As filed with the Securities and Exchange Commission on June 22, 2012

Registration No. 333-177262

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6 TO

Form S-11

REGISTRATION STATEMENT

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Wheeler Real Estate Investment Trust, Inc.

(Exact Name of Registrant as Specified in Its Governing Instruments)

Riversedge North, 2529 Virginia Beach Blvd., Suite 200, Virginia Beach, Virginia 23452

(757) 627-9088

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(800) 624-0909

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Bradley A. Haneberg, Esq. Kaufman & Canoles, P.C. Two James Center, 1021 East Cary Street, Suite 1400 Richmond, Virginia 23219 (804) 771-5700 – telephone (804) 771-5777 – facsimile |

Theodore M. Grannatt, Esq. Benjamin M. Hron, Esq. McCarter & English, LLP 265 Franklin Street Boston, Massachusetts 02110 (617) 449-6500 – telephone (617) 607-6026 – facsimile |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement of the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion, dated June 22, 2012

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Minimum Offering: 3,000,000 Shares

Maximum Offering: 4,000,000 Shares

Wheeler Real Estate Investment Trust, Inc.

Common Stock

This is the initial public offering of Wheeler Real Estate Investment Trust, Inc. We are offering a minimum of 3,000,000 shares and a maximum of 4,000,000 shares of our common stock.

We expect the initial public offering price of our common stock to be between $5.00 and $5.50 per share. Currently, no established public trading market exists for our shares. We intend to apply to have our common stock listed on the Nasdaq Capital Market under the symbol “WHLR.” We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We intend to elect to be taxed and to operate in a manner that will allow us to qualify as a real estate investment trust (“REIT”) for federal income tax purposes commencing with our taxable year ending December 31, 2012.

Investing in our common stock involves risks. You should read the section entitled “Risk Factors” beginning on page 15 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common stock. Such risks include, amount others:

| • | We have no operating history as a REIT or a publicly traded company, nor established financing sources, and may not be able to successfully operate as a REIT or a publicly traded company. |

| • | Our portfolio is dependent upon regional and local economic conditions and is geographically concentrated in the Mid-Atlantic, Southeast and Southwest. |

| • | Our estimated cash available for distribution is insufficient to cover our anticipated annual dividend, which may require us to use proceeds from this offering to find distributions. |

| • | We expect to have approximately $25.3 million of indebtedness outstanding following this offering, which may expose us to the risk of default under our debt obligations. |

| • | Our success depends on key personnel and the loss of such key personnel could adversely affect our ability to manage our business or implement our growth strategies. |

| • | We may be unable to identify, acquire or operate properties successfully, which could harm our financial condition and ability to pay distributions. |

| • | Our Administrative Services Company will face conflicts of interest caused by its arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders. |

| • | We may assume unknown liabilities in connection with our formation transactions, and any recourse against third parties may be limited. |

| • | Failure to qualify as a REIT would have significant adverse consequences to us and the value of our common stock. |

| Total | ||||||||||||||

| Per Share | Minimum Offering |

Maximum Offering |

||||||||||||

| Public offering price |

$ | [ | ] | $ | [ | ] | $ | [ | ] | |||||

| Placement fee(1) |

$ | [ | ] | $ | [ | ] | $ | [ | ] | |||||

| Proceeds, before expenses, to us(2) |

$ | [ | ] | $ | [ | ] | $ | [ | ] | |||||

| (1) | The placement fee will be 7% of the public offering price, or $[ ] per share. The placement fee does not reflect additional compensation to the placement agents in the form of a non-accountable expense allowance of 1.5% or $[ ] per share. See “Plan of Distribution.” |

| (2) | The total expenses of this offering, excluding the placement fee and expenses, are approximately $1,025,000. |

The placement agents must sell the minimum number of securities offered (3,000,000 shares) if any are sold. The placement agents are required to use only its best efforts to sell the securities offered. The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our placement agents after which the minimum offering is sold or (ii) December 22, 2012. Until we sell at least 3,000,000 shares, all investor funds will be held in an escrow account at SunTrust Bank, Richmond, Virginia. If we do not sell at least 3,000,000 shares by December 22, 2012, all funds will be promptly returned to investors (within one business day) without interest or deduction. If we complete this offering, net proceeds will be delivered to our company on the closing date. If we complete this offering, then on the closing date, we will issue common stock to investors in the offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Wellington Shields & Co., LLC | Capitol Securities Management, Inc. | |

The date of this prospectus is , 2012.

| 1 | ||||

| 15 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

49 | |||

| 66 | ||||

| 67 | ||||

| 70 | ||||

| 87 | ||||

| 93 | ||||

| 96 | ||||

| 100 | ||||

| 105 | ||||

| Description of the Partnership Agreement of Wheeler REIT, L.P. |

111 | |||

| 122 | ||||

| 124 | ||||

| Material Provisions of Maryland Law and of Our Charter and Bylaws |

129 | |||

| 135 | ||||

| 137 | ||||

| 154 | ||||

| 157 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| 160 | ||||

| A-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not, and the placement agents have not, authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

We use market data, demographic data, industry forecasts and projections throughout this prospectus. We have obtained certain market and industry data from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on historical market data, and there is no assurance that any of the projected amounts will be achieved. We believe that the market and industry research others have performed are reliable, but we have not independently verified this information.

i

You should read the following summary together with the more detailed information regarding our company and the historical and pro forma financial statements appearing elsewhere in this prospectus, including under the caption “Risk Factors.” References in this prospectus to “we,” “our,” “us” and “our company” refer to Wheeler Real Estate Investment Trust, Inc., a Maryland corporation, together with our consolidated subsidiaries, including Wheeler REIT, L.P., a Virginia limited partnership, of which we are the sole general partner (our “Operating Partnership”). References to our predecessor (“Predecessor”) refer to the entities and properties to be contributed to or purchased by our Operating Partnership pursuant to the formation transactions described elsewhere in this prospectus. Unless otherwise indicated, the information contained in this prospectus is as of March 31, 2012 and assumes (1) the formation transactions described under the caption “Structure and Formation of Our Company” are consummated, (2) the common stock to be sold in this offering is sold at $5.25 per share, which is the mid-point of the range of prices indicated on the front cover of this prospectus, and (3) the common units of limited partner interest in our Operating Partnership, or common units, to be issued in the formation transactions are valued at $5.25 per unit. Each common unit is redeemable for cash equal to the then-current market value of one share of common stock or, at our option, one share of our common stock, commencing 12 months following the completion of this offering. For the meanings of all defined terms used herein, please refer to the Glossary at page 157.

Wheeler Real Estate Investment Trust, Inc.

Overview

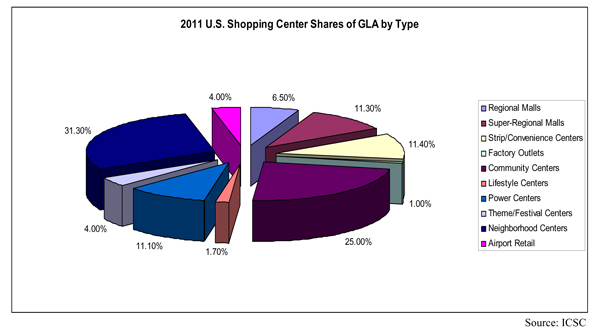

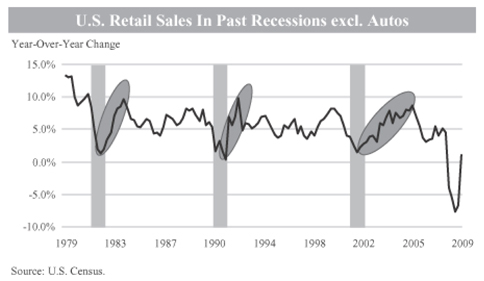

We are a Maryland corporation formed with the principle objective of acquiring, financing, developing, leasing, owning and managing income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. We will target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. We generally lease our properties to national and regional retailers that offer consumer goods and generate regular consumer traffic. We believe our tenants carry goods that are less impacted by fluctuations in the broader U.S. economy and consumers’ disposable income, generating more predictable property-level cash flows.

