UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

(Name of Registrant as Specified in Its Charter) |

STILWELL ACTIVIST INVESTMENTS, L.P. STILWELL VALUE PARTNERS VII, L.P. STILWELL ACTIVIST FUND, L.P. STILWELL VALUE LLC JOSEPH D. STILWELL PAULA J. POSKON KERRY G. CAMPBELL |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

STILWELL ACTIVIST INVESTMENTS, L.P

Dear Fellow Stockholder of Wheeler Real Estate Investment Trust, Inc.,

Stilwell Activist Investments, L.P. and certain of its affiliates (collectively, “Stilwell,” “we” or “our”) are the beneficial owners of an aggregate of 955,753 shares of common stock, par value $0.01 per share (the “Common Stock”), of Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (“Wheeler” or the “Company”), which includes 49,967 shares of the Company’s Series D Cumulative Convertible Preferred Stock, no par value, that are convertible into 73,654 shares of Common Stock, representing approximately 9.8% of the Company’s outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe change to the composition of the Board of Directors of the Company (the “Board”) is necessary in order to ensure that the Company is being run in a manner consistent with the best interests of all stockholders. We are seeking your support for the election of our three (3) nominees, Joseph D. Stilwell, Paula J. Poskon and Kerry G. Campbell, at the Company’s upcoming 2019 Annual Meeting of Stockholders (the “Annual Meeting”). The individuals we have nominated are highly-qualified, capable and ready to serve the stockholders of Wheeler.

Our interests are aligned with the interests of all Wheeler stockholders. We believe there is significant value to be realized at Wheeler. However, we are concerned that the Board is not capable of taking the appropriate action to address the Company’s perennial underperformance. Under the current Board, we have witnessed the abysmal performance of the Company’s stock and the destruction of significant value. We strongly believe that the Board must be reconstituted to ensure that the interests of stockholders are appropriately represented in the boardroom and that the Board takes the necessary steps to maximize stockholder value.

We urge you to consider carefully the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GREEN proxy card today FOR the election of Joseph D. Stilwell, Paula J. Poskon and Kerry G. Campbell at the Annual Meeting. The attached Proxy Statement and the enclosed GREEN proxy card are first being mailed to stockholders on or about October 29, 2019.

If you have any questions or require any assistance with your vote, please contact Stilwell or Okapi Partners LLC, which is assisting us, at the addresses and numbers listed below.

We appreciate your support.

Sincerely,

Megan Parisi

The Stilwell Group

(917) 881-8076

mparisi@stilwellgroup.com

If you have any questions, require assistance in voting your GREEN proxy card, or need additional copies of Stilwell’s proxy materials, please contact

Okapi Partners LLC at the phone numbers or email listed below.

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

(212) 297-0720

Call Toll-Free at: (877) 869-0171

E-mail: info@okapipartners.com

2019 ANNUAL MEETING OF STOCKHOLDERS

OF

Wheeler Real Estate Investment Trust, Inc.

_________________________

PROXY STATEMENT

OF

Stilwell Activist Investments, L.P.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GREEN PROXY CARD TODAY

Stilwell Activist Investments, L.P. (“Stilwell Activist Investments”), Stilwell Value Partners VII, L.P. (“Stilwell Value Partners VII”), Stilwell Activist Fund, L.P. (“Stilwell Activist Fund”), Stilwell Value LLC and Joseph Stilwell (collectively, “Stilwell,” “we” or “our”) are the largest stockholders of Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Company,” “Wheeler” or “WHLR”), which collectively beneficially own 955,753 shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company, which includes 49,967 shares of the Company’s Series D Cumulative Convertible Preferred Stock, no par value (the “Series D Preferred Stock”), that are convertible into 73,654 shares of Common Stock, representing approximately 9.8% of the Company’s outstanding shares. We believe that the Board of Directors of the Company (the “Board”) must be reconstituted to ensure that the Company is being run in a manner consistent with stockholders’ best interests. We have nominated three (3) highly-qualified director nominees, who are committed to exploring fully all opportunities to unlock stockholder value at the Company. We are seeking your support at the annual meeting of stockholders scheduled to be held at the Hilton Garden Inn Virginia Beach Oceanfront, located at 3315 Atlantic Avenue, Virginia Beach, Virginia 23451 on December 19, 2019 at 9:30 a.m., Eastern Standard Time (including any adjournments or postponements thereof and any meeting that may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect Stilwell’s three (3) director nominees, Joseph D. Stilwell, Paula J. Poskon and Kerry G. Campbell (each a “Nominee” and, collectively, the “Nominees”), to the Board as directors to serve until the 2020 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

| 3. | To ratify the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| 4. | To approve the Company’s 2019 Long-Term Incentive Plan (the “2019 Incentive Plan”); and |

| 5. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and the enclosed GREEN proxy card are first being furnished to the stockholders on or about October 29, 2019.

| 1 |

As of the date hereof, the members of Stilwell collectively own an aggregate of 955,753 shares of Common Stock, which includes 49,967 shares of Series D Preferred Stock that are convertible into 73,654 shares of Common Stock. The members of Stilwell intend to vote their shares FOR the election of the Nominees, AGAINST the advisory vote to approve the Company’s executive compensation, FOR the ratification of the appointment of Cherry Bekaert LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2019, and AGAINST approval of the 2019 Incentive Plan.

The Company has set the close of business on November 11, 2019 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Each share of Common Stock is entitled to one vote for each of the proposals to be voted on. The principal executive offices of the Company are located at Riversedge North, 2529 Virginia Beach Boulevard, Suite 200, Virginia Beach, Virginia 23452. The number of shares of Common Stock outstanding as of the Record Date has not yet been disclosed. Once the Company announces such information, Stilwell will supplement this Proxy Statement to include such information.

Stilwell is seeking your support at the Annual Meeting to elect its three (3) Nominees, Joseph D. Stilwell, Paula J. Poskon and Kerry G. Campbell, to the Board. If elected at the Annual Meeting, our Nominees will constitute a minority of the Board.

The Company has nominated eight (8) candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our three (3) Nominees, but also the candidates who have been nominated by the Company other than David Kelly, Jeffrey M. Zwerdling and John McAuliffe. This gives stockholders the ability to vote for the total number of directors up for election at the Annual Meeting.

THIS SOLICITATION IS BEING MADE BY STILWELL AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS THAT STILWELL IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GREEN PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STILWELL URGES YOU TO SIGN, DATE AND RETURN THE GREEN PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GREEN PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our GREEN proxy card are available at

www.okapivote.com/wheeler

| 2 |

IMPORTANT

Your vote is important, no matter how many or how few shares of Common Stock you own. Stilwell urges you to sign, date, and return the enclosed GREEN proxy card today to vote FOR the election of the Nominees and in accordance with Stilwell’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed GREEN proxy card and return it to Stilwell, c/o Okapi Partners LLC (“Okapi”), in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a GREEN voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our three (3) Nominees only on our GREEN proxy card. So please make certain that the latest dated proxy card you return is the GREEN proxy card.

