by our company on December 14, 2012. The property is located in Grove, Oklahoma. The property is 100% leased by one tenant, a Harps Food Store, under a single tenant triple net lease. The annual rent under the Harps Food Store lease is currently $364,432, or an $11.57 annualized rent per square foot. The Harps Food Store lease will expire on August 31, 2032 and is subject to eight renewal options of five years each. The property was 100% leased at December 31, 2012 and maintained a $11.57 annualized rent per square foot.

Twin City Crossing

Twin City Crossing is a 47,680 square foot neighborhood shopping center built in 1998 and renovated in 2002. We acquired the center on December 21, 2012. The property is located in Batesburg-Leesville, South Carolina and is currently occupied by five tenants, including a BI-LO grocery store. The property was 100% leased at December 31, 2012 and maintained a $9.37 annualized rent per square foot.

BI-LO leases 41,980 net rentable square feet, representing 88.05% of the total net rentable square feet at Twin City Crossing. BI-LO is the only tenant leasing in excess of 10% of the GLA of Twin City Crossing. The annual rent under the BI-LO lease is $356,830. The BI-LO lease is set to expire on December 31, 2021 and is subject to six renewal options of five years each.

The following table sets forth the lease expirations for leases in place at Twin City Crossing as of December 31, 2012, assuming that the tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Total Expiring GLA |

Percent of Total GLA Expiring |

Expiring Base Rent ($ in 000s) |

Percent of Total Base Rent |

|||||||||||||||

| Available |

— | — | 0.0 | % | $ | — | 0.0 | % | ||||||||||||

| 2013 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2014 |

2 | 2,700 | 5.66 | 34 | 7.61 | |||||||||||||||

| 2015 |

1 | 1,200 | 2.52 | 19 | 4.25 | |||||||||||||||

| 2016 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2017 |

1 | 1,800 | 3.78 | 37 | 8.28 | |||||||||||||||

| 2018 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2019 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2020 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2021 |

1 | 41,980 | 88.04 | 357 | 79.86 | |||||||||||||||

| 2022 and thereafter |

— | — | 0.0 | — | 0.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 5 | 47,680 | 100.0 | % | $ | 447 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Surrey Plaza

Surrey Plaza is a 42,680 square foot neighborhood shopping center built in 1993 and was acquired by our company on December 21, 2012. The property is located in Hawkinsville, Georgia and is currently occupied by 5 tenants, including a Harvey’s Supermarket, Rite Aid and Snap Fitness. The property was 100% leased at December 31, 2012 and maintained a $7.09 annualized rent per square foot.

The following tenants lease more than 10% of the GLA of Surrey Plaza:

Harvey’s Supermarket

| • | Harvey’s Supermarket leases 29,000 net rentable square feet, representing 67.95% of the net rentable square feet of the Surrey Plaza. |

| • | Annual rent under the Harvey’s lease is $187,050. |

| • | The Harvey’s lease expires on January 19, 2018 and has three renewal options for five years each. |

Rite Aid Pharmacy

| • | Rite Aid leases 7,680 net rentable square feet, representing 17.99% of the net rentable square feet of Surrey Plaza. |

| • | Annual rent under the Rite Aid lease is $59,520. |

| • | The Rite Aid lease expires on January 19, 2018 and has one renewal option for five years. |

16

Snap Fitness

| • | Snap Fitness leases 4,500 net rentable square feet, representing 10.54% of the net rentable square feet of Surrey Plaza. |

| • | Annual rent under the Snap Fitness lease is $31,500. |

| • | The Snap Fitness lease expires on March 31, 2017 and has two renewal options for five years each. |

The following table sets forth the lease expirations for leases in place at Surrey Plaza as of December 31, 2012, assuming that the tenants do not exercise any renewal options or early termination options:

| Lease Expiration Year |

Number of Expiring Leases |

Total Expiring GLA |

Percent of Total GLA Expiring |

Expiring Base Rent (in 000s) |

Percent of Total Base Rent |

|||||||||||||||

| Available |

— | — | 0.0 | $ | — | 0.0 | % | |||||||||||||

| 2013 |

1 | 1,500 | 3.52 | 19 | 6.27 | % | ||||||||||||||

| 2014 |

1 | — | 0.0 | 6 | 1.98 | |||||||||||||||

| 2015 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2016 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2017 |

1 | 4,500 | 10.54 | 31 | 10.23 | |||||||||||||||

| 2018 |

2 | 36,680 | 85.94 | 247 | 81.52 | |||||||||||||||

| 2019 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2020 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2021 |

— | — | 0.0 | — | 0.0 | |||||||||||||||

| 2022 and thereafter |

— | — | 0.0 | — | 0.00 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 5 | 42,680 | 100.0 | % | $ | 303 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Riversedge North

Riversedge North is a 10,550 square foot free-standing office building built by Wheeler Development in 2007. The property is located in Virginia Beach, Virginia and has been 100% leased by Wheeler Interests since November 2007. The annual rent under the Wheeler Interests lease is currently $274,131. The Wheeler Interests lease will expire on November 14, 2017, subject to four renewal terms of five years each.