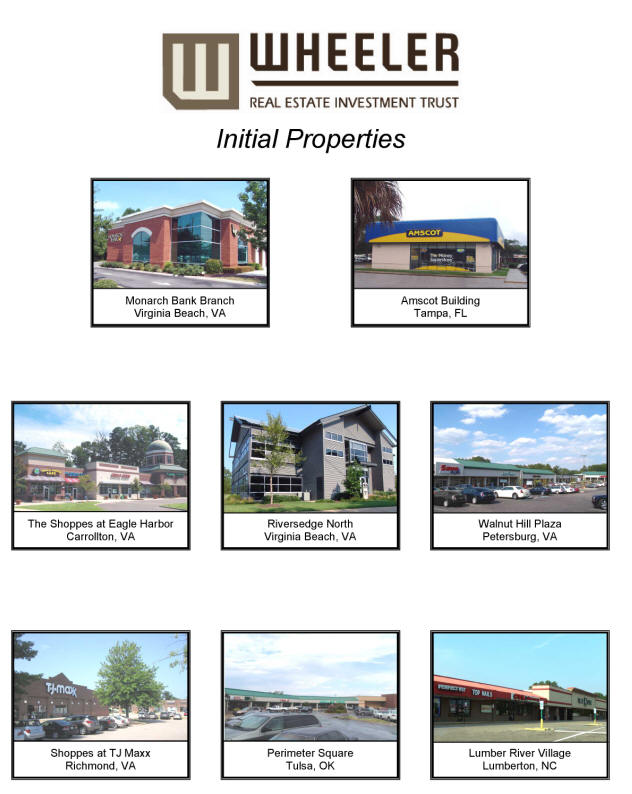

Upon consummation of this offering, we expect that our portfolio will be comprised of five retail shopping centers, two free-standing retail properties, and one office building. Five of these properties are located in Virginia, one is located in Florida, one is located in North Carolina and one is located in Oklahoma. As of March 31, 2012, our portfolio had a total gross leasable area (“GLA”) of 348,490 square feet and an occupancy level of approximately 90%.

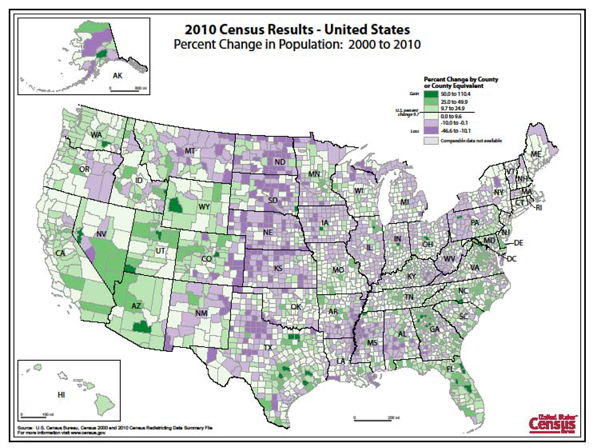

We believe our markets, which currently include the Mid-Atlantic, Southeast and Southwest, are characterized by strong demographics and dynamic, diversified economies that will continue to generate jobs and future demand for commercial real estate.

We were formed as a Maryland corporation on June 23, 2011. Jon S. Wheeler, our Chairman and President, when combined with his affiliates, is our largest stockholder. Our administrative services will be provided externally by WHLR Management, LLC (our “Administrative Service Company”) which is wholly owned by Mr. Wheeler. Pursuant to the terms of an administrative services agreement between our Administrative Service Company and us, our Administrative Service Company will be responsible for identifying targeted real estate investments for our board of directors consideration; overseeing the management of the investments; handling the disposition of the real estate investments our board of directors has chosen to sell; and administering our day-to-day business operations, including but not limited to, leasing duties, property management, payroll and accounting functions. We will also benefit from Mr. Wheeler’s partially or wholly owned related businesses and platform that specializes in retail real estate investment and management. Mr. Wheeler’s organization includes (i) Wheeler Interests, LLC, an acquisition and asset management firm, (ii) Wheeler Real Estate, LLC, a real estate leasing management and administration firm, (iii) Wheeler Development, LLC a full service real estate development firm, (iv) Wheeler Capital, LLC, a capital investment firm specializing in venture capital, financing, and small business loans, (v) Site Applications, LLC, a full service facility company, equipped to handle all levels of building maintenance, (vi)

1

Creative Retail Works, a full service design house, specializing in shopping centers and their tenants, and (vii) TESR, LLC, a tenant coordination company specializing in tenant relations and community events (collectively, our “Services Companies”).

Business and Growth Strategies

Our strategy is to opportunistically acquire and reinvigorate well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive risk-adjusted returns. Specifically, we intend to pursue the following strategies to achieve these objectives:

| • | Maximize value through proactive asset management. We believe our market expertise, targeted leasing strategies and proactive approach to asset management will enable us to maximize the operating performance of our portfolio. We will continue to implement an active asset management program to increase the long-term value of each of our properties. This may include expanding existing tenants, re-entitling site plans to allow for additional outparcels, which are small tracts of land used for freestanding development not attached to the main buildings, and repositioning tenant mixes to maximize traffic, tenant sales and percentage rents. As we grow our portfolio, we will seek to maintain a diverse pool of assets with respect to both geographic distribution and tenant mix, helping to minimize our portfolio risk. We continually monitor our markets for opportunities to selectively dispose of properties where returns appear to have been maximized and redeploy proceeds into new acquisitions that have greater return prospects. |

| • | Pursue value oriented investment strategy targeting properties fitting within our acquisition profile. We will acquire retail properties based on identified market and property characteristics, including: |

| • | Property type. We focus our investment strategy on income producing assets such as: |

| • | Strip centers. A strip center is an attached row of stores or service outlets managed as a coherent retail entity. |

| • | Neighborhood centers. A neighborhood center is designed to provide convenience shopping for the day-to-day needs of consumers in the immediate neighborhood. Neighborhood centers are often anchored by a supermarket or drugstore. |

| • | Community centers. A community center typically offers a wider range of apparel and other soft goods relative to a neighborhood center and in addition to, or in lieu of supermarkets and drugstores, may have discount department stores as anchor tenants. |

2

| • | Freestanding retail properties. A freestanding retail property constitutes any retail building that is typically occupied by a single tenant. |

| • | Anchor tenant type. We will target properties with anchor tenants that offer consumer goods that are less impacted by fluctuations in consumers’ disposable income. We believe nationally and regionally recognized anchor tenants that offer consumer goods provide more predictable property-level cash flows as they are typically higher credit quality tenants that generate stable revenues. |

| • | Lease terms. In the near term, we intend to acquire properties that feature one or more of the following characteristics in their tenants’ lease structure: properties with long-term leases (10 years remaining on primary lease term) for anchor tenants; properties under triple-net leases, which are leases where the tenant agrees to pay rent as well as all taxes, insurance and common area maintenance expenses that arise from the use of the property, thereby minimizing our expenses; and properties with leases which incorporate gross percentage rent and/or rental escalations that act as an inflation hedge while maximizing operating cash flows. As a longer-term strategy, we will look to acquire properties with shorter-term lease structures (2-3 years) for in-line tenants, which are tenants that rent smaller spaces around the anchor tenants within a property, that have below market rents that can be renewed at higher market rates. |