Okapi is assisting Stilwell with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares of Common Stock, please contact:

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

(212) 297-0720

Call Toll-Free at: (877) 869-0171

E-mail: info@okapipartners.com

| 3 |

REASONS FOR THE SOLICITATION

We are soliciting your support to elect our Nominees at the Annual Meeting because we have little confidence that the Board, as currently composed, has the objectivity and commitment to take the steps necessary to maximize value for the common stockholders at Wheeler. We believe that the Board needs to be reconstituted with directors who will represent the common stockholders’ best interests at Wheeler.

Specifically, we believe the Board has failed in its most basic duty to provide effective oversight of the Company given the significant underperformance of Wheeler and the substantial erosion of stockholder value that has occurred under this Board’s watch. We believe these deficiencies are in large part caused by poor capital allocation decisions, an inability to set and maintain a suitable dividend, broken corporate governance, empty promises, high overhead costs relative to peers and excessive compensation.

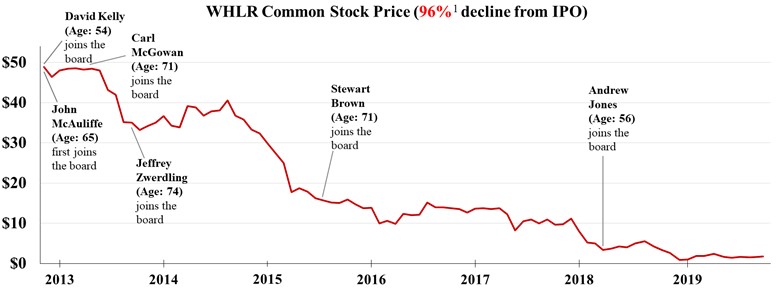

Despite our serious concerns, we tried to engage constructively with the Company to avoid a proxy contest and reach a mutually agreeable resolution. To that end, we engaged in numerous discussions with members of the Board and reached a verbal agreement regarding Board composition and related matters with Andrew Jones, Chairman of the Board, over the summer. However, despite this verbal commitment, the Chairman went radio silent for over a month. We then had a meeting with CEO David Kelly who informed us that our Nominees are not “suitable” and that he intends on essentially dragging Mr. Stilwell’s name through the mud if we proceed with a proxy contest. Given this concerning dialogue and verbal threat, Mr. Stilwell expressed his belief to Mr. Kelly that he finds him to be dishonest, dishonorable and incompetent and that this situation should be about Wheeler stockholders and the fact that the Company’s Common Stock has plummeted from approximately $48 per share to approximately $1.71 per share since the Company’s Initial Public Offering (IPO) in November 2012. Mr. Stilwell further expressed his belief that Mr. Kelly appears more interested in protecting his $400,000 salary than protecting stockholders’ best interests because Mr. Kelly knows that Mr. Stilwell is willing to hold management accountable for Wheeler’s abysmal performance (as opposed to Wheeler’s legacy directors who have clearly failed to do so).

While it has always been our preference to reach a resolution with the Company, these concerning settlement discussions and Mr. Kelly’s verbal threat have only solidified our belief that change is urgently needed to instill accountability in the boardroom.

Accordingly, we believe a reconstituted Board comprised of individuals elected by stockholders is required in order to ensure that management remains accountable to the Company and its common stockholders. Accordingly, we are soliciting your support to elect at the Annual Meeting our three (3) Nominees, who collectively bring the requisite skill sets, experience, fresh perspectives and common stockholder-alignment that we believe is currently lacking on the Board.

We Are Concerned with the Company’s Prolonged Common Stock Price Underperformance

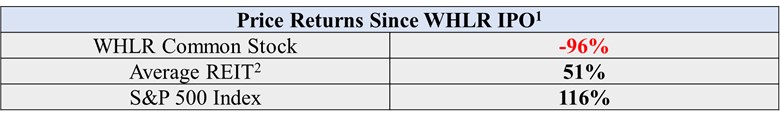

We believe common stockholders should be seriously concerned with the Company’s significant Common Stock price underperformance. As displayed in the charts below, Wheeler’s common stock price has declined a staggering 96% since the Company’s IPO in November 2012.

| 4 |

(1) Price returns on the WHLR common stock, the average REIT (MSCI U.S. REIT Index – see note 2) and the S&P 500 Index, according to S&P Global Market Intelligence, from WHLR’s first day of public trading, November 19, 2012, through October 16, 2019.

(2) Reflects the performance of the MSCI U.S. REIT Index which, according to a factsheet available on https://www.msci.com/msci-us-reit-index, represents about 99% of the U.S. REIT universe and is comprised of equity REITs with core real estate exposure (i.e., the index excludes mortgage REITs and some specialized REITs.)

Source: S&P Global Market Intelligence

| (1) | Our calculation, according to S&P Global Market Intelligence, is based on the $6/share closing price of WHLR on its first day of public trading, November 19, 2012 (adjusted to $48/share due to the 1-for-8 reverse stock split on March 31, 2017), and the $1.71/share closing price on October 16, 2019. |

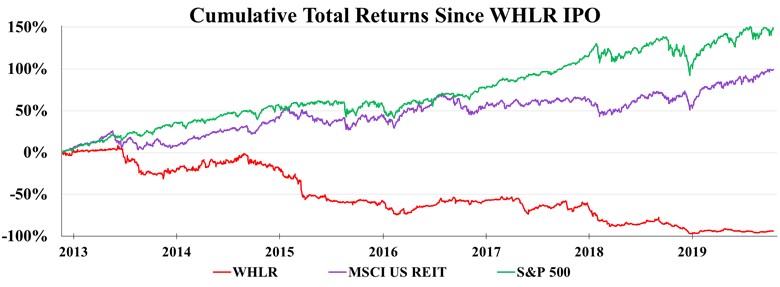

Since the Company’s IPO, Wheeler’s Common Stock has also significantly underperformed the MSCI US REIT and the S&P 500 indices. Even with the benefit of reinvested dividends, the Company’s Common Stock has only returned -94%, while the MSCI US REIT and the S&P 500 indices have returned 99% and 149%, respectively.1

1Total returns, according to S&P Global Market Intelligence, from WHLR’s first day of public trading, November 19, 2012, through October 16, 2019.

| 5 |

Source: S&P Global Market Intelligence

Because of this unacceptable performance, the Board, in our view, has not been an effective steward of common stockholder capital and management accountability.