Monarch Bank

The Monarch Bank property is a 3,620 square foot free-standing branch location of Monarch Bank and Monarch Financial Holdings, Inc., built in 2002. The property is located in Virginia Beach, Virginia and has been 100% leased by Monarch Bank under a single tenant triple net lease since December 2007. The annual rent under the Monarch Bank lease is currently $211,054. The Monarch Bank lease expired December 31, 2012 and was subject to two renewal terms of five years each. During January 2012, Monarch Bank exercised its first renewal option that will become effective January 1, 2013. Under the renewal option, annual rent will increase to $250,757.

Amscot Building

The Amscot Building is a 2,500 square foot free-standing branch location of Amscot Corporation built by Wheeler Development in 2004. Amscot Corporation is a financial services business, offering services such as check cashing, money orders, payday advances and prepaid debit cards. The property is located in Tampa, Florida and has been 100% leased by Amscot Corporation since March 2005. The annual rent under the Amscot Corporation lease is currently $101,400. The Amscot Corporation lease will expire March 31, 2020, subject to three renewal terms of five years each.

17

Outstanding Indebtedness

As of December 31, 2012, the outstanding mortgage indebtedness secured by our properties was approximately $31.8 million. Although we intend to assume each of these loans in connection with our formation transactions, the assumption is subject to the prior consent of the lenders and there can be no assurance that we will be able to obtain their consent. The following table sets forth information with respect to such indebtedness (dollars in thousands):

| Amount of Debt Outstanding as of December 31, 2012 |

Weighted Average Interest Rate |

Maturity Date | Amortization Period (Mths) |

Annual Debt Service |

Balance At Maturity |

|||||||||||||||||||

| Shoppes at TJ Maxx |

$ | 6,400,000 | 6.00 | % | 4/19/2013 | (3) | N/A | $ | 384,000 | $ | 6,400,000 | |||||||||||||

| Walnut Hill Plaza |

3,528,232 | 6.75 | 4/11/2014 | 300 | 303,232 | 3,447,074 | ||||||||||||||||||

| Lumber River Village |

3,050,117 | 5.65 | 5/1/2015 | 120 | 220,966 | 2,867,493 | ||||||||||||||||||

| Perimeter Square |

4,537,456 | 6.38 | 6/11/2016 | 120 | 337,066 | 4,101,738 | ||||||||||||||||||

| The Shoppes at Eagle Harbor |

3,904,664 | 6.20 | 2/28/2013 | (2) | 60 | 370,359 | 3,904,664 | |||||||||||||||||

| Riversedge North |

2,098,138 | 6.00 | 4/16/2013 | 60 | 162,674 | 2,088,865 | ||||||||||||||||||

| Monarch Bank |

1,533,346 | 4.15 | 12/30/2017 | 240 | 113,675 | 1,259,780 | ||||||||||||||||||

| Harps at Harbor Point |

3,416,550 | 3.99 | 12/14/2015 | 300 | 217,464 | 3,169,967 | ||||||||||||||||||

| Twin City Crossing |

3,375,000 | 4.86 | 1/6/2023 | 360 | 213,924 | 2,733,513 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| $ | 31,843,503 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| (1) | We currently have a commitment from a lender to refinance this property at a 3.88% interest rate and a 7 year maturity date with monthly principal interest payments of $33,880.18 based on a 25 year amortization. |

| (2) | The Shoppes at Eagle Harbor loan matured on February 28, 2013. We have refinanced the loan with another financial institution for $4.0 million at a 4.34% fixed interest rate. The loan calls for monthly principal and interest payments of $24,691.82 based on a 20 year amortization and a maturity date of February 28, 2018. |

| (3) | Debt is interest only until maturity. |

Major Tenants

The following table sets forth information regarding the ten largest tenants in our operating portfolio based on annualized base rent as of December 31, 2012.