| • | Geographic markets and demographics. We plan to seek investment opportunities throughout the United States; however, we will focus on the Mid-Atlantic, Southeast and Southwest, which are characterized by attractive demographic and property fundamental trends. We will target competitively protected properties in communities that have stable demographics and have historically exhibited favorable trends, such as strong population and income growth. |

| • | Capitalize on network of relationships to pursue transactions. We plan to pursue transactions in our target markets through the relationships we have developed. |

| • | Leverage our experienced property management platform. Our management team, together with the management teams of our Services Companies, has over 150 years of combined experience managing, operating and leasing retail properties. We consider our Services Companies to be in the best position to oversee the day-to-day operations of our properties, which in turn helps us service our tenants. We feel this generates higher renewal and occupancy rates, minimizes rent interruptions, reduces renewal costs and helps us achieve stronger operating results. Along with this, a major component of our leasing strategy is to cultivate long-term relationships through consistent tenant dialogue in conjunction with a proactive approach to meeting the space requirements of our tenants. |

| • | Grow our platform through a comprehensive financing strategy. We believe our capital structure will provide us with sufficient financial capacity and flexibility to fund future growth. Based on current capitalization, we believe we will have access to multiple sources of financing that are currently unavailable to many of our private market peers or overleveraged public competitors, which will provide us with a competitive advantage. Over time, these financing alternatives may include follow-on offerings of our common stock, corporate level debt, preferred equity and credit facilities. Upon completion of this offering, we expect to have a ratio of debt to total market capitalization of approximately 46% assuming completion of the minimum offering, or 42% assuming completion of the maximum offering. Although we are not required by our governing documents to maintain this ratio at any particular level, our Board of Directors will review our ratio of debt to total capital on a quarterly basis, with the goal of maintaining a reasonable rate consistent with our expected ratio of debt to total market capitalization going forward. |

Our Competitive Strengths

We believe the following competitive strengths distinguish us from other owners and operators of commercial real estate and will enable us to take advantage of new acquisition and development opportunities, as well as growth opportunities within our portfolio:

| • | Portfolio of Retail Properties. We have acquired and developed a portfolio of properties located in business centers in Virginia, North Carolina, Florida and Oklahoma. The retail properties comprising our initial portfolio fit within our property acquisition profile of income producing assets such as strip centers, neighborhood centers, grocery-anchored centers, community centers and free-standing retail properties. These properties are located in local markets that exhibit stable demographics and have historically exhibited favorable trends, such as strong population and income growth. These properties represent the initial base of the larger portfolio that we expect to build over time. |

| • | Experienced Management Team. Our executive officers and the management teams of our Services Companies have significant experience in the commercial real estate industry. |

| • | Access to a Pipeline of Acquisition and Leasing Opportunities. We believe that our market knowledge and network of relationships in the real estate industry will provide us access to an ongoing pipeline of attractive acquisition and investment opportunities in and near our markets, while also facilitating our leasing efforts and providing us with opportunities to increase occupancy rates at our properties. |

| • | Broad Real Estate Expertise with Retail Focus. Our management team has experience and capabilities across the real estate sector with experience and expertise particularly in the retail asset class, which we believe provides for flexibility in pursuing attractive acquisition, development and repositioning opportunities. |

Summary Risk Factors

You should consider carefully the risks discussed below and under the heading “Risk Factors” beginning on page 14 of this prospectus before purchasing our common stock. If any of these risks occur, our business, prospects, financial condition, liquidity, results of operations and ability to make distributions to our shareholders could be materially and adversely affected. In that case, the trading price of our common stock could decline and you could lose some or all of your investment. These risks include, among others, the following:

| • | We have no operating history as a REIT or a publicly traded company, nor established financing sources, and may not be able to successfully operate as a REIT or a publicly traded company. |

| • | Our portfolio is dependent upon regional and local economic conditions and is geographically concentrated in the Mid-Atlantic, Southeast and Southwest. |

| • | Our estimated cash available for distribution is insufficient to cover our anticipated annual dividend, which may require us to use proceeds from this offering to fund distributions. |

| • | We expect to have approximately $25.3 million of indebtedness outstanding following this offering, which may expose us to the risk of default under our debt obligations. |

| • | Our success depends on key personnel and the loss of such key personnel could adversely affect our ability to manage our business or implement our growth strategies. |

| • | We may be unable to identify, acquire or operate properties successfully, which could harm our financial condition and ability to pay distributions. |

| • | Our Administrative Services Company will face conflicts of interest caused by its arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders. |

| • | We may assume unknown liabilities in connection with our formation transactions, and any recourse against third parties may be limited. |

| • | Failure to qualify as a REIT would have significant adverse consequences to us and the value of our common stock. |

Real estate investments are subject to various risks and fluctuations and cycles in value and demand, many of which are beyond our control. Our economic performance and the value of our properties can be affected by many of these factors, including, among others, the following:

3

| • | adverse changes in financial conditions of buyers, sellers and tenants of our properties, including bankruptcies, financial difficulties, or lease defaults by our tenants; |

| • | local real estate conditions, such as an oversupply of, or a reduction in demand for, retail space or retail goods, and the availability and creditworthiness of current and prospective tenants; |

| • | vacancies or ability to rent space on favorable terms, including possible market pressures to offer tenants rent abatements, tenant improvements, early termination rights or below-market renewal options; |

| • | changes in operating costs and expenses, including, without limitation, increasing labor and material costs, insurance costs, energy prices, environmental restrictions, real estate taxes, and costs of compliance with laws, regulations and government policies, which we may be restricted from passing on to our tenants; |

| • | fluctuations in interest rates, which could adversely affect our ability, or the ability of buyers and tenants of properties, to obtain financing on favorable terms or at all; and |

| • | competition from other real estate investors with significant capital, including other real estate operating companies, publicly traded REITs and institutional investment funds. |

Our Properties

Our Portfolio

Upon completion of this offering and consummation of the formation transactions, we will own eight properties located in the Mid-Atlantic, Southeast, and Southwest markets, containing a total of approximately 348,490 in rentable square feet of retail space, which we refer to as our portfolio. The following table presents an overview of our portfolio, based on information as of March 31, 2012.

Portfolio

| Annualized | ||||||||||||||||||||||||||

| Base Rent | ||||||||||||||||||||||||||

| Net | per | |||||||||||||||||||||||||

| Number | Rentable | Leased | ||||||||||||||||||||||||

| Year Built/ | of | Square | Percentage | Annualized | Square | |||||||||||||||||||||

| Property |

Location | Renovated | Tenants | Feet | Leased | Base Rent | Foot (1) | |||||||||||||||||||

| Amscot Building |

Tampa, FL | 2004 | 1 | 2,500 | 100.0 | % | $ | 101,400.00 | $ | 40.56 | ||||||||||||||||

| Lumber River |

Lumberton, NC | |

1985/1997-98 (expansion)/2004 |

|

11 | 66,781 | 100.0 | % | 509,539.03 | 7.63 | ||||||||||||||||

| Monarch Bank |

Virginia Beach, VA | 2002 | 1 | 3,620 | 100.0 | % | 211,046.00 | 58.32 | ||||||||||||||||||

| Perimeter Square |

Tulsa, OK | 1982-83 | 9 | 58,277 | 100.0 | % | 685,337.52 | 11.76 | ||||||||||||||||||

| Riversedge North |

Virginia Beach, VA | 2007 | 1 | 10,550 | 100.0 | % | 274,089.00 | 25.98 | ||||||||||||||||||

| The Shoppes at TJ Maxx |

Richmond, VA | 1982/1999 | 14 | 93,552 | 81.2 | % | 926,480.20 | 12.20 | ||||||||||||||||||

| The Shoppes at Eagle Harbor |

Carrollton, VA | 2009 | 7 | 23,303 | 100.0 | % | 472,584.84 | 20.20 | ||||||||||||||||||

| Walnut Hill Plaza |

Petersburg, VA | 1959/2006/2008 | 11 | 89,907 | 82.7 | % | 550,153.00 | 7.40 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Portfolio |

55 | 348,490 | 90.5 | % | $ | 3,730,629.59 | $ | 11.83 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Annualized base rent per leased square foot includes the impact of tenant concessions. |

4

Structure and Formation of Our Company

Our Operating Entities

Our Operating Partnership

Following the completion of this offering and the formation transactions, substantially all of our assets will be held by, and our operations will be conducted through, the Operating Partnership. As the sole general partner of the Operating Partnership, we will generally have the exclusive power under the Amended and Restated Agreement of Limited Partnership of Wheeler REIT, L.P. (the “Partnership Agreement”) to manage and conduct the business and affairs of the Operating Partnership, subject to certain limited approval and voting rights of the limited partners, which are described more fully below in “Description of the Partnership Agreement of Wheeler REIT, L.P.” Our board of directors will manage our business and affairs.