We are Concerned with the Company’s Poor Capital Allocation Decisions

We believe the Company’s public offering of the Series D Preferred Stock was dilutive and therefore harmful to Wheeler common stockholders. In January 2018, Wheeler issued 1.4 million shares of Series D, $25 Convertible Preferred Stock at an $8.50 discount to face value, resulting in an immediate destruction of more than $12 million dollars for the common stockholders. Further, Wheeler owes $2.69 per share in annual dividends to Series D holders, which translates to a 16.3%2 cost of capital on the January 2018 issuance (not taking into account future dividend increases).3

According to press reports, the Board voted unanimously to sell the Series D shares at the $8.50 discount to face value. We find it difficult to understand how the Board approved the issuance of additional preferred debt at such a deep discount to face value without putting the matter to a stockholder vote.

Similarly, Institutional Shareholder Services Inc. (“ISS”), one of the leading proxy voting advisory firms, recommended that stockholders “WITHHOLD” on the election of every director up for re-election (other than John Sweet, who was a new director candidate at that time) at the Company’s 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”) because the Board unilaterally approved a significant increase in the Company’s authorized shares of preferred stock without putting the matter to a stockholder vote. According to ISS, Wheeler’s “decision to unilaterally increase its authorized preferred shares is concerning as shareholders should have the right to opine on matters that could affect their voting power and economic position at the [C]ompany.” Although stockholder approval is not required under Maryland law, we agree with ISS that the Company should have put such a material stock issuance to a stockholder vote, “particularly when the increase is significant and appear to be excessive,” as stated by ISS.

2 Calculations based on the Series D Preferred Stock’s current dividend rate of 10.75%, as stated in Item 1 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019, and the January 2018 public offering price of $16.50/share, as stated in Item 15 of WHLR’s Annual Report on Form 10-K, filed with the SEC on February 28, 2019.

3 Commencing September 21, 2023, Series D holders will be entitled to cumulative cash dividends at an annual dividend rate of the Initial Rate increased by 2% of the liquidation preference per annum on each subsequent anniversary thereafter, subject to a maximum annual dividend rate of 14% ($3.50/share), as stated in Item 1 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019, p. 25.

| 6 |

We also find it troubling that the Company approved the Series D issuance despite our public opposition to any additional offerings of preferred securities.

Perhaps even more concerning, however, is that the issuance exposes the common stockholders to greater consequences in the future. Beginning in September 2023, Series D holders have the option to redeem their preferred stock at $25 per share. If all of the Series D holders decide to redeem their 3,600,636 preferred shares, Wheeler would have to pay $90,015,900 in cash or issue the common stock equivalent, thereby significantly diluting existing common stockholders and even potentially wiping out existing common stockholders.

Despite these potentially dire consequences, the Company does not appear to have a clear strategy in place as to how it plans on handling this Series D redemption, which is only four years away. According to the Company’s first quarter 2019 prepared remarks, in response to the question: “How many more assets are either held for sale, or have been identified for potential sale?” the Company stated: “We believe that we have sold, or in the process of selling any assets that no longer meet our strategic investment focus. However, we continue to regularly assess our portfolio and look for ways to create value.” We seriously question how Wheeler can be finished with or close to finishing asset sales when the Board has yet to address (or even mention) the serious consequences of the optional Series D Preferred Stock redemption in 2023. We believe the Board needs to ensure that Wheeler continues selling underperforming properties to generate cash to buy back the Series D Preferred Stock.

In addition, under the terms of the Series D Preferred Stock, upon any “change of control,” the Series D holders have the option to redeem their preferred stock at $25 per share.4 As with the optional Series D Preferred Stock redemption in 2023, it is unclear how the Company would generate the cash to cover any such redemptions without conducting additional asset sales. Further, we believe this provision hinders the Company’s ability to objectively evaluate future strategic alternatives and protects legacy Board members—potentially to the stockholders’ detriment.5

WE BELIEVE THE BOARD HAS

FAILED TO PROVIDE EFFECTIVE

OVERSIGHT OF THE COMPANY

We are Concerned with the Board’s Inability to Meet Repeated Promises

Setting aside our concerns with the Board’s delay in removing the prior CEO Jon Wheeler (and only after we publicly called for his ouster) while the common stock materially declined for five years under his leadership, we continue to have serious concerns regarding this Board’s ability to effectively oversee management. Immediately after Mr. Wheeler’s termination on January 29, 2018, the Company began its supposed “turnaround.” Over a year and a half has passed, yet management and the Board have not made meaningful progress despite repeated promises to the contrary.

4 As stated in Item 1 of WHLR’s Registration Statement on Form 8-A, filed with the SEC on September 19, 2016.

5 As stated in Item 1 of WHLR’s Registration Statement on Form 8-A, filed with the SEC on September 19, 2016, a “Change of Control/Delisting” is deemed to occur in certain enumerated circumstances, including upon “Continuing Directors” ceasing to constitute at least a majority of the Board. “Continuing Director” refers to a director who either was a member of the Board on September 21, 2016 or who becomes a member of the Board subsequent to that date and whose appointment, election or nomination for election by stockholders was duly approved by a majority of the Continuing Directors on the Board at the time of such approval, either by a specific vote or by approval of the proxy statement issued by the Company on behalf of the Board in which such individual is named as a nominee for director.

| 7 |

Not only has the Board failed to reinstate the common dividend, but it has suspended three issues of preferred dividends for three consecutive quarters. Common stockholders have forgone approximately $19 million6 in dividends and preferred stockholders have forgone approximately $10 million7 in dividends, yet total debt outstanding has only shrunk by $28 million.8

We are also concerned with the Company’s failure to reduce its debt. Based on our calculations, the Company reduced its current outstanding debt of approximately $379 million by only $28 million. Given the significant amount of debt Wheeler faces, we believe the Company should sell its vanity project, JANAF, to generate much needed cash. We also believe the sale of JANAF would give Wheeler flexibility to begin addressing the Company’s balance sheet issues, including the Series D Preferred Stock redemption.

Further, despite the Company’s commitment to sell non-core assets, we believe it has made little progress. From January 30, 2018 through July 12, 2019, Wheeler listed twelve properties for sale and sold only seven.9 The Company has raised only $8.7 million10 in net proceeds from those sales.

Similarly, the Company has failed to reduce General and Administrative expenses to be in line with peers despite repeated assurances. Management, under the oversight (or lack thereof) of the current Board, has failed to keep Wheeler’s overhead costs in line with its peer group.11 In fact, since January 30, 2018, Wheeler has reduced headcount by only one full-time employee.

We Believe the Board’s Approval of the Sea Turtle Project Reflects its Poor Judgment and Inability to Properly Oversee Management

In addition to the current concerning issues facing the Company, common stockholders are still facing the ramifications from the Sea Turtle project. In less than three years, the Company lost its entire investment in a $12 million loan to the Sea Turtle Marketplace (“Sea Turtle”), former-CEO Jon Wheeler’s personal project.