| Tenants |

Total Net Rentable Square Feet |

Percent Of Total Net Rentable Square Feet |

Annualized Base Rent ($ in 000s) |

Percent of Total Annualized Base Rent |

Base Rent Per Leased Square Foot |

|||||||||||||||

| Bi-Lo |

41,980 | 8.93 | % | $ | 357 | 7.22 | % | $ | 8.50 | |||||||||||

| TJ Maxx |

32,400 | 6.89 | 294 | 5.94 | 9.07 | |||||||||||||||

| Harps Food Store |

31,500 | 6.70 | 364 | 7.36 | 11.57 | |||||||||||||||

| Food Lion |

30,280 | 6.44 | 155 | 3.13 | 5.12 | |||||||||||||||

| Harvey’s Supermarket |

29,000 | 6.17 | 187 | 3.78 | 6.45 | |||||||||||||||

| Career Point Business School |

26,813 | 5.70 | 339 | 6.85 | 12.64 | |||||||||||||||

| Family Dollar |

16,601 | 3.53 | 114 | 2.30 | 6.87 | |||||||||||||||

| Variety Wholesalers |

15,000 | 3.19 | 72 | 1.46 | 4.80 | |||||||||||||||

| Moran Foods |

14,812 | 3.15 | 98 | 1.98 | 6.62 | |||||||||||||||

| Cannon’s Online Auctions |

14,000 | 2.98 | 84 | 1.70 | 6.00 | |||||||||||||||

| Beauty World |

11,780 | 2.50 | 111 | 2.24 | 9.42 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Top Ten Tenants/Weighted Average |

264,166 | 56.18 | % | $ | 2,175 | 43.96 | % | $ | 8.23 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

18

Lease Expirations

The following table sets forth information with respect to the lease expirations of our properties as of December 31, 2012.

| Lease Expiration Year |

Number of Expiring Leases |

Total Expiring Net Rentable Square Feet |

Percent of Total Net Rentable Square Feet Expiring |

Expiring Base Rent (in 000s) |

Percent of Total Base Rent |

Expiring Base Rent Per Leased Square Foot |

||||||||||||||||||

| Available |

— | 26,881 | 5.71 | % | $ | — | — | % | $ | — | ||||||||||||||

| 2013 |

9 | 26,693 | 5.68 | 282 | 5.71 | 10.58 | ||||||||||||||||||

| 2014 |

15 | 28,630 | 6.09 | 411 | 8.30 | 14.34 | ||||||||||||||||||

| 2015 |

9 | 54,611 | 11.61 | 614 | 12.41 | 11.25 | ||||||||||||||||||

| 2016 |

8 | 41,142 | 8.75 | 466 | 9.42 | 11.33 | ||||||||||||||||||

| 2017 |

8 | 33,039 | 7.02 | 736 | 14.88 | 22.29 | ||||||||||||||||||

| 2018 |

9 | 133,978 | 28.48 | 1,099 | 22.20 | 8.20 | ||||||||||||||||||

| 2019 |

4 | 44,969 | 9.56 | 453 | 9.16 | 10.08 | ||||||||||||||||||

| 2020 |

1 | 4,427 | 0.94 | 64 | 1.30 | 14.52 | ||||||||||||||||||

| 2021 |

1 | 41,980 | 8.93 | 357 | 7.21 | 8.50 | ||||||||||||||||||

| 2022 and thereafter |

2 | 34,000 | 7.23 | 466 | 9.41 | 13.70 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total/Weighted Average |

66 | 470,350 | 100 | % | $ | 4,948 | 100 | % | $ | 11.16 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Property Management and Leasing Strategy

Our property management and substantially all of our leasing activities and operating and administrative functions (including leasing, legal, acquisitions, development, data processing, finance and accounting) are administered or coordinated by our Administrative Service Company. On-site functions such as maintenance, landscaping, sweeping, plumbing and electrical are subcontracted out at each location and, to the extent permitted by their respective leases, the cost of these functions is passed on to the tenants.

We believe that focused property management, leasing and customer retention are essential to maximizing the sales per square foot, operating cash flow and value of our properties. Our primary goal in property management is to maintain an attractive shopping environment on a cost effective basis for our tenants.

The majority of our property management and leasing functions are supervised and administered by our Administrative Service Company. Our Administrative Service Company maintains regular contact with our tenants and frequently visits each asset to ensure the proper implementation and execution of our market strategies. As part of our ongoing property management, our Administrative Service Company conducts regular physical property reviews to improve our properties, react to changing market conditions and ensure proper maintenance.

Our leasing representatives have become experienced in the markets in which we operate by becoming familiar with current tenants as well as potential local, regional and national tenants that would complement our current tenant base. We study demographics, customer sales and merchandising mix to optimize the sales performance of our centers and thereby increase rents. We believe this hands-on approach maximizes the value of our shopping centers.