Because we plan to conduct substantially all of our operations through the Operating Partnership, we are considered an UPREIT. UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” An UPREIT is a REIT that holds all or substantially all of its properties through a partnership in which the REIT holds a general partner and/or limited partner interest generally based on the value of capital raised by the REIT through sales of its capital stock. Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of unfavorable tax results. Generally, a sale or contribution of property directly to a REIT is a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may contribute the property to the UPREIT in exchange for limited partnership units in the partnership and defer taxation of gain until the seller later exchanges his limited partnership units on a one-for-one basis for REIT shares or for cash pursuant to the terms of the limited partnership agreement or the UPREIT sells the property.

Our Administrative Service Company

We intend to enter into an Administrative Services Agreement with our Administrative Service Company. Pursuant to the Administrative Service Agreement, our Administrative Service Company will provide us with appropriate support personnel to assist our executive management team and will perform certain services for us, subject to the oversight of our board of directors and our executive officers. Our Administrative Service Company will be responsible for, among other duties (1) performing and administering our day-to-day operations, (2) determining investment criteria in conjunction with our board of directors, (3) sourcing, analyzing and executing asset acquisitions approved by our board of directors, sales and financings, (4) performing asset management duties, (5) performing property management duties, (6) performing leasing duties, and (7) performing financial and accounting management. Our Administrative Service Company will receive an administrative services fee of $360,000 per year for the initial eight properties in our operating portfolio, and $20,000 per year for each additional property we acquire subsequent to the completion of this offering. Additionally, Wheeler Real Estate, LLC will receive a property management fee at a rate of 3% of our annual gross revenue and Wheeler Interests, LLC will receive an asset management fee at a rate of 2% of our annual gross revenue. Additionally, we will reimburse our Administrative Service Company for all reasonable out-of-pocket expenses incurred on our behalf, including but not limited to travel and general office expenses, such as copying and telephone usage. Our executive management team will consist of our Chairman/President, Chief Financial Officer, and Secretary. We do not expect to have any employees other than our executive management team. The salaries of such officers will be paid by our Administrative Service Company. They may also be eligible to receive additional compensation in the form of stock options granted under our 2012 Share Incentive Plan.

Formation Transactions

Each property that will be owned by us through our Operating Partnership upon the completion of this offering and the formation transactions is currently owned directly or indirectly by limited liability companies in which Jon S. Wheeler and his affiliates, certain of our other directors and executive officers and their affiliates and/or other third parties own a direct or indirect interest (the “Ownership Entities”). Each of the Ownership Entities is currently owned by a number of investors (the “Prior Investors”). With the exception of the current owners of The Shoppes at Eagle Harbor property, the Prior Investors will enter into contribution agreements with our Operating Partnership, pursuant to which they will contribute their interests in the Ownership Entities to our Operating Partnership substantially concurrently with the completion of this offering. The Prior Investors will receive cash or common units in exchange for their interests in the Ownership Entities. Such common units will be

5

issued by the Operating Partnership pursuant to the terms of a private offering in which the Operating Partnership will offer for sale, solely to persons and entities that represent in writing that they are either accredited investors, as defined in Rule 501 of the Securities Act of 1933, as amended (the “1933 Act”) or sophisticated investors, as described in Rule 506(b)(2)(ii) of the 1933 Act, in a transaction exempt from registration under federal and state securities laws, Operating Partnership common units or cash in exchange for membership interests in the Ownership Entities held by the Prior Investors.

We will directly purchase all of the membership interests of DF-1 Carrollton, LLC, which currently owns The Shoppes at Eagle Harbor. See “Certain Relationships and Related Transactions.” The value of the consideration to be paid to each of the Prior Investors in the formation transactions, in each case, will be based upon the terms of the applicable contribution or purchase agreement among our Operating Partnership, on the one hand, and the prior investor or investors, on the other hand, and will be determined based on a relative equity valuation analysis of all of the properties included in our portfolio. These relative values were based on a cash flow analysis (based on information provided by us) and on the face amount of the outstanding secured and mortgage debt on each property on March 31, 2012. This relative equity valuation was not performed by an independent real estate appraiser and is not a determination of the value of the properties to be included in our initial portfolio, but rather was a component taken into account by the participants in the formation transactions and utilized by them in constructing a formula for determination of their relative equity interests in us. See “Structure and Formation of Our Company—Our Structure—Determination of Consideration Payable for Our Properties.”

Additionally, common units exchanged for the Amscot Building, Monarch Bank and Riversedge North properties are subject to adjustment immediately following the public release of our audited consolidated financial statements for the year ended December 31, 2012 and upon the approval of a majority of our independent directors as follows:

| • | The adjustments will be calculated by applying the initial exchange methodology to such properties’ cash flows as used in preparing our audited consolidated financial statements for the year ended on December 31, 2012, subject to the adjustments approved by a majority of our independent directors. |

| • | If the adjusted exchange calculation increases the number of common units exchanged for any such property, the Prior Investors in such property will receive an additional number of common units in our Operating Partnership that, when multiplied by the initial offering price for this offering, will equal the increase in value plus the value of any distributions that would have been made with respect to such common units if such common units had been issued at the time of the acquisition of such property. |

| • | If, however, the adjusted exchange calculation decreases the number of common units exchanged for any such property, the Prior Investors in such property will forfeit that number of common units that, when multiplied by the initial offering price for this offering, equals the decrease in value plus that value of any distributions made with respect to such common units. The Prior Investors in such property will be prohibited from selling the common stock underlying their common units until any such adjustments are made. |

| • | If any Prior Investor receives cash instead of Operating Partnership common units, similar adjustments to the cash purchase price will also be made. |

Since the properties are being recorded at historical cost, any adjustment, which we do not expect to be significant based on current results at the properties, would only impact the number of common units issued in the exchange.

Each of the Prior Investors has a substantive, pre-existing relationship with us and with the exception of the Prior Investors in The Shoppes at Eagle Harbor, will be required to make an election to receive shares of our common units or cash in the formation transactions. The issuance of such common units will be effected in reliance upon one or more exemptions from registration provided by Section 4(2) of the Securities Act and corresponding provisions under state securities law.