Specifically, in September 2016, the Company issued $12 million in promissory notes to Sea Turtle, a development project in which then-CEO Jon Wheeler is an investor. The Company’s Sea Turtle notes rank junior to a $16 million loan from the Bank of Arkansas.12 In its November 2017 Investor Presentation, the Company stated that it expected Sea Turtle to “generate significant fee and interest income.” Sea Turtle thereafter borrowed an additional $4 million from the Bank of Arkansas and Wheeler approved an amended subordination agreement allowing that new loan to rank senior to the Company’s notes.13 We seriously question how the Board could allow this to happen in the first place, especially without asking for anything in return.

6 Calculation based on the basic weighted-average numbers of shares outstanding for the year ended December 31, 2018 and for the six months ended June 30, 2019, as reported in Part I Item 1 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019, and the most recently declared dividend per share of common stock, as reported in Item 5 of WHLR’s Annual Report on Form 10-K, filed with the SEC on February 28, 2019.

7 The sum of all accumulated undeclared dividends for the Series A Preferred Stock, the Series B Preferred Stock and the Series D Preferred Stock, as reported in Part I Item 1 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019.

8 Given the lack of full disclosure by the Company, we had to piece together these calculations based on WHLR’s total principal balance at December 31, 2017 and additional debt related to the JANAF acquisition on January 18, 2018, both of which are reported in Item 1 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on May 9, 2018 and WHLR’s total principal balance. In addition, this amount reflects the $6.5 million debt paydown resulting from the Perimeter Square sale on July 12, 2019 as reported in WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019.

9 Based on dispositions reported in Item 7 of WHLR’s Annual Report on Form 10-K, filed with the SEC on February 28, 2019, and Part I Item 2 of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019.

10 Excludes any proceeds received from the most recent sale of Perimeter Square because the Company has not yet publicly disclosed the net proceeds from such sale.

11 Based on the peer group reported in Item 11 of WHLR’s Annual Report on Form 10-K, filed with the SEC on March 7, 2018. Peer group median of 8.3% and WHLR of 10.4% based on LTM G&A as a percentage of Revenues. LTM obtained from of each company’s most recently filed quarterly or annual report.

12 As stated in a Prospectus Supplement Summary of WHLR’s Form 424B5, filed with the SEC on November 28, 2016.

13 As stated in the First Amendment to Subordination Agreement entered into as of November 23, 2017, and recorded in Book 3624, pp. 1808-1821, in the Beaufort County Office of the Register of Deeds.

| 8 |

As of December 31, 2017, as reported in the Company’s Annual Report on Form 10-K, the Company had fully reserved $1.7 million of receivables related to Sea Turtle and recorded a $5.3 million impairment on the Sea Turtle loan because it believed that the cash proceeds from selling Sea Turtle could no longer repay the $12 million in promissory notes. Was the Board aware of Sea Turtle’s deteriorating credit when it allowed this? All of this happened within six weeks of touting Sea Turtle generating “significant” income.

As of December 31, 2018, the Company had recorded an additional $1.7 million impairment on its loan to Sea Turtle, as reported in the Company’s Annual Report on Form 10-K. Then, in May 2019, Sea Turtle filed a voluntary petition for Chapter 11 bankruptcy14 and Wheeler recorded a final impairment of $5.0 million on the Sea Turtle loan, reducing its carrying value to $0.15

We believe these actions demonstrate the Board’s poor judgement and inability to protect stockholders’ best interests as well as its abject failure to provide effective oversight of the Company.

We are Concerned with Wheeler’s Poor Corporate Governance and Egregious Compensation Decisions

We are also concerned with the Company’s poor corporate governance, which we believe severely limits the ability of stockholders to seek effective change at Wheeler. Notably, stockholders cannot amend the Bylaws, can only act by unanimous written consent, and can only remove directors for cause and by a supermajority vote. In addition, stockholders must obtain a prohibitively high supermajority vote to amend shareholder-unfriendly provisions in the Company’s Articles, which likewise serves to disenfranchise stockholders. We believe that the Board should not be able to utilize Wheeler’s corporate machinery to insulate itself and prevent changes that would benefit all stockholders.

We are not alone regarding our governance concerns. ISS recommended that stockholders “WITHHOLD” on the re-election of the members of the Company’s Nominating and Corporate Governance Committee at the 2017 Annual Meeting and recommended a “WITHHOLD” vote on the re-election of Jeffrey Zwerdling, the Company’s lead independent director since 2015 (and one of the longest tenured members of the Board), at the 2018 Annual Meeting, given stockholders’ inability to amend the Bylaws, which ISS has noted “is a fundamental right, which is enshrined in most states’ corporation statutes.” While eliminating this right from stockholders is permissible under Maryland law, we agree with ISS that it is nonetheless a material restriction of an important stockholder right. According to ISS, “such a prohibition represents a material diminution of shareholders’ rights and a material governance failure.” A Board that gives itself the exclusive right to amend the Bylaws is not a Board that is willing to represent stockholders’ best interests. If elected to the Board, our Nominees will push for governance changes, including those recommended by ISS.

Likewise concerning is the Board’s approval of troubling employment agreements with its new executives, which contain provisions that we believe hinder its ability to objectively evaluate future strategic alternatives. Within a month of the Company’s touted “WHLR 2.0” the Board awarded to the current CEO, CFO and COO, contracts that have provisions entitling each individual to a 2.99x lump sum severance payment if that individual resigns within 12 months of a “change in control.”16

14

As stated in WD-I Associates’ Official Form 206D, filed with the United States Bankruptcy Court for the District of South

Carolina on May 7, 2019. 15

As stated in Part I Item 2 of WHLR’s Quarterly Report in Form 10-Q, filed with the SEC on August 5, 2019. 16

The payment is 2.99 times each executive’s then current base salary, less mandatory deductions, as reported in sub-paragraph

8.6 of Exhibits 10.1, 10.2 and 10.3 of WHLR’s Form 8-K, filed with the SEC on February 20, 2018, pp. 4-5.

| 9 |

ISS also expressed concern with these employment agreements and recommended that stockholders vote against the Company’s say-on-pay proposal at the 2018 Annual Meeting given that these agreements “include problematic ‘good reason’ termination definitions” and “allow executives to voluntarily resign for any reason within twelve months of a change in control and receive severance payments.”