19

Depreciation

The following table sets forth depreciation information for our properties as of December 31, 2012.

| Federal Tax Basis |

Depreciation Rate |

Method of Depreciation |

Useful Life Claimed |

|||||||||||

| Shoppes at TJ Maxx |

$ | 6,719,385 | 3.29 | % | Straight-Line | 5-39 Years | ||||||||

| Walnut Hill Plaza |

3,729,329 | 5.47 | Straight-Line | 5-39 Years | ||||||||||

| Lumber River Village |

4,486,787 | 2.84 | Straight-Line | 5-39 Years | ||||||||||

| Perimeter Square |

5,081,193 | 3.10 | Straight-Line | 5-39 Years | ||||||||||

| The Shoppes at Eagle Harbor |

4,457,803 | 2.39 | Straight-Line | 5-39 Years | ||||||||||

| Riversedge North |

2,207,571 | 5.31 | Straight-Line | 5-39 Years | ||||||||||

| Monarch Bank |

1,986,364 | 8.00 | Straight-Line | 5-39 Years | ||||||||||

| Amscot Building |

479,902 | 3.17 | Straight-Line | 5-39 Years | ||||||||||

| Harps at Harbor Point |

2,891,853 | 3.19 | Straight-Line | 5-39 Years | ||||||||||

| Twin City Crossing |

3,040,955 | 4.08 | Straight-Line | 5-39 Years | ||||||||||

| Surrey Plaza |

1,856,514 | 3.87 | Straight-Line | 5-39 Years | ||||||||||

| Wheeler Real Estate Investment Trust, L.P. |

17,813 | 20.00 | Straight-Line | 5-39 Years | ||||||||||

|

|

|

|||||||||||||

| $ | 36,955,469 | |||||||||||||

|

|

|

|||||||||||||

Real Estate Taxes

The following table sets forth real estate tax information for our properties:

| 2012 Realty Tax Rate(1) |

Total Annual Real Estate Taxes for the 2012 Tax Year |

|||||||

| Shoppes at TJ Maxx |

0.87 | % | $ | 77,819 | (2) | |||

| Walnut Hill Plaza |

1.35 | 53,571 | ||||||

| Lumber River Village |

1.38 | 44,969 | ||||||

| Perimeter Square |

1.48 | 63,716 | (2) | |||||

| The Shoppes at Eagle Harbor |

0.65 | 24,242 | ||||||

| Riversedge North |

0.89 | 16,424 | ||||||

| Monarch Bank |

0.89 | 10,578 | ||||||

| Amscot Building |

0.00 | — | (3) | |||||

| Harps at Harbor Point |

0.00 | — | (4) | |||||

| Twin City Crossing |

2.67 | 56,719 | (2) | |||||

| Surrey Plaza |

3.30 | 31,243 | (2) | |||||

|

|

|

|

|

|||||

| 13.48 | % | $ | 379,281 | |||||

|

|

|

|

|

|||||

| (1) | Represents the percentage of assessed value. |

| (2) | Property acquired during 2012. Taxes estimated based on real estate taxes paid by previous owner. |

| (3) | Amscot Building is under a ground lease that does not require it to pay real estate taxes. |

| (4) | Property built during 2012, so assessments and related tax bills are unavailable. |

| Item 3. | Legal Proceedings |

We are subject to various legal proceedings and claims that arise in the ordinary course of business. These matters are generally covered by insurance. While the resolution of these matters cannot be predicted with certainty, management believes the final outcome of such matters will not have a material adverse effect on our financial position, results of operation or liquidity.

We are involved in a lawsuit whereby we originally sued a prospective tenant for breach of contract related to an executed lease. The court found in favor of the defendant and assessed damages against us in the amount of $13,300. The defendant’s attorney has applied to the court to be reimbursed legal fees incurred by the defendant of approximately $368,000. We are responding to the litigation and intend to appeal and contest the ruling vigorously.

20

| Item 4. | Mine Safety Disclosures |

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information.

Our common stock is traded on the NASDAQ Stock Market under the symbol “WHLR”. On March 27, 2013, the closing price of our common stock reported on the Nasdaq Stock Market was $6.06 per share. Our common stock began trading on November 19, 2012. The high and low common stock sales prices per share during the periods indicated were as follows:

| Price per share of common stock: |

||||||||||||||||||||

| Quarter Ended |

Mar. 31 | June 30 | Sept. 30 | Dec. 31 |

Year | |||||||||||||||

| Fiscal year 2012 |

||||||||||||||||||||

| High |

$ | N/A | $ | N/A | $ | N/A | $ | 6.84 | $ | 6.84 | ||||||||||

| Low |

$ | N/A | $ | N/A | $ | N/A | $ | 5.50 | $ | 5.50 | ||||||||||

| Fiscal year 2011 |

||||||||||||||||||||

| High |

$ | N/A | $ | N/A | $ | N/A | $ | N/A | $ | N/A | ||||||||||

| Low |

$ | N/A | $ | N/A | $ | N/A | $ | N/A | $ | N/A | ||||||||||

Approximate Number of Holders of Our Common Shares

As of March 20, 2013 there were 29 holders of record of our common shares. This number excludes our common shares owned by shareholders holding under nominee security position listings.