Pursuant to the formation transactions, the following have occurred or will occur substantially concurrently with the completion of this offering. All amounts are based on the mid-point of the range set forth on the cover page of this prospectus.

| • | We were formed as a Maryland corporation on June 23, 2011, and our Operating Partnership was formed as a Virginia limited partnership, on April 5, 2012. |

| • | We will sell 3,000,000 shares (assuming a minimum offering) or 4,000,000 shares (assuming a maximum offering) of our common stock in this offering and we will contribute the net proceeds from this offering to our Operating Partnership in exchange for 3,000,000 common units (assuming a minimum offering) or 4,000,000 common units (assuming a maximum offering). |

6

| • | With the exception of The Shoppes at Eagle Harbor property, we and our Operating Partnership will consolidate the ownership of our portfolio by attempting to acquire 100% of the membership interests in the limited liability companies that directly or indirectly own such properties through a series of contribution agreements with such entities and the owners thereof. The value of the consideration to be paid to each of the owners of such entities in the formation transactions will be determined according to a formula set forth in such contribution agreements. |

| • | Our Operating Partnership intends to use approximately $1.67 million of the net proceeds of this offering to directly purchase 100% of the membership interests of DF-1 Carrollton, LLC, which currently owns The Shoppes at Eagle Harbor property, one of the original eight properties in our operating portfolio. |

| • | Prior Investors in the Ownership Entities will receive as consideration for such contributions, common units, or $ in cash in accordance with the terms of the relevant contribution agreements. The aggregate value of common units to be paid to Prior Investors in such entities at the mid-point of the range of prices shown on the cover of this prospectus is $ . This value will increase or decrease if our common stock is priced above or below the mid-point of the range of prices shown on the cover of this prospectus. |

| • | Our Operating Partnership intends to use a portion of the net proceeds of this offering to repay approximately $500,000 of outstanding indebtedness. As a result of the foregoing use of proceeds, we expect to have approximately $25.3 million of total debt outstanding upon completion of this offering and the formation transactions. This will result in a ratio of debt to total market capitalization of approximately 46% assuming completion of the minimum offering, or 42% assuming completion of the maximum offering. Although we are not required by our governing documents to maintain this ratio at any particular level, our Board of Directors will review our ratio of debt to total capital on a quarterly basis, with the goal of maintaining a reasonable rate consistent with our expected ratio of debt to total market capitalization going forward. |

| • | We expect to adopt our 2012 Share Incentive Plan. We expect that an amount equal to 10% of the common stock sold in the offering or an aggregate of 300,000 shares (assuming a minimum offering) or 400,000 shares (assuming a maximum offering) of our common stock will be available for issuance under the 2012 Share Incentive Plan. |

Benefits of the Formation Transactions to Related Parties

In connection with this offering and the formation transactions, Mr. Wheeler, our Chairman and President, and certain of our other directors and executive officers will receive material benefits. Mr. Wheeler and certain of his affiliates are guarantors of approximately $11 million of indebtedness, in the aggregate, that will be assumed by us upon completion of this offering. In connection with this assumption, we will seek to have Mr. Wheeler and his affiliates released from such guarantees and to have our Operating Partnership assume any such guarantee obligations as replacement guarantor. A full discussion of this and all other material benefits to be received by our executive officers and directors can be found in this prospectus under the heading “Certain Relationships and Related Transactions.”

7

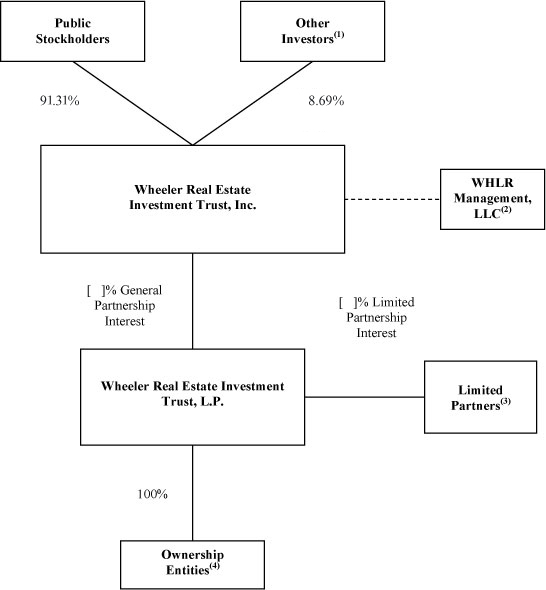

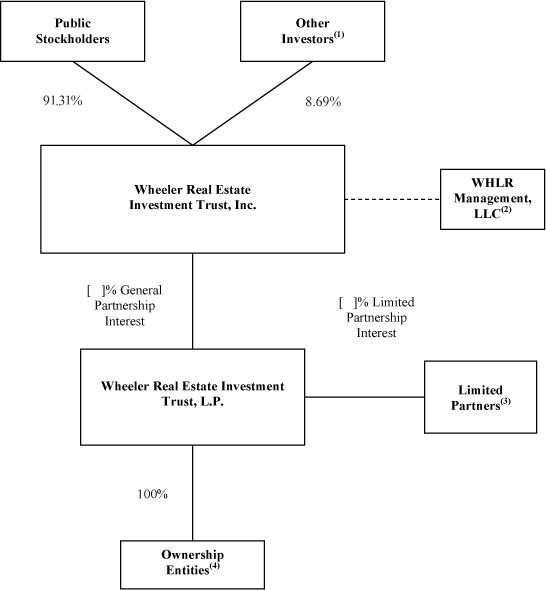

Our Structure

The following diagram depicts the expected ownership structure of Wheeler Real Estate Investment Trust, Inc. upon completion of the minimum offering and the formation transactions. We expect to own a % general partnership interest in our Operating Partnership and our Operating Partnership expects to indirectly own the properties in our portfolio, through the Ownership Entities.

| (1) | Consists of holders of 249,750 shares of Series A Convertible Preferred Stock. Upon completion of this offering, all issued and outstanding Series A Convertible Preferred Stock will automatically convert into a number of shares of common stock equal to (i) $4.00 divided by (ii) 66.66% of the public offering price of the common stock sold in this offering, or 285,457 shares of common stock assuming the mid-point of the price range set forth on the cover page of this prospectus. Jon S. Wheeler, our President and Chairman, controls 2,250 of such shares held by Sooner Capital, LLC. |

| (2) | WHLR Management, LLC, which is wholly-owned by Jon S. Wheeler, will provide administrative services to Wheeler Real Estate Investment Trust, Inc. pursuant to the terms of an administrative services agreement. |

| (3) | Prior Investors will receive [ ] limited partnership units in Wheeler REIT, L.P. in exchange for their membership interests in the Ownership Entities. Of those [ ] limited partnership units, 335,540 will be received by Jon S. Wheeler and 3,102 will be received by Robin Hanisch, our Secretary, in exchange for their membership interests in the Ownership Entities. |

| (4) | Upon completion of our formation transactions, we expect our Operating Partnership will own 100% of the membership interests of each of the Ownership Entities that own the initial eight properties in our portfolio. |