The Company’s misaligned compensation structure is further evidenced by the Board’s approval of increased compensation to Wheeler directors while the Company’s common stock price was plummeting. Between 2016 and 2018, the Board members received the following compensation increases.17

| Non-Employee Director | Increase in Compensation |

| Stewart Brown | 220% |

| John McAuliffe | 238% |

| Carl McGowan, Jr. | 234% |

| John Sweet* | 329% |

| Jeffrey Zwerdling | 246% |

*Former director

We believe there is a disturbing misalignment between pay and performance at Wheeler and are deeply concerned with this Board’s decision to reward itself for lackluster results while common stockholders have suffered and continue to suffer.

We are Concerned with the Board’s Lack of Sufficient Stock Ownership

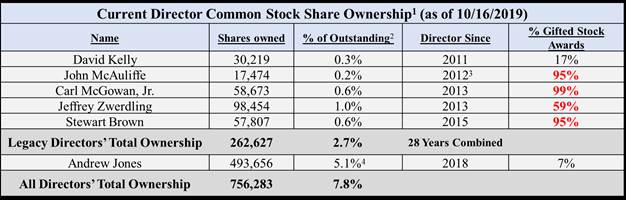

We believe the Board’s ineffectiveness at tackling the persistent destruction of stockholder value is in large part a function of a troubling misalignment of interests between the directors and Wheeler’s stockholders. As demonstrated by the chart below, the five longest-tenured directors have served on the Board for an aggregate of 28 years, yet collectively own less than 3% of the Company’s outstanding shares, which includes shares underlying awards granted to such individuals in their capacities as directors of the Company. In fact, four of these directors have been granted more than half of their current stock ownership through director awards, with three of them having been granted more than 90% of their current stock ownership through director awards.

17 The calculations are based on a comparison of the non-employee director compensation reported in Item 11 of WHLR’s Annual Report on Form 10-K, filed with the SEC on February 28, 2019, p. 70, reporting 2018 non-employee director compensation and WHLR’s Proxy Statement on Form DEF 14A, filed with the SEC on April 17, 2017, p. 17, reporting 2016 non-employee director compensation. The increase in John Sweet’s compensation is based on a pro-rata calculation because Mr. Sweet started serving on the Board on October 5, 2016. Excludes current director Andrew Jones, who was appointed to the Board in April 2018.

| 10 |

| (1) | Does not include Series B Convertible Preferred Stock, Common Stock Warrants, nor Series D Cumulative Convertible Preferred Stock. |

| (2) | Calculation based on 9,693,271 shares of WHLR common stock outstanding as of August 2, 2019, as stated on the cover page of WHLR’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2019. |

| (3) | John McAuliffe resigned from the Board of Directors on April 9, 2013, as stated in WHLR’s Form 8-K, filed with the SEC on April 10, 2013, p. 2, and was reappointed on December 2, 2015, as stated in WHLR’s Form 8-K, filed with the SEC on December 4, 2015, p. 2. |

| (4) | Includes 445,084 shares (4.8% of common stock outstanding) held in an IRA and funds managed by NS Advisors, LLC, according to Andrew Jones’s Form 4, filed with the SEC on February 27, 2019. |

We believe the lack of a substantial ownership interest in shares of Wheeler by the Company’s five longest-tenured directors has affected the Board’s ability to properly evaluate and address the serious challenges facing the Company. We believe the stockholders, as the true owners of the Company, must have a stronger voice at the Board level. Such a voice promotes greater accountability and creates an environment that forces other directors to consider new and innovative ways to positively impact shareholder value.

Stilwell, on the other hand, owns approximately 9.8% of the Company’s outstanding shares of Common Stock. It seems apparent to us that with so little “skin in the game” and not enough confidence in the Company to engage in meaningful stock purchases, the Board does not have the same commitment to stockholder value as we do.

| 11 |

We Believe Our Nominees Have the Experience, Qualifications and Commitment Necessary to Fully Explore Available Opportunities to Unlock Value for Common Stockholders

For the reasons set forth above, we lack confidence in management’s and the Board’s ability to unlock value for the benefit of Wheeler’s common stockholders. With proper guidance and oversight from a reconstituted Board, we believe there are opportunities to create value for Wheeler’s common stockholders.

Although our Nominees would only constitute a minority of the Board if elected at the Annual Meeting, we believe there are a number of initiatives that they could present to the full Board to help put the Company on a path toward stockholder value creation. Indeed, given the Company’s lack of a clear plan, we believe it is vital to reassess the Company’s current strategy and identify specific action items to help address the Company’s most pressing issues and then clearly disclose this plan to all stockholders. Such a plan needs to include, at a minimum, fixing the Company’s balance sheet and prioritizing how to address the retirement of the Series D Preferred Stock in 2023.

Accordingly, we believe any such plan needs to focus on reducing the Company’s high leverage and significant debt, which we believe can be accomplished through the sale of Wheeler’s largest shopping center, JANAF ($63M of property-level debt), monetization of more non-core assets such as Wheeler’s headquarters and the restaurant-focused Columbia Fire Station. We also believe Wheeler’s excessive overhead costs can be reduced. In addition, Wheeler’s compensation structure needs to be more appropriately aligned with Company performance and its governance profile vastly improved by implementing best-in-class governance provisions such as giving stockholders the ability to amend the Bylaws.

We have identified three (3) highly qualified and capable directors with valuable and relevant business and financial experience who we believe will bring a fresh perspective into the boardroom and will be extremely helpful in evaluating and executing on these and other initiatives to unlock value at the Company. Further, we believe Wheeler’s chronic underperformance warrants directors whose interests are closely aligned with those of the common stockholders and who will work constructively with the other members of the Board to protect the best interests of Wheeler’s common stockholders.

| 12 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Wheeler has nominated eight (8) candidates for election at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three (3) Nominees, Joseph D. Stilwell, Paula J. Poskon and Kerry G. Campbell, each of whom is currently independent of the Company. Each of our Nominees, if elected at the Annual Meeting, will serve until the 2020 annual meeting of the stockholders (the “2020 Annual Meeting”) and until his or her successor shall have been duly elected and qualified, or until his or her death, resignation, or removal. Your vote to elect our Nominees will have the legal effect of replacing three (3) incumbent directors with the Nominees. If elected, our Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed that they can implement the actions that they believe are necessary to enhance stockholder value. There is no assurance that any incumbent director will serve as a director if one or more of our Nominees are elected to the Board.

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each of the Nominees. The ages shown below are as of the date of the filing of this Proxy Statement. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth below. This information has been furnished to us by the Nominees. The Nominees are citizens of the United States.

THE NOMINEES

Joseph D. Stilwell, age 58, is the owner and managing member of Stilwell Value LLC, the general partner of a group of private investment partnerships known as The Stilwell Group. Mr. Stilwell started his first investment fund in 1993 and has been reviewing and analyzing financial statements and investing in financial companies for over 25 years. Since April 2009, he has served on the board of directors of Kingsway Financial Services Inc., a financial services company. Mr. Stilwell previously served on the boards of directors of American Physicians Capital, Inc. from November 2004 until it was acquired in October 2010 and SCPIE Holdings Inc. from December 2006 until it announced a sale of the company in October 2007. He graduated in 1983 from the Wharton School at the University of Pennsylvania with a Bachelor of Science in Economics.