Dividend Policy

We intend to pay cash dividends to holders of our common stock on a monthly basis. We paid a pro rata dividend with respect to the period commencing on the completion of our initial public offering and ending December 31, 2012 based on an annualized amount of $0.42 per share. We intend to maintain our initial dividend rate for the 12-month period following completion of our initial public offering unless actual results of operations, economic conditions or other factors differ materially from the assumptions used in our estimate. We intend to make dividend distributions that will enable us to meet the distribution requirements applicable to REITs and to eliminate or minimize our obligation to pay income and excise taxes. Initially, we will be required to use a portion of the net proceeds from our initial public offering to make such distributions. We may in the future also choose to pay dividends in shares of our common stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Future Liquidity Needs.”

21

Dividend Payments

We have made dividend payments to holders of our common stock and holders of common units in our Operating Partnership as follows since completion of our initial public offering in November 2012:

| Dividend Period |

Record Date |

Payment Date | Payment Amount per Share or Unit |

|||||||||

| November 19, 2012 - December 31, 2012 |

1/1/13 | 1/31/13 | $ | 0.049 | ||||||||

| January 1, 2013 - January 31, 2013 |

2/1/13 | 2/28/13 | 0.035 | |||||||||

| February 1, 2013 – February 28, 2013 |

3/1/13 | 3/31/13 | 0.035 | |||||||||

Equity Compensation Plan Information

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||

| Equity compensation plans approved by security holders |

0 | N/A | 500,000 | |||||||||

| Equity compensation plans not approved by security holders |

N/A | N/A | N/A | |||||||||

| Total |

0 | N/A | 500,000 | |||||||||

Use of Proceeds from Initial Public Offering

We closed our initial public offering on November 16, 2013. The effective date of our registration statement was October 23, 2012, and the file number assigned to it was 333-177262. After deducting the placement fee and commissions and other expenses of the initial public offering, we received net proceeds of approximately $13.46 million. Capitol Securities Management, Inc. and Wellington Shields & Co., LLC served as our placement agents for the offering. As of December 31, 2012, we spent proceeds from the offering in accordance with the following table:

| Description of Use |

Proposed Expenditure Amount |

Actual Expenditures through December 31, 2012 |

||||||

| Repayment of outstanding indebtedness |

500,000 | 840,500 | ||||||

| General working capital, including funding of dividend payments |

2,000,000 | 321,000 | ||||||

| Reimbursement of Operating Partnership for purchase of membership interests of DF-1 Carrollton, LLC |

1,780,000 | 1,782,337 | ||||||

| Cash payments to prior investors who have elected to receive cash instead of Operating Partnership Units for their contribution of membership interests in the Ownership Entities |

4,180,000 | 4,204,000 | ||||||

| Future Acquisitions |

5,000,000 | 5,035,000 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 13,460,000 | $ | 12,182,837 | ||||

|

|

|

|

|

|||||

22

Recent Sales of Unregistered Securities

On August 2, 2011, we completed a private offering of 126,250 shares of our Series A Convertible Preferred Stock at an offering price of $4.00 per share. There were no underwriting discounts or commissions in connection with such issuance and we received proceeds of $505,000. Such shares were purchased by 16 investors, all of whom are “accredited investors” as defined under Regulation D of the Securities Act of 1933. The issuance of such shares was effected in reliance upon exemptions from registration provided by Section 4(2) of the Securities Act of 1933, as amended and Rule 506 of Regulation D promulgated thereunder.

On January 26, 2012, we completed a private offering of 57,250 shares of our Series A Convertible Preferred Stock at an offering price of $4.00 per share. There were no underwriting discounts or commissions in connection with such issuance and we received proceeds of $229,000. Such shares were purchased by 10 investors, all of whom are “accredited investors” as defined under Regulation D of the Securities Act of 1933. The issuance of such shares was effected in reliance upon exemptions from registration provided by Section 4(2) of the Securities Act of 1933, as amended and Rule 506 of Regulation D promulgated thereunder.