8

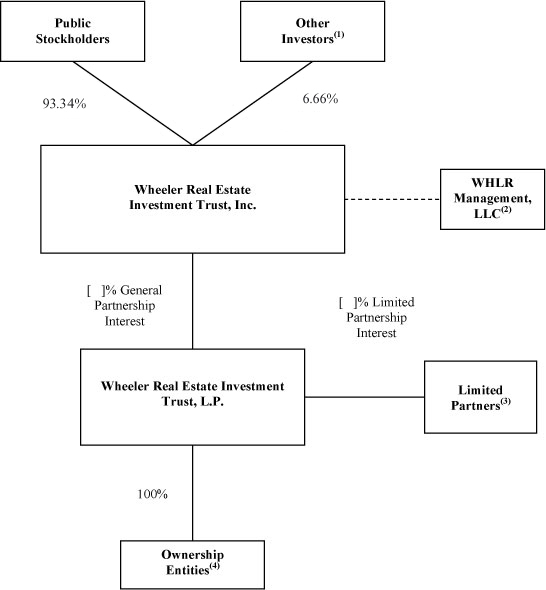

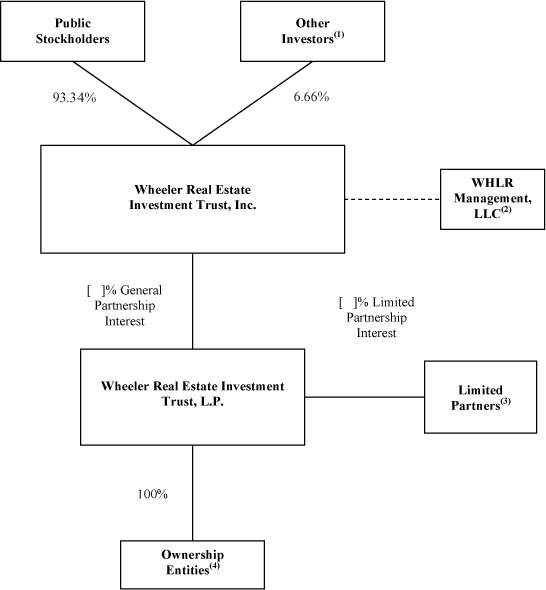

The following diagram depicts the expected ownership structure of Wheeler Real Estate Investment Trust, Inc. upon completion of the maximum offering and the formation transactions. We expect to own a __% general partnership interest in our Operating Partnership and our Operating Partnership expects to indirectly own the properties in our portfolio, through the Ownership Entities.

| (1) | Consists of holders of 249,750 shares of Series A Convertible Preferred Stock. Upon completion of this offering, all issued and outstanding Series A Convertible Preferred Stock will automatically convert into a number of shares of common stock equal to (i) $4.00 divided by (ii) 66.66% of the public offering price of the common stock sold in this offering, or 285,457 shares of common stock assuming the mid-point of the price range set forth on the cover page of this prospectus. Jon S. Wheeler, our President and Chairman, controls 2,250 of such shares held by Sooner Capital, LLC. |

| (2) | WHLR Management, LLC, which is wholly-owned by Jon S. Wheeler, will provide administrative services to Wheeler Real Estate Investment Trust, Inc. pursuant to the terms of an administrative services agreement. |

| (3) | Prior Investors will receive [ ] limited partnership units in Wheeler REIT, L.P. in exchange for their membership interests in the Ownership Entities. Of those [ ] limited partnership units, 335,540 will be received by Jon S. Wheeler and 3,102 will be received by Robin Hanisch, our Secretary, in exchange for their membership interests in the Ownership Entities. |

| (4) | Upon completion of our formation transactions, we expect our Operating Partnership will own 100% of the membership interests of each of the Ownership Entities that own the initial eight properties in our portfolio. |

9

Restrictions on Transfer

Under the Partnership Agreement, holders of common units do not have redemption or exchange rights, except under limited circumstances, for a period of 12 months, and may not otherwise transfer their units, except under certain limited circumstances, for a period of 12 months, from completion of this offering. After the expiration of this 12-month period, transfers of units by limited partners and their assignees are subject to various conditions, including our right of first refusal, described under “Description of the Partnership Agreement of Wheeler REIT, L.P.—Transfers and Withdrawals.” In addition, each of our executive officers, directors and director nominees and their affiliates, have agreed not to sell or otherwise transfer or encumber any shares of our common stock or securities convertible or exchangeable into our common stock (including common units) owned by them at the completion of this offering or thereafter acquired by them for a period of 180 days after the date of this prospectus.

Restrictions on Ownership of our Stock

Due to limitations on the concentration of ownership of REIT stock imposed by the Internal Revenue Code of 1986, as amended (the “Code”), our charter generally prohibits any person from actually, beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock or more than 9.8% in value of the aggregate outstanding shares of all classes and series of our stock (the “Ownership Limits”). See “Description of Securities—Restrictions on Ownership and Transfer.”

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have not made a decision whether to take advantage of any or all of these exemptions. If we do take advantage of any of these exemptions, we do not know if some investors will find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Conflicts of Interest

Following the completion of this offering and the formation transactions, conflicts of interest may arise between the holders of units and our stockholders with respect to certain transactions, such as the sale of any properties or a reduction of indebtedness, which could have adverse tax consequences to holders of units, including Mr. Wheeler, thereby making those transactions less desirable to such holders. In the event of such a conflict, we are under no obligation to give priority to the separate interests of our company or our stockholders. See “Policies with respect to Certain Activities—Conflict of Interest Policies” and “Description of the Partnership Agreement of Wheeler REIT, L.P.” In addition, other affiliates of Mr. Wheeler and/or our other directors and executive officers are parties to or, have interests in, certain agreements with us, including contribution agreements and employment agreements. See “Certain Relationships and Related Transactions—Formation Transactions.”

Distribution Policy

We intend to pay cash dividends to holders of our common stock on a monthly basis. We intend to pay a pro rata dividend

with respect to the period commencing on the completion of this offering and ending based on $ per share. On an annualized basis, this would be $0.42 per share. We intend to maintain our initial dividend rate for the 12-month period following completion of this offering unless actual results of operations, economic conditions or other factors differ materially from the assumptions used in our estimate. We intend to make dividend distributions that will enable us to meet the distribution requirements applicable to REITs and to eliminate or minimize our obligation to pay income and excise taxes. Initially, we may be required to use a portion of the net proceeds from this offering to make such distributions. We may in the future also choose to pay dividends in shares of our common stock. See “Material U.S. Federal Income Tax Considerations—Federal Income Tax Considerations for Holders of Our Common Stock—Taxation of Taxable U.S. Stockholders” and “Risk Factors—Risks Related to Our Status as a REIT—We may in the future choose to pay dividends in shares of our common stock, in which case you may be required to pay tax in excess of the cash you receive.”

Additionally, we have agreed with our placement agents that any common units held by Jon S. Wheeler, directly or indirectly or through his spouse, children or affiliated entities, or any common units held by any holder who would own more than 4.99% of our common stock upon conversion of such units, will be contractually subordinated to the remaining common units and common stock as it relates to dividend payments to be received by the holders of common units and the holders of common stock. See “Distribution Policy.”

10

Our Tax Status

We intend to elect to be taxed and to operate in a manner that will allow us to qualify as a REIT for federal income tax purposes commencing with our taxable year ending December 31, 2012. We believe that our organization and proposed method of operation will enable us to meet the requirements for qualification and taxation as a REIT. To maintain REIT status, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income to our stockholders.

Corporate Information

Our principal executive office is located at Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. Our telephone number is 757-627-9088. We have reserved the website located at www.WHLR.us. The information on, or accessible through, our website is not incorporated into and does not constitute a part of this prospectus or any other report or document we file with or furnish to the Securities and Exchange Commission (the “SEC”).

11

This Offering

| Common stock offered by us: |

Minimum: 3,000,000 shares Maximum: 4,000,000 shares | |

| Common stock to be outstanding after this offering: |

Minimum: 3,285,457 shares(1) Maximum: 4,285,457 shares(2) | |

| Common stock and common units to be outstanding after this offering |

Minimum: shares and common units(1)(3) Maximum: shares and common units(2)(4) | |

| Use of proceeds |

Assuming the mid-point of the price range set forth on the cover page of this prospectus, we estimate that the net proceeds of this offering, after deducting the placement fee and commissions and estimated expenses, will be approximately $13.39 million, assuming a minimum offering, or $18.19 million, assuming a maximum offering. We will contribute the net proceeds of this offering to our Operating Partnership. Our Operating Partnership intends to use the net proceeds of this offering as follows: | |

| • Approximately $0.5 million to repay outstanding indebtedness. | ||

| • Approximately $2.0 million for general working capital, which may be used to fund dividend payments. | ||

| • Approximately $1.67 million to reimburse our Operating Partnership for the purchase of the membership interests of DF-1 Carrollton, LLC, the current owner of The Shoppes at Eagle Harbor, one of the original eight properties in our operating portfolio. | ||