Stilwell believes Mr. Stilwell’s extensive experience and knowledge in capital allocation and maximizing shareholder value makes him well-qualified to serve as a director of the Company.

| 13 |

Paula J. Poskon, age 55, is the founder of STOV Advisory Services LLC (“STOV”), which offers professional consulting and advisory services to company executives and institutional investors in the areas of real estate, capital markets, investor relations, and diversity and inclusion. She has been STOV’s President since July 2016. Throughout the past decade, Ms. Poskon specialized in real estate investment trusts (REITs). Ms. Poskon served as Senior Vice President/Senior Real Estate Research Analyst at D.A. Davidson & Co., Inc. (“D.A. Davidson”), an employee-owned full-service investment firm, from September 2014 until May 2015. She was hired by D.A. Davidson to co-lead the launch of its real estate capital markets platform. Prior to that, Ms. Poskon was a Director and Senior Equity Research Analyst in Real Estate at Robert W. Baird & Co., Inc., an employee-owned wealth management, capital markets, asset management and private equity firm, from October 2005 until July 2014. She was named No. 3 on The Wall Street Journal’s “Best on the Street” among real estate analysts for 2009 and No. 2 among real estate analysts for stock-picking in 2011 by StarMine. From August 2000 until September 2005, Ms. Poskon was an Equity Research Associate, Asset Management Associate and Investment Banking Associate at Lehman Brothers, a global financial services firm. She graduated from the Wharton School at the University of Pennsylvania with a Bachelor of Science in Economics with a concentration in Accounting and a Master of Business Administration in Finance with a concentration in Strategic Management. Ms. Poskon is a frequent speaker at real estate industry conferences.

Stilwell believes Ms. Poskon’s more than 15 years of capital markets experience in equity research and investment banking, together with her extensive relationships and experience in the real estate industry, make her well-qualified to serve as a director of the Company.

| 14 |

Kerry G. Campbell, age 54, is the principal of a financial litigation and investment management consulting firm, Kerry Campbell LLC, where since February 2014, he has served as a financial expert witness for arbitrations and litigations and provided consulting services to financial institutions and investors. His firm has been retained by institutional investors, high net worth investors and large global diversified financial institutions. Prior to that, from March 2010 until January 2014, Mr. Campbell worked in investment research and portfolio construction as a Managing Director at Arden Asset Management, and as a Senior Vice President at Guggenheim Partners from November 2003 until December 2008. From 2001 until 2003, Mr. Campbell worked in prime broker risk management as a Managing Director at Bear Stearns. Prior to that, he worked as a commissioned registered representative, a private wealth management consultant focusing on arbitrage transactions and as a credit analyst/loan officer. Mr. Campbell received an M.B.A in Finance from the University of Chicago Booth Graduate School of Business and a Bachelor of Science in Finance summa cum laude from Fordham University Gabelli School of Business. Mr. Campbell is an Approved FINRA Dispute Resolution Arbitrator, a Chartered Financial Analyst®, a CERTIFIED FINANCIAL PLANNER™, an Accredited Investment Fiduciary Analyst™ and a Securities Experts Roundtable Member.

Stilwell believes Mr. Campbell’s 30 plus years of financial industry experience, together with his experience as a financial expert witness on behalf of defendants and plaintiffs in arbitrations and litigations, make him well-qualified to serve as a director of the Company.

The principal business address of Mr. Campbell is 38 Benedict Avenue, Staten Island, New York 10314. The principal business address of Ms. Poskon is 12372 Lima Lane Reston, Virginia 20191. The principal business address of Mr. Stilwell is 111 Broadway, 12th Floor, New York, New York 10006.

| 15 |

As of the date hereof, neither of Ms. Poskon nor Mr. Campbell beneficially owns securities of the Company and neither has engaged in any transactions in securities of the Company during the past two years. As of the date hereof, Mr. Stilwell does not directly own any securities of the Company and has not engaged in any transactions in securities of the Company during the past two years. Mr. Stilwell, by virtue of being the managing member and owner of Stilwell Value LLC, the general partner of each of Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments, may be deemed the beneficial owner of the 955,753 shares of Common Stock, which includes 49,967 shares of Series D Preferred Stock that are convertible into 73,654 shares of Common Stock, owned in the aggregate by Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments. In addition, Stilwell Activist Investments has entered into the Swaps (as defined below) that constitute economic exposure to an aggregate of 203,857 notional shares of the Series D Preferred Stock. For information regarding purchases and sales during the past two years by Stilwell Value Partners VII, Stilwell Activist Fund, and Stilwell Activist Investments in securities of the Company, please see Schedule I.

Stilwell Activist Investments, Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Value LLC and each of Ms. Poskon and Mr. Campbell are parties to separate nominee agreements (each, a “Nominee Agreement”), whereby Stilwell Activist Investments, Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Value LLC have agreed to reimburse each of Ms. Poskon and Mr. Campbell for his or her expenses incurred in connection with his or her nomination for election to the Board and to indemnify and hold each of Ms. Poskon and Mr. Campbell harmless from and against all damages and claims that may arise in connection with being nominated for election to the Board. Pursuant to the Nominee Agreements, each of Ms. Poskon and Mr. Campbell has agreed not to acquire, directly or indirectly, any shares of Common Stock, whether beneficially or of record, from the date of the respective Nominee Agreements until the conclusion of the Annual Meeting.

Stilwell Value LLC, as the general partner of each of Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments, may be entitled to an incentive allocation based on the annual performance of the respective investment portfolios of Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investment, which include securities of the Company. Mr. Stilwell, as the managing member and owner of Stilwell Value LLC, may be deemed to have earned a pro-rata portion of any such incentive allocation to which Stilwell Value LLC may be entitled.

Stilwell believes that each Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002.

| 16 |

Other than as stated herein, there are no arrangements or understandings between Stilwell and any of the Nominees, or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Mr. Stilwell and Stilwell Value LLC, an SEC-registered investment adviser affiliated with Mr. Stilwell, settled an SEC investigation without admitting or denying any of the allegations, and the SEC entered an administrative SEC order on March 16, 2015 (the “Order”) that alleged civil violations of certain securities regulations. These were for, among other things, failing to adequately disclose conflicts of interest presented by inter-fund loans between certain private investment partnerships managed by Stilwell Value LLC and/or Mr. Stilwell, which loans were repaid in full without monetary loss to investors from the alleged conduct. Under the Order, among other things, (i) Mr. Stilwell was suspended for twelve months (from March 2015 to March 2016) from association with Stilwell Value LLC or any other SEC regulated investment business, and he paid a civil money penalty of $100,000; and (ii) Stilwell Value LLC paid a civil money penalty of $250,000 and repaid certain management fees to investors. All penalty and repayment obligations pursuant to the Order were fully discharged. For a further description of the Order, its directives, and the fulfillment thereof, please refer to Schedule A of the Schedule 13D filed by Stilwell on July 8, 2019, as it may be amended from time to time.

On February 25, 2019, Stilwell Activist Investments commenced an action against Wheeler in Maryland Circuit Court for Baltimore County, seeking an order compelling the Company to make available for inspection certain financial records, pursuant to Maryland General Corporation law. The Complaint alleges that Stilwell Activist Investments made a demand for books and records on December 20, 2018, in light of the troubling performance of the Company. As alleged in the Complaint, the Company’s share price had declined substantially in 2018, its CEO had been terminated for cause, the Company stopped paying a dividend to common holders, and then defaulted on its dividend obligations to preferred shareholders. In particular, the demand sought records concerning the Company’s loans to Sea Turtle, a development discussed above, where its then CEO, Jon Wheeler, had a financial interest and which were written down and/or written off shortly after the loans were made. The Company failed to comply with Stilwell Activist Investments’ request to inspect the Company’s financial records. As a result, Stilwell Activist Investments initiated a suit to compel their production. In April 2019, the Company filed a motion with the Court seeking dismissal of the Complaint. Stilwell Activist Investments has opposed the motion. The Court has scheduled a hearing on the motion for October 31, 2019.

| 17 |

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve, or for good cause will not serve, the shares of Common Stock represented by the enclosed GREEN proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s Articles of Amendment and Restatement, as amended or Bylaws (collectively, the “Organizational Documents”) and applicable law. In addition, we reserve the right to solicit proxies for the election of any other substitute nominee if the Company makes or announces any changes to its Organizational Documents or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominees, to the extent this is not prohibited under the Organizational Documents and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Organizational Documents and shares of Common Stock represented by the enclosed GREEN proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional persons, to the extent this is not prohibited under the Organizational Documents and applicable law, if the Company increases the size of its Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Stilwell that any attempt to increase the size of the current Board or to classify the Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE “FOR”

THE ELECTION OF THE NOMINEES ON THE ENCLOSED GREEN PROXY CARD.

| 18 |

PROPOSAL NO. 2

ADVISORY VOTE ON COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the compensation of the named executive officers of the Company, as disclosed in the Company’s proxy statement under the heading “Compensation,” including the compensation tables and their accompanying narrative discussion, is approved.”

As disclosed in the Company’s proxy statement, the stockholder vote on the say-on-pay proposal is an advisory vote only, and is not binding on the Company, the Board or the Compensation Committee of the Board; however, the Board and the Compensation Committee may take into account the outcome of the vote when considering future compensation arrangements with the Company’s named executive officers.

WE RECOMMEND A VOTE “AGAINST” THIS SAY-ON-PAY PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

| 19 |

PROPOSAL NO. 3

RATIFICATION

OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Company’s Audit Committee has appointed Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 and is proposing that stockholders ratify such appointment. The Company is submitting the appointment of Cherry Bekaert LLP for ratification of the stockholders at the Annual Meeting.

WE RECOMMEND A VOTE “for” THE RATIFICATION OF THE SELECTION OF Cherry Bekaert LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR the Fiscal year ending December 31, 2019 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

| 20 |

PROPOSAL NO. 4

APPROVAL OF THE 2019 LONG-TERM INCENTIVE PLAN

As discussed in further detail in the Company’s proxy statement, the Board has approved the 2019 Incentive Plan, subject to approval by the Company’s stockholders. Accordingly, the Company is asking stockholders to approve the 2019 Incentive Plan.

According to the Company’s proxy statement, the 2019 Incentive Plan is intended to encourage share ownership among key employees and members of the Board who are not employees. Awards under the 2019 Incentive Plan may be in the form of incentive stock options, nonqualified stock options or restricted stock and unit awards and the benefits or amounts that may be received by or allocated to participants under the 2019 Incentive Plan will be determined at the discretion of the Compensation Committee.

A complete summary of the 2019 Incentive Plan and the material terms thereof are set forth in the Company’s proxy statement, along with a copy of the 2019 Incentive Plan. As disclosed in the Company’s proxy statement, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve this proposal.

WE RECOMMEND A VOTE “AGAINST” APPROVAL OF THE 2019 INCENTIVE PLAN AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

| 21 |

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date. According to the Company’s proxy statement, the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed GREEN proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, AGAINST the advisory vote to approve the Company’s executive compensation, FOR the ratification of Cherry Bekaert LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019, AGAINST approval of the 2019 Incentive Plan, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate eight (8) candidates for election as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our three (3) Nominees, but also the candidates who have been nominated by the Company other than David Kelly, Jeffrey M. Zwerdling and John McAuliffe. This gives stockholders the ability to vote for the total number of directors up for election at the Annual Meeting.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least a majority of the outstanding shares of Common Stock as of the Record Date will be considered a quorum for the transaction of business.

Votes withheld from director nominees, abstentions and broker non-votes will be counted as shares present for the purpose of determining a quorum but will not be counted in determining the number of shares voted “FOR” director nominees or treated as votes cast on any other proposal. According to the Company’s proxy statement, abstentions and broker non-votes will not affect the outcome of the vote on any of the proposals presented at the Annual Meeting.

A broker non-vote occurs when a bank, broker or other nominee who holds shares for another person returns a proxy but does not vote on a particular item, usually because the nominee does not have discretionary voting authority for that item and has not received instructions from the owner of the shares.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

If your shares are held in the name of your broker, a bank or other nominee, that party will give you instructions for voting your shares. If you do not give instructions to your bank or brokerage firm, it will not be allowed to vote your shares with respect to any of the proposals to be presented at the Annual Meeting. In the absence of voting instructions, shares subject to such so-called broker non-votes will not be counted as voted on those proposals and so will have no effect on the vote, but will be counted as present for the purpose of determining the existence of a quorum. Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting.

| 22 |

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ According to the Company’s proxy statement, directors will be elected pursuant to a plurality voting standard, which means that the eight (8) nominees for director receiving the highest number of “FOR” votes will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither an abstention nor a “broker non-vote” will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and “broker non-votes” will have no direct effect on the outcome of the election of directors.