| • Approximately $[ ] in cash payments to those prior investors who have elected to receive cash instead of Operating Partnership Units for their contribution of membership interests in the Ownership Entities. | ||

| • The balance, approximately $[ ] million (assuming a minimum offering) or $[ ] million (assuming a maximum offering) will be used for future acquisitions. | ||

| Risk Factors |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 14. and other information included in this prospectus before investing in our common stock. | |

| Nasdaq Capital Market symbol |

“WHLR” | |

| (1) | Includes (a) 3,000,000 shares of common stock to be issued in this offering, and (b) the 285,457 shares of common stock that will be issued upon the automatic conversion of the 249,750 outstanding shares of Series A Convertible preferred stock. Excludes 300,000 shares of our common stock available for future issuance under our 2012 Equity Incentive Award Plan. |

| (2) | Includes (a) 4,000,000 shares of common stock to be issued in this offering, and (b) the 285,457 shares of common stock that will be issued upon the automatic conversion of the 249,750 outstanding shares of Series A Convertible preferred stock. Excludes 400,000 shares of our common stock available for future issuance under our 2012 Equity Incentive Award Plan. |

| (3) | Includes common units expected to be issued in the formation transactions, which may, subject to certain limitations, be redeemed for cash or, at our option, exchanged for shares of common stock on a one-for-one basis. |

| (4) | Includes common units expected to be issued in the formation transactions, which may, subject to certain limitations, be redeemed for cash or, at our option, exchanged for shares of common stock on a one-for-one basis. |

12

SUMMARY SELECTED FINANCIAL DATA

The following table sets forth selected financial data on (i) a pro forma basis for our company giving effect to the offering and formation transactions, including the purchase accounting adjustments and (ii) the combined historical cost basis for the entities included in the Wheeler Real Estate Investment Trust, Inc. and Affiliates (“WHLR” or the “Predecessor”) financial statements which is considered the predecessor in these transactions. The pro forma and combined historical financial information and the offering and formation transactions, including the purchase accounting adjustments, are provided and discussed in detail in the unaudited pro forma financial information beginning on page F-2 of the financial statements included elsewhere in this prospectus.

You should read the following summary selected financial data in conjunction with our financial statements and the related notes and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The selected combined balance sheet data as of March 31, 2012 and 2011 and December 31, 2011 and 2010 and the selected combined operating data for the three months ended March 31, 2012 and 2011 and the years ended December 31, 2011 and 2010 have been derived from the combined audited financial statements of WHLR included elsewhere in this prospectus. This data is presented on a combined historical basis and does not include the impact of the offering and formation transactions, as described in the unaudited pro forma financial information beginning on page F-2 of the financial statements supplied in this prospectus.

Our unaudited summary selected pro forma condensed consolidated balance sheet and operating data as of and for the three months ended March 31, 2012 and the year ended December 31, 2011 assumes completion of this offering, the formation transactions, the repayment of certain indebtedness and the other adjustments described in the unaudited pro forma financial information beginning on page F-2 of this prospectus, as of January 1, 2011 for the operating data and as of March 31, 2012 for the balance sheet data.

The unaudited pro forma condensed consolidated balance sheet is presented for illustrative purposes only and is not necessarily indicative of what the actual financial position would have been had the transactions referred to above occurred on March 31, 2012, nor does it purport to represent the future financial position of the company. The unaudited pro forma condensed consolidated statements of operations are presented for illustrative purposes only and is not necessarily indicative of what the actual results of operations would have been had the transactions referred to above occurred on January 1, 2011, nor does it purport to represent the future results of operations of the company.

13

| Pro Forma | Historical | Pro Forma | Historical | |||||||||||||||||||||

| Three Months Ended March 31, 2012 |

Three Months Ended March 31, |

Year Ended December 31, 2011 |

Years Ended December 31, |

|||||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | |||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||

| OPERATING DATA: |

||||||||||||||||||||||||

| Total combined revenues |

$ | 1,458,048 | $ | 529,843 | $ | 459,388 | $ | 5,086,455 | $ | 1,925,277 | $ | 1,854,050 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses: |

||||||||||||||||||||||||

| Property operating |

249,664 | 73,205 | 71,231 | 845,585 | 352,508 | 301,076 | ||||||||||||||||||

| Depreciation and amortization |

493,405 | 186,611 | 184,618 | 1,972,106 | 744,931 | 732,852 | ||||||||||||||||||

| Real estate taxes |

73,346 | 26,193 | 26,520 | 293,221 | 104,555 | 95,356 | ||||||||||||||||||

| Repairs and maintenance |

25,953 | 15,779 | 6,747 | 227,262 | 63,253 | 124,864 | ||||||||||||||||||

| Advertising and promotion |

3,841 | 2,491 | 16,860 | 46,384 | 27,580 | 9,606 | ||||||||||||||||||

| Provision for credit losses |

— | — | — | 37,195 | 20,000 | 9,632 | ||||||||||||||||||

| Impairment charges, net |

— | — | — | 1,647,906 | — | — | ||||||||||||||||||

| Corporate general & administrative |

263,000 | 157,641 | — | 1,050,000 | 321,178 | — | ||||||||||||||||||

| Other |

28,244 | 10,170 | 7,119 | 113,869 | 39,902 | 38,148 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses |

1,137,453 | 472,090 | 313,095 | 6,233,528 | 1,673,907 | 1,311,534 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income |

320,595 | 57,753 | 146,293 | (1,147,073 | ) | 251,370 | 542,516 | |||||||||||||||||

| Non-operating income and expense: |

||||||||||||||||||||||||

| Interest expense |

(381,806 | ) | (197,904 | ) | (201,513 | ) | (1,552,645 | ) | (805,969 | ) | (800,678 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-operating income and expense |

(381,806 | ) | (197,904 | ) | (201,513 | ) | (1,552,645 | ) | (805,969 | ) | (800,678 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss (1) |

$ | (61,211 | ) | $ | (140,151 | ) | $ | (55,220 | ) | $ | (2,699,718 | ) | $ | (554,599 | ) | $ | (258,162 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss allocated to noncontrolling interests |

$ | (24,964 | ) | $ | (1,101,020 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net loss allocated to common stockholders |

$ | (36,247 | ) | $ | (1,598,698 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Pro forma loss per share: |

||||||||||||||||||||||||

| Basic |

$ | (0.01 | ) | $ | (0.49 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Diluted |

$ | (0.01 | ) | $ | (0.49 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Pro forma weighted-average number of shares: |

||||||||||||||||||||||||

| Basic |

3,285,457 | 3,285,457 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Diluted |

3,285,457 | 3,285,457 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| BALANCE SHEET DATA (as of period end): |

||||||||||||||||||||||||

| Investment properties, net |

$ | 34,124,199 | $ | 13,020,661 | $ | 13,650,737 | $ | 34,390,743 | $ | 13,171,218 | $ | 13,821,522 | ||||||||||||

| Cash and cash equivalents |

9,544,535 | 172,079 | 226,768 | 9,571,761 | 104,007 | 199,637 | ||||||||||||||||||

| Tenant Receivables |

718,418 | 614,684 | 591,984 | 622,903 | 572,591 | 557,589 | ||||||||||||||||||

| Other assets |

1,695,187 | 1,211,438 | 220,045 | 1,465,162 | 977,080 | 228,478 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

$ | 46,082,339 | $ | 15,018,862 | $ | 14,689,534 | $ | 46,050,569 | $ | 14,824,896 | $ | 14,807,226 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Mortgages and other indebtedness |

$ | 25,328,152 | $ | 12,075,193 | $ | 12,308,332 | $ | 25,446,294 | $ | 12,136,083 | $ | 12,350,577 | ||||||||||||

| Other liabilities |

3,354,461 | 2,248,537 | 1,495,395 | 3,082,986 | 2,019,488 | 1,456,330 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