Other Proposals ─ According to the Company’s Bylaws, a majority of the votes cast at a meeting of stockholders at which a quorum is present, shall be sufficient to approve any matter that may properly come before the meeting, other than the election of directors. Accordingly, approval of the non-binding, advisory resolution to approve the compensation of the Company’s named executive officers, the ratification of the appointment of Cherry Bekaert LLP as the Company’s independent registered public accounting firm and approval of the 2019 Incentive Plan each require the affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will be counted as shares present for the purpose of determining a quorum but will not be treated as votes cast on any other proposal and, therefore, will not affect the outcome of these other proposals.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy), by voting again by telephone or through the Internet, by delivering a written notice of revocation, or by signing and delivering a subsequently dated proxy that is properly completed. The revocation may be delivered either to Stilwell in care of Okapi at the address set forth on the back cover of this Proxy Statement or to the Company at Riversedge North, 2529 Virginia Beach Blvd., Suite 200, Virginia Beach, Virginia 23452 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Stilwell in care of Okapi at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the shares entitled to be voted at the Annual Meeting. Additionally, Okapi may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GREEN PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Stilwell. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

| 23 |

Members of Stilwell have entered into an agreement with Okapi for solicitation and advisory services in connection with this solicitation, for which Okapi will receive an initial fee of $40,000, as well as additional compensation to be determined at the conclusion of the solicitation, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Stilwell has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Stilwell will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi will employ approximately 25 persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Stilwell. Costs of this solicitation of proxies are currently estimated to be approximately $250,000 (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). Stilwell estimates that through the date hereof its expenses in connection with this solicitation are approximately $150,000. Stilwell intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. Stilwell does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

Stilwell Activist Investments, Stilwell Value Partners VII, Stilwell Activist Fund, Stilwell Value LLC, and the Nominees are participants in this solicitation.

The principal business of each of Stilwell Activist Investments, a Delaware limited partnership, Stilwell Value Partners VII, a Delaware limited partnership, and Stilwell Activist Fund, a Delaware limited partnership, is serving as a private investment partnership engaged in the purchase and sale of securities for its own account. The principal business of Stilwell Value LLC, a Delaware limited liability company, is serving as the general partner of each of Stilwell Activist Investments, Stilwell Value Partners VII, Stilwell Activist Fund and affiliated private investment partnerships. Mr. Stilwell is the managing member and sole owner of Stilwell Value LLC.

The address of the principal office of each of Stilwell Activist Investments, Stilwell Value Partners VII and Stilwell Activist Fund is 111 Broadway, 12th Floor, New York, New York 10006.

| 24 |

As of the date hereof, Stilwell Activist Investments directly owns 711,244 shares of Common Stock, which includes 36,876 shares of the Series D Preferred Stock that are convertible into 54,357 shares of Common Stock. As of the date hereof, Stilwell Value Partners VII directly beneficially owns 149,402 shares of Common Stock, which includes 8,402 shares of Series D Preferred Stock that are convertible into 12,385 shares of Common Stock. As of the date hereof, Stilwell Activist Fund directly beneficially owns 95,107 shares of Common Stock, which includes 4,689 shares of Series D Preferred Stock that are convertible into 6,912 shares of Common Stock. Stilwell Value LLC, as the general partner of each of Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments, may be deemed the beneficial owner of the 955,753 shares of Common Stock, which includes 49,967 shares of Series D Preferred Stock that are convertible into 73,654 shares of Common Stock, owned in the aggregate by Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments. Mr. Stilwell, as the managing member and owner of Stilwell Value LLC, the general partner of each of Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments, may be deemed the beneficial owner of the 955,753 shares of Common Stock, which includes 49,967 shares of Series D Preferred Stock that are convertible into 73,654 shares of Common Stock, owned in the aggregate by Stilwell Value Partners VII, Stilwell Activist Fund and Stilwell Activist Investments.

For information regarding purchases and sales of securities of the Company during the past two years by certain of the participants in this solicitation, please see Schedule I attached hereto. The securities of the Company directly owned by Stilwell Value Partners VII, Stilwell Activist Fund, and Stilwell Activist Investments were purchased with working capital. All purchases of securities of the Company made by Stilwell using funds borrowed from Jefferies LLC or Morgan Stanley, if any, were made in margin transactions on their usual terms and conditions. All or part of the securities of the Company owned by members of Stilwell may from time to time be pledged with one or more banking institutions or brokerage firms as collateral for loans made by such entities to members of Stilwell. Such loans generally bear interest at a rate based on the broker’s call rate from time to time in effect. Such indebtedness, if any, may be refinanced with other banks or broker-dealers.

Stilwell Activist Investments has entered into a certain International Swaps and Derivatives Association Master Agreement (the “ISDA Agreement”) in connection with Stilwell Activist Investments’ entry into contractual arrangements for cash-settled swaps referencing the Series D Preferred Stock (the “Swaps”). Pursuant to the ISDA Agreement, Stilwell Activist Investments purchased Swaps on the dates and at the execution prices referenced in Schedule I constituting economic exposure to an aggregate of 203,857 notional shares of the Series D Preferred Stock, which have a maturity date of March 1, 2022. The Swaps provide Stilwell Activist Investments with economic results that are comparable to the economic results of ownership but do not provide it with the power to vote or direct the voting or dispose of or direct the disposition of the shares of the Series D Preferred Stock that are the subject of the Swaps.

The participants in this solicitation do not have any material interest in the nomination of the Nominees, individually or in the aggregate, including any anticipated benefit therefrom, other than their interests in their capacities as stockholders (direct or beneficial) of the Company, as applicable.

| 25 |

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past ten years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his, her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his, her or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

Except as otherwise set forth in this Proxy Statement, there are no material proceedings to which any participant in this solicitation or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, except as otherwise set forth in this Proxy Statement, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Stilwell is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, that Stilwell is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GREEN proxy card will vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

The Company has not yet publicly disclosed the deadline for stockholders to submit a proposal in order to be considered for inclusion in the Company’s proxy statement and the form of proxy for the 2020 Annual Meeting, or the deadline for any director nomination or stockholder proposal of other business intended to be presented for consideration at the 2020 Annual Meeting, but not intended to be considered for inclusion in the Company’s proxy statement and form of proxy related to such meeting (i.e., not pursuant to Rule 14a-8 of the Exchange Act). Once the Company publicly discloses these deadlines, Stilwell intends to supplement this Proxy Statement to include such information.

| 26 |

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING based on reliance on Rule 14a-5(c). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

Stilwell Activist Investments, L.P.

October 29, 2019

| 27 |

SCHEDULE I

TRANSACTIONS IN SECURITIES OF the Company

DURING THE PAST TWO YEARS

| Nature of the Transaction | Securities Purchased/(Sold) | Date of Purchase / Sale |

Stilwell Activist Investments, L.P.

| Purchase of Series D Preferred Stock | 4,250 (convertible into 6,265 shares of Common Stock) |

02/01/2018 |