28,682,613 | 14,323,730 | 13,803,727 | 28,529,280 | 14,155,571 | 13,806,907 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total equity |

17,399,726 | 695,132 | 885,807 | 17,521,289 | 669,325 | 1,000,319 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities and equity |

$ | 46,082,339 | $ | 15,018,862 | $ | 14,689,534 | $ | 46,050,569 | $ | 14,824,896 | $ | 14,807,226 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| OTHER DATA: |

||||||||||||||||||||||||

| Cash flows provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 25,383 | $ | 93,142 | $ | 349,712 | $ | 419,522 | ||||||||||||||||

| Investing activities |

$ | (19,729 | ) | $ | — | $ | (33,346 | ) | $ | (46,760 | ) | |||||||||||||

| Financing activities |

$ | 62,418 | $ | (66,010 | ) | $ | (411,996 | ) | $ | (419,318 | ) | |||||||||||||

| Funds from Operations (FFO) (2) |

$ | 432,194 | $ | 46,460 | $ | 129,398 | $ | (727,612 | ) | $ | 190,332 | $ | 474,690 | |||||||||||

| (1) Earnings Per Share information not included in the schedule for historical results of operations since it is considered not applicable. |

| |||||||||||||||||||||||

| (2) Below is the calculation of FFO, which is a non-GAAP measurement, and the reconciliation to net income (loss) for the periods presented: |

| |||||||||||||||||||||||

| Pro Forma | Historical | Pro Forma | Historical | |||||||||||||||||||||

| Three Months Ended March 31, 2012 |

Three Months Ended March 31, |

Year Ended December 31, 2011 |

Years Ended December 31, |

|||||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | |||||||||||||||||||||

| Net loss |

$ | (61,211 | ) | $ | (140,151 | ) | $ | (55,220 | ) | $ | (2,699,718 | ) | $ | (554,599 | ) | $ | (258,162 | ) | ||||||

| Depreciation of real estate assets |

493,405 | 186,611 | 184,618 | 1,972,106 | 744,931 | 732,852 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total FFO |

$ | 432,194 | $ | 46,460 | $ | 129,398 | $ | (727,613 | ) | $ | 190,332 | $ | 474,690 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

14

Investing in our common stock involves risks. In addition to other information contained in this prospectus, you should carefully consider the following factors before acquiring shares of our common stock offered by this prospectus. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, results of operations and our ability to make cash distributions to our stockholders, which could cause you to lose all or a part of your investment in our common stock. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Forward-Looking Statements.”

Risks Related to Our Business and Operations

We have no operating history as a REIT or a publicly traded company, nor established financing sources, and may not be able to successfully operate as a REIT or a publicly traded company.

We have no operating history as a REIT or a publicly traded company. As of the date of this prospectus, we have not acquired any properties or other investment nor do we have any operations or independent financing. The initial properties are described herein and will not be subject to review by our common stockholders. We cannot assure you that the past experience of Mr. Wheeler and the management teams of our Services Companies will be sufficient to successfully operate our company as a REIT or a publicly traded company, including the requirements to timely meet disclosure requirements of the SEC, and comply with the Sarbanes-Oxley Act of 2002 and REIT requirements imposed by the Code. Upon completion of this offering, we will be required to develop and implement control systems and procedures in order to qualify and maintain our qualification as a REIT and satisfy our periodic and current reporting requirements under applicable SEC regulations and comply with Nasdaq listing standards, and this transition could place a significant strain on our management systems, infrastructure and other resources. Failure to operate successfully as a public company or maintain our qualification as a REIT would have an adverse effect on our financial condition, results of operations, cash flow and per share trading price of our common stock. See “—Risks Related to Our Status as a REIT—Failure to qualify as a REIT would have significant adverse consequences to us and the value of our common stock.”

Additionally, we do not have any established financing sources. If our capital resources are insufficient to support our operations, we will not be successful. You should consider our prospects in light of the risks, uncertainties and difficulties frequently encountered by companies that are, like us, in their early stage of development. To be successful in this market, we must, among other things:

| • | Identify and acquire additional investments that further our investment strategies; |

| • | Increase awareness of our REIT within the investment products market; |

| • | Attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; |

| • | Respond to competition for our targeted real estate properties and other investment as well as for potential investors; and |

| • | Continue to build and expand our operations structure to support our business. |

We cannot guarantee that we will succeed in achieving these goals, and our failure to do so could cause you to lose all or a portion of your investment.

Our portfolio of properties is dependent upon regional and local economic conditions and is geographically concentrated in the Mid-Atlantic, Southeast and Southwest, which may cause us to be more susceptible to adverse developments in those markets than if we owned a more geographically diverse portfolio.

Our properties are located in Virginia, North Carolina, Florida and Oklahoma, and the majority of our properties are concentrated in Virginia, which exposes us to greater economic risks than if we owned a more geographically diverse portfolio. Our Riversedge North property, which houses our company’s offices and the offices of our Administrative Service Company, comprises 7.35% of the total annualized base rent of the properties in our portfolio. As of March 31, 2012, our properties in Virginia represented approximately 65%, of the total annualized base rent of the properties in our portfolio. As a result, we are particularly susceptible to adverse economic or other conditions in this market (such as periods of economic slowdown or recession, business layoffs or downsizing, industry slowdowns, relocations of businesses, increases in real estate and other taxes and the cost of complying with governmental regulations or increased regulation). If there is a downturn in the economy in

15

our markets, our operations and our revenue and cash available for distribution, including cash available to pay distributions to our stockholders, could be materially adversely affected. We cannot assure you that our markets will grow or that underlying real estate fundamentals will be favorable to owners and operators of retail properties. Our operations may also be affected if competing properties are built in our markets. Moreover, submarkets within any of our markets may be dependent upon a limited number of industries. Any adverse economic or real estate developments in the Mid-Atlantic, Southeast or Southwest markets, or any decrease in demand for retail space resulting from the regulatory environment, business climate or energy or fiscal problems, could adversely impact our financial condition, results of operations, cash flow, our ability to satisfy our debt service obligations and our ability to pay distributions to our stockholders.

We expect to have approximately $25.3 million of indebtedness outstanding following this offering, which may expose us to the risk of default under our debt obligations.

Upon completion of this offering and consummation of the formation transactions, we anticipate that our total indebtedness will be approximately $25.0 million, a substantial portion of which will be guaranteed by our Operating Partnership, and we may incur additional debt to finance future acquisition and development activities.

Payments of principal and interest on borrowings may leave us with insufficient cash resources to operate our properties or to pay the dividends currently contemplated or necessary to maintain our REIT qualification. Our level of debt and the limitations imposed on us by our debt agreements could have significant adverse consequences, including the following:

| • | our cash flow may be insufficient to meet our required principal and interest payments; |

| • | we may be unable to borrow additional funds as needed or on favorable terms, which could, among other things, adversely affect our ability to meet operational needs; |

| • | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; |

| • | we may be forced to dispose of one or more of our properties, possibly on unfavorable terms or in violation of certain covenants to which we may be subject; |

| • | we may violate financial covenants in our loan documents, which would entitle the lenders to accelerate our debt obligations; and |

| • | our default under any loan with cross default provisions could result in a default on other indebtedness. |

If any one of these events were to occur, our financial condition, results of operations, cash flow and per share trading price of our common stock could be adversely affected. Furthermore, foreclosures could create taxable income without accompanying cash proceeds, which could hinder our ability to meet the REIT distribution requirements imposed by the Code.

The majority of our properties are retail shopping centers and depend on anchor stores or major tenants to attract shoppers and could be adversely affected by the loss of, or a store closure by, one or more of these tenants.